Second Amendment to Post-Petition Credit Agreement by Mississippi Chemical Corporation and Lenders

This amendment, dated March 1, 2004, modifies the Post-Petition Credit Agreement between Mississippi Chemical Corporation (MCC) and its lenders. It extends the deadline for a required liquidity event from February 29 to March 10, 2004, and reduces the minimum net cash proceeds from $25 million to $20 million. The amendment also outlines the process for releasing certain liens on assets being sold, contingent on the lenders receiving at least $20 million from the sale. All other terms of the original agreement remain in effect.

EXHIBIT 10.3

Post-Petition Credit Agreement

SECOND AMENDMENT TO POST-PETITION CREDIT AGREEMENT

THIS SECOND AMENDMENT TO POST-PETITION CREDIT AGREEMENT dated as of March 1, 2004, is entered into by and among Mississippi Chemical Corporation, a Mississippi corporation (“MCC”), and the lenders that are parties to the DIP Agreement listed on the signature pages hereto (the “Banks”).

RECITALS

A. MCC, a DIP Agent that has resigned and not yet been replaced, and the Banks entered into a certain Post-Petition Credit Agreement dated as of May 13, 2003, as amended by a Revised First Amendment to Post-Petition Credit Agreement and Waiver dated October 2, 2003 (as the same may be further amended, restated, supplemented, or otherwise modified from time to time, the “DIP Agreement”; capitalized terms used and not otherwise defined herein shall have the meanings assigned to them in the DIP Agreement), pursuant to which MCC was required by no later than February 29, 2004, to consummate the Potash Liquidity Event for net cash proceeds available to the Banks of not less than $25,000,000.00.

B. MCC has informed the Banks that it will be unable to satisfy the requirements relating to the Potash Liquidity Event and has requested that the parties hereto enter into this Amendment to modify certain terms and provisions relating thereto.

NOW THEREFORE, in consideration of the above premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

Section 1. Amendment. Effective upon the date provided in Section 4, the DIP Agreement shall hereby be amended as follows:

1.1. Section 7.28(c) of the DIP Agreement shall hereby be amended to (i) delete the date “February 29, 2004” which appears therein and substitute the date “March 10, 2004” therefor and (ii) delete the amount “$25,000,000” which appears therein and substitute the amount “$20,000,000” therefor; and

1.2. Section 7.28(d) of the DIP Agreement shall hereby be amended to delete the amount “$25,000,000” which appears in clause (iii) thereof and substitute the amount “$20,000,000” therefor.

Section 2. No Waiver. Except as otherwise expressly provided herein, all other terms and conditions of the DIP Agreement and the other Loan Documents, and all rights and remedies of the Banks and the DIP Agent thereunder, shall remain in full force and effect and all such terms, conditions, rights and remedies, together with all liens, security interests and encumbrances granted by MCC to the DIP Agent and/or the Banks pursuant to the Loan Documents are, in each case, hereby ratified and confirmed by MCC. MCC hereby expressly acknowledges that the Banks’ and the DIP Agent’s entering into this Amendment shall in no way

Post-Petition Credit Agreement

impair, diminish or otherwise effect the Banks’ or the DIP Agent’s right to require strict compliance with, or be deemed a waiver of any existing or future non-compliance by MCC or any of its Subsidiaries with, any provisions of the DIP Agreement (as amended hereby) or the other Loan Documents.

Section 3. Release of Liens.

