Royalty Agreement dated February 21, 2023 by and among TMC the metals company Inc., Nauru Ocean Resources Inc. and Low Carbon Royalties Inc

Exhibit 10.1

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

Royalty Agreement

This Agreement dated as of the 21st day of February, 2023.

Between:

Nauru Ocean Resources Inc., a company incorporated under the laws of the Republic of Nauru

(“Company”)

And:

TMC the metals company Inc., a company incorporated under the laws of the province of British Columbia

(“TMC”)

And:

Low Carbon Royalties Inc., a company incorporated under the laws of the province of British Columbia

(“Royalty Holder”)

Introduction:

| A. | The Company intends to develop the Project. |

| B. | The Company has agreed to create, grant and sell the Royalty to the Royalty Holder in accordance with the terms and conditions described herein. |

| C. | The Company is a wholly owned subsidiary of TMC. |

In Consideration Of, the covenants and mutual agreements contained in this Agreement and other good and valuable consideration (the receipt and sufficiency of which are acknowledged by each of the Parties), the Parties hereby agree as follows:

| 1. | Definitions and Interpretation |

| 1.1 | Definitions |

Unless the context otherwise requires, in this Agreement:

“25% Initial Investment” means $3,500,000;

“[***] IRR” means a [***] internal rate of return to the Royalty Holder on the 50% Initial Investment, prior to adjustment pursuant to Section 2.4(a);

“50% Initial Investment” means $7,000,000;

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

“[***] IRR” means a [***] internal rate of return to the Royalty Holder on the 25% Initial Investment, prior to adjustment pursuant to Section 2.5(a);

“Affiliate” means any Person that directly or indirectly controls, is controlled by, or is under common control with, a Party. For purposes of the preceding sentence, “control” means possession, directly or indirectly, of the power to direct or cause direction of management and policies through ownership of voting securities, contract, voting trust or otherwise;

“Agreement” means this document including any schedule or appendix to it;

“Approved Standard” means any of the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Mineral Reserves, Subpart 1300 of Regulation S-K under the United States Securities Act of 1933 and the United States Securities Exchange Act of 1934), the JORC Code, the SAMREC Code, or any other classification system for the reporting of mineral reserves and mineral resources that qualifies as an “acceptable foreign code” for purposes of NI 43-101 from time to time, in each case as such classification may be in effect from time to time, or any successor instrument, rule or policy to any of the foregoing;

“Arm’s Length Party” means, with respect to any particular Person, another Person that is not (i) a related party (as defined in the Income Tax Act (Canada)) of such Person, or otherwise determined not to be dealing at arm’s length (within the meaning of the Income Tax Act (Canada)) or (ii) an Affiliate of such Person;

“Authorization” means any authorization, approval, consent, concession, exemption, license, lease, grant, permit, franchise, right or similar arrangement (including surface rights, deep-sea rights, access rights, rights of way, privileges, concessions or franchises granted to or held by the Company by, or required to be obtained from, any Person (including a Governmental Body), for the exploration of the Property or the construction, development and operation of the Project), privilege or no-action letter from any Governmental Body having jurisdiction with respect to any specified Person, property, transaction or event, or with respect to any of such Person’s property or business and affairs (including any exploitation permit, zoning approval, mining permit, development permit or building permit) or from any Person in connection with any easements, contractual rights or other matters;

“Books and Records” the books, accounts, records and data of every kind or nature maintained by or on behalf of the Company or an Affiliate of the Company in relation to the Project, or the Company’s operations and activities on the Property, or the calculation of the Royalty, including books, accounts and records which relate to, contain or which consist of:

| (a) | the quantity of Product Sold in each Quarter or for which insurance proceeds have been received in the Quarter; |

| (b) | the calculation of each component of the Royalty for each Quarter; |

| (c) | the payment of the Royalty in each Quarter; |

| (d) | where there is any commingling in a Quarter of Product with materials extracted from areas outside the boundaries of the Property, the measures, moistures and assays of the minerals and substances in the Product extracted and recovered from the Property prior to the commingling; |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (e) | offtake agreements, settlement sheets, invoices, ledger cards, bills of lading and other shipping evidence, statements, correspondence, memoranda, credit files, electronically stored data and other data; |

| (f) | geological and metallurgical data, drill hole logs, cross sections and assay results; and |

| (g) | the exploration, development and mining of the Property; |

“Business Day” means a day that is not a Saturday, Sunday or any other day which is a public holiday or a bank holiday in the place where an act is to be performed or a payment is to be made;

“Buyer” means any Person (i) that purchases Product from the Company or its Affiliates; or (ii) that is the recipient or transferee of title to Product or the recipient of the entitlement to or benefit of Product from the Company or its Affiliates;

“Change of Control” of a Person (the “Subject Person”) means the consummation of any transaction or event, including any consolidation, business combination, arrangement, amalgamation or merger or any issue, transfer or acquisition of securities, the result of which is that any other Person (other than an Affiliate of the Subject Person) or group of other persons (other than an Affiliate of the Subject Person) acting jointly or in concert for purposes of such transaction or event (a) becomes the beneficial owners, directly or indirectly, of more than 50% of the votes attached to the voting securities of the Subject Person or (b) otherwise acquires control of the Subject Person through the occupation of a majority of the seats (other than the vacant seats) on the board of the Subject Person by individuals who were neither (i) nominated by the board of the Subject Person nor (ii) appointed, approved or endorsed by members of the board of the Subject Person; provided that a Change of Control of any Subject Person shall not include a change in the beneficial ownership of voting securities of such Subject Person, or acquisition of control of such Subject Person, if the common shares of such Subject Person were listed on a public securities exchange immediately prior to, or contemporaneously with, or immediately after the completion of such transaction;

“Claim” includes any claim, action, damage, loss, liability, cost, charge, expense, outgoing, payment or demand of any nature and whether present or future, fixed or unascertained, actual or contingent and whether at law, in equity, under statute, contract or otherwise;

“Cobalt” means cobalt contained in Product;

“Confidential Information” has the meaning given in Section 9.1(a);

“Copper” means copper contained in Product;

“Deductions” means any and all refining, treatment and other charges, insurance, deductions, transportation, settlement, financing, price participation charges and/or other charges, penalties, deductions, set-offs, Taxes and expenses pertaining to and/or in respect of the operation of the Project, the Property, the Products therefrom and the calculation or determination of the payments on account of the Royalty (or payments in lieu thereof) and for greater certainty, any payability that is less than 100% on any minerals or Metals contained in Products shall not be considered a Deduction;

“Disposal” means any disposal by any means including dumping, incineration, spraying, pumping, injecting, depositing or burying;

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

“Dispute” has the meaning given in Section 10.1;

“Dispute Notice” has the meaning given in Section 10.2(a)

“Dispute Representative” has the meaning given in Section 10.2(b);

“EDGAR” means the Electronic Data Gathering, Analysis, and Retrieval system;

“Encumbrance” means any mortgage, deed of trust, charge, pledge, hypothecation, security interest, priority or other security agreement, assignment, deposit arrangement, lien (statutory or otherwise), title retention agreement or arrangement, conditional sale, option, licence or licence fee, royalty, claim, production payment, restrictive covenant, preferential arrangement or other encumbrance of any nature or any agreement to give or create any of the foregoing, whether registered or recorded or unregistered or unrecorded;

“Environment” includes the air, surface water, groundwater, body of water, any land, soil or underground space even if submerged under water or covered by a structure, all living organisms and the interacting natural systems that include components of air, land, water, organic and inorganic matters and living organisms and the environment or natural environment as defined in any Environmental Law and “Environmental” will have a similar extended meaning;

