Titan Pharmaceuticals Corporate Presentation – March 2012

Summary

This document is a corporate presentation by Titan Pharmaceuticals, Inc. from March 2012. It outlines the company's business focus, particularly the development and market opportunity for Probuphine, a long-acting implant for opioid dependence. The presentation discusses clinical development, market size, patent life, and financial highlights. It also includes forward-looking statements about future plans and potential milestones. The key obligation is to inform investors and stakeholders about the company's progress and prospects, with no binding commitments or time-limited conditions.

EX-10.2 7 d333750dex102.htm CORPORATE PRESENTATION Corporate Presentation

Corporate Presentation March 2012 1 Exhibit 10.2 |

The presentation may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Reference is made in particular to the description of our plans and objectives for future operations, assumptions underlying such plans and objectives and other forward- looking terminology such as “may,” “expects,” “believes,” “anticipates,” “intends,” “expects,” “projects,” or similar terms, variations of such terms or the negative of such terms. Forward-looking statements are based on management’s current expectations. Actual results could differ materially from those currently anticipated due to a number of factors, including but not limited to, uncertainties relating to financing and strategic agreements and relationships; difficulties or delays in the regulatory approval process; uncertainties relating to sales, marketing and distribution of the Company's drug candidates that may be successfully developed and approved for commercialization; adverse side effects or inadequate therapeutic efficacy of the Company's drug candidates that could slow or prevent product development or commercialization; dependence on third party suppliers; the uncertainty of protection for the Company's patents and other intellectual property or trade secrets; and competition. Safe Harbor 2 |

• Titan Pharmaceuticals Highlights • Probuphine Development • Probuphine Market Opportunity • Financial Summary • Summary Presentation Content 3 |

• Specialty pharmaceutical company focused in CNS with an NDA submission for Probuphine™ expected in Q3, 2012 • Probuphine has the potential to be the first long acting therapeutic on the market for the treatment of opioid dependence – Six month controlled release formulation of an approved drug, buprenorphine – Clinical development completed – Addresses U.S. market of over $1B and growing – Significant unmet needs continue to exist in the market place – Potential peak sales of $300m – $500m – U.S. patent life to 2024 – Probuphine has the potential to be developed for treating chronic pain • ProNeura™ – unique long term drug delivery system can provide around the clock medication and has potential in additional applications • Near term value-creating milestones • Lean and capital efficient organization Titan Pharmaceuticals: Highlights 4 |

Probuphine Development 5 |

• Addiction is a primary, chronic disease of brain reward, motivation, memory and related neurobiological circuitry* • inability to consistently abstain • impairment in behavioral control • craving • diminished recognition of significant problems with one’s behaviors • Addiction involves cycles of relapse and remission • Without treatment or engagement in recovery activities, addiction is progressive and can result in disability or premature death *American Society of Addiction Medicine, Inc., 2011 Disease Overview 6 |

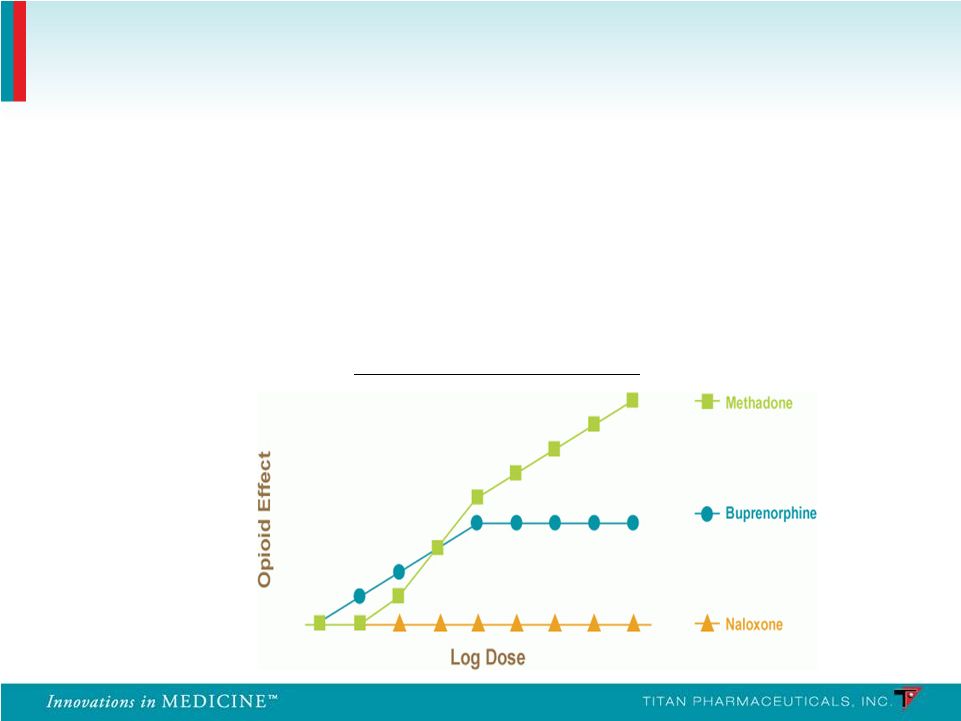

• In the U.S. buprenorphine has replaced methadone as the gold standard in treating opioid dependence • Buprenorphine is a mixed partial agonist at the mu receptor and an antagonist at the kappa receptor • Ceiling effect • Improved safety profile • Lack of euphoria Ceiling Effect of Buprenorphine Disease Treatment Overview 7 |

