Asset Purchase Agreement between VHT, Inc. and Gotham Innovation Lab Inc. (November 5, 2015)

This agreement is between VHT, Inc. (the Buyer) and Gotham Innovation Lab Inc. (the Seller), where VHT, Inc. agrees to purchase certain assets of Gotham Innovation Lab’s real estate media services business for $600,000. The Buyer will pay $400,000 at closing and the remainder in twelve monthly installments, with some payments contingent on the continuation of a key client contract. The Buyer only assumes specific contract liabilities after closing, while the Seller remains responsible for all other prior liabilities and taxes.

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”), dated as of November 5,

2015, is made by and between VHT, Inc., a Delaware corporation (“Buyer”), and Gotham

Innovation Lab Inc. d/b/a Gotham Photo Company, a New York corporation (“Seller”). Seller

and Buyer are sometimes hereinafter referred to individually as a “Party”, and collectively as the

“Parties”.

RECITALS

WHEREAS, Seller is engaged in the business of real estate media services, including

photography of properties, floor plan production, virtual staging of properties and video

production of properties, and (the “Business”); and

WHEREAS, Buyer desires to acquire certain assets of Seller, and Seller desires to sell

such assets to Buyer, all upon the terms and subject to the conditions of this Agreement.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, and intending to be legally bound hereby, the parties hereby

agree as follows:

ARTICLE 1

DEFINED TERMS

Section 1.1

Definitions. As used in this Agreement, unless the context otherwise

requires, capitalized terms used in this Agreement shall have the meanings set forth in Annex A

or otherwise given to such terms in the body of this Agreement.

ARTICLE 2

PURCHASE AND SALE OF ASSETS

Section 2.1

Purchase of Transferred Assets from Seller. At the Closing (as defined

below), Seller shall sell, convey, assign, transfer and deliver to Buyer, and Buyer shall purchase

from Seller, all of Seller’s right, title and interest in and to the Transferred Assets free and clear

of any and all Liens, including the Assumed Contracts (as defined below and set forth on

Schedule 4.6).

Section 2.2

Closing. The closing of the Transaction (the “Closing”) shall take place

remotely via the exchange of documents and signatures on the date of this Agreement or at such

other time and place as the Parties mutually agree upon in writing on the date hereof.

Section 2.3

Assumption of Contract Liabilities. Buyer does not assume and shall in

no event be liable for any Liabilities of Seller to any Person, whether fixed or non-fixed, known

or unknown, liquidated or unliquidated, secured or unsecured, contingent or otherwise, except

for any Liabilities expressly set forth in an Assumed Contract. Buyer shall perform and pay all

Liabilities as set forth in the Assumed Contracts, but only to the extent that such Liabilities arise

1

after the Closing Date (or in the case of payments due, only to the extent such payments are not

due until after the Closing Date) (the “Assumed Liabilities”).

Section 2.4

Excluded Liabilities. All Liabilities of Seller that are not Assumed

Liabilities (the “Excluded Liabilities”) shall be and remain solely Seller’s responsibility and

Seller shall pay and perform the Excluded Liabilities when due, including but not limited to

those liabilities that may accompany the Transferred Assets which existed as of and prior to the

Closing Date. Without limiting the generality of the foregoing, Seller shall remain liable for, and

pay and perform when due, and Buyer shall not assume, the following Excluded Liabilities:

(a)

Liabilities of Seller relating to Seller’s ownership or operation of the

Business or Transferred Assets prior to the Closing Date, including (i) Liabilities arising out of

or relating to Seller’s performance under any Contracts, including the Assumed Contracts,

licenses or permits, (ii) Liabilities to any current or former employee or consultant for unpaid

compensation, including unpaid bonuses or severance payments, (iii) Liabilities to any owner or

alleged owner of any equity interest in Seller, and (v) Liabilities for any claims, suits or actions

brought by any Person arising out of the operation of the Business prior to the Closing Date;

(b)

Any and all Indebtedness of Seller; and

(c)

Liabilities of Seller for Taxes for all periods, including Taxes arising out

of the consummation of the Transaction and all Taxes of any other Person imposed on Buyer, as

a transferee or successor, by contract or pursuant to any Law, which Taxes relate to an event or

transaction with respect to the Business occurring before the Closing.

ARTICLE 3

PURCHASE PRICE

Section 3.1

Purchase Price.

Subject to the terms and conditions hereof, in

consideration of the sale, transfer, conveyance and delivery of the Transferred Assets, including

the assignment of the Assumed Contracts, Buyer shall pay to Seller a total purchase price equal

to Six Hundred Thousand Dollars ($600,000) (the “Purchase Price”), which amount shall be paid

in accordance with this Section 3.1.

(a)

On the Closing Date, Buyer shall pay Four Hundred Thousand Dollars

($400,000) by wire transfer of immediately available funds to an account designated by Seller in

writing at least two Business Days prior to the Closing.

(b)

Commencing on Friday, January 29, 2016, Buyer shall pay twelve equal

monthly installments of $16,666.67 on the last business day of each month (the “Installment

Payments” and each, an “Installment Payment”), each Installment Payment to consist of (1) an

earn-out payment of $10,000 (the “Earn-Out Payments” and each, an “Earn-Out Payment”), and

(2) an additional payment of $6,666.67 (the “Additional Payments” and each, an “Additional

Payment”); provided however that

(i)

Buyer shall only be required to make the Earn-Out Payments for as

2

long as that certain Master Agreement for Media and Technology Services, dated as of

November 10, 2009, with Douglas Elliman LLC d/b/a Prudential Douglas Elliman Real Estate

(“Elliman”) remains in effect or a substantially similar agreement is entered into between Buyer

and Elliman and is full force and effect (the “Elliman Agreement”), provided however that

Elliman does not terminate said agreement as a result of (1) Elliman’s dissatisfaction with

Buyer’s management as it relates to the operation of the Business in connection with the Elliman

Agreement, (2) a material change in the services or product being offered to Elliman pursuant to

said agreement, or (3) an adverse material change in the quality of services and products being

offered to Elliman pursuant to said agreement; and

(ii)

if Buyer is entitled to indemnification pursuant to Section 8, Buyer

shall suspend payment of the last three Additional Payments and offset such amount against the

costs of the indemnity claim by providing to Seller prior written notice as outlined in Section 8,

(“Off-Set Rights”); provided that any remaining portion of the suspended Additional Payments

after satisfying the indemnity claim shall be paid to Seller.

(c)

All Installments Payments hereunder shall be made by Automated

Clearing House (ACH) or wire transfer to a bank account designated by Seller, such bank

account information to be provided to Buyer by Seller. Any and all late payments of Installment

Payments hereunder will be subject to a late payment charge from the date the amount was due

until paid in full at a rate per annum equal to the of lesser of six percent (6%) per annum or the

maximum interest rate permitted by law that may be charged under these circumstances. In the

event that Buyer fails to pay an Installment Payment within thirty (30) days of the date due (a

“Default”), Seller shall provide written notice to Buyer of such Default (a “Default Notice”), and

provide Buyer an opportunity to cure such Default by making the late Installment Payment (plus

any interest due thereunder as herein provided) within ten (10) days of Buyer’s receipt of the

Default Notice (the “Cure Period”). If Buyer fails to cure such Default within the Cure Period,

Seller may declare the entire balance of the Purchase Price immediately due and payable.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF SELLER

Except as set forth on the Disclosure Schedules, Seller represents and warrants to Buyer

as follows:

Section 4.1

Organization, Standing and Authority. Seller is a corporation duly

organized, validly existing and in good standing under the Laws of the State of New York.

Seller has all requisite corporate power and authority to carry on its Business as it is now being

conducted and enter into the Transaction. Seller has the requisite corporate power and authority

to execute and deliver this Agreement, to consummate the Transaction and to perform its

obligations under this Agreement. The execution, delivery and performance of this Agreement

and each Transaction Document to which Seller is a party and the consummation of the

Transaction have been duly authorized and approved by all required corporate action on the part

of Seller. This Agreement and each of the Transaction Documents to which Seller is a party

have been duly and validly executed and delivered by Seller. Assuming the due authorization,

execution and delivery by the other Parties hereto and thereto, this Agreement and each of the

3

Transaction Documents to which Seller is a party shall constitute, upon execution and delivery

thereof, the valid and binding obligations of Seller, enforceable in accordance with their terms,

except as enforcement may be limited by applicable bankruptcy, reorganization, insolvency,

moratorium or similar Laws affecting the enforcement of creditors’ rights generally and by

general principles of equity (regardless of whether enforcement is considered in a proceeding in

Law or equity).

