U.S. Bank SBA Payroll Protection Loan Agreement with General Moly, Inc. (April 23, 2020)

This agreement is between General Moly, Inc. and U.S. Bank for a $365,034 loan under the SBA Payroll Protection Program, created in response to the COVID-19 pandemic. The loan is intended to help cover payroll and certain business expenses, with the possibility of forgiveness if used for eligible costs and proper documentation is provided. The loan carries a 1% interest rate, an 18-month repayment schedule after a 6-month deferral, and no prepayment penalty. The agreement outlines the requirements for loan forgiveness and the borrower’s obligations to use the funds for business purposes.

Exhibit 10.1

U.S. BANK® SBA PAYROLL PROTECTION LOAN

| U.S. Bank® SBA Payroll Protection Loan | Borrower: General Moly, Inc. | ||||

| Note Date: | 04/23/2020 | Lakewood, CO 80401 | |||

| Tax ID Number: | 91-0232000 | ||||

| Type of Organization: | C-Corp | ||||

| Loan Amount: | $ 365,034.00 | State of Registration: | DE-Delaware | ||

| 1. | Loan (“Loan”). FOR VALUE RECEIVED, the undersigned borrower (“Borrower”) promises to pay to the order of U.S. Bank National Association (the “Bank”), the principal sum of $ 365,034.00 (the “Loan Amount”), in accordance with the terms of this U.S. Bank® SBA Payroll Protection Loan (this “Agreement”). |

| 1.1 | SBA Guaranty. In response to the Covid-19 pandemic the U.S. Congress has passed the CARES Act (“Act”) which among other things, includes amending Section 7(a) of the Small Business Act (15 U.S.C. 636(a)) to provide for this short-term SBA lending program between February 15, 2020 to June 30, 2020 (the “Covered Period”) for payroll protection of small businesses, nonprofit organizations, veterans organizations, or tribal business entities (the “Program”). The Loan evidenced by this Agreement is guaranteed by the U.S. Small Business Administration (“SBA”), information regarding which can be obtained from the SBA directly or at its website: www.sba.gov. Under this Program, if the proceeds of this Loan were used by the Borrower for eligible expenses as defined in Section 1102 of the Act to include payroll costs, continuation of heath care benefits, employee salaries, mortgage interest, rent, utilities, balances on SBA Economic Injury Disaster Loans (“EIDL”) and interest on other outstanding debt incurred prior to February 15, 2020 (“Eligible Expenses”), then Borrower may apply for loan forgiveness of all Eligible Expenses excluding interest on outstanding non-mortgage debt, and existing EIDL balances not used for forgivable purposes (“Forgivable Expenses”) from the SBA as outlined below. Upon Borrower certification of the amount of Loan proceeds used to pay Forgivable Expenses, such expenses will be forgiven as a principal payment on the Borrower’s Loan. The remaining Loan balance, if any, will be re-amortized and paid by the Borrower as detailed further in this Agreement. It is a condition of making this Loan that the SBA accept the Loan. In no event shall the interest rate, fees or other charges under this Agreement exceed the maximum rate or amounts permitted for the SBA Loan Program or any other maximum rates of interest imposed by applicable law. This Loan is only available to Borrowers that have their principal place of business in the United States. To the extent feasible, Borrower agrees to purchase only American-made equipment and products with the proceeds of this Loan. The SBA Guaranty does not affect the liability of the Borrower under this Agreement. |

| 1.2 | Forgiveness. Within 60 days from the Note Date, the Borrowers may request all or part of their Loan be forgiven by submitting an application for forgiveness and documentation verifying the number of fulltime equivalent employees on payroll and their pay rates during the eight weeks after this Note Date. Such documentation shall include payroll tax filings with the Internal Revenue Service, state income, state payroll, and state unemployment insurance filings, cancelled checks, payment receipts, transcripts of accounts, or other documents verifying payments for Forgivable Expenses (“Forgiveness Documentation”). Seventy-five percent of Eligible Expenses must be used for payroll related expenses and up to twenty-five percent may be used for other Eligible Expenses, to qualify for forgiveness. Borrower must also provide the Bank with a certification that the Forgiveness Documentation is true and correct, and the amount of requested forgiveness was used for Forgivable Expenses. After approval of the forgiveness amount and 6 month deferral period, the Bank will provide the Borrower written notification of the remaining balance and re-amortization of the Loan, if any. Forgiveness cannot be provided without the Borrower’s submission to the Bank of all the documents required by this Section 1.2. |

