WITNESSETH:

Exhibit 10.16

Bridge Loan Agreement is entered into the day of February 2008 set forth on the signature page of this Bridge Loan Agreement (the “Bridge Loan Agreement”) between IPtimize, Inc., a Delaware corporation located at 2135 S. Cherry Street, Suite 200, Denver, Colorado 80222 (the “Borrower”) and the individual, firm or entity listed on the last page of this Bridge Loan Agreement (the “Lender”). The Lender and the Borrower are sometimes individually referred to as a “Party” and collectively as the “Parties”.

WITNESSETH:

WHEREAS, the Borrower desires to borrow up to an aggregate of $1,650,000 (the “Total Bridge Loan”) from the Lender and all other similarly situated lenders who enter into Bridge Loan Agreements with the Borrower (collectively the “Lenders”) to meet the immediate working capital needs of the Borrower; and

WHEREAS, Borrower desires to borrow the pro rata portion of the Total Bridge Loan set forth on the last page of this Bridge Loan Agreement (the “Loan Amount”) from the Lender; and

WHEREAS, the Borrower intends to repay the Loan Amount out of the proceeds expected to be realized by the Borrower from a $5,000,000 permanent financing private offering planned by the Borrower (the “Private Offering”) or to sooner prepay the Loan Amount on the terms and conditions set forth in Section 1.5 below; and

WHEREAS, the Lender together with all other similarly situated Lenders, each of whom shall participate in the Total Bridge Loan on a pro rata and pari passu basis and who shall each execute his or its own bridge loan agreement and annexed promissory note with the Borrower are collectively willing to lend the Total Bridge Loan to the Borrower.

NOW, THEREFORE, in consideration of the representations, warranties, covenants and agreements herein contained, the receipt and adequacy of which is hereby acknowledged and accepted, the Parties hereby agree as follows:

| 1. | Terms of the Bridge. |

1.1 The Bridge. The Lender hereby agrees to lend the Loan Amount to the Borrower and the Borrower hereby accepts the Loan Amount from the Lender and agrees to repay the same in lawful money of the United States of America. The Loan Amount shall be evidenced by a nine month promissory note bearing interest at the rate of Twelve and 99/100 (12.99%) percent per annum on an actual day/360 day basis and payable on the Due Date (as that term is defined below), in the form annexed hereto as Exhibit “A” and hereby incorporated herein by reference (the “Note”). The Note shall be duly executed by the Borrower and delivered to the Lender simultaneously with the execution of this Bridge Loan Agreement.

1.2 Due Date. The Loan Amount shall be due and payable on the earlier of: (i) nine months from the date of this Bridge Loan Agreement; or (ii) the closing of the Private Offering (the “Due Date”).

1.3 Payments and Prepayments. The Borrower shall not be entitled to re-borrow any prepaid Loan Amount or other costs or charges. All payments made pursuant to this Bridge Loan Agreement shall be first applied to accrued and unpaid interest, then to any lien or other proper charges under this Bridge Loan Agreement and finally to the aggregated principal balance of the Loan Amount. Absent the foregoing, interest on the Loan Amount shall be due and payable in one lump sum on the Due Date.

1.4 Closings. The closing of the Bridge shall take place simultaneously with the execution of this Bridge Loan Agreement via facsimile. Simultaneously with the execution of this Bridge Loan Agreement, the Lender shall deliver the Loan Amount to the Borrower via the Lender’s personal check, by federal wire transfer or such other manner as shall be mutually agreed upon between the Borrower and the Lender (the “Closing”). At the Closing, the Borrower shall deliver: (i) this Bridge Loan Agreement duly executed by the Borrower; (ii) the Note duly executed by the Borrower; and (iii) the Warrant described and defined in Section 1.5 below duly executed by the Borrower.

1.5 Call Option. The Borrower shall have the exclusive and non-transferable right and option at any time following the Conditions Precedent (as that term is defined below in this Paragraph 1.5) to demand that the Lender surrender the Note to the Borrower for prepayment of the outstanding principal and accrued interest due thereunder (the “Call Option”). The Borrower cannot exercise the Call Option and prepay the Note until and unless it furnishes the Lender with 45 days advanced written notice of the Borrower’s exercise of the Call Option (the “Call Option Notice”). The Call Option Notice, which must set forth evidence of compliance with the Conditions Precedent, shall set a closing date not later than five business days after the date of the Call Option Notice where the Borrower shall repay the Note in full (the “Call Option Closing”). At the Call Option Closing, the Lender shall surrender the original Note to the Borrower against good funds representing full amount of unpaid principal of the Note and all accrued interest due thereunder.

The Borrower’s right to exercise the Call Option, to issue a Call Option Notice and prepay the Note is and shall be explicitly conditioned upon the following two conditions: (i) the last sale price (i.e., the closing bid price for the Borrower’s Common Stock in the Pink Sheet market or the OTC Bulletin Board market as reported by the Pink Sheets, LLC, NASDAQ or similar publisher of such quotations) for 20 consecutive trading days shall be $1.35 or greater; and (ii) a minimum average daily trading volume of 50,000 shares during such 20 day trading period (collectively the “Conditions Precedent”). The Call Option Notice shall be mailed to the Lender at its, his or her address appearing in the Agreement with a copy sent via email to the email address appearing in the Agreement and shall be effective as of the day sent. The Lender shall have the absolute right to convert all or any portion of the Note at any time prior to repayment by the Borrower without regard to or compliance with the Call Option.

2

1.6 Additional Consideration. As additional consideration for the Loan Amount, the Borrower hereby covenants and agrees as follows:

A. Simultaneously with the execution of this Bridge Loan Agreement, the Borrower shall cause the issuance and delivery to the Lender of a warrant in the form annexed hereto as Exhibit “B” and hereby incorporated herein by reference with a five (5) year term (the “Warrant”) entitling the Lender to purchase an aggregate of one share of the Borrower’s Common Stock, $.001 par value per share (the “Common Stock”) for each $.90 of the Loan Amount loaned to the Borrower hereunder (the “Warrant Shares”). In the event the Total Bridge Loan is lent to the Borrower by the Lenders, the Borrower will issue an aggregate of 1,833,333 Warrant Shares to the Lenders. The Warrant shall be exercisable at a price of $.45 per Warrant Share, the same price expected to be paid by investors in the Private Offering. The Warrant Shares, which initially will be unregistered (i.e., restricted) securities as that term is defined under the Securities Act of 1933, as amended (the “Securities Act”), shall be registered under the Securities Act in accordance with the following:

1.) If at any time during the five-year term of the Warrants, the Borrower proposes to file a Registration Statement under the Securities Act (a “Registration Statement”); it will at such time give written notice to the Lender of its intention to do so. Upon written request of the Lender, given within 15 days after the giving of any such notice by the Borrower, the Borrower will advise the Lender that it shall include the Lender’s Warrant Shares in the Registration Statement. If, however, the offering to which the Registration Statement relates is to be distributed by or through an underwriter or placement agent approved by the Borrower, the Lender may at the Lender’s option agree to sell the Warrant Shares through such underwriter or placement agent on the same terms and conditions as the underwriter or placement agent agrees to sell the other securities proposed to be registered. In addition, if such underwriter or placement agent determines that the inclusion of all the Warrant Shares sought to be sold would have an adverse effect on the offering, the Lender shall only be entitled to participate in the underwriting and register the Lender’s Warrant Shares on a pro rata basis or as such other lesser quantity of the Warrant Shares as the underwriter or placement agent may determine in its discretion.

2.) The Borrower hereby covenants and agrees that it shall prepare and promptly file with the Securities and Exchange Commission (the “Commission”) all amendments, post-effective amendments and supplements to the Registration Statement as may be necessary under the Securities Act and the regulations of the Commission to permit the sale of the Warrant Shares to the public; and

3.) The rights of the Lender hereof pursuant to this Section 1.5 may be exercised only by the Lender or any affiliate thereof.

B. The Lenders shall have the right and option to convert the entire unpaid balance of the Total Loan Amount and all unpaid interest due thereunder into shares of Common Stock at the rate of $.45 per share of Common Stock (the “Conversion Shares”). The Borrower shall register the Conversion Shares under the Securities Act in the same manner as the Warrant Shares; and the Conversion Shares shall be subject to the same conditions and restrictions as the Warrant Shares. If the Total Loan Amount principal is converted to Common Stock, the Borrower will issue an aggregate of 3,666,667 Conversion Shares to the Lenders.