Section 4.2

Conflict; Required Filings and Consents. No Consent of or to, or filing

with, any Governmental Authority or any other Person is required to be made or obtained by

Seller in connection with the execution, delivery, and performance of this Agreement or the

other Transaction Documents to which Seller is a party. Neither the execution, delivery, nor

performance of this Agreement by Seller, nor the consummation of the Transaction by Seller will

(a) conflict with or result in any breach of any provisions of the Organizational Documents of

Seller, (b) result in a violation or breach of, or constitute (with or without due notice or lapse of

time) a default (or give rise to any right of termination, cancellation, acceleration, vesting,

payment, exercise, suspension, or revocation) under any of the terms, conditions, or provisions

under any Assumed Contract or Transferred Asset, (c) violate any Law applicable to Seller or the

Transferred Assets, or (d) result in the creation or imposition of any Lien on any Transferred

Asset, except in the cases of clauses (b) or (c) for such violations, breaches, defaults or Liens that

would not reasonably be expected to have, individually or in the aggregate, a Material Adverse

Effect on Seller.

Section 4.3

Title To And Condition Of Transferred AssetsSeller has good and valid

title to, or a valid leasehold interest in, all of the Transferred Assets. Seller (a) has the power and

the right to sell, convey, transfer, assign and deliver to Buyer the Transferred Assets, and (b) on

the Closing Date shall sell, convey, transfer, assign and deliver the Transferred Assets free and

clear of all Liens.

(b)

The Transferred Assets are sufficient for the continued conduct of the

Business after the Closing in substantially the same manner as conducted prior to the Closing

and the Transferred Assets constitute all of the rights, property and assets necessary to conduct

the Business as currently conducted in all material respects.

Section 4.4

Financial Information. Schedule 4.4 contains copies of the Company’s

audited financial statements consisting of the balance sheet of the Company as of December 31,

2014 and the related statements of income and retained earnings and cash flow for the year then

ended (the “Audited Financial Statements”), and unaudited financial statements consisting of the

balance sheet of the Company as of September 30, 2015 and the related statements of income

and retained earnings and cash flow for the nine-month period then ended (the “Interim Financial

Statements,” and together with the Audited Financial Statements, the “Financial Statements”).

The Financial Statements are true and correct in all material respects and fairly present the

financial position of Seller as at such dates and the results of Seller’s operations and the changes

in Seller’s retained earnings and financial position for the periods related thereto and have been

prepared in a manner consistent with GAAP principals.

Section 4.5

No Undisclosed Liabilities. To Seller’s Knowledge, the Seller does not

have any Liabilities pertaining to the Transferred Assets (whether or not required to be disclosed

4

on a balance sheet prepared in accordance with GAAP), other than: (a) Liabilities adequately

reflected or reserved against on the Financial Information; (b) Liabilities incurred since June 30,

2015 in the ordinary course of business consistent with past practice; (c) Liabilities incurred in

connection with the Transaction; (d) contractual or other Liabilities incurred in the ordinary

course of business consistent with past practice; and (e) Liabilities or obligations which would

not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect

on Seller.

Section 4.6

Assumed Contracts.

(a)

Schedule 4.6 sets forth a true and correct list of all Contracts by which

Selleris bound in respect to the Business or the Transferred Assets that will be transferred to the

Buyer (the “Assumed Contracts”).

(b)

True and correct copies of all written Contracts listed on Schedule 4.6 and

descriptions of any oral Assumed Contracts listed and described thereon have been delivered to

Buyer. All of the Contracts set forth on Schedule 4.6 or in the other Schedules hereto are (i)

valid and enforceable in accordance with their respective terms, except to the extent that such

enforceabilty (A) may be limited by bankruptcy, insolvency, reorganization, moratorium or other

similar laws relating to creditors’ rights generally and (B) are in full force and effect. Seller is

not in default under any Assumed Contract nor, to Seller’s Knowledge, is any other party to any

such Assumed Contract in material default thereunder; nor, to Seller’s knowledge, is there any

condition or basis for any claim of a default by any party thereto or event which, with notice,

lapse of time or both, would constitute a default thereunder. Seller has paid in full or accrued all

amounts due from Seller thereunder for periods on or prior to the date hereof (whether or not

then currently payable) and has satisfied in full or provided in full for all of its Liabilities

thereunder for periods on or prior to the date hereof. All rights of Seller under the Assumed

Contracts extending beyond the Closing Date shall continue unimpaired and unchanged on and

after the Closing Date without (i) the requirement of Consent of any Person or (ii) the payment

of any penalty, the incurrence of any additional Liability or the change of any term.

(c)

to Seller’s Knowledge the Seller is not a party to or bound by any

Assumed Contract which was entered into other than in the ordinary course of its business

consistent with past practice.

(d)

To Seller’s Knowledge the Assumed Contracts listed on Schedule 4.6

constitute all material Contracts necessary to operate the Business as it is operated currently.

Section 4.7

Real Property. Schedule 4.7 sets forth a complete list, as of the date

hereof, of the address of each parcel of Licensed Real Property, each of which is licensed under a

valid and subsisting license agreement (each, a “Real Property Agreement”). Seller has provided

to Buyer true and correct copies of each Real Property Agreement, together with all

amendments, modifications or supplements, if any, thereto. Each Real Property Agreement is in

full force and effect, and neither Seller nor any other party is in breach or default under any of

such Real Property Agreement, and no event has occurred which, with notice or lapse of time,

would constitute such a breach or default or give any party thereunder the right to terminate or

accelerate any material rights under any such Real Property Agreement. Without limiting the

5

foregoing, Seller has not received any notice from any landlord asserting the existence of a

default under any Real Property Agreement. All rents and additional rents, royalties, license

fees, charges or other payments due and payable by Seller under the Real Property Agreements

have been paid through the Closing Date. Seller has not received written notice of any pending

or threatened condemnation, incorporation, annexation or similar proceeding with respect to the

Licensed Real Property or any portion thereof. The use of the Licensed Real Property for the

purposes for which it is presently being used is permitted under applicable zoning requirements,

and there is no deed, lease or other recorded or unrecorded restriction or legal impediment which

prohibits or restricts the use of the Licensed Real Property for the current operations of Seller.

Seller does not own any real property.

Section 4.8

Tangible Personal Property. Seller has good and marketable title to all

material tangible personal property included in the Transferred Assets, free and clear of any and

all Liens. All items of tangible personal property included in the Transferred Assets, whether

owned or held pursuant to leases, which are material to the operation of the Business, are in

working condition and in a state of good maintenance and repair (ordinary wear and tear

excepted). Seller has a valid and enforceable leasehold interest under each of the personal

property leases under which it is a lessee, which enforcement may be limited by applicable

bankruptcy, reorganization, insolvency, moratorium or similar Laws affecting the enforcement of

creditors’ rights generally and by general principles of equity (regardless of whether enforcement

is considered in a proceeding in Law or equity).

Section 4.9

Inventory. All inventory, whether or not reflected in the Financial

Information, consists of a quality and quantity usable and salable in the ordinary course of

business consistent with past practice. All inventory is owned by Seller free and clear of all

Liens, and no inventory is held on a consignment basis.

Section 4.10 Intellectual PropertySchedule 4.10(a) sets forth a true and complete list of

all Intellectual Property used in Seller’s conduct of the Business, separated by (i) Intellectual

Property that is owned by Seller, and (ii) licenses, whether written or other, setting forth the

details of the license.

(b)

Except as set forth in Schedule 4.10(b), Seller owns or has valid licenses

to use (which licenses are set forth in Schedule 4.10(a)) all Intellectual Property used in Seller’s

conduct of the Business, free and clear of all Liens. Seller’s conduct of the Business has not

infringed, misappropriated or otherwise unlawfully used and does not infringe, misappropriate or

otherwise unlawfully use the Intellectual Property of any Person. There are no facts or

circumstances that would render any of the Intellectual Property invalid or unenforceable and

each item of Seller’s registered Intellectual Property is valid and subsisting. To Seller’s

Knowledge, no Person has infringed or misappropriated or is infringing or misappropriating any

of the Intellectual Property, including any employee or former employee of Seller

(c)

Except as set forth in Schedule 4.10(c), Seller does not pay or receive any

royalty to or from anyone with respect to Intellectual Property, nor has Seller licensed anyone to

use any of the Intellectual Property owned by the Seller and used in Sellers’ conduct of the

Business.