“Environmental Laws” means all Laws relating in whole or in part to the Environment, including those relating to the storage, generation, use, handling, manufacture, processing, transportation, import, export, treatment, Release or Disposal of any Hazardous Substance;

“Excluded Taxes” means, with respect to the Royalty Holder, any of the following:

| (a) | any Taxes imposed on or measured by the Royalty Holder’s net income, net profits, capital gains, capital or branch profits, or franchise or capital Taxes imposed on (or measured by) the taxable capital of the Royalty Holder, in each case, imposed by the jurisdiction (or any political subdivision thereof) under the laws of which it is incorporated or continued or resident or organized, in each case determined by application of the laws of such jurisdiction, or in which it has a permanent establishment or carries on business, in each case determined by application of the laws of such jurisdiction; |

| (b) | any Taxes imposed by reason of the Royalty Holder receiving payments under this Agreement to an account in a jurisdiction other than Canada, or the jurisdiction in which it is incorporated or continued or resident or organized, if applicable; |

“Execution Date” means the date of this Agreement;

“Financing Party” has the meaning given in Section 8.4;

“First Repurchase Payment” has the meaning given in Section 2.4(a);

“First Royalty Repurchase Option” has the meaning given in Section 2.4(a);

“Good Industry Practice” means, in relation to any decision or undertaking, the exercise of that degree of diligence, skill, care, prudence, oversight, economy and stewardship which is commonly observed or would reasonably be expected to be observed by skilled and experienced professionals in the North American mining industry engaged in the same type of undertaking under the same or similar circumstances;

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

“Governmental Body” means any federal, provincial, state, territorial, regional, municipal, local government or authority, intergovernmental organization, quasi government authority, fiscal or judicial body, government or self-regulatory organisation, commission, board, tribunal, organisation, stock exchange or any regulatory, administrative or other agency, or any political or other subdivision, department, or branch of any of the foregoing including any indigenous or native body (or both, as the case may be) exercising governance powers by right, title or custom;

“Gross Proceeds” in any given Quarter means the aggregate of the following revenues received by the Company:

| (a) | all proceeds received by the Company from the Sale of Products, whether processed on or off of the Property, determined as follows, without duplication: |

| (i) | if Products are Sold by the Company (or any Affiliate) to an Arm’s Length Party, then the Gross Proceeds in respect of such Products will be equal to the aggregate gross proceeds received by the Company or such Affiliate from such Sale; |

| (ii) | if there is a loss of Products, then the Gross Proceeds will be equal to the aggregate insurance proceeds paid to the Company (or any Affiliate) in respect of such loss; |

| (iii) | if Trading Activities involve the physical delivery of Products, then the Market Value of Products subject to such Trading Activities; or |

| (iv) | if Products are Sold to an Affiliate, then the Gross Proceeds in respect of such Products will be the Market Value thereof, unless that Affiliate then Sells such Product to an Arm’s Length Party, in which case the Gross Proceeds shall be calculated in accordance with paragraph (a) above, provided that (i) if Sale and payment for the Product Sold are not made in the same Quarter, the Product Sold shall be deemed to be Sold in the Quarter in which the later of Sale or payment for the Product Sold occurs, and (ii) if a provisional settlement for a Sale occurs during one Quarter and the final settlement for such Sale occurs in a subsequent Quarter, the adjustment will be taken into account in determining the Product Sold in the subsequent Quarter; and |

| (b) | to the extent permitted, or not disallowed, either by the terms of any agreements between any Financing Party and the Company (or an Affiliate) or pursuant to any subordination agreement between a Financing Party and the Royalty Holder, any amount received by the Company (or an Affiliate) as compensation for the expropriation or forcible taking of all, or any portion, of the Property; |

“Hazardous Substance” means any pollutant, contaminant, waste, hazardous substance, hazardous material, toxic substance, dangerous substance or dangerous good as defined, judicially interpreted or identified in any Environmental Law;

“ICC” means the International Chamber of Commerce or any entity which replaces it or which substantially succeeds to its powers or functions;

“ICC Rules” has the meaning given in Section 10.3(b)(i);

“IFRS” means the International Financial Reporting Standards adopted by the International Accounting Standards Board from time to time;

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

“Indemnified Party” has the meaning given in Section 6.1;

“Interest Rate” means the Secured Overnight Financing Rate plus 3%;

“ISA” means the International Seabed Authority, an intergovernmental organization established pursuant to the UNCLOS;

“Law” includes:

| (a) | intergovernmental, Federal, Provincial, State and local government legislation including regulations and by-laws, and for greater certainty, including the UNCLOS; |

| (b) | legislation of any jurisdiction other than those referred to in paragraph (a) with which a Party must comply; |

| (c) | common law and equity; |

| (d) | judgments, decrees, writs, administrative interpretations, guidelines, policies, injunctions, orders or the like, of any Governmental Body with which a Party is legally required to comply and the ISA; |

| (e) | regulations, directives, rulings or policies of intergovernmental organizations; and |

| (f) | Governmental Body requirements and consents, certificates, licences, permits and approvals (including conditions in respect of those consents, certificates, licences, permits and approvals); |

“Manganese” means manganese contained in Product;

“Market Value” means, with respect to any particular Sale of Products on any particular date of determination, the average daily price of such Product as published by the London Metals Exchange for the past 3 calendar months calculated by summing such quoted price reported for each day in such 3 month period and dividing the sum by the number of days for which such price was reported;

“Metals” means all metals and minerals, including Cobalt, Copper, Manganese and Nickel;

“Mineral Reserves” means proven and probable mineral reserves (or their equivalent) as defined under any Approved Standard;

“Mineral Resources” means measured, indicated and inferred mineral resources (or their equivalent) as defined under any Approved Standard;

“NI 43-101” means National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (or any successor instrument, rule or policy);

“Nickel” means nickel contained in Product;

“No Interest Letter” has the meaning given in Section 8.4;

“Notice” or “notice” has the meaning given in Section 11.1;

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

“Parties” means the Company and the Royalty Holder and “Party” means either the Company or the Royalty Holder, as the context requires;

“Person” means any individual, corporation, partnership, joint venture, association, joint-stock company, trust, unincorporated organization or other form of enterprise, or any government or any agency or political subdivision thereof;

“Personnel” means, at the relevant time, in relation to a Party, any of its (or any Affiliates’) directors, officers or employees;

“Product” means any and all Metals and minerals of every nature and kind, (including precious and base metals), in whatever beneficiated form or state which are produced, extracted by processing, recovered in soluble solution or otherwise recovered or produced from material mined or excavated from the Property, and including any such material derived from any processing or reprocessing of any Tailings, and including any other products resulting from the further milling, processing or other beneficiation of such materials, including concentrate or doré, and for greater certainty, excludes any Tailings where there is no reasonable expectation of such Tailings being processed resulting in the production of Metals;

“Project” means the Company’s and TMC’s commercial exploitation of the polymetallic nodules found on the seafloor in the Property;