| 1.3 | Interest. The unpaid principal balance will bear interest at an annual rate of 1.00%. |

| 1.4 | Payment Schedule. Principal and interest are payable in 18 installments of $ 20,397.20 each, beginning on[11/23/2020] (“Deferral Period”) and on the same date of each consecutive month thereafter (except that if a given month does not have such a date, the last day of such month), plus a final payment equal to all unpaid principal and accrued interest on [04/23/2022], the maturity date. Installment payment amounts will be re-amortized after the Deferral Period and partial loan forgiveness credit is applied, at such time an updated Payment Schedule will be provided to Borrower. There is no penalty for Borrowers who pay off their Loan early. |

| 1.5 | Automatic Payments. If this box is checked, then at all times that this Agreement is in effect, Borrower hereby authorizes the Bank to automatically deduct the amount of all payments required under this Agreement from: |

| [¨] | Borrower’s business deposit account number ________________________ held with the Bank. | |

| [¨] | Borrower’s business deposit account held at ________________________ (Financial Institution) with Account Number ________________________ and Routing Number ________________________. |

This account is the “Payment Source Account.” If there are insufficient funds in the Payment Source Account to pay the required payment, Borrower agrees to pay all fees on the Payment Source Account, which result from the automatic deductions, including any overdraft/NSF charges and any returned payment fee. If for any reason the Bank does not charge the Payment Source Account for payment, or if an automatic payment from the Payment Source Account is reversed, the payment is still due according to this Agreement. The number of withdrawals from the Payment Source Account may be limited, as set out in the customer agreement for that account. The Bank may cancel the automatic payment deduction from the Payment Source Account at any time in its discretion.

| U.S. Bank Customer Confidential |

| 1.6 | Calculation of Interest and Maximum Rate. Interest will be computed for the actual number of days principal is unpaid, using a daily factor obtained by dividing the stated interest rate by 360. In no event will the interest rate hereunder exceed that permitted by applicable law. If any interest or other charge is finally determined by a court of competent jurisdiction to exceed the maximum amount permitted by law, the interest or charge shall be reduced to the maximum permitted by law, and the Bank may credit any excess amount previously collected against the balance due or refund the amount to Borrower. |

| 1.7 | Late Payment Fee. Subject to applicable law, if any payment is not made on or before its due date, the Bank may collect a delinquency charge of $15.00 or 5% of the delinquent amount, whichever is less; provided, however, that if any portion of the Loan evidenced by this Agreement has been guaranteed by the U.S. Small Business Administration, the late fee shall not exceed 5% of the delinquent amount. Collection of the late payment fee shall not be deemed to be a waiver of the Bank’s right to declare a default hereunder. |

| 1.8 | Loan Purpose. Borrower represents that the proceeds of the Loan evidenced by this Agreement will be used for business purposes. Borrower specifically represents and warrants the following business purpose uses of the Loan proceeds; The funds will be used to retain workers and maintain payroll or make mortgage payments, lease payments, and utility payments. |

| 1.9 | Deposits and Paying Procedure. The Bank is authorized and directed to credit any of Borrower’s accounts with the Bank (or to the account Borrower designates in writing) for all Loans made hereunder, and the Bank is authorized to debit such account or any other account of Borrower with the Bank for the amount of any principal, interest or expenses due under this Agreement or other amount due hereunder on the due date with respect thereto. Payments due under this Agreement and other Loan Documents will be made in lawful money of the United States. All payments may be applied by the Bank to principal, interest and other amounts due under the Loan documents in any order, which the Bank elects. If, upon any request by Borrower to the Bank to issue a wire transfer, there is an inconsistency between the name of the recipient of the wire and its identification number as specified by Borrower, the Bank may, without liability, transmit the payment via wire based solely upon the identification number. |