6

(d)

Except as set forth in Schedule 4.10(d), all rights of Seller in and to the

Intellectual Property used in Seller’s conduct of the Business will be unaffected by the

transactions contemplated by this Agreement.

(e)

Except as set forth in Schedule 4.10(e), Seller has not given nor received

any written notice of any pending conflict with, or infringement of the rights of others with

respect to any Intellectual Property owned by Seller or used in Seller’s conduct of the Business.

Section 4.11 Litigation. Except as set forth in Schedule 4.11, there is no litigation or

governmental, administrative or judicial proceeding or investigation pending or, to Seller’s

Knowledge, threatened against Seller in connection with any part of the Business or the

Transferred Assets. Seller is not (a) in violation in any respect of any applicable Laws, (b)

subject to the provisions of any order, writ, injunction, judgment or decree of any court or

governmental agency or instrumentality or (c) subject to or in default with respect to any Order.

Section 4.12 Employee Matters.

(a)

Schedule 4.12(a) sets forth a true and complete list of (i) all the current

employees of Seller as of the date specified on such list (which shall be no earlier than ten

Business Days prior to the date hereof), their current respective positions or job classifications

and their current respective wage scales or salaries, whether such employee is at-will or subject

to an employment contract, exempt/non-exempt classification, and any accrued liability of Seller

with respect to each such employee of Seller for any unused vacation and other paid time off as

of the date hereof and (ii) the name of each individual who currently provides, or who has within

the prior twelve-month period provided, services to Seller as an independent contractor with

respect to the Business.

(b)

No employee of Seller is covered by a collective bargaining agreement or

represented by a labor union or labor organization. There is not any, and during the past three

years there has not been any, labor strike, dispute, work stoppage or lockout in existence or

threatened against the Business. Seller is not engaged in any unfair labor practice in connection

with the conduct of the Business, and there are no unfair labor practice charges or complaints

against Seller in existence or threatened in connection with the conduct of the Business. Seller is

in compliance in all respects with all applicable Laws respecting employment and employment

practices, terms and conditions of employment and wages and hours.

(c)

Seller has delivered to Buyer a true, correct and complete copy of each

employment agreement, severance agreement, consulting or independent contractor agreement,

confidentiality/non-disclosure agreement, assignment of inventions agreement and/or restrictive

covenant agreement, including, but not limited to non-competition and non-solicitation

agreements, entered into with an employee or independent contractor of the Business.

(d)

Except as set forth on Schedule 4.12(b), all work product pertaining to the

Business was created by regular full-time or part-time employees of Seller at the time such

person contributed to any such work product, and such author or developer has irrevocably and

explicitly assigned to Seller in writing all copyrights and other proprietary rights in such person’s

7

work product pertaining to the Business, including but not limited to photographs of current or

former employees used in the Business.

(e)

The employment of each employee and independent contractor of Seller is

terminable by Seller at will, and Seller has no obligation to provide any particular form or period

of notice prior to terminating the employment of such employees or such relationship with such

independent contractors, nor does Seller have any obligation to provide any post-termination

payments to any such person, other than amounts due and owing for services performed up to

and including the date of termination, and payment of accrued but unused paid time off, to the

extent such payment upon termination is required by Seller’s policies and/or practices or

applicable law.

(f)

With respect to current and former employees and independent contractors

of the Business, Seller is and has been for the past four (4) years in compliance with all

applicable Laws respecting employment and employment practices, including but not limited to

Laws respecting minimum wage and overtime payments, employment discrimination, workers’

compensation, family and medical leave, immigration, and occupational safety and health

requirements. There are no claims against Seller or, to the Knowledge of Seller, threatened to be

brought or filed, by or with any Governmental Authority relating to or arising out of any

applicable Laws, and there are no internal complaints brought by any current or former employee

or service provider (including, but not limited to, independent contractors) in connection with the

employment (or relationship) of any such person, including relating to or arising out of any

applicable Laws.

(g)

Each person classified by Seller as an independent contractor with respect

to the Business satisfies and has satisfied the requirements of any applicable Law to be so

classified, and Seller has fully complied with all applicable Laws fully and accurately reported

such independent contractors’ compensation on IRS Forms 1099 (and foreign equivalent thereof)

when required to do so.

(h)

Seller is not delinquent to, nor has failed to pay when due, any employee

or independent contractor for any wages (including overtime, meal breaks or waiting time

penalties), fees, salaries, commissions, accrued and unused vacation pay, holiday pay, sick pay

or other paid time off, or on-call payments or equal pay to which they would be entitled under

applicable Law, if any, bonuses, benefits or other compensation for any services performed by

them or amounts required to be reimbursed or damages or interest paid to such individuals.

(i)

Seller does not maintain any “employee pension benefit plan” (as defined

in Section 3(2) of the Employee Retirement Income Security Act of 1974, as amended

(“ERISA”)) (“Pension Plan”), “employee welfare benefit plan” (as defined in Section 3(1) of

ERISA) or any stock option or other equity based, bonus, incentive or deferred compensation or

severance plan or arrangement.

Section 4.13 Taxes. Seller has timely filed all tax returns required to be filed by it, each

such tax return has been prepared in substantial compliance with all applicable laws, and all such

tax returns are complete, true and accurate in all material respects. There are no Liens for Taxes

(other than for current Taxes not yet due and payable) upon the Business or Transferred Assets,

8

and no liability for Taxes for which Buyer may be responsible upon the consummation of the

Transaction. With respect to the Business, Seller has withheld and paid all Taxes required to

have been withheld and paid in connection with amounts paid or owing to any employee,

independent contractor, creditor, member or other third party.

Section 4.14 Compliance with Laws. Seller has not violated or failed to comply with

any Law, or any Order, applicable to the Business or it operations, the violation or failure to

comply with which could have a Material Adverse Effect on Buyer.

Section 4.15 Licenses and Permits. Seller has such certificates, permits, licenses,

franchises, consents, approvals, orders, registrations, authorizations and clearances from, the

appropriate Governmental Authorities and other Persons as are necessary to conduct or operate

the Business as presently conducted (collectively “Seller’s Licenses”), and all Seller’s Licenses

are valid and in full force and effect. Schedule 4.15 sets forth a list of all material Seller’s

Licenses. Seller’s Licenses shall be transferred to Buyer, free and clear of any and all Liens, at

Closing as part of the Transferred Assets to the extent assignable.

Section 4.16 Related-Party Transactions. Except as set forth on Schedule 4.16, no

employee, officer, director, stockholder of Seller, or any of their respective Affiliates, or, to

Seller’s Knowledge, any member of any such Person’s immediate family (collectively, “Related

Persons”), (i) is a party to any Assumed Contract or is involved in any business arrangement or

other relationship with Seller (whether written or oral), or (ii) has any claim or cause of action

against Seller.

Section 4.17 Customers and Service Providers. Since June 30, 2015, none of Seller’s

top 25 customers or service providers has affirmatively terminated its relationship with Seller or

materially reduced or changed the pricing or other terms of its business with Seller and no such

customer or service provider of Seller has notified Seller that it intends to terminate or materially

reduce or change the pricing or other terms of its business with Seller.

Section 4.18 Brokers. No Person is entitled to any brokerage, financial advisory,

finder’s or similar fee or commission payable in connection with the Transaction based upon

arrangements made by or on behalf of Seller.

ARTICLE 5

REPRESENTATIONS AND WARRANTIES OF BUYER

Except as set forth on the Disclosure Schedules, Buyer represents and warrants to Seller

as follows:

Section 5.1

Organization and Authority. Buyer is a corporation validly existing and in

good standing under the Laws of the State of Delaware. Buyer has the requisite corporate power,

authority and legal capacity to execute and deliver this Agreement, to consummate the

Transaction and to perform its obligations under this Agreement. The execution, delivery and

performance of this Agreement and each Transaction Document to which Buyer is a party and

the consummation of the Transaction have been duly authorized and approved by all required

9

corporate action on the part of Buyer. This Agreement and each of the Transaction Documents

to which Buyer is a party has been duly and validly executed and delivered by Buyer. Assuming

the due authorization, execution and delivery by the other Parties hereto and thereto, this

Agreement and each of the Transaction Documents to which Buyer is a party shall constitute,

upon execution and delivery thereof, the valid and binding obligations of Buyer, enforceable in

accordance with their terms, except as enforcement may be limited by applicable bankruptcy,

reorganization, insolvency, moratorium or similar Laws affecting the enforcement of creditors’

rights generally and by general principles of equity (regardless of whether enforcement is

considered in a proceeding in Law or equity).