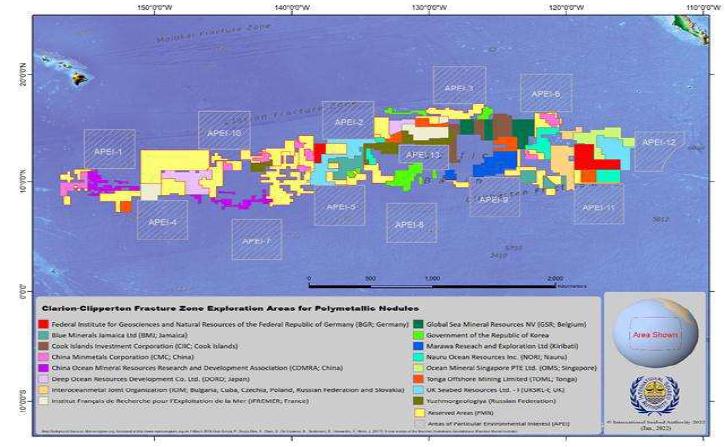

“Property” means the contract area over which the Company holds the NORI Exploration Contract (as defined in Schedule A) for exploring polymetallic nodules currently comprised of the four blocks(NORI Area A, B, C, and D) covering 74,830 km2 in the Clarion Clipperton Zone that were granted by the ISA as set out in Schedule A and depicted in the map set out in Schedule B to this Agreement together with any present mineral rights or future mineral rights resulting from renewal, extension, modification, substitution, amalgamation, succession, conversion, demise to lease, renaming or variation of any of those mineral rights or any additional mineral rights deriving from those mineral rights, including any future exploitation contract that replaces or amends the NORI Exploration Contract (whether granting or conferring the same, similar or any greater rights and whether extending over the same or a greater or lesser domain) and will automatically include any reacquisition of mineral rights contemplated by Section 4.6;

“Quarter” and “Quarterly” mean the period commencing on the date that the Company or its Affiliates first receives payment for the Sale of Product and expiring on the day preceding the next occurring 1st day of January, April, July or October and thereafter each successive period of 3 calendar months;

“Restricted Person” means any person that:

| (a) | is named, identified, described in or on or included in or on any of: |

| (i) | the lists issued under Canadian economic sanctions and terrorism financing legislation, including the Special Economic Measures Act (Canada), the Criminal Code (Canada), the United Nations Act (Canada), the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law) (Canada), and the Freezing Assets of Corrupt Foreign Officials Act (Canada), and any regulations promulgated under the foregoing; |

| (ii) | the Denied Persons List, the Entity List or the Unverified List, compiled by the Bureau of Industry and Security, U.S. Department of Commerce; |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (iii) | the List of Statutorily Debarred Parties compiled by the U.S. Department of State; |

| (iv) | the Specially Designated Nationals And Blocked Persons List compiled by the U.S. Office of Foreign Assets Control; |

| (v) | the Annex to (or any person that is otherwise subject to the provisions of) U.S. Executive Order No. 13324; |

| (vi) | the Consolidated List of Financial Sanctions Targets compiled by Her Majesty’s Treasury (United Kingdom); |

| (vii) | the Consolidated List of Persons, Groups and Entities Subject to European Union Financial Sanctions as prepared by the European External Action Service and agreed by the Council of the European Union; or |

| (viii) | any publicly available lists maintained from time to time under the applicable Laws of Canada, the United States, the United Kingdom or the European Union relating to anti-terrorism or anti-money laundering matters; |

| (b) | is subject to trade restrictions or other government sanctions under any applicable Laws of Canada, the United States, the United Kingdom or the European Union from time to time, including: |

| (i) | the Special Economic Measures Act (Canada), the Criminal Code (Canada), the United Nations Act (Canada), the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law) (Canada) and the Freezing Assets of Corrupt Foreign Officials Act (Canada); |

| (ii) | the International Emergency Economic Powers Act, 50 U.S.C.; or |

| (iii) | the Trading with the Enemy Act, 50 U.S.C. App. 1 et seq.; or any other enabling legislation or executive order relating thereto, including the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Title III of Pub. L. 107-56; or |

| (c) | is known, after reasonable inquiry, to be an Affiliate of a person referred to in paragraph (a) or (b) of this definition; |

“Royalty” means the Royalty Percentage of the Gross Proceeds from Product that is Sold to which the Royalty Holder is entitled pursuant to the terms of this Agreement, exclusive of any and all Taxes;

“Royalty Percentage” means 2%, subject to adjustment pursuant to Section 2.4 and Section 2.5;

“Royalty Statement” has the meaning given in Section 5.2;

“Sale” or “Sold” means the earlier of:

| (a) | transfer of title to Product from the Company or its Affiliates to a Buyer (and includes a transfer of title to Product transported off the Property that the Company or its Affiliates elects to have credited to or held for its account by a refinery); and |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (b) | receipt of insurance proceeds by the Company or its Affiliates for any Product that is lost or damaged; |

“Second Repurchase Payment” has the meaning given in Section 2.5(a);

“Second Royalty Repurchase Option” has the meaning given in Section 2.5(a);

“Tailings” means all tailings, waste rock or other waste products derived from the Property;

“Taxes” means any present or future income and other taxes, levies, rates, royalties, deductions, withholdings, assessments, fees, dues, duties, imposts and other charges of any nature whatsoever, together with any interest and penalties, additions to tax and other additional amounts, levied, collected, withheld, assessed or imposed by any Governmental Body (of any jurisdiction), and whether disputed or not;

“Trading Activities” means any and all activities by which the Company or any of its Affiliates:

| (a) | sells or disposes of Product by entering into offtake agreements or engaging in any sales or dispositions of Product, in any case, for other than market-based prices determined in a manner consistent with customary quotational periods in industry standard offtake agreements for similar types of minerals; |

| (b) | engages in any commodity futures trading, forward sale and/or purchase contracts, options trading or metals trading; |

| (c) | engages in price protection transactions, arrangements and mechanisms or speculative purchases and sales of forward, futures and option contracts; |

| (d) | engages in any other hedging transactions or arrangements similar to those referred to in paragraphs (a), (b) and (c) of this definition; or |

| (e) | engages in any combination of the foregoing; |

“UNCLOS” means the 1994 Agreement Relating to the Implementation of the United Nations Convention on the Law of the Sea; and

“WSMD Procedures” has the meaning given in Section 3.9.

| 1.2 | Interpretation |

Unless the context otherwise requires, in this Agreement:

| (a) | a reference to a Section or Schedule is a reference to a section of or a schedule to this Agreement; |

| (b) | the singular includes the plural and conversely and a gender includes all genders; |

| (c) | a reference to an agreement or document (including a reference to this Agreement) is to the agreement or document as amended, varied, supplemented, novated or replaced except to the extent prohibited by this Agreement or that other agreement or document; |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (d) | a reference to a party to an agreement (including this Agreement) or document includes the party’s successors and permitted substitutes (including persons taking by novation) or assigns (and, where applicable, the party’s legal personal representatives); |

| (e) | a reference to legislation or to a provision of legislation includes a modification or re-enactment of it, a legislative provision substituted for it and a regulation, code, by-law, ordinance or statutory instrument issued under it; |

| (f) | the word “including” means “including without limitation” and “include” and, “includes” will be construed similarly; |

| (g) | all provisions requiring a Party to do or refrain from doing something will be interpreted as the covenant of that Party with respect to that matter notwithstanding the absence of the words “covenants” or “agrees” or “promises”; |

| (h) | all provisions requiring a Party to do something will be interpreted as including the covenant of that Party to cause that thing to be done when the Party cannot directly perform the covenant but can indirectly cause that covenant to be performed, whether by an Affiliate under its control or otherwise; and |

| (i) | a reference to anything (including a right, obligation or concept) includes a part of that thing, but nothing in this Section 1.2(i) implies that performance of part of an obligation constitutes performance of the obligation. |

| (j) | headings and any table of contents or index are for convenience only and do not form part of this Agreement or affect its interpretation. |

| (k) | where a word or expression is given a particular meaning, other parts of speech and grammatical forms of that word or expression have a corresponding meaning. |

| (l) | if an act must be done on a specified day which is not a Business Day, then the act must be done instead on the next Business Day. |

| (m) | a provision of this Agreement must not be construed to the disadvantage of a Party merely because that Party was responsible for the preparation of this Agreement or the inclusion of the provision in this Agreement. |

| 1.3 | Currency |

Unless otherwise indicated, all references to currency in this Agreement, including “dollars” and “$” are to lawful money of the United States of America.