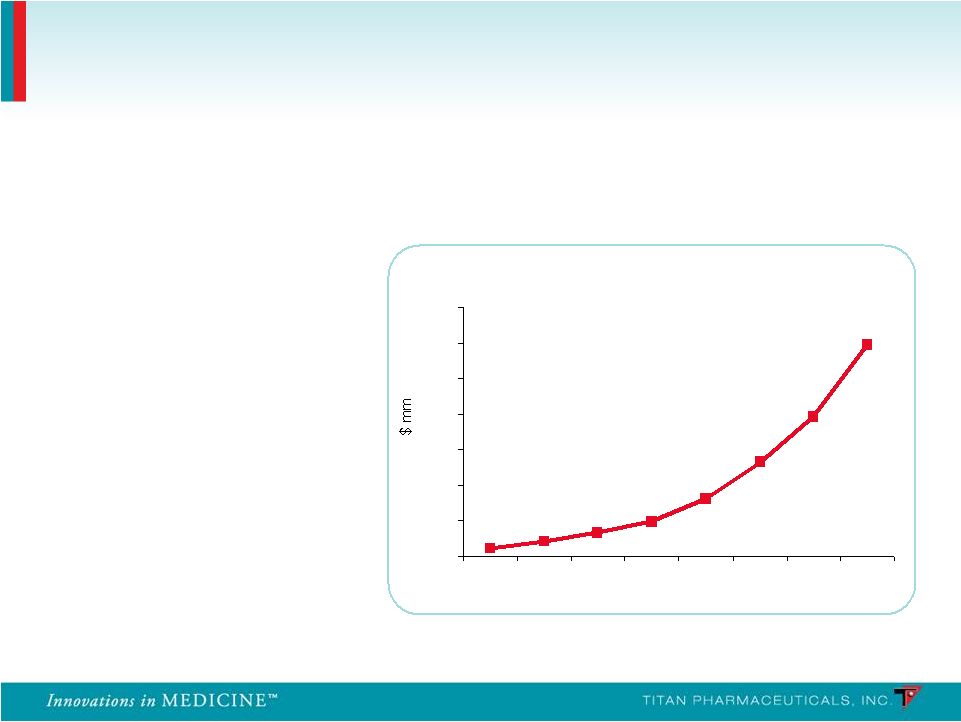

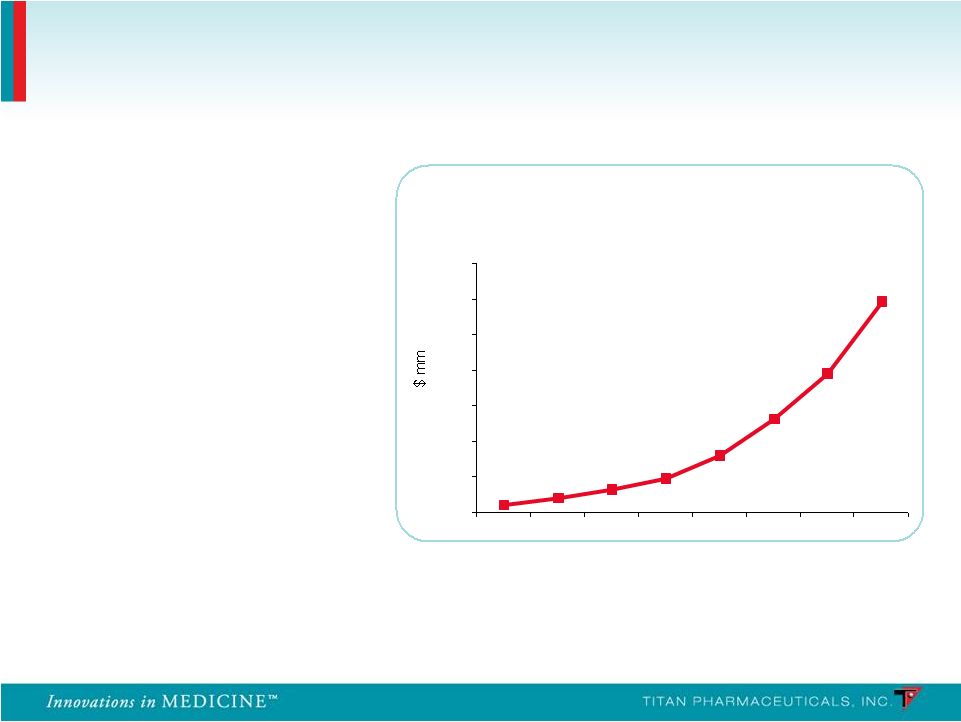

Launched in 2003 Global sales exceed $1.2B in 2010 (U.S. sales of $1B) Source: EvaluatePharma; Reckitt Benckiser 2010 Annual Report Suboxone ® Franchise WW Sales 0 200 400 600 800 1000 1200 1400 2003 2004 2005 2006 2007 2008 2009 2010 58% CAGR for the last 4 years Suboxone has grown rapidly Incremental Treatment Improvements Have Driven Conversion and Growth of the Market 8 |