3

| 2. | Brief Description of the Company. |

2.1 Overview. The Borrower is a Denver based company with 15 employees and approximately 428 stockholders. The Borrower’s Common Stock currently trades in the Pink Sheets under the symbol IPZI.PK. Following the approval of the Commission of the Borrower’s Registration Statement on Form 10 (hereinafter described in Section 3 below) and the approval after final review of the Financial Industry Regulatory Authority (“FINRA”) to the Form 211 application of a registered broker dealer for the commencement of trading, the Borrower expects that its Common Stock will be approved for trading on the OTCBB Market.

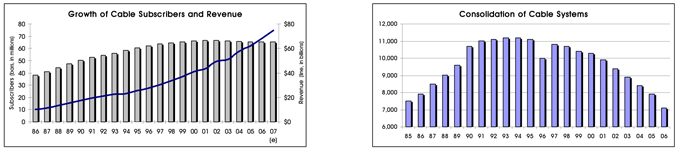

A. As set forth in greater detail in Exhibit “C”, Summary Description of Business annexed to this Bridge Loan Agreement, the Borrower is a broadband voice and data service provider to the cable industry and to business customers nationwide. The Borrower utilizes broadband data access (including cable system networks and the Internet) to furnish a suite of voice and data communications services. The Borrower is often referred to as a hosted provider because it serves as a single point of contact to its cable system operator and small business customers, “hosting” various desired Internet Protocol (“IP”) based communications services.

2.2 Recent Events. The Borrower recently attracted 35-year cable industry veteran Ron Pitcock as Chairman and Chief Executive Officer pending the closing of the Private Offering. In addition, the Borrower has attracted three designees for the board of directors and one nominee for Chief Financial Officer with significant experience in providing services to the communications industries (See Section 7 “Management” on page 8). The Borrower has recently completed a service agreement with Level 3 Communications, Inc. (“Level 3”) and a reseller agreement with C-COR (“C-COR,” currently being acquired by Arris Group Inc.). The Borrower believes that it has assembled the right industry relationships along with its VoIP product, to successfully serve the unmet needs of cable systems located in smaller geographic markets to offer VoIP phone service to their existing cable subscribers.

2.3 Service to Cable Operators. The Borrower provides voice-over-internet (“VoIP”) telephony service for the commercial and residential customers of cable system operators. The Borrower’s service agreement with Level 3, a national broadband backbone provider, allows the Borrower to offer its cable system customers carrier-grade broadband access anywhere in the country, and with the ability for their voice customers to terminate calls anywhere in the world.

A. While large cable operators have begun offering VoIP telephony in major United States cities, few operators currently have a voice product available in smaller “Tier 2” and “Tier 3” markets.

B. The Borrower’s proven technology works seamlessly on broadband networks worldwide, including those offered by cable companies.

4

C. This allows cable operators to use the Borrower’s voice service for their customers to complete the “triple play” bundle of video, data and voice.

D. The Borrower can also provide fully-supported hosted VoIP services to the “Big Three” cable operators in major “Tier 1” metropolitan markets by focusing on the mix of commercial services SMBs require, while helping the “Big Three” multiple system operators (“MSOs”, including Time Warner Cable, Comcast Cable Communications and Cox Communications) to better penetrate the commercial market.

2.4 Service to Business Customers: The Borrower’s business customers use their broadband connection (including cable-delivered broadband) to the Internet to reach our gateway servers (that is, a means of electronically managing and routing calls) which then directs their call to a national broadband network to connect to any phone at any destination in the world.

A. The Borrower’s voice and network services help our business customers save money on their communications costs, reduce technical complexity, and increase business productivity.

2.5 The Borrower’s Business Development is Directly Assisted by Major Industry Partners. The market for cable-delivered VoIP is projected by the Cable & Television Association for Marketing (“CTAM”) to be 21 million subscribers, representing $8.1 billion in industry revenue by 2010. Through the Borrower’s service agreements with a national network provider and a cable technology provider, the Borrower has the opportunity to more quickly reach cable operators and SMB customers nationwide. The Borrower anticipates serving over 50,000 VoIP subscribers by year-end 2008.

| 3. | Form 10-SB Incorporated by Reference and the Lender’s Awareness. |

On September 26, 2007, the Borrower filed a Registration Statement on Form 10-SB with the Commission (the “Form 10”), the text of which is hereby incorporated herein by reference. By virtue of the Lender’s initials in the separate box set fort on the signature page of this Bridge Loan Agreement, the Lender hereby represents to the Borrower that: (i) the Lender is an “Accredited Investor” as that term is defined in Rule 501(a) of Regulation D under the Securities Act; (ii) the Lender is familiar with a Registration Statement on Form 10-SB; and (iii) the Lender has been furnished with the opportunity to receive a copy of the Form 10 from the Borrower together with such other information and documentation as the Lender has requested to satisfy the Lender’s due diligence needs with respect to the Loan Amount and the risks associated therewith, particularly the risks set forth under the caption “Risk Factors” in the Form 10 as set forth in Section 4 below.

| 4. | Risk Factors Associated with the Borrower and the Note. |

An investment in the Borrower involves a high degree of risk and should be considered only by a Lender who can sustain the loss of the Lender’s entire investment. Accordingly, and by virtue of the Lender’s initials in the separate box set fort on the signature

5

page of this Bridge Loan Agreement, the Lender hereby represent that, prior to the signing of this Bridge Loan Agreement, the Lender have read the 26 risk disclosures contained under the caption “Risk Factors” set forth starting on page 23 of the Form 10 as well as the following special risks:

4.1 Possible Undercapitalization. This Offering is being made by the Borrower on a strictly “best efforts” basis. There is no minimum amount of Total Bridge Loans that must be advanced by the Lenders nor are there any escrow provisions or protection. All funds received from investors will be deposited in the Borrower’s operating account and immediately utilized for working capital purposes. In the event insufficient capital is available through the Private Offering, there can be no assurance that additional capital will be available when needed, and the Borrower may be deemed to be undercapitalized and may be unable to implement or to carry out its business plan. While management believes that it will be successful in raising the capital contemplated by the Private Offering, there can be no assurance thereof. In the event the Borrower is undercapitalized, the risk of failure will, in all probability, be borne primarily by the purchasers of the Lenders;

4.2 Amendments to Rule 144. On November 15, 2007 the Commission adopted changes to Rule 144 which among other things, shorten the holding period for restricted (i.e., unregistered) shares of publicly owned companies from one year to six months. There can be no assurance that the Borrower will have registered the Conversion Shares or the Warrant Shares issuable upon conversion of the Bridge Loans or the exercise of the Warrant in the Registration Statement prior to August 2008 when the same will become eligible for sale under Rule 144 or that the Borrower will then be in compliance with the public information requirements of Rule 144 necessary to allow the Lender’s use of Rule 144;

4.3 Insolvency of the Borrower. As of the date of this Bridge Loan Agreement, the Borrower may legally be deemed to be insolvent in that its liabilities exceed its assets, it has a negative shareholder equity balance, has outstanding liabilities that cannot presently be met by its revenues, and has effectively no market value as a “Pink-Sheet” traded company;

4.4 OTCBB Trading. The listing of the Borrower’s Common Stock on the OTCBB Market and the commencement of trading thereon will be dependent upon both the Commission’s final review of the Form 10 and the final review of the Financial Industry Regulatory Authority (“FINRA”) to the application of a registered broker dealer for the commencement of trading on the OTCBB Market (the “Form 211”). The Form 10 automatically became effective on November 25, 2007 (60 days after filing) despite the fact that the Borrower has not finished responding to all of the Commission’s comments; and the Form 211 will not become effective until the submitting broker dealer is finished responding to the comments of FINRA. Accordingly, the Borrower can offer no assurance as to when, if ever, that its Common Stock will commence trading on the OTCBB Market; and

6

4.5 “Stale” Financial Information. The selected financial information set forth below in Section 5 is as of June 30, 2007 and not September 30, 2007 as would normally be the case for a company whose Form 10 Registration Statement became effective under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Since the Form 10 did not become effective under the Exchange Act until November 25, 2007, the Borrower was not required to file a Quarterly Report on Form 10-QSB for the three and nine months ended September 30, 2007; and its next required filing will be its Annual Report on Form 10-KSB for the fiscal year ended December 31, 2007, containing audited financial statements for the two fiscal years then ended. Accordingly, the Lenders will be making their investment decision to invest in the Borrower based upon what would normally be deemed to be “stale” financial statements. In the absence of reviewed financial statements for the three and nine months ended September 30, 2007, the Lenders will be relegated to relying upon the verbal assurance of the Borrower’s management that the Borrower’s financial condition has not materially degenerated during this period.

| 5. | Selected Financial Information. |

Comparison of the year ended December 31, 2006 to the year ended December 31, 2005.