| 1.4 | Good Faith |

The Parties must deal with each other in good faith in connection with this Agreement and all transactions and dealings contemplated by it. In particular, the Company agrees in all dealings in relation to the Property to act in good faith towards the Royalty Holder to preserve its entitlement to the Royalty payable pursuant to Section 2.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 2. | Royalty |

| 2.1 | Grant of Royalty |

Upon receipt of the initial investment in the amount of [***] from the Royalty Holder, such amount being comprised of $5,000,000 in cash and [***] common shares in the capital of the Royalty Holder, the Company hereby creates, grants and conveys to and for the benefit of the Royalty Holder, and covenants to pay to the Royalty Holder, the Royalty, free of all Deductions, on and subject to the terms of this Agreement.

| 2.2 | Interest in the Property |

The Parties intend that the Royalty, to the maximum extent permissible under applicable Law, constitutes an interest in the Property and agree that:

| (a) | the Royalty will run with the Property and the title to the Property, and any disposition or transfer of the Property, or any interest in the Property, will be subject to the Royalty; |

| (b) | any sale or other disposition by the Company of any interest in the Property will be effective only in accordance with Section 8.3; |

| (c) | the Royalty Holder’s entitlement to any payments due on account of the Royalty will arise at the time of the production of Product, and all such payments will be held by the Company in trust for the Royalty Holder until paid to the Royalty Holder in accordance with the provisions of this Agreement; |

| (d) | to the maximum extent possible under applicable Law, the Company will, upon request by the Royalty Holder, sign and deliver to the Royalty Holder, and the Royalty Holder may register or otherwise record (or require the Company to register or otherwise record) against the Property, this Agreement or a notice of this Agreement, and any other similar document or documents as the Royalty Holder may request that will have the effect of giving notice of the existence of the Royalty to third Persons, and protecting the Royalty Holder’s right to receive the Royalty and the performance by the Company of the other covenants and obligations under this Agreement; |

| (e) | if any renewal, extension, modification, substitution, amalgamation, succession, conversion, demise to lease, renaming or variation of any mineral right is granted as contemplated in the definition of Property, the Company agrees if permissible under Law, to execute and deliver such document or documents as the Royalty Holder may reasonably request to acknowledge that the Royalty is applicable to the same including any registration or recording document of any nature whatsoever, inclusive of those contemplated in Section 2.2(d); and |

| (f) | without limiting the generality of the foregoing, the Company shall, the maximum extent possible under the UNCLOS and the regulations of the ISA, take all steps and actions necessary, including seeking consent of the ISA and any sponsoring state, to register the Royalty as an Encumbrance on any exploitation contract granted to the Company by the ISA, provided nothing shall require the Royalty Holder to fulfil qualification criteria under UNCLOS; provided that any Encumbrance granted to the Royalty Holder hereunder shall be postponed and subordinated to any Encumbrance in favour of any existing or future Financing Party in accordance with Section 8.5. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 2.3 | Term |

The Royalty will exist in perpetuity. The Royalty will not be terminated by reason of the suspension of operations or closure of any facility, or mining operations on or related to the Property. If a court of competent jurisdiction or other lawful body determines that the term or any other provision of this Agreement violates any statutory or common law rule against perpetuities or other international or transnational law, then the term of this Agreement will automatically be revised and reformed to coincide with the maximum term permitted by the rule against perpetuities or such other provision or other international or transnational law and this Agreement will not be terminated solely as a result of a violation of the rule against perpetuities or other international or transnational law.

| 2.4 | First Royalty Repurchase Option |

| (a) | Provided that the Company is not in default of any of its payment obligations under this Agreement, the Company will have the exclusive and irrevocable one-time right and option (“First Royalty Repurchase Option”) to purchase fifty percent (50%) of the Royalty on or after the second anniversary following the date of this Agreement, by making a payment (“First Repurchase Payment”) in cash by wire transfer to the Royalty Holder in the amount that, when combined with the aggregate Royalty payments received by Royalty Holder prior to the date the First Repurchase Payment is made, would provide the Royalty Holder with a [***] IRR. The First Royalty Repurchase Option shall expire on the seventh anniversary following the date of this Agreement. |

| (b) | If the Company elects to exercise the First Royalty Repurchase Option pursuant to Section 2.4(a), the Company must provide to the Royalty Holder a minimum of thirty (30) days prior written notice of the date that it will pay the First Repurchase Payment, such date to be the next Business Day following the end of a Quarter. Provided that the Company is not in default of any of its payment obligations under this Agreement, upon receipt of the First Repurchase Payment on the next Business Day following the end of a Quarter along with the Royalty payment due for such Quarter, all without set-off or deduction, the Royalty Holder must convey and surrender fifty percent (50%) of the Royalty to the Company by way of a mutually agreeable instrument. Any such conveyance and surrender will be effective on the date that payment of the First Repurchase Payment is made. For greater certainty, if the First Royalty Repurchase Option is exercised by the Company, then the adjusted Royalty Rate will be 1.00% going forward (including for the Quarter in which the First Repurchase Payment is made). |

| (c) | For greater certainty, any exercise of the First Royalty Repurchase Option will not derogate from, or impact any rights of the Royalty Holder that arose or accrued prior to the date that the First Repurchase Payment is made, including any Royalty amounts payable and any audit rights. |

| 2.5 | Second Royalty Repurchase Option |

| (a) | Provided that the Company is not in default of any of its payment obligations under this Agreement, and the First Royalty Repurchase Option has been exercised, the Company will have the exclusive and irrevocable one-time right and option (“Second Royalty Repurchase Option”) to purchase an additional twenty-five percent (25%) of the original Royalty on or after the fifth anniversary following the date of this Agreement, by making a payment (“Second Repurchase Payment”) in cash by wire transfer to the Royalty Holder in the amount that, when combined with the aggregate Royalty payments received by Royalty Holder prior to the date the Second Repurchase Payment is made, would provide the Royalty Holder with a [***] IRR. The Second Royalty Repurchase Option shall expire on the tenth anniversary following the date of this Agreement. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (b) | If the Company elects to exercise the Second Royalty Repurchase Option pursuant to Section 2.5(a), the Company must provide to the Royalty Holder a minimum of thirty (30) days prior written notice of the date that it will pay the Second Repurchase Payment, such date to be the next Business Day following the end of a Quarter. Provided that the Company is not in default of any of its payment obligations under this Agreement, upon receipt of the Second Repurchase Payment on the next Business Day following the end of a Quarter along with the Royalty payment due for such Quarter, all without set-off or deduction, the Royalty Holder must convey and surrender twenty-five percent (25%) of the original Royalty to the Company by way of a mutually agreeable instrument. Any such conveyance and surrender will be effective on the date that payment of the Second Repurchase Payment is made. For greater certainty, if both the First Royalty Repurchase Option and the Second Royalty Repurchase Option are exercised by the Company, then the adjusted Royalty Rate will be 0.50% going forward (including for the Quarter in which the Second Repurchase Payment is made). |

| (c) | For greater certainty, any exercise of the Second Royalty Repurchase Option will not derogate from, or impact any rights of the Royalty Holder that arose or accrued prior to the date that the Second Repurchase Payment is made, including any Royalty amounts payable and any audit rights. |

| 3. | Royalty Payments |

| 3.1 | Accrual of Payment Obligation |

Following the first Sale by the Company or its Affiliates of Product the Company must calculate and pay the Royalty for each Quarter in accordance with this Agreement.