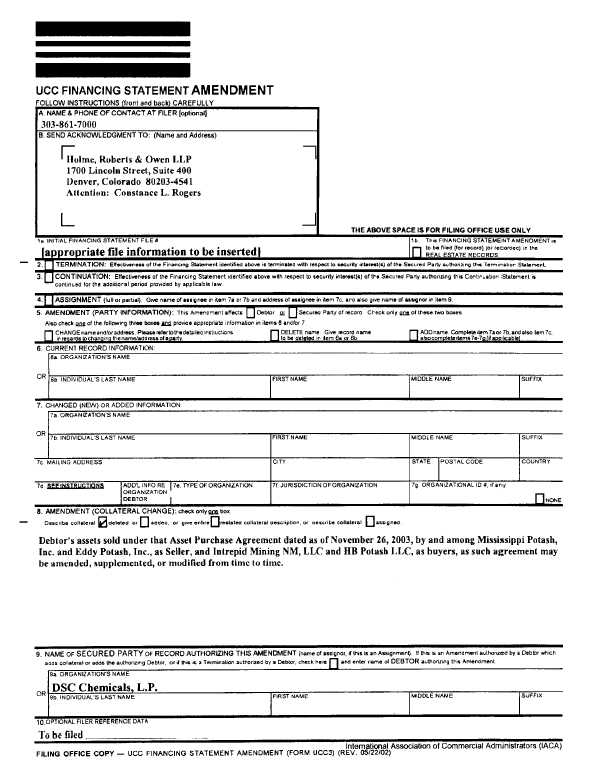

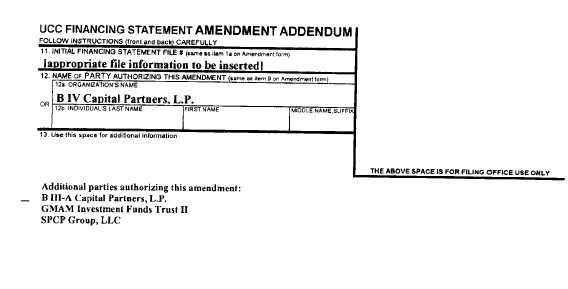

(a) The Banks hereby agree to execute (i) a Release of Liens (the “Release”) in the form attached hereto as Exhibit A releasing the liens and security interests granted by Mississippi Potash, Inc. and Eddy Potash, Inc. (the “Sellers”) in certain of Sellers’ assets being sold (the “Sold Assets”) pursuant to that Asset Purchase Agreement dated as of November 26, 2003, between Sellers and Intrepid Mining NM, LLC, a New Mexico limited liability company, and HB Potash LLC, a New Mexico limited liability company (collectively, the “Buyers”), as such agreement may be amended from time to time (the “Purchase Agreement”), and pursuant to that Order Authorizing Sale of Transferred Assets Free and Clear of Liens, Claims and Interests and Assumption and Assignment of Executory Contracts in Connection Therewith (Potash), dated February 12, 2004, by Edward Ellington, United States Bankruptcy Judge, and (ii) such instruments (the “Lien Release Instruments”) as may be necessary or reasonably appropriate to evidence or effect the releases of liens and security interests under the Release and in a form reasonably acceptable to Lenders, including without limitation UCC-3 Financing Statements in the form attached hereto as Exhibit B (the “UCC-3s”) and any instruments necessary to release liens encumbering real property. When necessary, the Lien Release Instruments shall be in such form as may be properly recorded in the applicable public records of any governmental authority where such Lien Release Instruments would be filed for the purpose of giving public notice of the foregoing release of liens. The Banks authorize Sellers to file the UCC-3s in the appropriate public records to evidence the release of liens and security interests contemplated herein. In connection with the foregoing authorization, the Sellers are permitted to authorize the Buyers to file the UCC-3s on Sellers’ behalf.

(b) The Banks, at MCC’s expense, shall execute the Release and the Lien Release Instruments upon MCC’s request and shall deliver the executed Release and Lien Release Instruments to MCC’s lawyers to be held in escrow pending the consummation of the sale under the Purchase Agreement. Banks shall release such documents from escrow upon (i) the receipt by wire transfer of immediately available funds of Bank’s pro rata share of Net Cash Proceeds from the sale under the Purchase Agreement in an aggregate amount not less than $20,000,000, and (ii) the oral, written, or electronic mail confirmation by Bank’s lawyers to MCC’s lawyers of Banks’ receipt of such funds. If Banks do not receive such funds by 5:00 p.m. Chicago, Illinois time on March 3, 2004, the documents delivered into escrow shall be immediately returned to Banks’ attorney or otherwise handled as so instructed by Banks’ attorney.