The following data summarizes the Borrower’s statements of operations for the years ended December 31, 2005 and 2006. The information presented below was derived from audited financial information.

| Year Ended December 31, | ||||||||

| Statement of Operations Data | 2005 | 2006 | ||||||

| Revenue | $ | 1,525,892 | $ | 926,021 | ||||

| Costs and operating expenses | ||||||||

| Costs of sales | 735,836 | 515,150 | ||||||

| General and administrative | 2,139,973 | 1,973,253 | ||||||

| Non-cash stock compensation | 1,765,889 | 846,253 | ||||||

| Impairment of fixed assets | 25,000 | — | ||||||

| Depreciation and amortization | 41,760 | 22,254 | ||||||

| Total costs and expenses | 4,508,458 | 3,356,910 | ||||||

| Net operating (loss) | (3,270,066 | ) | (2,430,889 | ) | ||||

| Other income (expense) | ||||||||

| Non-cash interest expense | (30,400 | ) | (195,002 | ) | ||||

| Non-cash financing expense | 87,500 | (98,274 | ) | |||||

| Interest expense | (49,726 | ) | (83,369 | ) | ||||

| Net (loss) | (3,350,192 | ) | (2,807,534 | ) | ||||

| Class A Preferred stock dividend | (53,387 | ) | (50,000 | ) | ||||

| Net (loss) attributable to common stockholders | $ | (3,403,579 | ) | $ | (2,857,534 | ) | ||

7

Comparison of the six months ended June 30, 2007 to six months ended June 30, 2006.

The following table summarizes the results of the Borrower’s operations for the six months ended June 30, 2006 and 2007. The information presented below and in the following discussion was derived from unaudited financial information. In the opinion of the Borrower’s management, the unaudited financial statements include all adjustments, consisting only of normal, recurring adjustments that management considers necessary for a fair statement of the results of that period. The Borrower’s historical results are not necessarily indicative of the results to be expected in any future period.

| Six Months Ended June 30, | ||||||||

| Statement of Operations Data | 2006 | 2007 | ||||||

| Revenue | $ | 516,552 | $ | 433,944 | ||||

| Costs and operating expenses | ||||||||

| Costs of sales | 264,275 | 318,100 | ||||||

| General and administrative | 1,276,687 | 716,087 | ||||||

| Non-cash stock compensation | 391,111 | 319,084 | ||||||

| Depreciation and amortization | 12,096 | 22,927 | ||||||

| Total costs and expenses | 1,944,169 | 1,376,198 | ||||||

| Net operating (loss) | (1,427,617 | ) | (942,254 | ) | ||||

| Other income (expense) | ||||||||

| Gain on settlement of A/P | — | 32,713 | ||||||

| Non-cash interest expense | (195,002 | ) | — | |||||

| Non-cash financing expense | (30,125 | ) | (43,757 | ) | ||||

| Interest expense | (31,347 | ) | (99,806 | ) | ||||

| Net (loss) | (1,684,091 | ) | (1,053,104 | ) | ||||

| Class A Preferred stock dividend | (25,000 | ) | (30,000 | ) | ||||

| Net (loss) attributable to common stockholders | $ | (1,709,091 | ) | $ | (1,083,104 | ) | ||

The Borrower will make its full audited and unaudited financial statements available to the Lender upon the Lender’s written request. The Borrower’s historical results are not necessarily indicative of the results to be expected in any future period.

| 6. | Capitalization. |

The Borrower’s capitalization is comprised of 70,000,000 shares of Common Stock, of which 12,942,242 shares are outstanding (exclusive of an aggregate of 4,738,430 shares of Common Stock issuable upon exercise of outstanding options and warrants, 2,582,762 shares of Common Stock issuable upon conversion of outstanding convertible debt and 803,079 shares of Common Stock issuable upon conversion of outstanding Series A and Series B Preferred Stock; and 10,000,000 shares of Preferred Stock, $.001 par value per share, (“Preferred Stock”), of which 513,079 shares in two classes are outstanding as of the date of this Bridge Loan Agreement.

8

If all of the Notes are converted, the 3,666,667 Conversion Shares will represent an approximate 22% equity interest in the Borrower’s outstanding shares of Common Stock. If all of the Warrants are exercised, the 825,000 Warrant Shares will represent an approximate 4.7% equity interest in the Borrower’s outstanding shares of Common Stock. The combined 4,491,667 Conversion and Warrant Shares will represent an approximate 25.8% equity interest in the 17,433,909 shares of the Borrower’s Common Stock that will then be issued and outstanding.

| 7. | Management. |

The following table provides information regarding the individuals who presently comprise and who are expected to comprise the Borrower’s executive officers and directors following the closing of the Private Offering:

| Name | Age | Present Position | Post–Closing Position | |||

| Ron Pitcock | 60 | Advisor and CEO designee | Chairman of the Board and Chief Executive Officer | |||

| Clinton J. Wilson | 52 | President and Director | President, Chief Operating Officer and Director | |||

| Robert T. Flood | 57 | Chief Technology Officer | Chief Technology Officer | |||

| Adam Nichols | 42 | Advisor and Nominee | Chief Financial Officer | |||

| William R. Cullen | 66 | Nominee as director | Director | |||

| Stanley F. McGinnis | 61 | Nominee as director | Director | |||

| Donald Prosser | 56 | Nominee as director | Director | |||

The principal occupations for the past five years (and, in some instances, for prior years) of each of the Borrower’s executive officers, executive officer designees, directors and director nominees are as follows:

Ron Pitcock joined the Borrower as a consultant and advisor in April 2007 pending his election as Chairman and Chief Executive Officer following the Borrower’s receipt of the Total Bridge Loan. Mr. Pitcock is a successful technology entrepreneur, who brings 35 years of cable and communications experience to the Borrower principally as a chief executive officer or as head of the business. From 1997 through 2000, he founded and took public High Speed Access Corporation, a publicly owned Delaware corporation (NASDAQ: HSAC). High Speed Access Corporation was a leading provider of high-speed internet access via cable modem to residential and commercial end users in exurban areas with an eventual market cap of $2.5 billion. Mr. Pitcock was employed in increasingly responsible positions including Vice Chairman and former Chief Executive Officer, President and Chief Operating Officer. Prior to 1997, and since 1990, he was employed by Antec Corp., a publicly owned Delaware corporation (Nasdaq: ANTC) a wholly owned subsidiary of Anixter International and a developer, manufacturer and distributor of optical

9

and radio frequency transmission equipment for broadband communications systems and developer of emerging opportunities in the cable television and telecommunications industry. Mr. Pitcock was employed in increasingly responsible positions including Executive Vice President of Antec’s TeleWire Division with $230 million in sales where he was responsible for business forecasting, expense control, sales and marketing programs, new product development and corporate re-engineering. Prior thereto since 1980, he was employed by Anixter Brothers, then a privately owned Illinois corporation that was subsequently acquired by Sam Zell of Intel Corporation and became Anixter International (NYSE: AXE), the world’s leading supplier of communications products with 7,500 employees and $4.9 billion in 2006 revenue. Mr. Pitcock was employed in increasingly responsible positions including Regional Vice President where he was responsible for growing the Midwest Region sales from $5 million to $100 million. From 1974 through 1980, Mr. Pitcock was engaged in the cable television industry including serving as Vice President and General Manager of Comsec Corporation, a privately owned cable television company in Corpus Christi, Texas that developed a six town franchise that was sold to Telecommunications, Inc.; and Regional Engineer and Chief Technician for Contental Cablevision, a privately owned cable television system in Dover, New Hampshire. He received a Bachelor of Business Administration degree from Corpus Christi State University (now part of Texas A&M University) in Corpus Christi, TX in 1978 and a Master of Science degree in Telecommunications from the University of Denver in 1992. Mr. Pitcock entered the army in 1967 as an enlisted man and exited in 1974 as a Major. During his enlistment he served in the United States, Ethiopia, and Vietnam.