| 3.2 | Payments |

Royalty payments will be due and payable Quarterly within thirty (30) days following the end of the Quarter in which the obligation to pay the Royalty accrued.

| 3.3 | Audit and Adjustments |

| (a) | Without limiting any other provision of this Agreement, to the extent that the Royalty Holder has any questions regarding the calculation of the Royalty or the Royalty Statement the Company must forthwith provide background information and documentation relating to the same and work in good faith to resolve the Royalty Holder’s questions, subject to any third-party confidentiality obligations of the Company and its Affiliates (in which case the Company will provide such information directly to the Royalty Holder’s auditor). |

| (b) | Each Royalty payment will be considered final and in full satisfaction of all obligations of the Company with respect to that payment unless the Royalty Holder gives the Company written notice within twenty-four (24) months after receipt by the Royalty Holder of the Royalty Statement that relates to the Royalty payment in question. |

| (c) | The Royalty Holder may, for a period of one hundred and twenty (120) days after delivering to the Company the notice under Section 3.3(a), upon reasonable notice and at all reasonable times, have the Company’s Books and Records relating to the calculation of the Royalty payment in question audited by an independent firm of chartered professional accountants or certified public accountants with expertise in auditing royalty payments selected by the Royalty Holder. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (d) | If an audit conducted in accordance with Section 3.3(c) determines that there has been a deficiency or an excess in the payment made to the Royalty Holder, then subject to Section 3.3(e), such deficiency or excess will be resolved by adjusting the next Royalty payment due. |

| (e) | If a Party disagrees with the determination in Section 3.3(d) that there has been a deficiency or an excess in the payment made to the Royalty Holder, that Party will have the right to provide background information and documentation in support of its position within twenty (20) Business Days of such determination and to meet with the independent firm that conducted the audit to discuss the calculation methodologies and such firm must in good faith consider the material and whether to revise its determination pursuant to Section 3.3(d). |

| (f) | The Royalty Holder may only exercise its audit right once per calendar year unless pursuant to an audit a deficiency of 5% or more of the amount due to the Royalty Holder is determined to exist, in which case the Company must pay the costs of such audit and the annual limitation on audits will be suspended until such time as two (2) consecutive audits confirm that no deficiencies in the amount due to the Royalty Holder. Failure on the part of the Royalty Holder to make claim on the Company for adjustment within the twenty-four (24) month period specified in Section 3.3(b) will establish the correctness of the Royalty payment and preclude the making of claims for adjustment of the Royalty payment. |

| (g) | Notwithstanding the foregoing or any other provision of this Agreement, if the auditor appointed under Section 3.3(c) determines, or finds reason to believe that, fraud or gross negligence may exist in respect of any Royalty payment, then no time limit will preclude the number of audits and adjustments on past Royalty payments,. |

| 3.4 | Currency and Wire Transfer |

All cash Royalty payments must be made in United States dollars without Deductions, demand, notice, set-off, or reduction, by wire transfer in good immediately available funds, to such bank account as the Royalty Holder may nominate in writing to the Company from time to time.

| 3.5 | Late Payment |

If any Party fails to pay any sum payable by it under or in accordance with this Agreement then that Party must pay interest on that sum (compounded monthly) from the due date for payment until that sum plus accrued interest is paid in full at the rate per annum which is the Interest Rate on the date on which the payment was due calculated daily. The right to require payment of interest under this Section 3.5 is without prejudice to any other rights the non-defaulting Party may have against the defaulting Party under this Agreement, at law, in equity or otherwise.

If the Company is in default of any payment obligation to the Royalty Holder under this Agreement then the Company will automatically, without the Royalty Holder being required to give notice of default, make demand, institute legal or arbitral proceedings or perform any other action, be deemed to be in default of, and in arrears under, this Agreement.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 3.6 | Reserved |

| 3.7 | Disposition of Product |

The Company must not dispose of any Product except pursuant to a Sale by the Company of Product by the methods set out in the definition of “Gross Proceeds”.

| 3.8 | Trading Activities of the Company |

| (a) | The Company and any of its Affiliates will have the right to engage in Trading Activities which may involve the possible physical delivery of Product. |

| (b) | The calculation of Gross Proceeds will not be affected by, the Royalty will not apply to, and the Royalty Holder will not be entitled or required to participate in, any gain or loss of the Company or its Affiliates in Trading Activities or in the actual marketing or sale of Product delivered pursuant to Trading Activities. In determining the Royalty payable on any Product delivered pursuant to Trading Activities, the Company will not be entitled to deduct from Gross Proceeds any losses suffered by the Company or its Affiliates in Trading Activities. If the Company engages in Trading Activities, then the Royalty will be determined on the basis of the Market Value of such Products as of the date of Sale without regard to the price or proceeds actually received by the Company for, or in connection with, such Sale or the manner in which such Sale was made by the Company. The Parties agree that the Royalty Holder is not a participant in the Trading Activities of the Company, and therefore the Royalty will not be diminished or improved by losses or gains of the Company in any such Trading Activities. |

| 3.9 | WSMD Procedures |

The Company must ensure that weighing, sampling, moisture determination and assaying procedures (“WSMD Procedures”) are conducted in connection with all shipments of Product Sold and that all such WSMD Procedures are conducted in accordance with Good Industry Practice. The Company must provide, or cause to be provided, to the Royalty Holder the required information pursuant to Section 5.2, including, upon request from the Royalty Holder, the Books and Records relevant to the weighing, sampling, moisture determination and assaying of the Product subject to such shipments, subject to any third-party confidentiality obligations of the Company and its Affiliates (in which case the Company will provide such information directly to the Royalty Holder’s auditor only).

| 4. | Operation Of The Property |

| 4.1 | Company to Determine Operations |

Any decision concerning methods, the extent, times, procedures and techniques of any:

| (a) | exploration, development and mining related to the Property; |

| (b) | processing or extraction treatment; |

| (c) | materials to be introduced on or to the Property or produced from the Property and all decisions concerning the sale or disposition of Product from the Property; and |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (d) | operations or continuance of operations of the Property or any portion thereof, including with respect to closure and care and maintenance, |

will be made by the Company and must be made by the Company in accordance with Good Industry Practice in the relevant circumstances.

| 4.2 | Compliance with Applicable Laws |

The Company must ensure that all operations and activities in respect of the Property will be performed in a commercially reasonable manner in compliance, in all material respects, with applicable Laws, Authorizations and in accordance with Good Industry Practice.

| 4.3 | Stockpiling |

The Company may temporarily stockpile any Product from the Property at such place or places as the Company may elect. In the event that the Company stockpiles or holds inventory of any Product it must ensure security for the site where such Product is stockpiled in accordance with Good Industry Practice.