(c) MCC and each Guarantor acknowledges that neither (i) the foregoing release of liens, (ii) the execution of the Release, (iii) the execution of the Lien Release Instruments, or (iv) the execution of any other instrument necessary or appropriate to effect or evidence the release of guaranties and the release of liens and security interest contemplated herein will, by their execution, impair or affect their respective obligations under the DIP Agreement or any other Loan Document to which they may be a party.

2

Post-Petition Credit Agreement

Section 4. Counterparts. This Amendment may be executed in any number of counterparts, each of which when taken together shall constitute an original and all of which when taken together shall constitute one and the same agreement.

Section 5. References to DIP Agreement. All references in the DIP Agreement to “this Agreement,” “hereunder,” “hereto” and words of similar import, and all references in any other agreements to the DIP Agreement shall, in each case, be deemed references to the DIP Agreement as amended hereby.

Section 6. Governing Law. This Amendment and the rights and duties of the parties hereto shall be construed and determined in accordance with the internal laws of the State of Illinois.

Section 7. Effectiveness. This Amendment shall be effective on the first date after the date hereof that each of the parties hereto shall have executed a counterpart hereof and of the Acknowledgement attached hereto and shall have delivered the same by telecopy to the following person as counsel for the Banks:

Scott J. Moore

Jenner & Block LLP

One IBM Plaza

Chicago, Illinois 60611

Telecopy: 312 ###-###-####

[THE REMAINDER OF THIS PAGE IS INTENTIONALLY LEFT BLANK]

3

Post-Petition Credit Agreement

IN WITNESS WHEREOF, the parties hereto have set their hand as of the date and year first above written.

| BANKS: | DSC CHEMICALS, L.P. | |||||||

| By: | DSC Advisors, L.P., its Investment Manager | |||||||

| By: | DSC Advisors, LLC, its General Partner | |||||||

| By: | /s/ David S. Markus | |||||||

| Name: David S. Markus | ||||||||

| Title: Member | ||||||||

| B IV CAPITAL PARTNERS, L.P. | ||||||||

| By: | GP Capital IV, LLC, its General Partner | |||||||

| By: | DDJ Capital Management, LLC, Manager | |||||||

| By: | /s/ David J. Breazzano | |||||||

| Name: David J. Breazzano | ||||||||

| Title: Member | ||||||||

| B III-A CAPITAL PARTNERS, L.P. | ||||||||

| By: | GP III-A, LLC, its General Partner | |||||||

| By: | DDJ Capital Management, LLC, Manager | |||||||

| By: | /s/ David J. Breazzano | |||||||

| Name: David J. Breazzano | ||||||||

| Title: Member | ||||||||

| GMAM INVESTMENT FUNDS TRUST II | ||||||||

| By: | DDJ Capital Management, LLC, on behalf of GMAM Investment Funds Trust II, in its capacity as investment manager | |||||||

| By: | /s/ David J. Breazzano | |||||||

| Name: David J. Breazzano | ||||||||

| Title: Member | ||||||||

S-1

Post-Petition Credit Agreement

| SPCP GROUP, LLC | ||||||||

| By: | /s/ Jeff Gelfand | |||||||

| Name: Jeff Gelfand | ||||||||

| Title: CFO | ||||||||

S-2

Post-Petition Credit Agreement

| BORROWER: | MISSISSIPPI CHEMICAL CORPORATION | |||||||

| By: | /s/ Timothy A. Dawson | |||||||

| Name: Timothy A. Dawson | ||||||||

| Title: Senior Vice President and CFO | ||||||||

S-3

Post-Petition Credit Agreement

ACKNOWLEDGEMENT

Each of the undersigned acknowledges and agrees that neither (i) the release of certain liens in favor of the Sellers contemplated in the Second Amendment to Post-Petition Credit Agreement to which this Acknowledgement is attached, (ii) the execution of the Release, (iii) the execution of the Lien Release Instruments, or (iv) the execution of any other instrument necessary or appropriate to effect or evidence the release of liens and security interests contemplated in the foregoing Second Amendment will, by their execution, impair or affect their respective obligations under the DIP Agreement and other Loan Documents to which such undersigned party may be a party.