Clinton J. Wilson was a co-founder of the Borrower in May 2003 and served as the Borrower’s Executive Vice President of Corporate Development until June 2004 when he was elected to the Borrower’s Board of Directors and until April 2005 when he was elected President. He was elected Chief Executive Officer in May 2006 to fill the vacancy created by the resignation of John R. Evans from that position. Mr. Wilson has more than 26 years of senior sales and marketing management experience. In 2001, Mr. Wilson was president of InDigiNet, Inc., a Denver based data networking solutions provider. Prior to this engagement, he was the senior vice president and general manager of AuraServ Communications, a venture-backed VoIP service platform for business clients. Between 1997 and 2000, Mr. Wilson was a vice president for Convergent Communications, Inc. From 1992 to 1997, Mr. Wilson was the vice president of sales for ICG Communications, Inc. His industry experience also includes positions with both MCI and AT&T. He earned his Bachelor of Science degree in Finance and Marketing from the University of Colorado at Boulder.

Robert T. Flood has been the Borrower’s Chief Technology Officer since August 2004, and was a director from 2004 to 2005. Mr. Flood has more than 30 years of technical leadership experience within the telecommunications industry. In 2001, he founded and became Chief Executive Officer and Chief Technology Officer of Virginia-based Pingtone Communications, Inc. (“Pingtone”), a telephone service company which supplied IP telephony services to desktop and permitting customers. From 1999 to 2001, Mr. Flood was Chief Information Officer and Chief Technology Officer for Cable & Wireless Global, an international communications carrier with operations in more than 70 countries. From 1993 to 1999, Mr. Flood served as Senior Vice-President of Engineering and Chief Technology Officer for ICG Communications, Inc. Beginning in 1974, Mr. Flood worked at Centel (“Centel”), a local telephone service provider that was acquired by Sprint in 1992. In 1988, Mr. Flood became the General Engineering Manager for Centel’s Nevada and Texas territories. Mr. Flood received a Bachelor of Arts degree in Economics from the University of Nebraska and a Master’s degree in Economics from the University of Nevada-Las Vegas. He has participated in the Kellogg Executive Development Program at the J.L. Kellogg Graduate School of Management at Northwestern University in Chicago. Mr. Flood has authored two books on IP telephony.

10

Adam Nichols joined the Borrower as a consultant and advisor in April 2007 pending his nomination as Chief Financial Officer following the closing of the Private Offering. Mr. Nichols brings 18 years of corporate finance and accounting experience to the Borrower. Prior to joining the Borrower, and since April 2005, he served as Chief Financial Officer for Guardian Holdings, Inc., a privately owned a retail mortgage banking and provider of Internet based document preparation in Denver, Colorado where he was instrumental in developing and/or implementing several innovative systems including key business metrics, budgeting and forecasting processes, a business intelligence system utilizing data warehousing technology and expense reduction strategies. Prior and since 1994, he was employed by ICG Communications, Inc., a regional telecommunications provider that was acquired by Level 3 Communications, Inc., in 2006 for $163 MM (“ICG”) in increasingly responsible positions including the Director of Finance. At ICG he developed and implemented the process and financial models used to evaluate capital expenditures which exceeded $100MM annually and led implementation of a data warehouse designed to provide timely and accurate information on the Company’s revenue ($600MM annually). Prior to joining ICG, and since 1994, he served as Assistant Controller for ABC Companies, Inc, a privately owned receivable management and commercial debt collection services company where he developed and implemented process improvements to eliminate inefficiencies, improve accuracy and reduce costs through lower headcount and reduced overtime. From 1993 to 1994, he was employed as a senior auditor by DuPont (E. I. du Pont de Nemours and Company). From 1988 to 1993, he was a Senior Analyst for the Rocky Mountain Oil and Gas Exploration and Production Division of DuPont. Mr. Nichols received a Bachelor of Business Administration degree in Finance from New Mexico State University in 1987.

Board of Directors Nominees:

William R. Cullen is a nominee to the Borrower’s Board of Directors who is expected to be elected following the closing of the Private Offering. Mr. Cullen brings us over 35 years of hands on cable and communications experience including 25 years as President and 15 years as Chief Executive Officer. Since 2005, he has been the founder and CEO of Cullcom, LLC, a California based strategy and financial consultancy. From 1997 through 2004, he served as Chairman, President and Chief Executive Officer (previously the Executive Vice President, Chief Operating Officer and Chief Financial Officer) of Webb Interactive Services, Inc., (NASDAQ: WEBB), a publicly owned Colorado corporation then engaged in pioneering high speed Internet services in the cable industry and developing and marketing Internet-based commerce and communications services and presently in the development of extensible instant messaging/presence software and products. From 1994 through 1997, he served as the Chairman, Chief Executive Officer and co-founder of Access Television Network, Inc., a privately owned, Irvine, California based cable television system operator with 25 million subscribers. From 1992 to 1994, Mr. Cullen served as the President and Chief Executive Officer of the California News Channel operation of Cox Communications, Inc., a Big 3 multiple cable system operator. From 1983 to 1991, he was employed by United Artists Cable Corporation; a Los Angeles based multiple cable system operator, in increasingly responsible

11

positions including Senior Vice President of the Southwest Division. From 1981 through 1983 he served as President of Tribune Cable of California, Inc., a cable television system operator. Mr. Cullen received a Bachelor of Arts degree in Economics from the University of Vermont in 1963. In addition to being a respected cable speaker and panelist, Mr. Cullen was Cable Television Business Magazine’s Marketing 1990 Executive of the Year and recipient of the California Cable Television Association’s Outstanding Leadership Award In 1991 and 1992. Mr. Cullen is qualified as an Audit Committee Financial Expert as that term is defined in Section 407 of the Sarbanes-Oxley Act of 2002, as amended.

Stanley F. McGinnis is a nominee to the Borrower’s Board of Directors who is expected to be elected following the Borrower’s receipt of the Total Bridge Loan. Mr. McGinnis is the Chief Executive Officer and principal stockholder of Secure Signals International, Inc., a Delaware corporation and successor to McGinnis Group International, LLC, a Colorado limited liability company, d/b/a Secure Signals International that he founded in 1987(“SSI”). SSI is a leading cable risk management company that developed an industry-unique theft of services program resulting in the collection of over $300 million in stolen signal revenue, the recovery of over 500,000 illegal devices and over 13,000 theft-of-service interrogations for its “Big 3” and other cable system clients. Mr. McGinnis, who has been active in the cable and satellite television industry for over 19 years, is a Certified Fraud Specialist, a Certified Fraud Examiner and a court certified expert witness for piracy. In addition to spearheading several national and regional piracy device investigations that resulted in multi-million dollar recoveries, he has recovered over $300 million for the cable industry during his career. Prior to his involvement with the SSI, he served as the President and Chief Operating Officer for four successful retail companies with locations nationwide. Mr. McGinnis is also a qualified expert witness in the areas of labor relations, employee defalcations, worker’s compensation fraud, wrongful terminations, sexual harassment, and bonding insurance claims. He attended the College of Marin in Kentfield, California for two years of criminal law courses and three years of law school at LaSalle University in Chicago.

Donald W. Prosser, CPA is a nominee to the Borrower’s Board of Directors who is expected to be elected following the Borrower’s receipt of the Total Bridge Loan. Mr. Prosser brings us over 30 years of experience in finance and accounting including over ten years as Chief Financial Officer of publicly owned corporations. Mr. Prosser was Chief Financial Officer for VCG Holding Corp. (NASDAQGM:VCGH), a publicly owned Colorado corporation engaged in ownership and operation of nightclubs that provide quality live adult entertainment and food and beverage services with a $160 million market cap from 2002 through September 2007 and served as Treasurer since 2003. From 1997 until his employment by VCG Holding Corp., Mr. Prosser served as CFO and director of three publicly traded companies: from 1997 to 1999, Chartwell International, Inc.(OTCBB: CWII), a publisher of high school athletic information and recruiting services; from 1999 to 2000, Inform Worldwide Holdings Inc. formerly Anything Internet Corporation (OTCBB: IWWI), a computer equipment and internet services provider; and from 2001 to 2002, NetCommerce, Inc., an Internet services provider, and Arête Industries, Inc. as director from 2003 to present. From 1992 through 1998, he served as a Managing Director of American Express Tax and Business Services, Inc., a wholly owned subsidiary of American Express