• Efficacy • Medication compliance • Retention of patients • Reduction in the use of opioids and other substances • Safety and tolerability • Risks of misuse, abuse, diversion • Risk of precipitating withdrawal • Risk of overdose Significant Unmet Medical Needs in the Treatment of Opioid Dependence 9 |

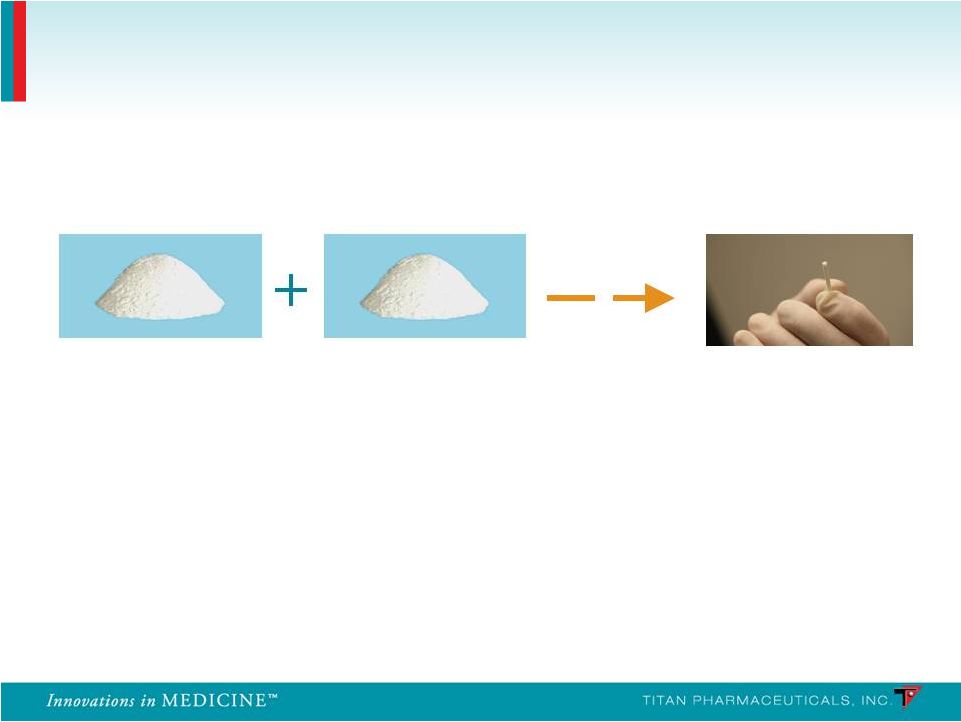

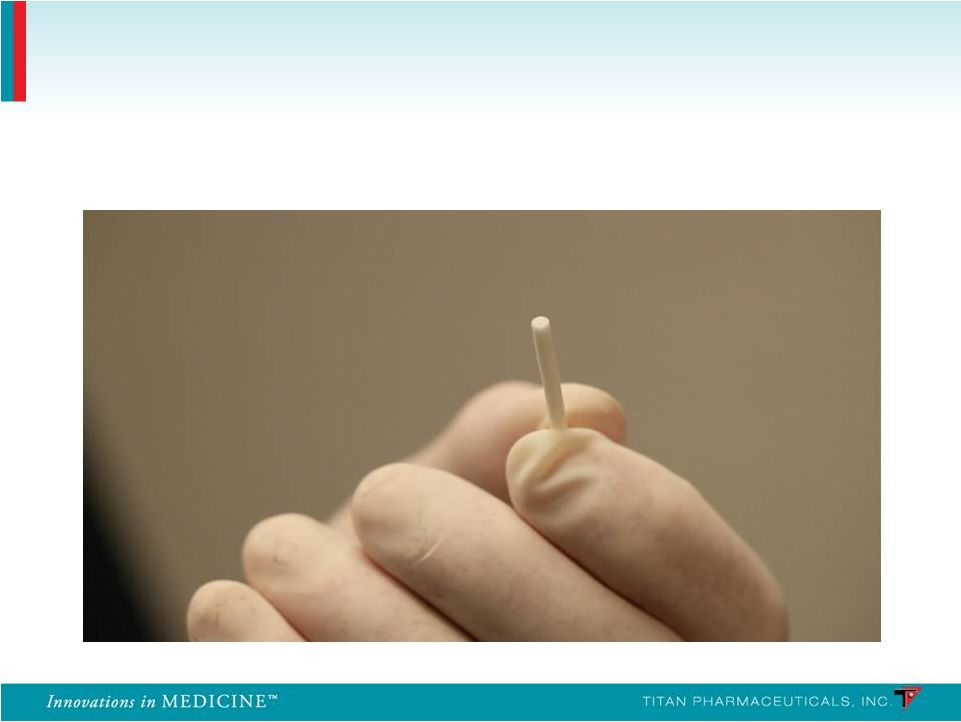

Solid Matrix Long-Term Delivery • Non-biodegradable • Inserted subcutaneously • Stable non-fluctuating blood levels of drug maintained for over 6 months Probuphine is a subcutaneous implant capable of delivering continuous and persistent around the clock blood levels of buprenorphine for 6 months following a single treatment, enhancing patient compliance and retention Probuphine 10 |

EVA polymer Buprenorphine Each implant contains 80 mg of buprenorphine HCl which has been blended and extruded with ethylene vinyl acetate (EVA) co-polymer Probuphine Probuphine 11 26 mm long, 2.5 mm diameter Inert component of several approved products Approved for treatment of opioid addiction, and acute and chronic pain Blended & Extruded |