[Remainder of page intentionally left blank.]

Acknowledgement-1

Post-Petition Credit Agreement

Executed as of March 1, 2004.

| MISSCHEM NITROGEN, L.L.C., a Delaware limited liability company | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

| MISSISSIPPI NITROGEN, INC., a Delaware corporation | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

| TRIAD NITROGEN, L.L.C., a Delaware limited liability company | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

| MISSISSIPPI PHOSPHATES CORPORATION, a Delaware corporation | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

| MISSISSIPPI CHEMICAL MANAGEMENT COMPANY, a Delaware corporation | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

Acknowledgement-S-1

Post-Petition Credit Agreement

| MISSISSIPPI CHEMICAL COMPANY, L.P., a Delaware limited partnership | ||

| By: | Mississippi Chemical Management Company, a Delaware corporation | |

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

| MELAMINE CHEMICALS, INC., a Delaware corporation | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President—Finance | ||

| MISSISSIPPI POTASH, INC., a Mississippi corporation | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

| EDDY POTASH, INC., a Mississippi corporation | ||

| By: | /s/ Timothy A. Dawson | |

| Name: Timothy A. Dawson | ||

| Title: Vice President of Finance and Treasurer | ||

Acknowledgement-S-2

Post-Petition Credit Agreement

EXHIBIT A

RELEASE OF LIENS

This Release of Liens (this “Release”) is executed as of March 1, 2004, by the lenders under the Credit Agreement (defined below) executing the signature pages attached hereto (the “Banks”), in favor of MISSISSIPPI CHEMICAL CORPORATION, a Mississippi corporation (“Borrower”), and MISSISSIPPI POTASH, INC., a Mississippi corporation, and EDDY POTASH, INC., a Mississippi corporation (each individually, a “Seller” and collectively, the “Sellers”).

RECITALS:

A. Borrower and Sellers are parties to that certain Post-Petition Credit Agreement dated as of May 16, 2003 (as amended, supplemented or otherwise modified from time to time, the “Credit Agreement”), by and among Borrower, a DIP Agent that has been resigned and not yet been replaced, the Sellers and the Other Guarantors (defined below), and the Banks’ predecessors-in-interest. Capitalized terms not otherwise defined herein shall have the meanings assigned to them in the Credit Agreement.

B. The Banks are the current “Banks” under the Credit Agreement.

C. The Sellers, together with certain other affiliates of Borrower that are parties to the Credit Agreement (the “Other Guarantors”), executed the Credit Agreement as guarantors thereunder, pursuant to which the Sellers and the Other Guarantors guaranteed certain indebtedness of Borrower and the performance of Borrower’s obligations under the Credit Agreement.

D. To secure their respective Guaranty Obligations, the Sellers granted a security interest in certain Collateral in favor of the DIP Agent and the Banks.

E. The Sellers intend to sell substantially all of their respective assets (the “Sold Assets”) used or held for use in the business of mining, refining, and distributing potash (the “Asset Sale”) to Intrepid Mining NM, LLC, a New Mexico limited liability company, and HB Potash LLC, a New Mexico limited liability company (collectively, “Buyers”), pursuant to that certain Asset Purchase Agreement dated as of November 26, 2003, by and between the Sellers and Buyers, as such agreement may be amended, supplemented, or modified from time to time, and pursuant to that Order Authorizing Sale of Transferred Assets Free and Clear of Liens, Claims and Interests and Assumption and Assignment of Executory Contracts in Connection Therewith (Potash), dated February 12, 2004, by Edward Ellington, United States Bankruptcy Judge.

F. Borrower and the Sellers desire for the Banks to release the liens and encumbrances on the Sold Assets granted under the Credit Agreement.