12

Company. From 1975 through 1992, Mr. Prosser was engaged in public accounting as a senior manager and/ or partner in three CPA firms: FOX and Company (a national firm now Grant Thornton) 1975 – 1982; Idleberg & Hayes 1983 – 1987; and Pannell Kerr & Forester (a national firm) 1988 – 1992. Mr. Prosser received a Master of Arts degree in Taxation and a Bachelor of Arts degree in Accounting and History from Western State College of Colorado in 1975 and 1973, respectively. He has been a licensed Certified Public Accountant in the State of Colorado since 1975, and has maintained a private practice since 1992. Since 2003, he has served as a member of the Board of Director and as an Officer of the Western State College of Colorado Foundation. Mr. Prosser is qualified as an Audit Committee Financial Expert as that term is defined in Section 407 of the Sarbanes-Oxley Act of 2002, as amended.

| 8. | Representations, Warranties and Covenants. |

In order to implement the operation of this Bridge Loan Agreement, the Parties hereby jointly and severally represent, warrant, covenant, agree and consent as follows:

8.1 Financial Condition of the Borrower. The Borrower has provided, or will provide as available, all material information regarding the financial condition of the Borrower as of the latest practicable date;

8.2 Authority. The Borrower and the Lender have full legal authority to enter into this Agreement and to perform the same in the time and manner contemplated;

8.3 Approval. This Agreement has been submitted to, ratified and approved by the Board of Directors of the Borrower and by the Lender in the manner required by the law of the Lender’s jurisdiction of residence;

8.4 Licenses, Etc. The Borrower shall comply with all applicable laws and regulatory requirements at all times. The Borrower shall obtain and maintain such authorizations, licenses, permits and other governmental or regulatory agency approvals as are required for the performance of this Bridge Loan Agreement;

8.5 Valid Issuance. The Warrant, the Warrant Shares and the Conversion Shares shall be when issued, duly and validly issued, fully paid and non-assessable;

8.6 Reservation. The Borrower shall reserve the Warrant Shares and the Conversion Shares for issuance upon the exercise of the Warrants and the conversion of the Note by the Lender;

8.7 Restricted Securities. The Lender acknowledges, accepts and understands that until and unless the same are registered under the Securities Act: (i) the Warrant Shares and the Conversion Shares will be “restricted securities” as that term is defined under the Securities Act; (ii) the Lender will be acquiring the Warrant Shares and the Conversion Shares solely for the Lender’s own account, for investment purposes and without a view towards the resale or distribution thereof; (iii) the Warrant Shares

13

and the Conversion Shares will be subject of stop transfer orders on the books and records of the Borrower’s transfer agent and shall be imprinted with a standard form of restrictive legend; and (iv) any sale of the Warrant Shares or the Conversion Shares will be accomplished only in accordance with the Securities Act and the rules and regulations of the Commission adopted thereunder;

8.8 Accredited Investor. As evidenced by the Lender’s completion of the individual questionnaire annexed hereto as Exhibit “D” or the entity questionnaire annexed hereto as Exhibit “E” and hereby incorporated herein by reference, the Lender is an “accredited investor” as that terms is defined in Regulation D of the Securities Act and as such: (i) has adequate means of providing for the Lender’s current needs and possible contingencies; (ii) is able to bear the economic risk of the Lender’s investment; (iii) is capable of evaluating the relative risks and merits of the Lender’ investment in the Borrower; (iv) can bear the economic risk of losing the Lender’s entire investment in the Borrower represented by the Loan Amount; (v) has not relied upon any oral statements or representations by the Borrower or its principals; (vi) understands the undercapitalized and speculative nature of the Borrower’s business as well as the uncertainties attendant upon the Borrower’s ability to reach profitability from its present insolvent status; and (vii) has consulted the Lender’ own financial, legal and tax advisors with respect to the economic, legal and tax consequences of the Lender’s investment in the Borrower;

8.9 Use of Proceeds. As indicated in the summary of use of proceeds set forth on Exhibit “F” annexed hereto and hereby incorporated herein by reference, the Borrower shall utilize an approximate $400,000 portion of the proceeds from the Bridge Loan to satisfy or compromise its federal withholding tax obligation to the Internal Revenue Service as its first order of priority; and

8.10 Sale or Merger. In the event that prior to the Lender’s conversion or full repayment of the Bridge Loan, the Borrower shall have been sold to, consummated a merger or have been acquired by a third party (a “Business Combination”), the Lender shall be entitled to receive an amount equal to the difference between $1.35 and the amount per share received by the Borrower in the Business Combination (the “Business Combination Payment”). The Business Combination Payment shall be paid to the Lender at the closing of the Business Combination (the “Business Combination Closing”) in cash, equity or debt instruments at the option of the Borrower. The Borrower shall furnish the Lender with ten days prior written notice of the Business Combination Closing; and the Borrower shall furnish the Lender with written notice of its intent to pay cash, equity or debt instruments prior to the date of the Business Combination Closing.

| 9. | Default: Rights and Remedies on Default. |

9.1 Events of Default. The occurrence of any of the following events shall be an event of default under this Agreement (“Events of Default”):

A. The material breach of any representation, warranty or covenant of the Borrower contained in this Bridge Loan Agreement including the failure to promptly deposit the Commission Income into the Account and any repayment not cured within fifteen (15) days of written notice of such breach;

14

B. If the Borrower: (i) files a petition in bankruptcy or a petition to take advantage of any insolvency act or other act for the relief or aid of debtors; (ii) makes an assignment for the benefit of its creditors; (iii) consents to or acquiesces in the appointment of a receiver, liquidator or trustee of itself or of the whole or any part of its properties and assets; (iv) files a petition or answer seeking for itself reorganization, arrangement, composition, readjustment. liquidation, dissolution or similar relief under the federal bankruptcy laws or any other applicable law; (v) on a petition in bankruptcy filed against it, is adjudicated a bankrupt; or (vi) is served with a three-day (3) notice to quit any of its leasehold premises, which notice is not discharged or contested in good faith by appropriate proceedings prior to the initiation of an unlawful suit against the Borrower;

C. If a court of competent jurisdiction shall enter an order, judgment or decree appointing, without the consent of acquiescence of the Borrower, as a receiver, liquidator or trustee of the Borrower, or of the whole or any substantial part of its properties and assets, or approving a petition filed against it seeking reorganization, arrangement, composition, readjustment, liquidation, dissolution or similar relief under the federal bankruptcy laws or any other applicable law, and such order judgment or decree shall remain un-vacated or not set aside or un-stayed for an aggregate of thirty (30) days, whether or not consecutive, from the date of the entry thereto; or if, under the provisions of any other law for the relief or aid of debtors, any court of competent jurisdiction shall assume custody or control of the Borrower or the whole or any substantial part of its operations and assets and such custody and control shall remain un-terminated or un-stayed for an aggregate of thirty (30) days, whether or not consecutive, from the date of assumption of such custody or control.

9.2 Due and Payable. Upon the occurrences of any such Event of Default, the Lender at the Lender’s option and exercised by written notice to the Borrower, shall deem the principal under this Bridge Loan Agreement, together with the interest and charges accrued thereon, become immediately due and payable. The Lender may exercise any or all of the rights and remedies granted under the provisions of the Uniform Commercial Code of the State of Delaware (as now or hereafter in effect). Any proceeds realized from the disposition of the assets of the Borrower under bankruptcy or liquidation provisions, shall: (i) first be applied to the payment of any wages due to any employees of the Borrower pursuant to Colorado Department of Labor statutes; (ii) then to any secured indebtedness of the Borrower; (iii) then to any expenses incurred by the Lender in connection with the disposition; and (iv) the balance shall be applied to the payment of the Loan Amount; (v) then to any trade or vendor indebtedness; (vi) thereafter to any other indebtedness and the equity shareholders of the Borrower. Any surplus proceeds shall be an asset of the Borrower. In the event such proceeds prove insufficient to satisfy all indebtedness secured hereunder, then Borrower shall be liable for the deficiency.

9.3 Other Remedies. The rights, powers and remedies granted to the Lender pursuant to the provisions of this Bridge Loan Agreement shall be in addition to all the rights, powers and remedies granted to the Lender under any statute or rule of law. Any forbearance, failure or delay by order, exercising any right, power or remedy under this Bridge Loan Agreement shall not be

15

deemed to be waiver of such right, power or remedy. Any single or partial exercise (if any right, power or remedy under this Bridge Loan Agreement shall not preclude the further exercise thereof, and every right, power and remedy of the Lender under this Bridge Loan Agreement shall continue in full force and effect until such right, power or remedy is specifically waived by any instrument executed by the Lender.