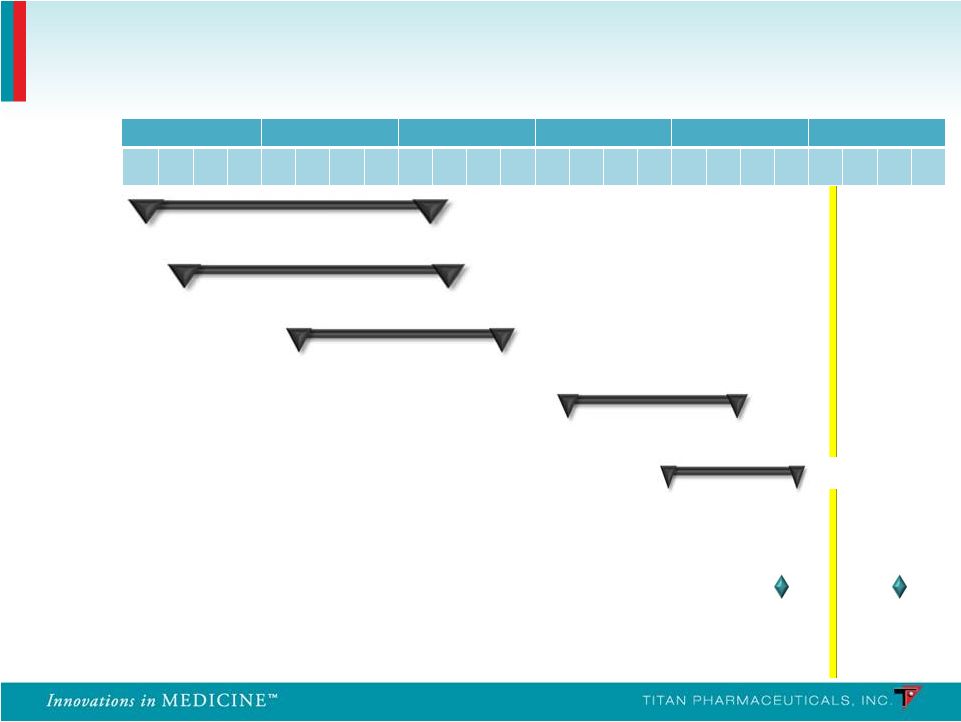

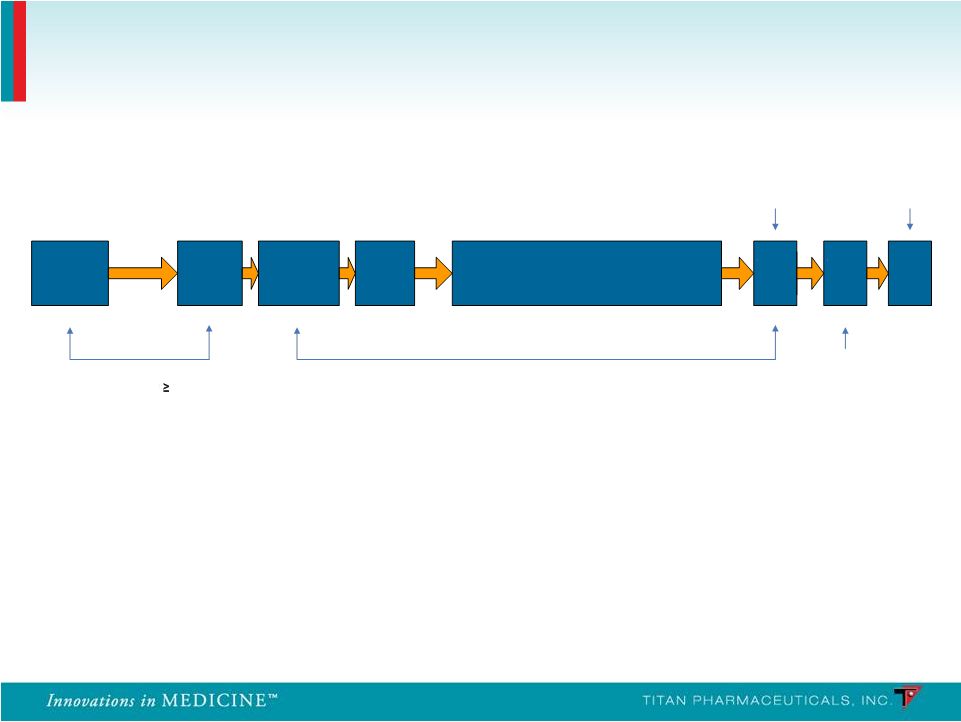

PRO-810 Pharmacokinetics Pharmacokinetics PRO-806 U.S. Efficacy 2 U.S. Efficacy 2 Pre-NDA meeting U.S. Retreatment 2 U.S. Retreatment 2 2007 2008 2009 2010 2011 2012 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 PRO-805 U.S. Efficacy 1 U.S. Efficacy 1 PRO-807 U.S. Retreatment 1 U.S. Retreatment 1 n = 163 n = 163 n = 62 n = 62 n = 9 n = 9 n = 287 n = 287 n = 85 n = 85 Probuphine: Clinical Development Program NDA NDA submission submission 12 PRO-811 |

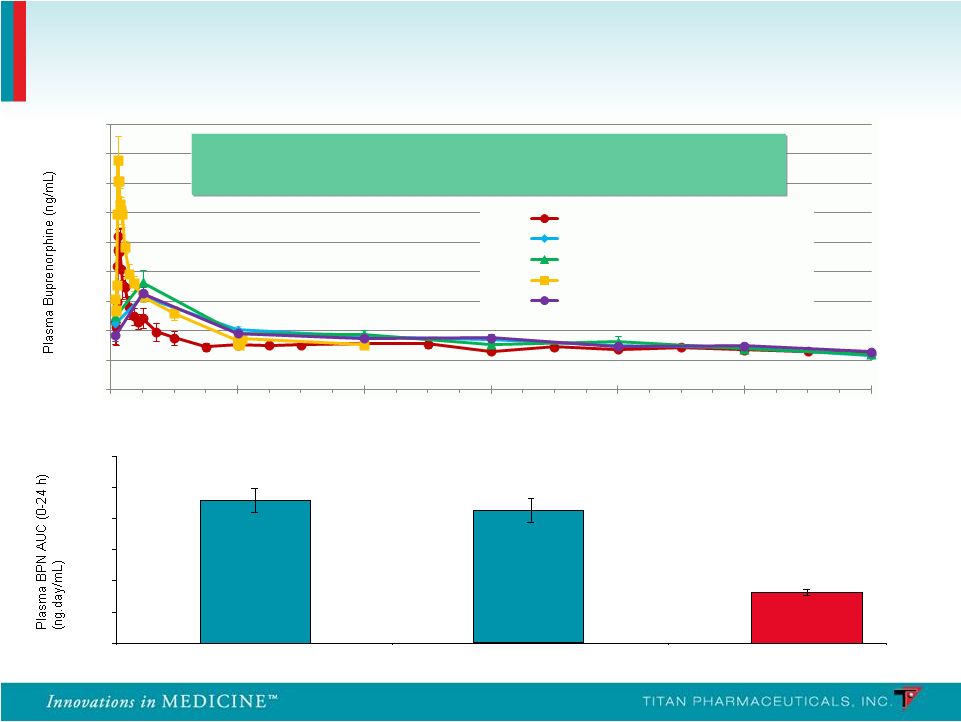

PRO 810 – Mean Plasma Buprenorphine AUC (0-24 h) 2.29 2.13 0.82 0 0.5 1 1.5 2 2.5 3 Suboxone (Day -2) Suboxone (Day -1) Probuphine (Steady State) Probuphine: Plasma Pharmacokinetics 13 Continuous, around the clock medication maintaining a Continuous, around the clock medication maintaining a stable level of buprenorphine in the patient stable level of buprenorphine in the patient Weeks on Study 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 0 4 8 12 16 20 24 Phase 1/2 (4 implants, n=6) PRO 805 (4 or 5 Implants, n=104) PRO 807 (4 or 5 Implants, n=61) PRO 810 (4 Implants, n=9) PRO 806 (4 or 5 Implants, n=113) - - - - |

Study 2 (PRO-806): • n = 287; 20 sites • Three-arm: Double-blind randomized, placebo-controlled and open-label active (Suboxone) Study 1 (PRO-805): • n = 163; 18 sites • Two-arm: Double-blind randomized, placebo- controlled (Urine Toxicology Three Times Per Week) Probuphine: Two Phase 3 Controlled Studies 14 Up to 16 days SL BPN Dose 12 16 mg/day 3 Days 6-month Treatment Phase Telephone Call Implant Removal End of Treatment / Induction Follow-up Screening Baseline Implant Visit Randomize/ - Post Implant Treatment and x/ week Urine Visits 3 (Weeks 1 – 24) Week 24 Week 26 Week 25 - |