Section 5.2

Consents and Approvals. Except as set forth on Schedule 5.2, no Consent

of or to, or filing with, any Governmental Authority, domestic or foreign, or any other Person is

required to be made or obtained by Buyer in connection with the execution, delivery, and

performance of this Agreement or the other Transaction Documents to which Buyer is a party

and the consummation of the Transaction.

Section 5.3

No Violations. Neither the execution, delivery nor performance of this

Agreement by Buyer, nor the consummation by Buyer of the Transaction, nor compliance by

Buyer with any of the provisions hereof, will (a) conflict with or result in any breach of any

provisions of the Organizational Documents of Buyer, (b) result in a violation or breach of, or

constitute (with or without due notice or lapse of time) a default under any material Contract or

other instrument or obligation to which Buyer is a party or by which Buyer or Buyer’s properties

or assets may be bound or, (c) violate any Law applicable to Buyer.

Section 5.4

Brokers. No Person is entitled to any brokerage, financial advisory,

finder’s or similar fee or commission payable in connection with the Transaction based upon

arrangements made by or on behalf of Buyer.

ARTICLE 6

COVENANTS

Section 6.1

Additional Matters and Further Assurances. Seller and Buyer shall use

reasonable efforts to execute and deliver such other instruments of conveyance, transfer or

assumption, as the case may be, and take such other actions as may be reasonably requested to

implement more effectively, the conveyance, transfer and operation, as applicable, of the

Transferred Assets and the Business to or by Buyer. Seller and Buyer shall cooperate and take

such actions as may be reasonably requested by the other Party in order to effect an orderly

transfer of the Business with a minimum of disruption to the operations and employees of the

businesses of the Parties. Neither Buyer nor Seller shall take any action which is materially

inconsistent with its obligations under this Agreement.

Section 6.2

Confidentiality. Except as required by law or to carry out the transactions

contemplated by this Agreement, from and after the Closing, Seller shall, and shall cause its

Affiliates and each of their respective employees, directors, officers and owners, to, hold, and

shall use its reasonable best efforts to cause its or their respective Representatives to hold, in

confidence any and all information, whether written or oral, concerning the Business to the

10

extent such information is not publicly accessible or available at the time of any disclosure.

Section 6.3

Change of Corporate Name or Dissolution of Seller. Seller shall cease the

use of the name “Gotham Innovation Lab Inc.” and the d/b/a “Gotham Photo Company”

immediately after the Closing Date, and Seller shall in no way compete with Buyer, solicit any

employees, independent contractors, customers or service providers of Buyer, or engage in any

business of a similar nature to the Business. Seller shall use reasonable efforts to wind up its

affairs and (i) change the name of Seller to something that does not contain the phrase “Gotham

Photo Company” or any derivation thereof immediately upon Closing, and (ii) file a Certificate

of Dissolution with the New York Department of State, Division of Corporations, within six

months after the Closing Date.

Section 6.4

Account Receivables. From and after the Closing, if Buyer receives or

collects any funds relating to any accounts receivable existing as of the Closing Date pertaining

to the Transferred Assets, Buyer shall remit such funds to Seller via ACH payment or wire

transfer within six Business Days after its receipt thereof. From and after the Closing, if Seller

or an Affiliate of Seller receives or collects any funds relating to any accounts receivable existing

subsequent to the Closing Date pertaining to the Transferred Assets, Seller or an Affiliate of

Seller shall remit such funds to Buyer within five Business Days after its receipt thereof. Buyer

shall exercise a duty of good faith in the efforts to facilitate the collection of funds relating to any

accounts receivable existing as of the Closing Date pertaining to the Transferred Assets.

Section 6.5

Transfer Taxes. All transfer, documentary, sales, use, stamp, registration,

value added and other such Taxes and fees (including any penalties and interest) incurred in

connection with this Agreement and the other Transaction Documents shall be borne and paid by

Seller when due. Seller shall, at its own expense, timely file any Tax Return or other document

with respect to such Taxes or fees (and Buyer shall cooperate with respect thereto as necessary).

Section 6.6

Limited Power of Attorney. From and after the Closing, Seller hereby

appoints Buyer as its true and lawful attorney-in-fact of, for, and in the name, place and stead of

Seller, for the specific purpose of endorsing checks received by Buyer after the Closing which

are made in the name of Seller for (1) accounts receivable existing as of the date of Closing,

whether or not pertaining to the Transferred Assets, which Buyer shall remit to Seller via ACH

payment or wire transfer within six Business Days after its receipt thereof, (2) any amounts

received by Buyer that represent moneys earned post-Closing, whether or not pertaining to the

Transferred Assets, that should have been paid in the name of Buyer, which Buyer shall keep in

its possession for use, deposit, or otherwise in its sole discretion, and Seller hereby appoints the

Buyer as its true and lawful attorney-in-fact to ask for, demand, take and collect any funds

relating to any accounts receivable existing as of the Closing Date pertaining to the Transferred

Assets.

Notwithstanding the above, Buyer shall have no right to assign, transfer, deliver,

hypothecate, subdivide or otherwise deal with all or any portion of the funds relating to any

accounts receivable existing as of the Closing Date pertaining to the Transferred Assets.

Section 6.7

Employee Benefits.

11

(a)

To the extent that, after the Closing Date and through December 31, 2015,

either of John Porcheddu or Jennifer Long exercises vacation days that accrued during the period

from January 1, 2015 to the Closing Date during his or her, as applicable, employ with Seller

(the “Vacation Days”), Seller will reimburse Buyer for the amount of all salary payments made

by Buyer to each of Mr. Porcheddu and Ms. Long with respect to the Vacation Days. In such

event, Buyer shall deliver written notice to Seller of the exercise of Vacation Days by each of

Mr. Porcheddu and Ms. Long, which shall include the amount due and owing to Buyer therefrom

and wire instructions of Buyer or other specified payment method (the “Reimbursement

Notice”), and Seller shall remit the payment specified via the method specified in such

Reimbursement Notice.

(b)

Seller, at Buyer’s expense, hereby agrees to maintain its current coverage

under (1) the Gold option of EmblemHealth HMO 40/60 (the “Health Plan”), and (2) the Dental

Insurance and Vision Benefits offered under the United Health Care OxfordOBM Premiere

Specialty Option plan (the “Dental and Vision Plan,” and together with the Health Plan, each a

“Benefit Plan” and together the “Benefit Plans”) through December 31, 2015 (the “Coverage

Period”), and will not terminate either Benefit Plan or reduce or modify its coverage under either

Benefit Plan, or terminate coverage of any of the employees covered under such Benefit Plan,

before the expiration of the Coverage Period.