9.4 Waiver. The Borrower for itself and its legal representatives, successors and assigns, expressly waives presentment, protest, demand, notice of dishonor, notice of nonpayment, notice of maturity, notice of protest, presentment for the purpose of accelerating maturity, and diligence in collection, and consents that the Lender may extend the time for payment or otherwise modify the terms of payment or any part or the whole of the Loan Amount. To the fullest extent permitted by law, the Borrower waives the statute of limitations in any action brought by the Lender in connection with this Bridge Loan Agreement and the right to a trial by jury.

10. Assignments. Neither Party shall assign or transfer any rights or obligations hereunder, except that: (i) the Borrower may assign or transfer this Agreement to a successor corporation in the event of a merger, consolidation, transfer, or sale of all or substantially all of the assets of the Borrower, provided that no such assignment shall relieve the Borrower from liability for the obligations assumed by it hereunder; and (ii) the Lender may assign or transfer this Agreement provided that no such assignment shall relieve the Lender from liability for the Lender’s obligations hereunder and that such assignment does not violate the Securities Act of 1933, as amended.

11. Entire Agreement. Each Party hereby covenants that this Agreement is intended to and does contain and embody all of the understandings and agreements, both written or oral, of the Parties with respect to the subject matter of this Agreement, and that there exists no oral agreement or understanding, expressed or implied, whereby the absolute, final and unconditional character and nature of this Agreement shall be in any way invalidated or affected. There are no representations, warranties or covenants other than those set forth in this Agreement.

12. Binding Arbitration. The Parties agrees that any and all disputes that arise out of this Agreement shall be submitted to and resolved through final and binding arbitration in the City of Denver, State of Colorado, in accordance with the rules and regulations of the American Arbitration Association. In such event, the Parties shall split the cost of any arbitration filing and hearing fees and the cost of the arbitrator (collectively the “Arbitration Costs”). Each Party will bear its own attorneys’ fees, however, the prevailing Party shall be entitled to recover its attorneys’ fees and the Arbitration Costs from the other Party and the arbitrator shall be authorized to award attorneys’ fees and Arbitration Costs to the prevailing Party. The arbitration shall be instead of any civil litigation; therefore, the Parties hereby waive any right to a trial, and agree that the arbitrator’s decision shall be final and binding to the fullest extent permitted by law and enforceable by any court having jurisdiction thereof. The Parties shall accept the verdict or decision of the arbitrator and indemnify and hold the prevailing Party harmless from any and all liability arising out of the subject matter of the arbitration.

16

13. Facsimile Signatures and Counterparts. Facsimile signatures on this Agreement shall be sufficient and acceptable to bind the Parties and for execution of this Agreement. This Agreement shall only be effective and binding when executed by both Parties hereto. This Agreement may be executed in counterparts, each of which so executed shall be deemed an original and constitute one and the same agreement.

14. Notices. Any notice required or contemplated by this Agreement shall be deemed sufficiently given when delivered in person, transmitted by facsimile (if followed by a copy by mail within three (3) business days) or sent by registered or certified mail or priority overnight package delivery service to the principal office of the Party entitled to notice or at such other address as the same may designate in a notice for that purpose. All notices shall be deemed to have been made upon receipt, in the case of mail, personal delivery or facsimile, or on the next business day, in the case of priority overnight package delivery service. Such notices shall be addressed and sent or delivered to the Parties at the addresses set forth in the first paragraph of this Agreement, or to such other address of which a Party may notify the other Party in writing.

15. Modification, Waiver and Amendment. A modification or waiver of any of the provisions of this Agreement shall be effective only if made in writing and executed with the same formality as this Agreement. The failure of any Party to insist upon strict performance of any of the provisions of this Agreement shall not be construed as a waiver of any subsequent default of the same or similar nature or of any other nature. No Party may or shall amend this Agreement, in whole or in part, verbally, by reliance, by course of conduct or otherwise, unless expressly and specifically acknowledged in writing and signed by both the Borrower and the Lender.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date above set forth.

| IPtimize, Inc. | ||

| By: | /s/ Clinton J. Wilson, President and CEO | |

| Clinton J. Wilson, President and CEO | ||

THE SIGNATURE PAGE FOR THE LENDER APPEARS ON THE NEXT PAGE

17

IN WITNESS WHEREOF, the Lender hereby executes this Agreement as of the 20th day of February, 2008.

| FOR INDIVIDUALS: | FOR ENTITIES: | |||||

| Dollar Amount of Bridge Note | Dollar Amount of Bridge Note | |||||

| Name (both if purchasing jointly) | Business or Entity Name | |||||

| Home Address | Business Address | |||||

| Home City, State and Zip Code | Business City, State and Zip Code | |||||

| Home Telephone | Business Telephone | |||||

| Home Telephone-Other | Name of Authorized Signatory | |||||

| Home Facsimile | Business Facsimile | |||||

| Home E-Mail | Business E-Mail | |||||

| Tax ID# or Social Security # | Employer ID# or License # | |||||

| Individual Signature | Entity Signature | |||||

Name in which the Note should be issued:

18

Acknowledgement of the Borrower’s offer of the Form 10 and the Risk Factors set forth therein: (Insert Initials)

EXHIBIT “A”

THIS PROMISSORY NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR QUALIFIED UNDER STATE SECURITIES LAWS AND MAY NOT BE SOLD, PLEDGED, OR OTHERWISE TRANSFERRED UNLESS (A) COVERED BY AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, AND QUALIFIED UNDER APPLICABLE STATE SECURITIES LAWS, OR (B) IPTIMIZE, INC. HAS BEEN FURNISHED WITH AN OPINION OF COUNSEL ACCEPTABLE TO IPTIMIZE, INC. TO THE EFFECT THAT NO REGISTRATION OR QUALIFICATION IS LEGALLY REQUIRED FOR SUCH TRANSFER.

IPTIMIZE, INC.

12.99% BRIDGE CONVERTIBLE PROMISSORY NOTE

FOR VALUE RECEIVED, IPtimize, Inc. a Delaware corporation located at 2135 S. Cherry Street, Suite 200, Denver, Colorado 80222 (the “Borrower”) hereby covenants and promises to pay to the order of the individual, firm or entity listed on the last page of this promissory note (the “Holder”), the principal sum indicated on the last page of this promissory note (the “Note”) in lawful money of the United States of America with interest at a rate of twelve and 99/100 (12.99%) percent per annum on an actual day/360 day basis (collectively the “Loan Amount”) and payable on the Due Date (as that term is defined below). All principal, interest and other costs incurred in connection with this Note shall be due and payable to the Holder on the earlier of (i) nine months from the date of this Note; or (ii) the closing of the $5,000,000 permanent financing Private Offering planned by the Borrower (the “Due Date”). This Note is attached as an exhibit to a Bridge Loan Agreement of even date herewith between the Borrower and the Holder, the text of which is hereby incorporated herein by reference (the “Bridge Loan Agreement”). The capitalized terms shall have the same meaning ascribed thereto in the Bridge Loan Agreement.

Upon compliance with the Conditions Precedent, the Borrower shall have the right to exercise the Call Option to pay or prepay, without penalty, all of the unpaid principal balance of this Note together with any accrued interest. The Borrower shall not be entitled to re-borrow any prepaid amounts of the principal, interest or other costs or charges. The Borrower is duly authorized to enter into this Note. This Note may not be assigned except as provided in Section 5 below.

The Borrower and all endorsers, guarantors, sureties, accommodation parties hereof and all other persons liable or to become liable for all or any part of the indebtedness represented by this Note (collectively the “Obligors”), hereof severally and jointly waive presentment for payment, protect diligence, notice of nonpayment and of protest, and agreement to any extension of time of payment and partial payments before, at or after maturity.

19

| 1. | Payments. |

A. Interest. Unless sooner converted as hereinafter enumerated in Section 2, a single interest payment shall be payable on the Due Date.