| 4.4 | Commingling |

Commingling of Products from the Property with other ores, doré, concentrates, precipitates, metals, minerals or mineral by-products produced elsewhere is permitted, provided that:

| (a) | reasonable and customary procedures are established for the weighing, sampling, assaying and other measuring or testing necessary to fairly allocate valuable metals contained in such Products and in the other ores, doré, concentrates, metals, minerals and mineral by-products; |

| (b) | representative samples of the Products must be retained by the Company and assays (including moisture and penalty substances) and other appropriate analyses of these samples must be made before commingling to determine gross metal content of the Products and that the Company must retain such analyses for a reasonable amount of time, but not less than 24 months, after receipt by the Royalty Holder of the Royalty paid with respect to such commingled Products from the Property; and |

| (c) | the amount of valuable metals contained in such Products and in the other ores, doré, concentrates, metals, minerals and mineral by-products are capable of being accurately verified by audit under Section 3.3. |

| 4.5 | Surrender |

Subject to Section 4.6, the Company may, in its absolute discretion, allow to lapse or expire, abandon or surrender all or any part of the Property.

| 4.6 | Reacquisition of Property |

If the Company or any Affiliate or any successor or assign of the Company surrenders, allows to lapse or otherwise terminates its interest in the Property or any part of the Property and reacquires a mineral right or a direct or indirect interest in mineral rights, including by contract or license, in respect of the area covered by the former Property, then the Royalty will apply, subject to the approval of the ISA if required, to such mineral right or interest so acquired and such right or interest will thereafter become part of the Property. The Company must give written notice to the Royalty Holder within five (5) Business Days of any acquisition of such mineral right or interest, as applicable and on demand of the Royalty Holder and to the extent permitted by applicable Law, must register at the relevant public registry, this Agreement, or a memorandum of this Agreement, against the mineral right or interest referred to above, as applicable.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 5. | Records, Access And Reporting |

| 5.1 | Records and Access |

The Company must:

| (a) | keep true, accurate and complete Books and Records in accordance with either United States generally accepted accounting principles or IFRS, each as amended, supplemented or replaced from time to time to enable the Royalty to be calculated in accordance with this Agreement; and |

| (b) | permit the Royalty Holder at its own cost, after it has given reasonable Notice to the Company, to inspect at the Company’s premises at all reasonable times and with access to the Company’s relevant Personnel, the Books and Records referred to in Section 5.1(a), and to make and take away with it copies of such Books and Records; provided that if any such Books and Records are subject to any third-party confidentiality obligations of the Company and its Affiliates, the Company will provide such information directly to the Royalty Holder’s auditor only. |

| 5.2 | Royalty Statements |

At the same time as paying each Royalty payment under Section 3.2, the Company must provide to the Royalty Holder a report setting out in reasonable detail the following information (“Royalty Statement”):

| (a) | the quantity, type and grade of Metals extracted during that Quarter; |

| (b) | the quantity, type and grade of Product that has been processed during that Quarter and the location of the relevant facilities; |

| (c) | the quantity, type and grade of all Product that has been Sold during that Quarter; |

| (d) | the quantity and type of Product held or unsold during that Quarter; |

| (e) | the Royalty for that Quarter and details of the Gross Proceeds during the Quarter, details on the proceeds of Sale for underlying the calculation of the Royalty; and |

| (f) | other pertinent information in sufficient detail to explain the calculation of the Royalty payment. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 6. | INDEMNITY |

| 6.1 | Indemnity |

The Company must indemnify and keep indemnified the Royalty Holder, its Affiliates, and their respective directors, officers, employees and agents and their successors and assigns (each an “Indemnified Party”) for, from and against any Claim, that may be made or brought against an Indemnified Party by a third party that arise out of or in connection with:

| (a) | any breach or non-compliance with applicable Law including Environmental Law; |

| (b) | the physical environmental condition of the Project and matters of health and safety related thereto or any action or claim brought with respect thereto (including conditions arising before the Execution Date); or |

| (c) | any Hazardous Substances on, in or under the Property or the soil, sediment, water or groundwater forming part of the Property, whether in the past, present or future, or any Hazardous Substances on any other lands or areas having originated or migrated from the Property or the soil, sediment, water or groundwater forming part of the Property. |

| 6.2 | Survival of Indemnity |

The indemnity in Section 7.1 is a continuing obligation, separate and independent from other obligations and will not be discharged by any one payment or act and will survive expiration or earlier termination of this Agreement.

| 7. | MAINTENANCE OF EXISTENCE AND TITLE; WARRANTIES |

| 7.1 | Maintenance of Existence |

The Company shall use its commercially reasonable efforts to at all times do or cause to be done all things necessary to maintain its corporate or other entity existence and to obtain and, once obtained, maintain all Authorizations necessary to carry on its business and own the Property.

| 7.2 | Title Maintenance and Taxes |

The Company shall use its commercially reasonable efforts to:

| (a) | not do or permit to be done, anything that may prejudice the Property or render the Property, or any interest in the Property, liable for forfeiture; and |

| (b) | maintain title to the Property, including paying, when due, all Taxes, duties or other payments on or with respect to the Property and doing all things and making any payments required by applicable Law or appropriate and permitted by applicable Law to maintain the right, title and interest of the Company and the Royalty Holder, respectively, in the Property and under this Agreement. |

| 8. | Assignment and Future Financing |

| 8.1 | Meaning of Assign |

For the purposes of this Section 8, “assign” and inflexions of “assign” means to transfer, sell, assign or otherwise dispose of in any manner whatsoever.

| 8.2 | Assignment by the Royalty Holder |

The Royalty Holder may at any time, assign all or any part of the Royalty, including for an indefinite period or for a stated term of years or up to a specified dollar amount, provided that (i) the Royalty Holder shall provide written notice to the Company of the assignment, and (ii) unless such assignment is made upon the occurrence and continuation of a Royalty payment default by the Company, the aggregate additional amounts payable by the Company under Sections 12.1(a) or Section 12.1(b) shall be no greater than what they would have been if the interest of the initial Royalty Holder had not been sold, assigned or transferred. Nothing in this Section 8.2 shall in any way restrict or prevent the Royalty Holder from granting participation interests in the Royalty Holder’s interests, rights and obligations hereunder. If the Royalty Holder assigns part of the Royalty, the Royalty Holder and all such assignees must appoint a common administrative agent for payment, audit rights and notice under this Agreement.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 8.3 | Assignment by the Company |

The Company may assign all or any interest in the Property (directly or indirectly, including by way of Change of Control) as long as:

| (a) | in the case of a direct assignment of all or any interest in the Property, the assignee has delivered a deed or other instrument under which the assignee covenants to be bound by the terms and conditions of this Agreement, including this Section 8.3, in the place of the Company (to the extent of the interest assigned); |

| (b) | in the case of a direct assignment, if the assignee is a holding company, the parent company of such assignee has delivered a deed or other instrument under which such parent company covenants to be bound by the terms and conditions of this Agreement, including this Section 8.3 and Section 12.2, in the place of TMC (to the extent of the interest assigned); and |

| (c) | in the case of a indirect assignment for an interest equal to or greater than 50% in the Property (including by way of Change of Control), the company acquiring and indirect interest equal to or greater than 50% in the Property has delivered a deed or other instrument, substantially in the form of a No Interest Letter. |

If the Company has not complied with this Section 8.3 in relation to an assignment of all or any interest in the Property, then the Company will remain liable to the Royalty Holder with respect to the Royalty notwithstanding that the assignment occurred and any such assignment will be void and ineffective as between the Royalty Holder and the Company.