• Urine toxicology (blinded to sites and patients) • Tests for presence of opioids (heroin, methadone, prescription pain medications, etc.) • Clinical Global Improvement • Clinician-rated • Patient-rated • Symptoms of opioid withdrawal and craving • Clinician-rated (COWS) • Patient-rated (SOWS and craving VAS) • Patient-reported illicit drug use • Mood • Beck Depression Inventory II Study Assessments 15 |

Outcome Measures Outcome Measures Probuphine Probuphine > Placebo > Placebo CDF of % Negative Urines (24 weeks) p = 0.0117 (primary) Treatment Retention (24 weeks) p < 0.0001 Global Severity of Opioid Addiction (Patient Rated) (24 Weeks) p < 0.0021 Global Severity of Opioid Addiction (Physician Rated) (24 Weeks) p < 0.0086 Patient-rated opioid withdrawal (24 weeks) p = 0.0005 Clinician-rated opioid withdrawal (24 weeks) p = 0.0008 Opioid craving (24 weeks) p = 0.0006 Study 1: Efficacy Results – Probuphine vs Placebo 16 |

Outcome Measures Outcome Measures Probuphine > Placebo Probuphine > Placebo p < 0.0001 (primary) p < 0.0001 (primary) p = 0.0002 p = 0.005 p = 0.031 p = 0.0003 p = 0.0002 p < 0.0001 p < 0.0001 p < 0.0001 Study 2: Efficacy Results – Probuphine vs Placebo 17 CDF of % Negative Urines (24 weeks) CDF of % Negative Urines Incorporating Patient Self Report (24 weeks) Treatment Retention (24 weeks) Patient-Rated Global Severity Global Improvement (24 Weeks) Clinician-Rated Global Severity Global Improvement (24 Weeks) Patient-rated opioid withdrawal (24 weeks) Clinician-rated opioid withdrawal (24 weeks) Opioid craving (24 weeks) |

Probuphine vs. Suboxone: Percentage of Urine Samples Probuphine vs. Suboxone: Percentage of Urine Samples Negative for Illicit Opioids in Weeks 1-24 Negative for Illicit Opioids in Weeks 1-24 • Non-Inferiority Comparison (-15% Margin): • 31% Probuphine vs. 33% Suboxone • 95% Confidence Interval for Difference: -10.8, 5.9 • Least-Squared Means Comparison: • 36% Probuphine vs. 35% Suboxone Study 2: Efficacy Results – Probuphine vs Suboxone 18 |

PRO-805 End of Treatment / PRO-807 Baseline Start SL BPN Induction Implant Visit / 4 Probuphine Implants Post- Implant Visit Wk 1 Wk 24 Wk 25 Wk 26 Wk 8 Wk 12 Wk 16 Wk 20 Wk 4 Implants Removed Stop Sublingual Buprenorphine 12-24 Hours Prior to Implantation End of Treatment/ Implant Removal Follow-Up Visit Telephone Call 24 Hours Up to 14 Days Six-Month, Open-Label, Multicenter Retreatment Trials in Patients Completing the Controlled Studies PRO - 807 • 14 study sites in the U.S. • 62 patients who completed PRO-805 received 4 initial Probuphine implants • 6 patients received a 5 th implant PRO - 811 • 20 study sites in the U.S. • 85 patients who completed PRO-806 received 4 initial Probuphine implants • Study completed end of Dec 2011 and initial results released in Feb 2012 19 |

• Probuphine was clinically and statistically superior to placebo in the treatment of opioid-addicted patients, and demonstrated non-inferiority to Suboxone. • Adverse events were mild to moderate in severity and generally consistent with the patient population and the known safety profile of buprenorphine in all studies. • Early termination due to adverse events was low in all studies. • The number and profile of serious adverse events was low in all studies and similar to placebo. • The implant procedure was generally well tolerated in all studies and there was no evidence of implant diversion or misuse. • Probuphine delivers an efficacious, low level of buprenorphine continuously for six months. Clinical Summary 20 |

• Pre-NDA meeting completed with the FDA on October 25, 2011 • Clinical data on safety and efficacy of Probuphine considered to be sufficient for NDA submission • Manufacturing scale up plans are acceptable to the FDA, however, additional data on the characterization of the EVA and Probuphine is required to complete the Chemistry, Manufacturing and Controls section • FDA provided guidance on the requirements for a Priority Review designation and suggested that appropriate information should be included with the NDA submission • NDA submission is targeted for Q3, 2012 • CMC section related analytical testing underway at two vendors • Electronic NDA document preparation commenced at CRO • Manufacturing facility expansion and production scale-up in process NDA Preparation Status 21 |