B. Principal. Unless sooner converted as hereinafter enumerated in Section 2, payment of the full principal amount due under this Note shall be made on the Due Date. In the event that the principal shall not be paid on the Due Date, and shall remain unpaid for a period of five business (5) days or more, then a late charge of two (2%) percent shall be due and owing for each month or any portion thereof that such payment shall remain unpaid.

| 2. | Conversion. |

At any time and from time to time prior to the Due Date or the Call Option Closing and not thereafter, the Holder shall have the right to convert the entire unpaid principal balance and all unpaid interest into fully paid and non-assessable shares of the Borrower’s Common Stock, $.001 par value per share (the “Conversion Shares”) at $.45 per Conversion Share (the “Conversion Price”) on the following terms and conditions:

A. Fair Conversion Price. The price the Borrower utilized in determining how many Conversion Shares the Holder shall be entitled to receive, although arbitrarily determined, is nonetheless hereby acknowledged and accepted by the Borrower and Holder as fair and equitable given the Borrower’s precarious financial condition and immediate need for capital;

B. Manner of Conversion. On the Holder’s presentation to the Borrower of a duly executed Notice of Conversion in the form annexed to this Note together with the original executed copy of this Note, the Holder shall be entitled, subject to the limitations herein contained, to receive in exchange therefore a certificate or certificates for fully paid and non-assessable Conversion Shares at the Conversion Price per Conversion Share. This Note shall be deemed to have been converted and the person converting the same to have become the holder of record of Conversion Shares, for the purpose of receiving dividends and for all other purposes whatever as of the date when the Notice of Conversion and this Note are surrendered to the Borrower as aforesaid.

C. No Fractional Shares. No fractional Conversion Shares shall be issuable upon any conversion, it being intended and agreed that the number of Conversion Shares to be received by a Holder upon conversion of this Note be rounded out (up or down) to the nearest whole share;

D. Reservation of Shares. So long as any portion of the principal amount of this Note shall remain unpaid, the Borrower shall reserve and keep available out of its authorized and unissued common share capitalization, solely for the purpose of effecting the conversion of this Note, such number of Conversion Shares as shall from time to time be sufficient to effect the conversion of the unpaid principal balance and accrued interest of this Note. The Borrower shall from time to time increase its authorized common share capitalization and take such other action as may be necessary to permit the issuance from time to time of the Conversion Shares as fully paid and non-assessable securities upon the conversion of this Note;

20

E. Payment of Taxes. The Borrower shall pay any and all taxes which may be imposed upon it with respect to the issuance and delivery of the Conversion Shares upon the conversion of this Note as herein provided. However, the Borrower shall not be required in any event, to pay any transfer or other taxes by reason of the issuance of such Shares in names other than that of the Holder and no such conversion or issuance of Conversion Shares shall be made unless and until the person requesting such issuance has paid to the Holder the amount of any such tax, or has established to the satisfaction of the Borrower, and its transfer agent, if any, that no such tax is payable or has been paid;

F. Dividends. Upon any conversion of this Note, as herein provided, no adjustment or allowance shall be made for accumulated dividends on the Conversion Shares, all rights to dividends, if any, shall commence as of the date of issuance thereof, and nothing in this sentence shall be deemed to relieve the Borrower from its obligation to pay any dividends which shall thereafter be declared and shall be payable to Holders of Conversion Shares of record as of a date prior to such conversion even though the payment date for such dividend is subsequent to the date of conversion;

G. Investment Representations. The Holder has been advised, and by the acceptance of this Note, agrees and acknowledges that until and unless the Conversion Shares have been registered under the Securities Act of 1933, as amended (the “Securities Act”), none of the Conversion Shares issuable upon conversion of this Note shall have been registered under the Securities Act or under any state securities law; and that the Borrower is relying upon an exemption from registration based upon the Holder’s investment representations. In this regard, the Holder hereby represents and warrants to the Borrower that: (i) in the event the Holder avails himself of the conversion feature of this Note, the Holder will acquire the Conversion Shares for investment purposes and without a view to the transfer or resale thereof; (ii) in the event the Holder avails himself of the conversion feature of this Note, the Holder will hold the Conversion Shares until the earlier of the effective date of the Registration Statement defined in Section H. below or such later time as may be required under the Securities Act; (iii) any sale of the Conversion Shares will be accomplished only in accordance with the Securities Act and the rules and regulations of the Securities and Exchange Commission adopted thereunder; and (iv) the Holder hereby consents to the issuance by the Borrower of a standard form of stop transfer order against any and all certificates representing the Conversion Shares on the books and records of the Borrower and its transfer agent; and consents to the Borrower placing a standard form of investment legend on any and all certificates representing the Conversion Shares;

21

H. Registration Rights. The Borrower hereby covenants and agrees that the Conversion Shares shall be registered under the Securities Act in accordance with the following:

1). If at any time prior to the repayment of the full Loan Amount, the Borrower proposes to file a Registration Statement under the Securities Act (a “Registration Statement”); it will at such time give written notice to the Holder of its intention to do so. Upon written request of the Holder, given within 15 days after the giving of any such notice by the Borrower, the Borrower will advise the Holder that it shall include its Conversion Shares in the Registration Statement. If, however, the offering to which the Registration Statement relates is to be distributed by or through an underwriter or placement agent approved by the Borrower, the Holder may at his option agree to sell the Conversion Shares through such underwriter or placement agent on the same terms and conditions as the underwriter agrees to sell the other securities proposed to be registered. In addition, if such underwriter or placement agent determines that the inclusion of all the Conversion Shares sought to be sold would have an adverse effect on the offering, the Holder shall be entitled to participate in the underwriting and register the Holder’s Conversion Shares on a pro rata basis or in such other lesser quantity of the Conversion Shares as the underwriter or placement agent may determine in its discretion;

B. The Borrower covenants and agrees that it shall prepare and promptly file with the Securities and Exchange Commission (the “Commission”) all amendments, post-effective amendments and supplements to the Registration Statement as may be necessary under the Securities Act and the regulations of the Commission to permit the sale of the Conversion Shares to the public; and

C. The rights of the Holders hereof pursuant to this Section 2 may be exercised only by the Holder or any affiliate thereof.

| 3. | Events of Default. |

This Note is made pursuant to the Bridge Loan Agreement. Any default of any obligation by the Borrower under this Note shall constitute an Event of Default of the obligations of the Borrower under the Bridge Loan Agreement, and any Event of Default under the Bridge Loan Agreement shall constitute an Event of Default under this Note. The Borrower acknowledges that this Note is enforceable, valid and binding upon the Borrower. If for any reason, any court authority or governmental entity declares this Note invalid, unlawful or against public policy, then, the parties hereto acknowledge that neither the obligation of the Borrower to repay the Note, nor any of the covenants, obligations or representations of the parties contained within the Bridge Loan Agreement shall be affected by such declaration.

Upon the occurrence of an Event of Default, as that term is defined in Section 3 of the Bridge Loan Agreement, then and in such event, the Borrower will be deemed to have defaulted under this Note and the Holder may, on written notice, accelerate all payments due under this Note or have the rights and remedies set forth in Section 3 of the Bridge Loan Agreement.

| 4. | Cumulative Remedies. |

The rights and remedies of the Holder hereof under this Note shall be deemed cumulative, and the exercise of any right or remedy shall not be regarded as barring any other remedy or remedies. The institution of any action to recovery any portion of the indebtedness evidenced by this Note shall not be deemed a waiver of any other right of the Holder.

22

| 5. | Assignments. |

This Note is binding upon and shall inure to the benefit of the Parties hereto and their respective heirs, executors, administrators, representatives and/or successors and permitted assigns. Notwithstanding the foregoing, neither the Borrower nor the Holder shall assign or transfer any rights or obligations hereunder, except that: (i) the Borrower may assign or transfer this Note to a successor corporation in the event of a merger, consolidation or transfer or sale of all or substantially all of the assets of the Borrower, provided that no such further assignment shall relieve the Borrower from liability for the obligations assumed by it hereunder; and (ii) the Holder may assign this Note so long as such assignment does not violate the Securities Act of 1933, as amended.

The acceptance of any installments or payments by the Holder after the due date herein, or the waiver of any other or subsequent breach or default may prevent the Holder hereof from immediately pursuing any or all of his remedies.

IN WITNESS WHEREOF, the Borrower hereto has caused this Note to be executed as of the day and year indicated below by the undersigned thereunto duly authorized.

Dated: Denver, Colorado

February 20, 2008

| IPTIMIZE, INC. | ||

| By: | /s/ Clinton J. Wilson, President and CEO | |

| Clinton J. Wilson, President and CEO | ||

The balance of this page has intentionally been left blank.