ARTICLE 7

CLOSING DELIVERIES

Section 7.1

Deliveries by Seller at Closing. At the Closing, Seller shall deliver to

Buyer:

(a)

An Employment Agreement with Buyer, dated as of the Closing Date, in

the form attached hereto as Exhibit A, executed by Vince Collura (the “Employment

Agreement”);

(b)

a general bill of sale, in the form attached hereto as Exhibit B, with respect

to the Transferred Assets to be conveyed by Seller at the Closing, and any other documents

requested by Buyer so as to convey to Buyer good title, free and clear of all Liens, to all of

Seller’s right, title and interest in and to the Transferred Assets to be conveyed at Closing;

(c)

an assignment and assumption agreement, in the form attached hereto as

Exhibit C (the “Assignment and Assumption Agreement”), pursuant to which Seller assigns to

Buyer all of its right, title and interest in and to, and Buyer assumes all of Seller’s obligations

under or for the Assumed Contracts;

(d)

those certain confirmatory assignment agreements executed by certain

employees of Seller (the “Confirmatory Assignment Agreements”), pursuant to which such

employees acknowledge that all rights, title and interest in any of their work product remains the

sole right of Seller;

(e)

any and all consents necessary to transfer and assign the Transferred

Assets;

12

(f)

Certificate of the Secretary of Seller, dated as of the Closing Date,

certifying that attached thereto are true and complete copies of (i) the resolutions of the directors

of Seller and resolution of the directors of shareholder of Seller which authorize the execution,

delivery and performance of this Agreement, the Transaction Documents, and the Transaction,

and certifying that such resolutions have not been amended or rescinded and are in full force and

effect; and (ii) the Organizational Documents of Seller as in effect as of the Closing Date, and

certifying the identity and incumbency of the directors and officers authorized to execute and

deliver this Agreement and the Transaction Agreements on behalf of Seller;

(g)

Certificate executed by the Chief Executive Officer of Seller, dated as of

the Closing Date, certifying that the representations and warranties of Seller contained in this

Agreement, the other Transaction Documents and any certificate delivered in connection with

any of the foregoing are true and correct in all respects on and as of the date hereof;

(h)

a good standing certificate for Seller, dated no earlier than ten days before

the Closing Date, from its jurisdiction of formation and from each other jurisdiction in which

Seller is qualified or registered to do business as a foreign company;

(i)

a Form 8594 executed by Seller; and

(j)

all other documents, certificates, instruments or writings reasonably

requested by Buyer in connection herewith.

Section 7.2

Deliveries by Buyer at Closing. At the Closing, Buyer shall deliver to

Seller:

(a)

the Purchase Price in accordance with Section 3.1;

(b)

the Employment Agreement;

(c)

the Assignment and Assumption Agreement; and

(d)

all other documents, certificates, instruments or writings reasonably

requested by Seller in connection herewith.

Section 7.3

Delivery of Transferred Assets. At Closing, Seller shall place Buyer in

full possession and control of the Transferred Assets, provided that Buyer and Seller agree to use

their reasonable efforts to coordinate such delivery in a mutually agreeable manner in order to

minimize, to the greatest extent possible, any Taxes.

ARTICLE 8

INDEMNIFICATION

Section 8.1

Survival of Representations, Warranties, and Covenants.

The

representations and warranties contained in this Agreement and in any instrument delivered

pursuant to this Agreement shall survive the Closing Date and the consummation of the

13

Transaction and shall continue in full force and effect until 12:00 AM Eastern Standard time on

January 1, 2017. The covenants contained in this Agreement and in any instrument delivered

pursuant to this Agreement shall survive the Closing Date and the consummation of the

Transaction, in accordance with their terms.

Section 8.2

Indemnification by Seller. Except as otherwise expressly provided in this

Agreement, Seller shall indemnify Buyer and its Affiliates and each of their employees,

directors, officers and owners (collectively referred to herein as “Buyer Indemnified Parties”)

against and hold them harmless from any Losses suffered or incurred by Buyer Indemnified

Parties for or on account of or arising from or in connection with (a) any breach of any

representation or warranty of Seller contained in this Agreement, (b) any breach of any covenant

or agreement of Seller contained in this Agreement or any agreement entered into by Seller

pursuant to this Agreement, (c) any Excluded Liabilities, including any Liability arising out of

the ownership of the Transferred Assets, the operations of the Business or the activities of Seller

prior to the Closing Date, or (d) any claims relating to or arising from any Persons based on such

Person’s actual or claimed equity interests in Seller.

Section 8.3

Indemnification by Buyer. Except as otherwise expressly provided in this

Agreement, Buyer shall indemnify Seller and its employees, directors, officers and owners

(collectively referred to herein as “Seller Indemnified Parties”) against and hold them harmless

from any Losses suffered or incurred by Seller Indemnified Parties for or on account of or arising

from or in connection with (a) any breach of any representation or warranty of Buyer contained

in this Agreement, or (b) any breach of any covenant or agreement of Buyer contained in this

Agreement or any agreement entered into by Buyer pursuant to this Agreement; provided,

however, Buyer shall not be liable for such Losses under this Section 8.3 to the extent such

Losses exceed a One Hundred and Fifty Thousand Dollars ($150,000) aggregate ceiling (after

which point Buyer will have no obligation to indemnify Seller Indemnified Parties from and

against further Losses).

Section 8.4

Notice and Defense.

(a)

If at any time a party entitled to indemnification hereunder (the

“Indemnitee”) shall receive notice from any third party of any asserted Loss claimed to give rise

to indemnification hereunder, the Indemnitee shall promptly give notice thereof (“Claims

Notice”) to the party obligated to provide indemnification (the “Indemnitor”) of such Loss. The

Claims Notice shall set forth a brief description of the Loss, in reasonable detail, and, if known

or reasonably estimable, the amount of the Loss that has been or may be suffered by the

Indemnitee. The failure of the Indemnitee to give a Claims Notice promptly shall not waive or

otherwise affect the Indemnitor’s obligations with respect thereto, except to the extent that the

Indemnitor is prejudiced as a result of such failure (or to the extent the associated claim is barred

by another provision hereof regarding any survival period). All indemnity claims by the

Indemnitee shall be bona fide. Any claim for indemnification with respect to any of such matters

which is not asserted by a notice given as herein provided specifically identifying the particular

breach underlying such claim and the reasonable detail of facts and Losses relating thereto within

the specified periods of survival may not be pursued until and unless properly made, and if

regarding a representation or warranty, within the applicable survival period as set forth in

Section 8.1. Thereafter, the Indemnitor shall have, at its election, the right to compromise or

14

defend any such matter at the Indemnitor’s sole cost and expense through counsel chosen by the

Indemnitor and approved by the Indemnitee (which approval shall not unreasonably be

withheld); provided, however, that (i) Indemnitor provides evidence reasonably satisfactory to

Indemnitee that Indemnitor has the financial wherewithal to satisfy and discharge the Loss in

full, and (ii) any such compromise or defense shall be conducted in a manner which is reasonable

and not contrary to the Indemnitee’s interests, and the Indemnitee shall in all events have a right

to veto any such compromise or defense which is unreasonable or which would jeopardize in any

material respect any assets or business of the Indemnitee or any of its affiliates or increase the

potential liability of, or create a new liability for, the Indemnitee or any of its affiliates and,

provided further that the Indemnitor shall in all events indemnify the Indemnitee and its affiliates

against any damage resulting from the manner in which such matter is compromised or

defended, including any failure to pay any such claim while such litigation is pending.

Notwithstanding the foregoing, if the Indemnitor receives a firm offer to settle a third party

Claim, and the Indemnitor desires to accept such offer, the Indemnitor will give written notice to

the Indemnitee to that effect. In the event that the Indemnitor does so undertake to compromise

and defend a claim, the Indemnitor shall notify the Indemnitee of its intention to do so. Each

party agrees in all cases to use commercially reasonable efforts to cooperate with the defending

party and its counsel in the compromise of or defending of any such liabilities or claims. In

addition, the nondefending party shall at all times be entitled to monitor such defense through the

appointment, at its own cost and expense, of advisory counsel of its own choosing.

(b)

In the event any Indemnitee should have an indemnity claim against any

Indemnitor hereunder which does not involve a third party Claim, the Indemnitee shall transmit

to the Indemnitor a Claims Notice. The Indemnitor shall have fifteen (15) business days after

receipt of any such Claims Notice in which to object in writing to the claim or claims made by

Indemnitee in such Claims Notice, which written objection (the “Objection Notice”) shall state,

in reasonable detail, the basis for Indemnitor’s objection. In the event that Indemnitor does

deliver an Objection Notice with respect to any claim or claims made in any Claims Notice, the

Indemnitor and the Indemnitee shall, within the fifteen (15) day period beginning as of the date

of the receipt by Indemnitee of the Objection Notice, attempt in good faith to agree upon the

proper resolutions of each of such claims. If the parties should so agree, a written memorandum

setting forth such agreement shall be prepared and signed by both parties. If no agreement can

be reached after good faith negotiations within such fifteen day negotiating period (or such

extended period as the Indemnitor and the Indemnitee shall mutually agree upon in writing), the

parties may pursue their remedies at law (subject to the terms and conditions of this Agreement).

Section 8.5

Indemnification Limits and Restrictions.