| 1.10 | Returned Payment Charge. For each payment made by Borrower to the Bank that is returned or rejected (such as a check that is returned unpaid, or an automated transfer that is rejected), Borrower shall pay the Bank a returned payment fee of $25.00. |

| 2. | Warranties/Covenants. Borrower continuously warrants and agrees as follows: |

| 2.1. | Borrower’s Name, Location; Notice of Location Changes. Unless otherwise disclosed to the Bank in writing prior to the execution of this Agreement, Borrower’s name and organizational structure has remained the same during the past five years. The Borrower will continue to use only the name set forth with Borrower’s signature unless Borrower gives the Bank prior written notice of any change. Furthermore, Borrower shall not do business under another name nor use any trade name without giving 10 days prior written notice to the Bank. The Borrower will not change its status or organizational structure without the prior written consent of the Bank. The address appearing at the top of this Agreement is Borrower’s chief executive office (or residence if Borrower is a sole proprietor). |

| 2.2. | Financial Information. The Borrower will (i) maintain accounting records in accordance with generally recognized and accepted principles of accounting consistently applied throughout the accounting periods involved; (ii) provide the Bank with such information concerning its business affairs and financial condition (including insurance coverage) as the Bank may reasonably request. |

| 2.3. | Setoff. The Borrower grants to the Bank an express contractual right to set off against all depository account balances, cash and any other property of Borrower now or hereafter in the possession of the Bank and the right to refuse to allow withdrawals from any account (collectively “ Setoff”). The Bank may, at any time upon the occurrence of a default hereunder (notwithstanding any notice requirements or grace/cure periods under this or other agreements between Borrower and the Bank) Setoff against the Obligations whether or not the Obligations (including future installments) are then due or have been accelerated, all without any advance or contemporaneous notice or demand of any kind to Borrower, such notice and demand being expressly waived. |

| 2.4. | Borrower Compliance. The Borrower represents and warrants they will comply with all rules, laws, and obligations set forth under the SBA Paycheck Protection Program. |

| 2.5. | Prohibition of Executive Officer Status. Borrower is not an Executive Officer of Bank as defined under 12 C.F.R. §215.2, if Borrower should become an Executive Officer of Bank, Borrower understands Bank reserves the right to require Borrower to repay on demand, any amount outstanding on the loan made under this Agreement. |

| 3. | Default. Notwithstanding any cure periods described below, Borrower shall immediately notify the Bank in writing when Borrower obtains knowledge of the occurrence of any event of default specified below. Regardless of whether Borrower has given the required notice, the occurrence of one or more of the following shall constitute a default: |

| 3.1. | Nonpayment. The Borrower shall fail to pay (i) any interest due or any fees, charges, costs or expenses under this Agreement by five (5) days after the same becomes due; or (ii) any principal amount of this Agreement when due. |

| 3.2. | Nonperformance. The Borrower shall fail to perform or observe any agreement, term, provision, condition, or covenant (other than a default occurring under this paragraph 3) required to be performed or observed by Borrower hereunder or under any other agreement with or in favor of the Bank. |

| 3.3. | Misrepresentation. Any financial information, statement, certificate, representation or warranty given to the Bank by Borrower (or any of their representatives) in connection with entering into this Loan and/or borrowing hereunder, or required to be furnished under the terms hereof, shall prove untrue or misleading in any material respect (as determined by the Bank in the exercise of its judgment) as of the time when given. |

| 3.4. | Default on Other Obligations. The Borrower is in default under the terms of any loan agreement, promissory note, lease, conditional sale contract or other agreements, document or instrument evidencing, governing or severing any indebtedness owing by Borrower to the Bank or any indebtedness in excess of $10,000 owing by Borrower to any third party, and the period of grace, if any, to cure said default shall have passed. |

| U.S. Bank Customer Confidential |

| 3.5. | Judgments. Any judgment shall be obtained against Borrower, which, together with all other outstanding unsatisfied judgments against Borrower, shall exceed the sum of $10,000 and shall remain unvacated, unbonded or unstayed for a period of thirty (30) days following the date of entry thereof. |