A-1

Post-Petition Credit Agreement

RELEASE:

NOW, THEREFORE, with full knowledge that Borrower, the Sellers, Buyers and certain financial institutions providing acquisition capital are relying on the agreements of the Banks contained herein in consummating the Asset Sale, and with full knowledge that the Sellers would not consummate such transactions but for the agreements of the Banks herein contained, the Banks hereby agree as follows:

1. Release of Liens. The Banks hereby:

(a) terminate all security interests in the Sold Assets;

(b) release all liens in favor of the Banks and the DIP Agent on the Sold Assets. The Banks agree to execute and record such instruments as are necessary or reasonably appropriate to effect or evidence the foregoing release of liens, including without limitation UCC-3 Financing Statements in the form attached as Exhibit B to that Second Amendment to Post-Petition Credit Agreement of even date herewith executed by the Banks and Borrower, and any releases of liens for any Sold Assets that are real property.

(c) authorize the Sellers to file any documents provided for under Sections 1(a) and 1(b) (included within such authorization, Sellers are permitted to authorize Buyers to file such instruments).

2. Parties Bound. This Release is binding upon the DIP Agent, any substitute DIP Agent, and the Banks, and their respective successors and assigns, and inures to the benefit of Borrower and the Sellers and their respective successors and assigns.

3. Governing Law. This Release shall be governed and construed in accordance with the laws of the State of Illinois.

4. Counterparts. To facilitate execution, this Release may be executed in as many counterparts as may be convenient or required. It shall not be necessary that the signature of, or on behalf of, each party, or that the signature of all persons required to bind any party, appear on each counterpart. All counterparts shall collectively constitute a single instrument. It shall not be necessary in making proof of this instrument to produce or account for more than a single counterpart containing the respective signatures of, or on behalf of, each of the parties hereto. A signature page to any counterpart may be detached from such counterpart without impairing the legal effect of the signatures thereon and thereafter attached to another counterpart identical thereto except having attached to it additional signature pages.

5. Further Assurances. The Banks, for themselves, the DIP Agent, and any substitute DIP Agent, agree at MCC’s expense to execute such other instruments or take such other actions as are required or reasonably appropriate to give full force and effect to the release of the liens contemplated herein.

[THE REMAINDER OF THIS PAGE IS INTENTIONALLY LEFT BLANK]

A-2

Post-Petition Credit Agreement

Executed as of the date first written above.

| BANKS: | DSC CHEMICALS, L.P. | |||||||

| By: | DSC Advisors, L.P., its Investment Manager | |||||||

| By: | DSC Advisors, LLC, its General Partner | |||||||

| By: | ||||||||

| Name: | ||||||||

| Title: | ||||||||

| B IV CAPITAL PARTNERS, L.P. | ||||||||

| By: | GP Capital IV, LLC, its General Partner | |||||||

| By: | DDJ Capital Management, LLC, Manager | |||||||

| By: | ||||||||

| Name: | ||||||||

| Title: | ||||||||

| B III-A CAPITAL PARTNERS, L.P. | ||||||||

| By: | GP III-A, LLC, its General Partner | |||||||

| By: | DDJ Capital Management, LLC, Manager | |||||||

| By: | ||||||||

| Name: | ||||||||

| Title: | ||||||||

| GMAM INVESTMENT FUNDS TRUST II | ||||||||

| By: | DDJ Capital Management, LLC, on behalf | |||||||

| of GMAM Investment Funds Trust II, in its | ||||||||

| capacity as investment manager | ||||||||

| By: | DDJ Capital Management, LLC, Manager | |||||||

| By: | ||||||||

| Name: | ||||||||

| Title: | ||||||||

A-3

Post-Petition Credit Agreement

| SPCP GROUP, LLC | ||

| By: | ||

| Name: | ||

| Title: | ||

A-4

Post-Petition Credit Agreement

EXHIBIT B

FORM OF UCC-3 FINANCING STATEMENT

[Follows this page.]

B-1

Post-Petition Credit Agreement

B-2

Post-Petition Credit Agreement

B-3