• Buprenorphine has several advantages over other opioids used for chronic pain • Safer than other opioids – ceiling effect for respiratory depression, relatively long half-life, minimal euphoric effect • Buprenorphine transdermal patch (3-7 days) is approved in U.S., Europe and Australia for the treatment of moderate to severe chronic pain • Therapeutic window of 0.1 – 0.5 ng/ml plasma level can be delivered with 1 to 2 Probuphine implants • Probuphine value proposition for treating chronic pain • Around the clock non-fluctuating therapeutic levels, no on/off therapy cycling, enhances compliance and increases patient convenience Sources: NEJM 2003;349:1943-53 Sittl, Expert Rev. Neurotherapeutics 2005;5(3): 315-323 Probuphine for the Treatment of Chronic Pain 22 |

Probuphine Market Opportunity 23 |

• Prevalence is large and growing rapidly • Worldwide: > 6m persons addicted to opioids • U.S. > 2m, range varies between 2-4m depending on source • Opioid addiction is a chronic long term illness • Patients who stop all medically-assisted therapy (MAT) are highly susceptible to relapse • Opioid addiction market is now >$1.2B globally • Opioid prescriptions have grown 400% from 1997-2007 • Hospitalizations have increased 500% over the last 10 years • Treatment for abuse of pain relievers increased at a 13% CAGR from 2002-2009 Sources: EPIDEMIC: RESPONDING TO AMERICA’S PRESCRIPTION DRUG ABUSE CRISIS, Executive Office of the President of the United States (2011); 2009 National Survey on Drug Use and Health (NSDUH); “A Wave of Addiction and Crime, with the Medicine Cabinet to Blame”, New York Times (Sept 23, 2010); Drug Abuse Warning Network (DAWN), SAMHSA, HHS; “A General in the Drug War”, New York Times (Jun 14, 2011) Market Overview 24 |

• Methadone tablets mainstay for opioid addition in U.S. from late 1960’s to 2002 • Strong restrictions regarding patient access and administration access in U.S. • Can be lethal and has high potential for misuse, abuse and diversion • Subutex ® and Suboxone ® oral formulations approved in 2002 • Safer than methadone and other opioids • Buprenorphine can occupy opioid receptors but produces ”ceiling effect” • Mitigates euphoric effect and respiratory depression • Fewer restrictions on patient access • Enabled treatment in office-based setting • Misuse, abuse and diversion problematic • Naltrexone • Opioid antagonist • Must be completely detoxified before initiating therapy • Minority of opioid addicted patients succeed Competitors: Few and Well Established with no New Innovations on Immediate Horizon 25 |

• Launched in 2003 • Global sales exceed $1.2B in 2010 (U.S. sales of $1B) Source: EvaluatePharma; Reckitt Benckiser 2010 Annual Report Suboxone ® Franchise WW Sales 0 200 400 600 800 1000 1200 1400 2003 2004 2005 2006 2007 2008 2009 2010 58% CAGR for the last 4 years 90% of prescriptions were written by 5,037 physicians Suboxone ® Sales Exceed $1B a Year in the U.S. Suboxone ® sales have grown at a 58% CAGR over the last 4 years Extremely Concentrated Prescriber Base 26 |

Suboxone Prescribing Physicians 27 Breakdown of Suboxone Prescribing Physicians Other 12% Pain/Neuro 5% Psych 32% IM/FP/GP 51% Source: IMS Health |

• Efficacy • Reduction in the use of opioids • Retention of patients and their treatment on therapy • Reduction in the use of other substances • Safety and tolerability • Risk of overdose • Risk of misuse, abuse, diversion • Risk of precipitating withdrawal • Accessibility / cost • Delivery • Onset of action • Restrictions on administration Source: Decision Resources 2011 Top Unmet Needs Defined by Physicians 28 |

Efficacy Effective in reducing illicit opioid use Enhanced compliance may lead to superior outcomes Safety Lower drug exposure may provide superior safety and tolerability Ease of Use Unique delivery system dosed once every six months Continuous buprenorphine delivery • Non-fluctuating blood levels, around-the clock medication • Potential 100% compliance Diversion Limited access to implants • Subcutaneous placement • Specific distribution (non-retail) Probuphine Value Proposition Probuphine is the first and only potential treatment for opioid dependence that can provide continuous and persistent around the clock blood levels of buprenorphine for six months, enhancing patient compliance and retention and preventing diversion 29 |

• Billion dollar market large and growing • Significant unmet needs continue to exist in the market place • Excellent margins due to small, target prescriber population • 5,037 physicians wrote 90% of buprenorphine prescriptions in the U.S. in 2010 • Sales Force of 50 reps can cover majority of prescribers • Controlled distribution facilitates efficiency and maintenance of accounts • Unique value proposition for Probuphine better addresses unmet needs and has the potential to become the new gold standard of treatment – Peak sales $300-500m Market Opportunity Ideal as Specialty Pharma Stand- alone or as an Addition to Existing CNS Franchise 30 |

