REDEVELOPMENT AGREEMENT FOR THE FORSYTH/HANLEY REDEVELOPMENT AREA

Exhibit 10.1

REDEVELOPMENT AGREEMENT

FOR THE

FORSYTH/HANLEY REDEVELOPMENT AREA

BETWEEN THE

CITY OF CLAYTON, MISSOURI

AND

CENTENE PLAZA REDEVELOPMENT CORPORATION

Dated: December 30, 2005

TABLE OF CONTENTS

| Page | ||||

| Recitals | 1 | |||

| ARTICLE 1 | ||||

| INCORPORATED ITEMS; DEFINITIONS; EXHIBITS | ||||

| 1.01 | Items Incorporated into this Agreement; Coordination with Redevelopment Plan | 2 | ||

| 1.02 | Definitions | 2 | ||

| 1.03 | Exhibits | 3 | ||

| ARTICLE 2 | ||||

| REDEVELOPMENT PROJECT | ||||

| 2.01 | Redevelopment Project | 4 | ||

| 2.02 | Acquisition | 4 | ||

| 2.03 | Acquisition by Condemnation | 5 | ||

| 2.04 | Business Assistance | 6 | ||

| 2.05 | Notice of Acquisition | 7 | ||

| 2.06 | Deadline for Acquisition of Property and Construction of Redevelopment Project | 7 | ||

| 2.07 | Site Plan | 8 | ||

| 2.08 | Certificate of Substantial Completion | 8 | ||

| 2.09 | Financial Ability | 8 | ||

| 2.10 | Removal of Blight | 8 | ||

| 2.11 | Insurance | 8 | ||

| 2.12 | Redevelopment Project Maintenance | 9 | ||

| 2.13 | Changes | 9 | ||

| 2.14 | City Access to Redevelopment Project | 9 | ||

| 2.15 | Construction/Use Provisions | 9 | ||

| 2.16 | Development Expertise | 10 | ||

| ARTICLE 3 | ||||

| FORCE MAJEURE | ||||

| 3.01 | Force Majeure | 10 | ||

| 3.02 | Extensions | 10 | ||

| ARTICLE 4 | ||||

| TAX ABATEMENT AND PAYMENTS IN LIEU OF TAXES | ||||

| 4.01 | Tax Abatement | 10 | ||

| 4.02 | Payments in Lieu of Taxes | 11 | ||

| 4.03 | Earnings Limitation on Redevelopment Project | 13 | ||

| 4.04 | Financial and Annual Reports | 13 | ||

| 4.05 | Accounting Practices | 14 | ||

(i)

| ARTICLE 5 | ||||

| TRANSFER OF THE REDEVELOPMENT AREA | ||||

| 5.01 | Corporation’s Right to Transfer the Redevelopment Area | 14 | ||

| ARTICLE 6 | ||||

| DEFAULT AND REMEDIES | ||||

| 6.01 | Default and Remedies | 14 | ||

| ARTICLE 7 | ||||

| GENERAL PROVISIONS | ||||

| 7.01 | Modifications; Successors and Assigns | 15 | ||

| 7.02 | Payment of City’s Costs | 15 | ||

| 7.03 | Creation of Community Improvement District | 16 | ||

| 7.04 | Term of Agreement | 16 | ||

| 7.05 | Representatives Not Personally Liable | 17 | ||

| 7.06 | Indemnification and Hold Harmless | 17 | ||

| 7.07 | Contest of Assessed Valuation | 17 | ||

| 7.08 | Notice | 18 | ||

| 7.09 | Severability | 18 | ||

| 7.10 | Headings | 19 | ||

| 7.11 | Recording of Agreement | 19 | ||

| 7.12 | Governing Law; Other Applicable Provisions | 19 | ||

| 7.13 | Corporation’s Right of Termination | 19 | ||

| 7.14 | Counterpart | 19 | ||

Exhibit A - Site Plan

Exhibit B - Legal Description of the Redevelopment Area

Exhibit C - Redevelopment Plan

Exhibit D - Form of Certificate of Substantial Completion

Exhibit E - Transferee Agreement

Exhibit F - Special Development Conditions

(ii)

REDEVELOPMENT AGREEMENT

THIS REDEVELOPMENT AGREEMENT is made and entered into effective as of the 30th day of December, 2005, by and between the CITY OF CLAYTON, MISSOURI (the “City”), a Missouri municipal corporation, and CENTENE PLAZA REDEVELOPMENT CORPORATION (the “Corporation”), a Missouri urban redevelopment corporation, for the implementation of the Forsyth/Hanley Redevelopment Plan described herein. Capitalized terms not otherwise defined herein are defined in Article 1 of this Agreement.