(a)

De Minimis. No indemnification shall be payable by Seller with respect to

any indemnity claim under Section 8.2 with respect to any individual Loss (or series of related

Losses arising out of the same or substantially similar circumstances) which is (or, for such a

series, are in the aggregate) less than Five Thousand Dollars ($5,000.00) (the “De Minimis

Amount”); provided, however, that, in each case subject to the other terms of this Section 8, if

such Loss (or Losses) exceeds the De Minimis Amount, then all of such indemnification shall be

payable for the entire amount of such Loss (or Losses), including the portion that is less than the

De Minimis Amount.

15

(b)

Caps. The aggregate liability of Seller for indemnification payable

hereunder with respect to any Indemnity Claim under Section 8.2 shall not exceed the Purchase

Price (the “Cap”). Any indemnification shall be paid in United States dollars in immediately

available funds.

(c)

Notwithstanding anything in this Agreement to the contrary, Losses shall

not include consequential, special or punitive damages.

Section 8.6

Seller Indemnification. With respect to any indemnity claim under

Section 8.2, Buyer hereby agrees that it shall seek recourse and remedy for such indemnifiable

Losses (subject to Sections 8.7 and 8.8 below) in the following order of priority: first, Buyer

shall enforce its set-off rights pursuant to Section 3.1 (b)(ii), including against any earn-out

payments which are due or may become due under clause (ii) of Section 3.1(b), to the extent of

such indemnifiable Losses;

(b)

to the extent that such indemnifiable Losses shall not be fully paid

pursuant to the foregoing clause (a), Buyer shall seek recourse and remedy against Seller.

Section 8.7

Amount of Losses. The amount of any Loss payable hereunder shall be

calculated net of any insurance proceeds actually received by the Indemnitee with respect

thereto. In the event that an Indemnitee receives any insurance proceeds with respect to any

Loss for which any such Person has been indemnified hereunder, then a refund equal to such

insurance proceeds shall be made promptly to the Indemnitor. The Indemnitee shall use

commercially reasonable efforts to file insurance claims that may reduce or eliminate Losses.

ARTICLE 9

GENERAL PROVISIONS

Section 9.1

Notices. All notices, claims, demands, and other communications

hereunder shall be in writing and shall be deemed given upon (a) confirmation of receipt of a

facsimile transmission, (b) confirmed delivery by a standard overnight carrier or when delivered

by hand, or (c) the expiration of five (5) Business Days after the day when mailed by registered

or certified mail (postage prepaid, return receipt requested), addressed to the respective Parties at

the following addresses (or such other address for a Party as shall be specified by like notice):

If to Buyer, to

VHT, Inc.

6400 Shafer Court, Suite 200

Rosemont, Illinois 60018

Attention: Brian Balduf

with a copy to:

Duane Morris LLP

16

190 South LaSalle Street, Suite 3700

Chicago, Illinois 60603-3433

Attention: N. Paul Coyle, Esq.

and

If to Seller, to

iGambit Inc.

1050 W. Jericho Tpke., Suite A

Smithtown, NY 11768

Attention: Elisa Luqman, General Counsel

with a copy to:

Roetzel & Andress

350 East Las Olas Boulevard

Las Olas Centre II, Suite 1150

Fort Lauderdale, FL ###-###-####

Attention: Joel Mayersohn

Section 9.2

Entire Agreement; Assignment. This Agreement (including any Annexes,

Schedules, Exhibits and the other documents and instruments referred to herein) (a) constitutes

the entire agreement between the parties hereto and supersedes all other prior agreements and

understandings, both written and oral, among the Parties or any of them, with respect to the

subject matter hereof, including any transaction between or among the Parties hereto, and (b)

shall not be assigned without the prior written consent of the non-assigning party, whether by

operation of Law or otherwise provided, however, that Seller may assign this Agreement without

such consent to an Affiliate, including the right to receive Installment Payments pursuant to

Section 3.1 and Account Receivables pursuant to Section 6.4.

Section 9.3

Governing Law. This Agreement, the rights of the parties and all Actions

arising in whole or in part under or in connection herewith, will be governed by and construed in

accordance with the domestic substantive laws of the State of New York, without giving effect to

any choice or conflict of law provision or rule that would cause the application of the laws of any

other jurisdiction.

Section 9.4

Waiver of Jury Trial. EACH PARTY HEREBY IRREVOCABLY

WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY ACTION ARISING

OUT OF, OR RELATING TO, THIS AGREEMENT.

Section 9.5

Amendment. This Agreement may not be amended except by an

instrument in writing signed on behalf of all the Parties hereto.

Section 9.6

Waiver. Any of the terms and conditions of this Agreement may be

waived in whole or in part, but only by an agreement in writing making specific reference to this

Agreement and executed by the Party that is entitled to the benefit thereof. The failure of any

17

Party hereto to insist upon strict performance of or compliance with the provisions of this

Agreement shall not constitute a waiver of any right of any such Party hereunder or prohibit or

limit the right of such Party to insist upon strict performance or compliance at any other time.

Section 9.7

Severability; Validity; Parties in Interest. Any term or provision of this

Agreement that is invalid or unenforceable in any situation in any jurisdiction will not affect the

validity or enforceability of the remaining terms and provisions hereof or the validity or

enforceability of the offending term or provision in any other situation or in any other

jurisdiction. In the event that any provision hereof would, under applicable law, be invalid or

unenforceable in any respect, each party hereto intends that such provision will be construed by

modifying or limiting it so as to be valid and enforceable to the maximum extent compatible

with, and possible under, applicable law.

Section 9.8

Interpretive Matters. The Parties have participated jointly in the

negotiation and drafting of this Agreement. In the event an ambiguity or question of intent

arises, this Agreement shall be construed as if drafted jointly by the Parties, and no presumption

or burden of proof shall arise favoring or disfavoring any Party by virtue of the authorship of any

of the provisions of this Agreement.

Section 9.9

Descriptive Headings. The headings contained in this Agreement are for

reference purposes only and shall not affect in any way the meaning or interpretation of this

Agreement.

Section 9.10 Counterparts; Effectiveness; Facsimile Signatures. This Agreement may

be executed in two or more counterparts, each of which shall be deemed to be an original but all

of which shall constitute one and the same agreement. This Agreement shall become effective

when each Party hereto shall have received counterparts thereof signed by the other Parties

hereto. A signature hereto sent or delivered by facsimile or other electronic transmission shall be

as legally binding and enforceable as a signed original for all purposes.