23

EXHIBIT “B”

COMMON STOCK PURCHASE WARRANT

THE WARRANT EVIDENCED BY THIS CERTIFICATE AND THE COMMON STOCK ISSUABLE UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR UNDER ANY STATE SECURITIES LAWS. THE WARRANT OR SHARES OF COMMON STOCK ISSUABLE UPON ITS EXERCISE MAY NOT BE SOLD, TRANSFERRED, ASSIGNED OR OTHERWISE DISPOSED OF UNLESS A REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS WITH RESPECT TO SUCH DISPOSITION IS THEN IN EFFECT OR UNLESS THE PERSON PROPOSING TO MAKE THE DISPOSITION SHALL FURNISH, WITH RESPECT TO SUCH DISPOSITION, AN OPINION OF COUNSEL SATISFACTORY TO IPTIMIZE, INC. TO THE EFFECT THAT SUCH SALE, TRANSFER, ASSIGNMENT OR OTHER DISPOSITION WILL NOT INVOLVE ANY VIOLATION OF THE REGISTRATION PROVISIONS OF THE ACT (OR ANY SUPERSEDING STATUTE) OR ANY APPLICABLE STATE SECURITIES LAWS.

IPTIMIZE, INC.

COMMON STOCK PURCHASE WARRANT

This certifies that, for value received, the individual, firm or entity listed on the last page of this Common Stock Purchase Warrant (the “Holder”) or the Holder’s permitted assigns, is entitled, subject to the terms and conditions hereinafter set forth in this Common Stock Purchase Warrant (the “Warrant”) at any time after issuance and delivery hereof, but before 5:00 o’clock p.m., Colorado time on the fifth anniversary of the execution of this Warrant, and not thereafter (the “Expiration Date”), to purchase the number of shares of Common Stock, $.001 par value per share, of IPtimize, Inc., a Delaware corporation located at 2135 South Cherry Street, Suite 200, Denver, Colorado 80222 (the “Company”) set forth on the last page of this Warrant (the Warrant Shares”). The purchase price payable upon the exercise of this Warrant shall be $0.45 per Warrant Share (the “Warrant Price”).

24

The Warrant Price shall be paid in lawful funds of the United States of America payable in cash or by certified or official bank check. The number of Warrant Shares has been computed on the basis of one Warrant Share for every two Dollars loaned to the Company by the Holder pursuant to a Bridge Loan Agreement of even date herewith to which this Warrant is attached as an exhibit (the “Bridge Loan Agreement”). For example, if the Holder invested $100,000 in the Company under the Agreement, the Holder would be entitled to purchase 50,000 Warrant Shares.

Upon delivery of this Warrant duly executed, together with payment of the entire Warrant Price for all of the Warrant Shares at the principal office of the Company, or at such other address as the Company may designate by notice in writing to the Holder, the Holder shall be entitled to receive a certificate or certificates for the Warrant Shares. All shares of the Company’s common stock (the “Common Stock”) which may be issued upon the exercise of this Warrant will, upon issuance and payment therefore in accordance with the terms hereof, shall be fully paid and non-assessable and free from any taxes, liens, and charges with respect thereto.

This Warrant is subject to the following terms and conditions:

1. Full Exercise of Warrant. This Warrant may be exercised in its entirety at any time after issuance and delivery hereof and prior to the Expiration Date. No partial exercise of this Warrant shall be permitted.

2. Charges, Taxes and Expenses. The issuance of certificates for shares of the Common Stock upon the exercise of this Warrant shall be made with charges to the Holder hereof for any tax or other expense in respect to the issuance of such certificates, all of which taxes and expenses shall be paid by the Warrant holder, and such certificates shall be issued in the name of, or in such name or names as may be directed by, the Holder; provided, however, that in the event that certificate for shares of Common Stock are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise shall be duly executed by the Holder hereof in person or by an attorney duly authorized in writing.

3. Certain Obligations of the Company. The Company agrees that it will take any corporate action which may, in the opinion of its counsel, be necessary in order that the Company may validly and legally issue fully-paid and non-assessable shares of Common Stock at the Warrant Price.

4. Notice to Warrant Holder. So long as this Warrant is outstanding: (i) if the Company shall pay any dividend or make any distribution upon the Common Stock; or (ii) if the Company shall offer to the holders of Common Stock for subscription or purchase by them any share of stock of any class or any other rights; or (iii) if any capital reorganization of the Company, reclassification of the capital stock of the Company, consolidation or merger of the Company with or into any corporation, sale, lease or transfer of all or substantially all of the property and assets of the Company to another corporation or voluntary or involuntary dissolution, liquidation or winding up of the Company shall be effected, then, in any such case, the Company may cause to be mailed by certified mail to

25

the Holder hereof, at least 15 days prior to the date specified in (x) or (y) below, as the case may be, a notice containing a brief description of the proposed action and stating the date on which (x) a record is to be taken for the purpose of such dividend, distribution or rights, or (y) such reorganization, reclassification, consolidation, merger, sale, lease, transfer, dissolution, liquidation or winding up to take place and the date, if any is to be fixed, as of which the holders of Common Stock of record shall be entitled to exchange their shares of Common Stock for securities or other property deliverable upon such reorganization, reclassification, consolidation, merger, sale, lease, transfer, dissolution, liquidation or winding up.

5. Adjustment to Warrant Price. If at any time during the term of this Warrant the Company shall subdivide, forward split or reverse split the outstanding shares of Common Stock, the Warrant Price in effect immediately prior to such subdivision, forward split, or reverse split shall be proportionately decreased or increased as the case may be, so that the Warrant holder’s percentage ownership interest in the Company shall not change effective at the close of business on the date of such action. This is not an anti-dilution provision.

6. Registration. The Company hereby covenants and agrees to include the Warrant Shares in the Registration Statement as that term is defined in Section 1.7 of the Agreement to which this Warrant is attached as an exhibit. The Warrant Shares shall be subject to the restrictions and limitations contained in Section 1.7 of the Agreement.

| 7. | Miscellaneous. |

A. The Company covenants that it will at all times reserve and keep available, solely for the purpose of issue upon the exercise hereof, a sufficient number of shares of Common Stock to permit the exercise holder in full.

B. The terms of this Warrant shall be binding upon and shall inure to the benefit of any successors or assigns of the Company and of the heirs, representatives and estate of the Holder.

C. The Holder of this Warrant shall not be entitled to vote or receive dividends or be deemed to be a shareholder of the Company for any purpose.

D. This Warrant may not be divided into separate Warrants.

E. This Warrant and all rights hereunder shall be transferable by the Holder so long as the Holder; (i) furnishes the Company with prior written notice of the name and address of the assignee and whether this Warrant has been assigned or transferred in whole or in part; and (ii) such assignment or transfer does not violate the Securities Act of 1933, as amended. The Company may deem and treat the Holder of this Warrant at any time as the absolute owner hereof for all purposes and shall not be affected by any notice to the contrary.

26

F. Upon receipt by the Company of evidence satisfactory to it of the loss, theft, destruction or mutilation of this Warrant, and (in the case of loss, theft or destruction) of reasonably satisfactory indemnification, and upon surrender and cancellation of this Warrant, if mutilated, the Company will execute and deliver a new Warrant of like tenor and date.

IN WITNESS WHEREOF, the Company has caused this Warrant to be signed by the undersigned thereunto duly authorized, as of the date indicated below.

Dated: Denver, Colorado

February 20, 2008

| Number of Warrant Shares: | ||||||||

| (Initialed by the Company) | ||||||||

| IPTIMIZE, INC. | ||

| By: | /s/ Clinton J. Wilson, President and CEO | |

| Clinton J. Wilson, President and CEO | ||

FORM OF SUBSCRIPTION

(To be signed only upon exercise of the Warrant.)

To: IPtimize, Inc.:

The undersigned, the holder of this Warrant, hereby irrevocably elects to exercise the purchase rights represented by this Warrant for, and to purchase thereunder, pursuant to and in accordance with the terms of this Warrant, Shares of Common Stock, $.001 par value per share of IPtimize, Inc., and herewith makes payment of the Warrant Price per share of Common Stock, or an aggregate of $ , and requests that a certificate for such shares of Common Stock be issued in the name of and be delivered to , whose address is .

| Dated: | ||||

| (Signature must conform in all respects to name of holder as specified on the face of the Warrant | ||||

27

EXHIBIT “C”

SUMMARY BUSINESS DESCRIPTION

VoIP for Cable. IPtimize, Inc. is a broadband voice and data service provider to the cable TV industry and to business customers nationwide.