| 8.4 | Future Financing - No Interest Letter |

Prior to the Company entering into any debt financing arrangements in respect of the Property or granting any Encumbrance, directly or indirectly, in the Property relating to indebtedness or other financing, the Company shall cause each provider of such financing (each, a “Financing Party”) to deliver to the Royalty Holder, a letter agreement, substantially in the form attached as Schedule C (a “No Interest Letter”).

| 8.5 | Subordination to Financing Parties |

At the request of the Company, the Royalty Holder agrees to enter into, with each Financing Party that has provided a No Interest Letter, a subordination agreement in a form acceptable to such Financing Party and the Royalty Holder (acting reasonably), which shall provide for the postponement, standstill and subordination of any Encumbrance granted to the Royalty Holder pursuant to Section 2.2(f) to any Encumbrances in favour of such Financing Party.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 9. | Confidentiality |

| 9.1 | Confidentiality |

| (a) | Subject to Section 9.1(b), each Party covenants with the other that it will keep confidential the terms of this Agreement and all information (whether in tangible, electronic or other form) provided or disclosed to a Party by reason of the operation of this Agreement, including any information regarding a Party’s Affiliates (“Confidential Information”). |

| (b) | Each Party undertakes that neither it, its Affiliates or their respective Personnel will, without the prior written consent of the other Party, disclose any Confidential Information to any third Person unless: |

| (i) | the disclosure is expressly permitted by this Agreement; |

| (ii) | subject to Section 9.1(c), the disclosure consists of information required to be disclosed under applicable Laws relating to disclosure by public companies in Canada or the United States of America; |

| (iii) | the information is already in the public domain (unless it entered the public domain because of a breach of this Section 9.1 by the Party); |

| (iv) | the disclosure is made on a confidential basis to the Party’s officers, employees, agents, financiers or professional advisers, and is necessary for the Party’s business and such Persons agree to keep the disclosure confidential in accordance with this Section 9.1; |

| (v) | the disclosure is necessary to comply with any applicable Law, or an order of a court or tribunal; |

| (vi) | subject to Section 9.1(c), the disclosure is necessary for a Party or its Affiliates to comply with a directive or request of any Governmental Body, securities regulator or stock exchange (whether or not having the force of Law) so long as a responsible person in a similar position would comply; |

| (vii) | subject to Section 9.1(c), the disclosure is necessary or desirable to obtain an authorization from any Governmental Body, securities regulator or stock exchange; |

| (viii) | the disclosure is necessary in relation to any discovery of documents, or any proceedings before an arbitrator, court, tribunal, other Governmental Body, securities regulator or stock exchange; or |

| (ix) | the disclosure is made on a confidential basis to a prospective assignee, purchaser, acquiror or financier of the Party, or to any other person who proposes to enter into contractual relations with the Party and agrees to keep the disclosure confidential in accordance with this Section 9.1. |

| (c) | Before disclosing any Confidential Information publicly in accordance with Section 9.1(b)(ii) or to a Governmental Body or securities regulator in accordance with Sections 9.1(b)(vi) or 9.1(b)(vii), the disclosing Party must, to the extent permitted by applicable Law, provide the other Party with a draft of the proposed disclosure for its consideration and comment. The other Party will provide any comments promptly. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 9.2 | Announcements |

The Parties shall jointly plan and co-ordinate, and shall cause their respective Affiliates to jointly plan and coordinate, any public notices, press releases, and any other publicity concerning the entering into of this Agreement and none of the Parties or its Affiliates shall act in this regard without reasonable prior consultation with the other Parties, unless such disclosure is required to meet timely disclosure obligations of such Parties or their Affiliates under Applicable Laws in circumstances where prior consultation with the other Parties is not practicable, and a copy of such disclosure shall be provided to the other Parties at such time as it is made publicly available.

| 9.3 | Filing of Agreement |

Each Party agrees that if a Party or any of its Affiliates is required to file a copy of this Agreement in any public registry, filing system or depository, including, in order to comply with applicable Law, it must notify the other Party of such requirement promptly and the Parties must consult with each other with respect to any proposed redactions to this Agreement in compliance with such applicable Laws before it is filed in any such registry, filing system or depository. The Royalty Holder acknowledges that a copy of this Agreement may be publicly filed by TMC under its profile on EDGAR.

| 10. | Dispute Resolution |

| 10.1 | Disputes |

Any dispute, controversy or claim in relation to this Agreement, including the existence, interpretation, validity, performance or breach of this Agreement or any matter arising under this Agreement, including whether any matter is subject to arbitration or this Section 10 (“Dispute”) must be resolved in accordance with the provisions of this Section 10.

| 10.2 | Dispute Notices and Dispute Representatives |

| (a) | In the event of any Dispute between the Parties, a Party may give to the other Party a notice (“Dispute Notice”) specifying the Dispute and requiring its resolution under this Section 10. |

| (b) | If the Dispute is not resolved within ten (10) Business Days after a Dispute Notice is given to the other Party, then each Party must nominate one (1) representative from its senior management to resolve the Dispute (each, a “Dispute Representative”), who must negotiate using their respective commercially reasonable efforts to attain a resolution of the Dispute. |

| 10.3 | Arbitration |

| (a) | If a Dispute has not been resolved by the Dispute Representatives under Section 10.2(b) within ten (10) Business Days of the date of referral of the Dispute to the Dispute Representatives or such longer period of time as agreed, then a Party may, by notice to the other Party, submit the Dispute to arbitration for final resolution in accordance with the remaining provisions of this Section 10. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (b) | The Parties agree that: |

| (i) | any Dispute will be finally resolved by arbitration conducted in accordance with the then current Rules of Arbitration of the ICC (“ICC Rules”); |

| (ii) | the seat or legal place of the arbitration will be Vancouver, British Columbia, Canada and the language of the arbitration will be English; |

| (iii) | all arbitral proceedings will be private and confidential and may be attended only by the arbitrators, the Parties and their representatives, and witnesses to the extent they are testifying in the proceedings; |

| (iv) | any Dispute must be heard and determined by three (3) arbitrators and each Party must, within ten (10) Business Days after commencement of the arbitration, select one (1) person to act as arbitrator. The two (2) arbitrators so selected must, within five (5) Business Days of their appointment, select a third arbitrator who will serve as the chairperson of the arbitral panel; |

| (v) | each arbitrator must be a senior practicing lawyer and a disinterested person who has no connection with either Party or the performance of this Agreement and must be qualified by education, training and experience to hear and determine matters in the nature of the Dispute; |

| (vi) | if a Party fails to appoint an arbitrator as required under Section 10.3(b)(iv), or if the arbitrators selected by the Parties are unable or fail to agree upon a third arbitrator within five (5) Business Days of their appointment, then that arbitrator will be selected and appointed in accordance with the ICC Rules; |

| (vii) | if an arbitrator dies, resigns, refuses to act, or becomes incapable of performing his or her functions as an arbitrator, then the ICC may declare a vacancy on the panel and the vacancy will be filled by the method by which that arbitrator was originally appointed; |

| (viii) | the arbitral panel may determine all questions of law and jurisdiction (including questions as to whether or not a Dispute is arbitrable) and all matters of procedure relating to the arbitration; |

| (ix) | any award or determination of the arbitral panel will be final and binding upon the Parties in respect of all matters relating to the arbitration, the procedure, the conduct of the Parties during the proceedings and the final determination of the issues in the arbitration; and |

| (x) | there will be no appeal from any award or determination of the arbitral panel to any court and judgment on any arbitral award may be entered in any court of competent jurisdiction. |

| (c) | No arbitration proceeding may be commenced under this Section 10 unless commenced within the time period permitted for actions by the applicable statute of limitations. |

| (d) | Notwithstanding the foregoing, either Party may apply to a court of competent jurisdiction for an interim measure of protection, or for any order for equitable relief explicitly provided for in this Agreement which the arbitrator does not have the jurisdiction to grant. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 10.4 | Performance of Obligations During Dispute |