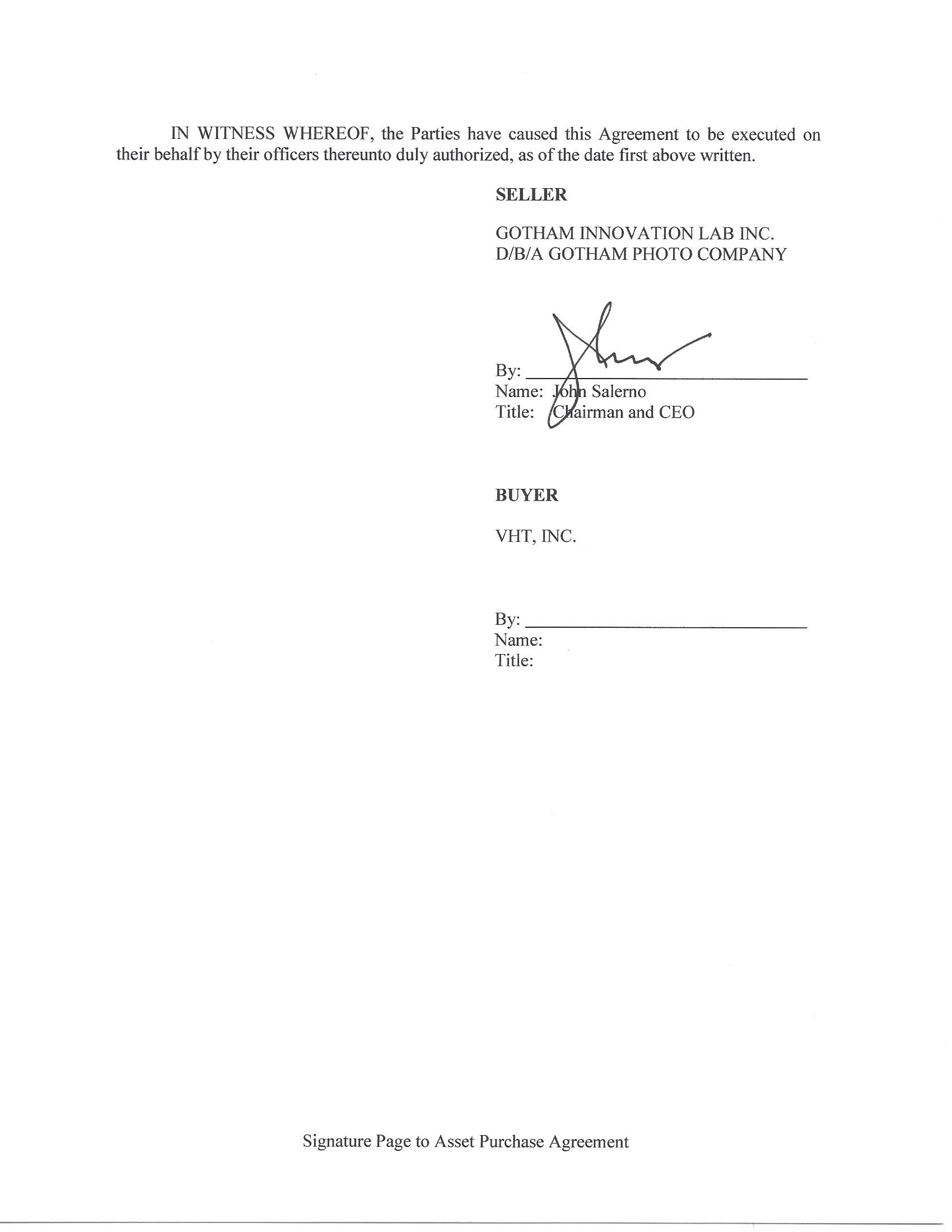

[signature pages follow]

18

Annex A

Definitions

“Affiliates” as applied to any Person, means any other Person directly or indirectly through one

or more intermediaries controlling, controlled by, or under common control with, that Person.

For the purposes of this definition, “control” means the possession of fifty percent (50%) or more

of the voting stock or equity or membership interests of such Person.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial

banks in New York, New York are authorized or required by Law to close.

“Consent” means any approval, consent, ratification, waiver or other authorization from, or

notice to, any Person.

“Contract” means any agreement, contract, commitment, or other binding arrangement or

understanding, whether written or oral.

“GAAP” means generally accepted accounting principles under current United States accounting

rules and regulations, consistently applied.

“Governmental Authority” means any federal, state, local or foreign government or any

subdivision, agency, instrumentality, authority, department, commission, board or bureau

thereof, provided, in each case, that the relevant action in any given circumstance has the force

of Law, or any federal, state, local or foreign court, tribunal or arbitrator of competent

jurisdiction.

“Indebtedness” of any Person means (i) the principal, accreted value, accrued and unpaid

interest, prepayment and redemption premiums or penalties (if any), unpaid fees or expenses and

other monetary obligations in respect of (A) obligations of such Person for money borrowed, and

(B) indebtedness evidenced by notes, debentures, bonds or other similar instruments for the

payment of which such Person is responsible or liable; (ii) all obligations of such Person issued

or assumed as the deferred purchase price of property, all conditional sale obligations of such

Person and all obligations of such Person under any title retention agreement (but excluding

trade accounts payable and other accrued current liabilities arising in the ordinary course of

business, but including the current liability portion of any indebtedness for borrowed money);

(iii) all obligations of such Person under leases required to be capitalized in accordance with

GAAP; (iv) all obligations of such Person for the reimbursement of any obligor on any letter of

credit, banker’s acceptance or similar credit transaction; (v) all obligations of such Person under

interest rate or currency swap transactions (valued at the termination value thereof); (vi) all

obligations of the type referred to in clauses (i) through (v) of any Persons for the payment of

which such Person is responsible or liable, directly or indirectly, as obligor, guarantor, surety or

otherwise, including guarantees of such obligations; and (vii) all obligations of the type referred

to in clauses (i) through (vi) of other Persons secured by (or for which the holder of such

obligations has an existing right, contingent or otherwise, to be secured by) any Lien on any

property or asset of such Person (whether or not such obligation is assumed by such Person).

“Intellectual Property” means any corporate name, fictitious name, trademark, trademark

A-1

application, service mark, service mark application, trade name, brand name, product name,

slogan, trade secret, know-how, patent, patent application, copyright, copyright application,

design, logo, formula, invention, product right, technology or other intangible asset of any

nature.

“Knowledge” means (i) with respect to an individual, knowledge of a particular fact or other matter, if

such individual is aware of such fact or other matter or should be aware of such fact or other matter,

after reasonable inquiry by such individual, and (ii) with respect to a Person that is not an individual,

knowledge of a particular fact or other matter if any individual who is serving, or who has at any time

served, as a director, officer, partner, executor, or trustee of such Person (or in any similar capacity) has,

or at any time had, knowledge of such fact or other matter or should be aware of such fact or other

matter, after reasonable inquiry by such Person.

“Law” means any law, statute, regulation, ordinance, rule, order, decree, judgment, consent

decree, settlement agreement or governmental requirement enacted, promulgated or imposed by

any Governmental Authority.

“Liabilities” means any and all debts, liabilities, losses and obligations.

“Licensed Real Property” means the real property office space presently licensed by or subject

to a licensing agreement by Seller as licensee.

“Lien” means any security interest, lien, charge, mortgage, deed, assignment, pledge,

hypothecation, claim, encumbrance, easement, restriction or interest of another Person of any

kind or nature.

“Loss and Losses” means any Liabilities, judgments, claims, deficiencies, demands, actions,

Orders, assessments, damages, dues, penalties, fines, amounts paid in settlement, losses and out-

of-pocket costs and expenses (including reasonable attorneys’ and accountants’ fees), whether or

not involving a third-party claim.

“Material Adverse Effect” means, with respect to a Person, any fact, event, change,

development or effect that, individually or in the aggregate, has or could have a material adverse

effect on the business, assets, financial condition or results of operations, or prospects of such

Person or its business, taken as a whole.

“ “Person” means any corporation, partnership, joint venture, limited liability company,

organization, entity, authority or individual.

“Order” means any award, injunction, judgment, order, ruling, subpoena, or verdict or other

decision entered, issued, made, or rendered by any Governmental Authority.

“Organizational Documents” means the certificate or articles of incorporation and bylaws, and

any amendment to any of the foregoing.

“Representative” means, with respect to any Person, any director, officer, principal, attorney,

employee, agent, consultant, accountant, or any other Person acting in a representative capacity

A-2

for such Person.

“Taxes” means all taxes, charges, fees, duties, levies or other assessments, including income,

gross receipts, net proceeds, ad valorem, turnover, real and personal property (tangible and

intangible), sales, use, franchise, excise, value added, license, payroll, unemployment,

environmental, customs duties, capital stock, disability, stamp, leasing, lease, user, transfer, fuel,

excess profits, occupational and interest equalization, windfall profits, severance and employees’

income withholding and Social Security taxes imposed by the United States or any other country

or by any state, municipality, subdivision or instrumentality of the United States or of any other

country or by any other tax authority, including all applicable penalties and interest, and such

term shall include any interest, penalties or additions to tax attributable to such Taxes.

“Tax Return” means any return, declaration, report, claim for refund, information return or

statement or other document relating to Taxes, including any schedule or attachment thereto, and

including any amendment thereof.

“Transaction” means all of the transactions contemplated by this Agreement.

“Transaction Documents” means each agreement, document, or instrument or certificate

contemplated by this Agreement or to be executed by the Parties in connection with the

consummation of the Transaction.

“Transferred Assets” means all assets set forth on the bill of sale to be transferred by Seller to

Buyer pursuant to Section 7.1(b) and all of the Assumed Contracts.

A-3

EXHIBIT A

EMPLOYMENT AGREEMENT

To be delivered under separate cover.

EXHIBIT B

BILL OF SALE

BILL OF SALE

THIS BILL OF SALE (this “Bill of Sale”) is made and delivered this 5th day of

November, 2015, by GOTHAM INNOVATION LAB INC. D/B/A GOTHAM PHOTO

COMPANY, a New York corporation (the “Seller”), for the benefit of VHT, INC., a Delaware

corporation (the “Buyer”). Capitalized terms used but not defined herein shall have the

meanings ascribed to such terms in the Agreement (as hereinafter defined).