| 3.6. | Inability to Perform; Bankruptcy/Insolvency. (i) The Borrower shall die or cease to exist, or (ii) any bankruptcy, insolvency or receivership proceedings, or an assignment for the benefit of creditors, shall be commenced under any federal or state law by or against Borrower; or (iii) Borrower shall become the subject of any out-of-court settlement with its creditors; or (v) Borrower is unable or admits in writing its inability to pay its debts as they mature. |

| 3.7 | Adverse Change; Insecurity. (i) There is a material adverse change in the Borrower’s business, properties, financial condition or affairs. |

| 4. | Acceleration of Obligations. Upon the occurrence of any of the events identified in paragraph 3 and the passage of any applicable cure periods, the Bank may at any time thereafter, by written notice to Borrower, declare the unpaid principal balance of any Obligations, together with the interest accrued thereon and other amounts accrued hereunder, to be immediately due and payable; and the unpaid balance shall thereupon be due and payable, all without presentation, demand, protest or further notice of any kind, all of which are hereby waived, and notwithstanding anything to the contrary contained herein. Upon the occurrence of any event under paragraph 3.6, the unpaid principal balance of any Obligations, together with all interest accrued thereon and other amounts accrued hereunder, shall thereupon be immediately due and payable, all without presentation, demand, protest or notice of any kind, all of which are hereby waived, and notwithstanding anything to the contrary contained herein. |

| 5. | Cumulative Remedies; Notice; Waiver. The Bank may enforce its rights and remedies under this Agreement upon default. In addition to the remedies for default set forth in this Agreement, the Bank upon default shall have all other rights and remedies for default provided by the Uniform Commercial Code, as well as any other applicable law and this Agreement. The rights and remedies specified herein are cumulative and are not exclusive of any rights or remedies, which the Bank would otherwise have. |

| 5.1 | Waiver by the Bank. The Bank may permit Borrower to attempt to remedy any default without waiving its rights and remedies hereunder, and the Bank may waive any default without waiving any other subsequent or prior default by Borrower. Furthermore, delay on the part of the Bank in exercising any right, power or privilege hereunder or at law shall not operate as a waiver thereof: nor shall any single or partial exercise of such right, power or privilege preclude other exercise thereof or the exercise of any other right, power or privilege. No waiver or suspension shall be deemed to have occurred unless the Bank has expressly agreed in writing specifying such waiver or suspension. |

| 6. | Waivers; Relationship to Other Documents. All Borrowers waive presentment, protest, demand, and notice of dishonor. The warranties, covenants and other obligations of Borrower (and the rights and remedies of the Bank) in this Agreement and all related documents are intended to be cumulative and to supplement each other. |

| 7. | Expenses and Attorneys’ Fees. The Borrower will reimburse the Bank and any participant in the Obligations (“Participant”) for all attorneys’ fees and all other costs, fees and out-of-pocket disbursements incurred by the Bank or any Participant in connection with the preparation, execution, delivery, administration, defense and enforcement of this Agreement, including fees and costs related to any waivers or amendments with respect thereto. The Borrower will also reimburse the Bank and any Participant for all costs of collection before and after judgment, and the costs of preservation and/or liquidation of any collateral. |

| 8. | Applicable Law; Interpretation; Joint Liability. This Agreement shall be governed by and interpreted in accordance with the internal laws of the state of Ohio, except to the extent superseded by Federal law. THE BORROWER HEREBY CONSENTS TO THE EXCLUSIVE JURISDICTION OF ANY STATE OR FEDERAL COURT SITUATED IN THE COUNTY OR FEDERAL JURISDICTION OF THE BANK’S BRANCH WHERE THE LOAN WAS ORIGINATED, AND WAIVES ANY OBJECTION BASED ON FORUM NON CONVENIENS, WITH REGARD TO ANY ACTIONS, CLAIMS, DISPUTES OR PROCEEDINGS RELATING TO THIS NOTE, THE COLLATERAL, ANY OTHER LOAN DOCUMENT, OR ANY TRANSACTIONS ARISING THEREFROM, OR ENFORCEMENT AND/OR INTERPRETATION OF ANY OF THE FOREGOING. Invalidity of any provisions of this Agreement shall not affect any other provision. Nothing herein shall affect the Bank’s rights to serve process in any manner permitted by law or limit the Bank’s right to bring proceedings against Borrower in the competent courts of any other jurisdiction or jurisdictions. This Agreement, and any amendment hereto (regardless of when executed) will be deemed effective and accepted only upon the Bank’s receipt of the executed originals thereof. If there is more than one Borrower, the liability of Borrowers shall be joint and several, and the reference to “ Borrower” shall be deemed to refer to all Borrowers. When SBA is the holder, this Note will be interpreted and enforced under Federal law, including SBA regulations. The Bank or SBA may use state or local procedures for filing papers, giving notice, and other purposes. By using such procedures, SBA does not waive any federal immunity from state or local control, penalty, tax, or liability. As to this Loan, Borrower may not claim or assert against SBA any local or state law to deny any obligation, defeat any claim of SBA, or preempt federal law. |