To the extent permitted by the nature of the Dispute, during the existence of any Dispute the Parties must continue to perform their respective obligations under this Agreement without prejudice to their position in respect of such Dispute, unless the Parties otherwise agree.

| 11. | Notice |

| 11.1 | Form of Notice |

Any notice, consent, demand or other communication in relation to this Agreement (“Notice”) must be:

| (a) | in writing; |

| (b) | delivered by hand or by prepaid, registered or certified mail or courier to the address, or if sent electronically as an attachment to an email to the email or other internet address for each Party. |

| 11.2 | Delivery |

| (a) | A Notice is effective: |

| (i) | if delivered by hand, on the date it is delivered to the addressee; |

| (ii) | in the case of delivery by mail, five (5) Business Days after the date of posting (if posted to an address in the same country) or ten (10) Business Days after the date of posting (if posted to an address in another country); |

| (iii) | if couriered, on the date on which the courier confirms delivery; or |

| (iv) | if sent electronically at the time which is 12 hours from the time the email was sent, unless a later time is specified in the Notice or a notification of a delivery failure is received by the sender. |

| (b) | A Notice received after 5pm. in the place of receipt is taken to be received on the next Business Day in the place of receipt. |

| (c) | An email does not itself constitute a Notice but a Notice may be transmitted as an attachment to an email. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| 11.3 | Address for Notice |

| (a) | Each Party’s address and email address will be as specified below or as notified in writing from time to time to the other Party: |

| (i) | in the case of the Company: |

| Attention: | Craig Shesky, Chief Financial Officer | |

| Address: | 595 Howe Street | |

| Vancouver, BC | ||

| V6C 2T5 | ||

| Canada | ||

| Email Address: | ***@*** | |

| with a copy to: | ||

| Attention: | Ryan Coombes, General Counsel and Corporate Secretary | |

| Address: | 595 Howe Street | |

| Vancouver, BC | ||

| V6C 2T5 | ||

| Canada | ||

| Email Address: | ***@*** | |

| (ii) | in the case of the Royalty Holder: |

| Attention: | Chief Financial Officer, Low Carbon Royalties Inc. | |

| Address: | 2600- 595 Burrard Street | |

| Vancouver, BC | ||

| V7X 1L3 | ||

| Canada | ||

| Email Address: | ***@*** |

| (b) | A Party may, from time to time, notify the other Party in writing of any change to its details in Section 11.3. |

| 12. | Miscellaneous |

| 12.1 | Taxes |

| (a) | All payments of any kind made under this Agreement or document to be delivered hereunder by or on behalf of the Company shall be made free and clear and without any present or future deduction, withholding, charge, levy or imposition for or on account of any Taxes, except as required by applicable Laws. Subject to Section 12.1(c) below, all Taxes, if any, as are required by applicable Laws to be deducted, withheld, charged, levied, collected or imposed on any Person on or with respect to any such payment made by or on behalf of the Company shall be paid by the Company by paying to the Royalty Holder, in addition to such payment, such additional payment as is necessary to ensure that the net amount received by the Royalty Holder (net of any such Taxes, including any Taxes required to be deducted, withheld, charged, levied, collected or imposed on any such additional amounts) equals the full amount that the Royalty Holder would have received had no such deduction, withholding, charge, levy, collection or imposition been required. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (b) | Subject to Section 12.1(c), if the Royalty Holder becomes liable for any Taxes, other than Excluded Taxes, imposed on any payments under this Agreement, the Company shall indemnify the Royalty Holder for such Tax, and the indemnity payment shall be increased as necessary so that, after the imposition of any Tax on the indemnity payment (including Tax in respect of any such increases in the indemnity payment), the Royalty Holder shall receive the full amount of Taxes for which it is liable and are due and payable. Any indemnity payments for Taxes shall be due and payable by the Company within five (5) Business Days of demand from the Royalty Holder. If reasonably requested by the Company, the Royalty Holder will use reasonable efforts to dispute the imposition or assertion of such Taxes by the relevant Governmental Body, all at the Company’s expense. A certificate as to the amount of such payment or liability delivered to the Company by the Royalty Holder shall be conclusive absent manifest error. |

| (c) | Notwithstanding Sections 12.1(a) and 12.1(b), the Company shall not be responsible for any Excluded Taxes imposed or collected by any foreign jurisdiction in respect of payments of any kind made by the Royalty Holder pursuant to this Agreement. |

| (d) | The parties agree to reasonably cooperate to (i) ensure that no more Taxes, duties or other charges are payable other than as required under applicable Law and (ii) obtain a refund or credit of any Taxes which have been overpaid. |

| (e) | Without limiting the provisions of Sections 12.1(a) and 12.1(b), the Company shall timely pay any Taxes (other than Excluded Taxes) to the relevant Governmental Body in accordance with applicable Law. |

| (f) | As soon as practicable after any payment of Taxes by the Company to a Governmental Body pursuant to Section 12.1, the Company shall deliver to the Royalty Holder the original or a certified copy of a receipt issued by such Governmental Body evidencing such payment, a copy of the return reporting such payment or other evidence of such payment reasonably satisfactory to the Royalty Holder. |

| 12.2 | Covenant of TMC |

TMC hereby unconditionally and irrevocably guarantees and shall be jointly and severally liable for all obligations, including any indemnity given hereunder, of the Company pursuant to the terms and conditions of this Agreement. Notwithstanding the foregoing,

| (a) | if the Company assigns the Property and complies with Section 8.3; or |

| (b) | if TMC assigns any of its interest in the Company to a third party, and such third party delivers a deed or other instrument under which such third party covenants to be bound by the terms and conditions of this Agreement in the place of TMC (to the extent of the interest assigned), then TMC shall, concurrently with such assignment, be fully and forever discharged and released from its guarantee hereunder (to the extent of the interest assigned). |

| 12.3 | Governing Law |

| (a) | Except for matters of title to the Property or security interests granted in the Property, which will be governed by the Law of its situs, this Agreement is governed by the law in force in the Province of British Columbia and the law of Canada applicable in British Columbia, without regard to any conflict of laws or choice of laws rules or principles that would permit or require the application of the laws of any other jurisdiction. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

| (b) | Subject to Section 10, each Party irrevocably submits to the exclusive jurisdiction of the courts exercising jurisdiction in the Province of British Columbia and any court that may hear appeals from any of those courts for any proceeding in connection with this Agreement, subject only to the right to enforce a judgment obtained in any of those courts in any other jurisdiction. |

| 12.4 | Other Activities and Interests |

This Agreement and the rights and obligations of the Parties under this Agreement are limited to the Property and the Project. Except as expressly provided in any other written agreement between the Parties with respect to the Property (and then only to the extent expressly provided in that other written agreement), each Party will have the free and unrestricted right to enter into, conduct and benefit from any and all business ventures of any kind whatsoever, whether or not competitive with the activities undertaken under this Agreement, without disclosing such activities to the other Party or inviting or allowing the other Party to participate in those activities.

| 12.5 | No Partnership |