WHEREAS, this Bill of Sale is entered into pursuant to that certain Asset Purchase

Agreement, dated as of November 5, 2015, by and between the Buyer and the Seller (the

“Agreement”), the terms of which are incorporated herein by reference, which provides for,

among other things, the sale and assignment by the Seller to the Buyer of the Transferred Assets

(as defined below).

NOW, THEREFORE, in consideration of the mutual promises contained in the

Agreement, and for other good and valuable consideration, the receipt and sufficiency of which

is hereby acknowledged by the Seller, and subject to the terms and conditions of the Agreement:

1.

Conveyance of the Transferred Assets. For good and valuable consideration, the

receipt, adequacy and legal sufficiency of which is hereby acknowledged, and as contemplated

by Section 3.1 of the Agreement, Seller hereby sells, transfers, assigns, conveys, grants and

delivers to Buyer, effective as of the date first written above, all of the Seller’s right, title and

interest in and to, and, with respect to intellectual property, all world-wide right, title and interest

in and to, free and clear of all liens, claims and encumbrances, together with the goodwill of the

business symbolized by the intellectual property being assigned, and all causes of action for any

and all past infringements of the rights being assigned and the right to collect and retain proceeds

therefrom, all of the assets set forth on Exhibit A hereto (the “Transferred Assets”)

2.

Further Assurances. Seller for itself, its successors and assigns, hereby covenants

and agrees that, from time to time at the reasonable request of the Buyer, Seller (i) shall take all

action as may be reasonably necessary to put Buyer in actual possession of the Transferred

Assets, and (ii) shall execute, acknowledge and deliver or cause to be done, executed,

acknowledged or delivered, all such further acts, deeds, instruments, transfers and assurances as

may be reasonably requested by the Buyer in order to assign, transfer, set over, convey, assure

and confirm unto, and vest in, the Buyer, its successors and assigns, any or all of the Transferred

Assets assigned to Buyer.

3.

Agreement Controlling. This Bill of Sale is executed and delivered pursuant to

the Agreement. This Bill of Sale is subject in all respects to the terms and conditions of the

Agreement, and all of the representations, warranties, covenants and agreements of the Seller and

the Buyer contained therein, all of which shall survive the execution and delivery of this Bill of

Sale in accordance with the terms of the Agreement. Nothing contained in this Bill of Sale shall

be deemed to supersede, enlarge or modify any of the obligations, agreements, covenants or

warranties of the Seller and the Buyer contained in the Agreement. Notwithstanding anything to

the contrary contained in this Bill of Sale, in the event of any conflict between the terms of this

Bill of Sale and the terms of the Agreement, the terms of the Agreement shall control.

DM3 ###-###-####.3

4.

Binding Effect. This Bill of Sale shall be binding upon and shall inure to the

benefit of the Buyer and the Seller and their respective legal representatives, successors and

assigns.

[Signature Page Follows]

-2-

DM3 ###-###-####.3

IN WITNESS WHEREOF, and intending to be legally bound hereby, the Seller has

caused this Bill of Sale to be duly executed and delivered as of the day and year first above

written.

SELLER:

GOTHAM INNOVATION LAB INC. D/B/A

GOTHAM PHOTO COMPANY

By:

Name:

Title:

[Signature Page to Bill of Sale]

EXHIBIT A

Transferred Assets

Transferred Assets

1) Clear and unencumbered ownership of all images produced by any employee or contractor

since the inception of the company, excluding only those that have previously been assigned to

Elliman

2) Written assignments of rights to all images created by employees or contractors since the

inception of the company.

3) Any and all rights to images or use of images granted to Gotham through the Master

Agreement for Media and Technology Services with Douglas Elliman LLC

4) Any and all furniture and equipment used in the day to day operations of Gotham, including but

not limited to any computers, phones, phone system, desks, chairs, copiers, servers, software,

cabinets, cameras, monitors, air conditioners, microwaves and general office supplies.

5) All client records including but not limited to; name, contact info, ordering history.

6) The accounts receivable and accounts payable detail ledger of the company as of Closing.

7) Any and all software utilized in the day to day operation of the company, including but not

limited to; e-mail, word processing, spreadsheets, presentations, chat,

8) All social media accounts and online accounts that represent the company or are used in the day

to day business

9) All materials and original works previously prepared or used in the day to day operation of the

business including but not limited to; brochures, presentations, videos, commercials, posters,

reports, lists, analysis, project plans, business cases, and other work related documents.

10) Client Contracts

Master Agreement for Media and Technology Services, dated as of November 10, 2009 with

Douglas Elliman LLC d/b/a Prudential Douglas Elliman Real Estate.

11) Photographers and Media Suppliers Master Service Agreements (Same Work for Hires)

Andres Orozco

08/09/2013

Andrew Federico

01/05/2014

Barbara Pitt

09/11/2015

Brian Wittmuss

07/03/2013

Sara Cavic

03/28/2014

Daniel Osborn

05/27/2015

Jamina Tomic

03/31/2015

Karin Bruno

11/26/2013

Mekko Harjo

01/26/2012

Pearl May

09/25/2014

DM3 ###-###-####.3

Richard Silver

07/05/2013

Shari Laidley

08/26/2013

Thomas Mendenhall 01/29/2014

Yuko Torihara

04/29/2014

Frank Stephens

09/14/2015 Floorplan Artist

Micheal Marshall

08/28/2013 Floorplan Artist

12) Other Contracts

Adjet Koja Fringe Development Independent Contractor Agreement dated January 1, 2015.

Business Contract between Gotham Innovations Lab, LLC and Esoftflow Company Limited

dated April 4, 2015.

13) Trade Names

Team5

Gotham Innovation Lab Inc.

Gotham Photo Company

Gotham

Gotham Photo

Gotham Media

14) Proprietary Software (unregistered Copyrights)

EXPO (all versions)

E-Brochure (all versions)

Gotham Media Management System (all versions)

Gotham Business Operations Systems (all versions)

Online Media Storing and Sharing APIs (all versions)

Team5_Aspnet-Funtions DLL Library (all versions)

Team5 Client services System (all versions)

Originally developed by Vince Collura, William Che Everich (Contractor), Khalid Mills

(Contractor) in 2009.

Account / Site List

Adobe Creative Cloud

creative.adobe.com

Adspeed

http://www.adspeed.com

Authorize.net

http://authorize.net

This is used to collect VOW

payments.

Craigslist

http://craigslist.org

Dropbox

http://www.dropbox.com

This Dropbox is used for

retouching and MMS issues

eBrochure

admin.gothamphotocompany.com/admin

Esoft Catalog

http://www.3dfurniturecatalogue.com/

Esoft eportal

http://portal.esoftflow.net/

Retouching/staging/renovation,

floor plans, video editing services

EventBrite

http://www.eventbrite.com

event ticketing site

DM3 ###-###-####.3

Flickr

http://www.flickr.com

Gotham's Flickr account

Godaddy (MANAGEMENT https://www.godaddy.com/

Domain manager site. For MGMT

ONLY)

purposes ONLY.

Gotham Facebook

http://www.facebook.com/gothamnyc

gothamnyc

twitter.com

Imageination

http://www.imageination.tv

Instagram.com

Intuit PaymentNetwork

https://ipn.intuit.com

CC Payments via QB

iTunes (for Matterport /

iPad)

Jive

Jive.com

Phone system - MANAGEMENT

ONLY

Metropix

http://www.metropix.co.uk

floorplans

Microsoft

For Samii/Jenni accounts

Moo

http://www.moo.com

Business cards

Network Solutions

https://www.networksolutions.com

associated email:

***@***

PlatinumHD

new active links sent via emails

when video done

PREZI

http://www.prezi.com

Create astonishing presentations

live and on the web

QuickBooks

qbo.intuit.com

Ronin

https://gotham.roninapp.com/estimates

Login via Gmail!

Salesforce

http://www.salesforce.com

Staples

http://www.staples.com

Tumblr

http://gothamnyc.tumblr.com/

The GothamNYC tumblr account.

Twitter - GothamNYC

http://www.twitter.com/gothamnyc

WellcomeMat

http://www.wellcomemat.com

Video upload site

Wix

Wix.com

Gotham's website -

MANAGEMENT ONLY

Yousendit

https://www.hightail.com

CANCELLED PAID ACCOUNT

Youtube (OLD - do not use)

http://www.youtube.com

***@***

###-###-####