• Patent applications are for method-of-use claims • Method-of-use and similar claims provide strong protection of commercial product: • Alternate device or alternate indication would require de novo clinical trials Country Opioid Dependence U.S. Granted (to 2024) Pending Europe Pending Pending Japan Granted (to 2023) Granted (to 2023) Canada Pending Pending Mexico Granted (to 2023) Granted (to 2023) Australia Granted (to 2023) Granted (to 2023) New Zealand Granted (to 2023) Granted (to 2023) Hong Kong Pending Pending India Pending Pending Probuphine Intellectual Property 31 Pain Treatment |

• Equity • Common Stock Outstanding 59.4m • Stock Options/ Restricted Stock 5.6m – weighted-average exercise price of $1.56 per share • Warrants 13.0m – weighted-average exercise price of $1.78 per share • December 30, 2011 • Cash $ 5.4m • Debt $ 12.3m – Principal $10m + Present Value of Interest $2.3m Financial Summary 32 |

Probuphine • Billion dollar opioid dependence market is large and growing • Worldwide: > 6m people addicted to opioids • Addresses significant unmet needs that exist in the market place • Reduction in the use of opioids • Retention of patients on therapy (persistence and compliance) • Diversion, abuse • Probuphine has the potential to be the first long acting therapeutic on the market for the treatment of opioid dependence • Six month controlled release formulation of buprenorphine has key advantages in patient compliance to treatment, and avoidance of diversion/abuse • $300-500m potential annual peak sales in opioid dependence • Potential application in treating chronic pain • Goal to establish U.S. commercialization partnership by the time of NDA filing ProNeura • Possible applications of technology for long term drug delivery in other chronic illnesses, e.g. Parkinson’s Disease Titan Pharmaceuticals Summary 33 |

Marc Rubin, M.D. July 30, 2008 34 |

Buprenorphine Implant 35 |

Insertion Applicator 36 |

Insertion Location 37 |

Removal Clamp 38 |

Summary of Non-Implant Site Adverse Events Frequency ( 10% in Any Treatment Group) PRO-805 PRO-807 Probuphine (n = 108) Placebo (n = 55) Probuphine (n = 62) System Organ Class n % n % n % Any Adverse Events 85 78.7 41 74.5 43 69.4 Gastrointestinal Constipation 15 13.9 3 5.5 8 12.9 Diarrhea 6 5.6 7 12.7 2 3.2 Nausea 15 13.9 7 12.7 2 3.2 Toothache 12 11.1 3 5.5 3 4.8 Infections Nasopharyngitis 15 13.9 3 5.5 2 3.2 Upper Respiratory 14 13.0 6 10.9 3 4.8 Musculoskeletal Back Pain 13 12.0 3 5.5 5 8.1 Nervous System Headache 27 25.0 10 18.2 11 17.7 Psychiatric Anxiety 11 10.2 5 9.1 2 3.2 Insomnia 23 21.3 12 21.8 8 12.9 39 |

PRO-806 PRO-811 Probuphine (n = 114) Placebo (n = 54) Suboxone (n = 119) Probuphine (n = 85) System Organ Class n % n % n % n % Any Adverse Events 77 67.5 33 61.1 85 71.4 57 67.1 Gastrointestinal Constipation 5 4.4 1 1.9 5 4.2 2 2.4 Diarrhea 2 1.8 3 5.6 2 1.7 2 2.4 Nausea 7 6.1 1 1.9 8 6.7 3 3.5 Toothache 4 3.5 1 1.9 5 4.2 3 3.5 Infections Nasopharyngitis 6 5.3 3 5.6 12 10.1 2 2.4 Upper Respiratory 10 8.8 4 7.4 11 9.2 7 8.2 Musculoskeletal Back Pain 6 5.3 3 5.6 7 5.9 5 5.9 Nervous System Headache 15 13.2 5 9.3 19 16.0 10 11.8 Psychiatric Anxiety 2 1.8 3 5.6 6 5.0 3 3.5 Insomnia 9 7.9 8 14.8 16 13.4 2 2.4 Summary of Non-Implant Site Adverse Events Frequency ( 10% in Any Treatment Group) 40 |

Summary of Implant Site Adverse Events Frequency ( 10% in Any Treatment Group) PRO-805 PRO-807 PRO-806 PRO-811 Probuphine (n = 108) Placebo (n = 55) Probuphine (n = 62) Probuphine (n = 114) Placebo (n = 54) Probuphine (n = 85) Erythema 25.0% 21.8% 25.8% 3.5% 0% 1.2% Edema 13.0% 9.1% 12.9% 1.8% 0% 0.0% Itching 25.0% 14.5% 19.4% 4.4% 3.7% 1.2% Pain 22.2% 10.9% 19.4% 8.8% 9.3% 0.0% Bleeding 12.0% 12.7% 16.1% 1.8% 3.7% 3.5% Bruising 5.6% 14.5% 9.7% 7.9% 11.1% 3.6% Scar 9.3% 12.7% 1.6% 0% 0% 1.6% 41 |