| 9. | Participations/Successors. The Bank may, at its option, sell all or any interests in this Agreement to other financial institutions (the “ Participant”), and in connection with such sales (and thereafter) disclose any financial information the Bank may have concerning Borrower to any such Participant or potential Participant. This provision does not obligate the Bank to supply any information or release Borrower from its obligation to provide such information, The rights, options, powers and remedies granted in this Agreement will extend to the Bank and to its successors and assigns, will be binding upon Borrower and its successors and assigns and will be applicable hereto and to all renewals and/or extensions hereof. |

| 10. | Copies; Entire Agreement; Modification. The Borrower hereby acknowledges the receipt of a copy of this Agreement. IMPORTANT: READ BEFORE SIGNING. THE TERMS OF THIS AGREEMENT SHOULD BE READ CAREFULLY BECAUSE ONLY THOSE TERMS IN WRITING AND EXPRESSING CONSIDERATION ARE ENFORCEABLE. NO OTHER TERMS OR ORAL PROMISES NOT CONTAINED IN THIS WRITTEN CONTRACT MAY BE LEGALLY ENFORCED. THE TERMS OF THIS AGREEMENT MAY ONLY BE CHANGED BY ANOTHER WRITTEN AGREEMENT. THIS NOTICE SHALL ALSO BE EFFECTIVE WITH RESPECT TO ALL OTHER CREDIT AGREEMENTS NOW IN EFFECT BETWEEN BORROWER AND THE BANK. A MODIFICATION OF ANY OTHER CREDIT AGREEMENTS NOW IN EFFECT BETWEEN BORROWER AND THE BANK, WHICH OCCURS AFTER RECEIPT BY BORROWER OF THIS NOTICE, MAY BE MADE ONLY BY ANOTHER WRITTEN INSTRUMENT. ORAL OR IMPLIED MODIFICATIONS TO SUCH CREDIT AGREEMENTS ARE NOT ENFORCEABLE AND SHOULD NOT BE RELIED UPON. |

| U.S. Bank Customer Confidential |

| 11. | Waiver of Jury Trial. TO THE EXTENT PERMITTED BY LAW, BORROWER AND BANK HEREBY JOINTLY AND SEVERALLY WAIVE ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY ACTION OR PROCEEDING RELATING TO ANY OF THE LOAN DOCUMENTS, THE OBLIGATIONS THEREUNDER, OR ANY TRANSACTION ARISING THEREFROM OR CONNECTED THERETO. BORROWER AND BANK EACH REPRESENTS TO THE OTHER THAT TIIIS WAIVER IS KNOWlNGLY, WILLINGLY, AND VOLUNTARILY GIVEN. |

| 12. | Attachments. All documents attached hereto, including any appendices, schedules, riders, and exhibits to this Loan Note are hereby expressly incorporated by reference. |

IMPORTANT INFORMATION

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

CELLULAR PHONE CONTACT POLICY: By providing Bank with a telephone number for a cellular phone or other wireless device, each Borrower expressly consents to receiving communications - including but not limited to prerecorded or artificial voice message calls, text messages, and calls made by an automatic telephone dialing system - from Bank (including its affiliates and agents) at that number. This express consent applies to each such telephone number provided to Bank now or in the future and permits such calls regardless of their purpose. Calls and messages may incur access fees from a cellular provider.

We may report information about your account to credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected in your personal credit report

MISSOURI NOTICE: ORAL AGREEMENTS OR COMMITMENTS TO LOAN MONEY, EXTEND CREDIT OR TO FORBEAR FROM ENFORCING REPAYMENT OF A DEBT INCLUDING PROMISES TO EXTEND OR RENEW SUCH DEBT ARE NOT ENFORCEABLE, REGARDLESS OF THE LEGAL THEORY UPON WIIICH IT IS BASED THAT IS IN ANY WAY RELATED TO THE CREDIT AGREEMENT. TO PROTECT YOU (BORROWER(S)) AND US (CREDITOR) FROM MISUNDERSTANDING OR DISAPPOINTMENT, ANY AGREEMENTS WE REACH COVERING SUCH MATTERS ARE CONTAINED IN THIS AGREEMENT, ANY GUARANTY AND ANY OTHER RELATED DOCUMENT WHICH IS THE COMPLETE AND EXCLUSIVE STATEMENT OF THE AGREEMENT BETWEEN US, EXCEPT AS WE MAY LATER AGREE IN WRITING TO MODIFY IT.

WASHINGTON NOTICE: UNDER WASHINGTON LAW, ORAL AGREEMENTS OR ORAL COMMITMENTS TO LOAN MONEY, EXTEND CREDIT, OR FORBEAR FROM ENFORCING REPAYMENT OF A DEBT ARE NOT ENFORCEABLE.

NEBRASKA NOTICE: A CREDIT AGREEMENT MUST BE IN WRITING TO BE ENFORCEABLE UNDER NEBRASKA LAW. TO PROTECT BORROWER AND LENDER FROM MISUNDERSTANDINGS OR DISAPPOINTMENTS, ANY CONTRACT, PROMISE, UNDER TAKING OR OFFER TO FORBEAR REPAYMENT OF MONEY OR TO MAKE ANY OTHER FINANCIAL ACCOMMODATION IN CONNECTION WITH THIS LOAN OF MONEY OR GRANT OR EXTENSION OF CREDIT, OR ANY AMENDMENT OF, CANCELLATION OF, WAIVER OF, OR SUBSTITUTION FOR ANY OR ALL OF THE TERMS OR PROVISIONS OF ANY INSTRUMENT OR DOCUMENT EXECUTED IN CONNECTION WITH THIS LOAN OR MONEY OR GRANT OR EXTENSION OF CREDIT MUST BE IN WRITING TO BE EFFECTIVE.

OREGON NOTICE: UNDER OREGON LAW, MOST AGREEMENTS, PROMISES, AND COMMITMENTS MADE BY LENDER AFTER OCTOBER 3, 1989, CONCERNING LOANS AND OTHER CREDIT EXTENSIONS THAT ARE NOT FOR PERSONAL, FAMILY, OR HOUSEHOLD PURPOSES, OR SECURED SOLELY BY THE BORROWER’S RESIDENCE, MUST BE IN WRITING, EXPRESS CONSIDERATION AND BE SIGNED BY THE LENDER TO BE ENFORCEABLE.

| U.S. Bank Customer Confidential |

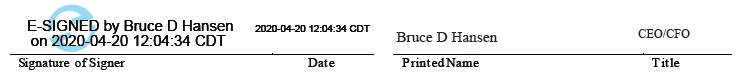

SIGNATURE

By signing this Agreement, each person (“Signer”), individually and on behalf of Borrower, requests the Loan from the Bank. Each Signer is authorized to sign on behalf of Borrower and will provide business resolutions to the Bank upon request. Each Signer has read and agrees to all applicable provisions. Each Signer authorizes the Bank to (1) obtain credit records and other credit and employment information about the Signers personally and the Borrower (now and in the future), including from state and federal tax authorities, for deciding whether to approve the requested Loan and for later periodic account review and collection purposes, and (2) furnish information about the Borrower to credit bureaus, other Signers, and other persons who claim to be authorized by the Borrower to receive such information. The Borrower and each Signer guaranty that all information in this Agreement is correct and agree to notify the Bank if any information changes. All Loan proceeds shall be used only for business purposes generally, and for the specific purposes described in this Agreement.

| U.S. Bank Customer Confidential |