RECITALS

| 1. | Chapter 353 of the Revised Statutes of Missouri, known as The Urban Redevelopment Corporations Law (the “URC Law”), authorizes the City to approve, by ordinance, redevelopment plans that allow for the redevelopment of blighted areas within the City and the granting of tax abatements and exemptions to encourage such redevelopment. |

| 2. | The Board of Aldermen of the City, in recognition that the Redevelopment Area has not experienced meaningful new private sector investment in recent years and that the Redevelopment Area is blighted within the meaning of that term in the URC Law, solicited proposals on April 22, 2005, to facilitate redevelopment of such area. On May 27, 2005, Centene Corporation (the “Developer”) submitted a proposal (the “Proposal”) in response thereto. |

| 3. | The Proposal calls for three phases of redevelopment: Phase I consists of the Developer’s acquisition and renovation of the City-owned parking garage and construction of a pedestrian bridge connecting the garage to the Developer’s current office building; Phase II consists of construction of a new 16-story office building to house the Developer’s headquarters and to provide additional office space for expansion and lease; and Phase III consists of a new office building for future expansion and lease, retail space and a parking structure. The Proposal requested that the City provide for partial tax abatement in order to make the proposed development economically feasible. Subsequent to the submission of the Proposal, the Developer agreed not to seek tax abatement on Phase I in return for other redevelopment consideration; consequently, the Redevelopment Area will consist of only those portions of property relating to Phase II and Phase III, as described in the Proposal. |

| 4. | The Board of Aldermen has: (a) enacted into law Resolution No. 05-31 conveying in fee the City-owned parking garage at 7733 Carondelet Avenue, (b) enacted into law Ordinance No. 5911, finding the Redevelopment Area to be blighted within the meaning of Section 353.020(2) of the URC Law, approving the Redevelopment Plan, and authorizing and directing the City Manager to enter into this Redevelopment Agreement, and (c) determined that the clearance and redevelopment provided for in the Redevelopment Plan are necessary for the public convenience and necessity and that the approval of the Redevelopment Plan and the activities related thereto are necessary for the preservation of the public health, safety and welfare. |

| 5. | The Corporation intends to (a) construct or cause to be constructed the Redevelopment Project within the Redevelopment Area in one or more phases, (b) acquire property within the Redevelopment Area for the purpose of receiving tax abatement under the URC Law in one or more phases, and (c) transfer such property to the Developer for the purpose of operating a commercial office and retail development in one or more phases. |

| 6. | The Corporation is in good standing in the State of Missouri and has represented that it has the necessary expertise, skill and ability to carry out the commitments contained in this Agreement. |

NOW, THEREFORE, for and in consideration of the foregoing Recitals (which are incorporated into this Agreement as an integral part hereof) and the promises, covenants and agreements contained herein, the City and the Corporation do hereby agree as follows:

ARTICLE 1

INCORPORATED ITEMS; DEFINITIONS; EXHIBITS

1.01 Items Incorporated into this Agreement; Coordination with Redevelopment Plan. The provisions of: (a) the URC Law, (b) the Redevelopment Plan and (c) the Proposal are hereby incorporated herein by this reference thereto and made in whole a part of this Agreement. To the extent that any of the provisions of this Agreement conflict with any of the provisions of the Redevelopment Plan, the provisions of this Agreement shall control and govern.

1.02 Definitions. In addition to the terms defined elsewhere in this Agreement, the following capitalized words and terms shall have the following meanings:

“Affiliate” means any entity that is controlled by the Developer or a wholly-owned subsidiary of the Developer.

“Agreement” means this Redevelopment Agreement.

“Authorizing Ordinance” means Ordinance No. 5911 adopted by the City on December 13, 2005, finding the Redevelopment Area to be blighted within the meaning of the URC Law, approving the Redevelopment Plan and authorizing this Agreement.

“Building Permit” means any and all demolition, grading and/or building permits required by the City’s Code of Ordinances to construct all or any portion of the Redevelopment Project.

“Business Assistance Policy” means the relocation policy of the City for the Redevelopment Area adopted on December 13, 2005, pursuant to Ordinance No. 5910.

“Certificate of Substantial Completion” means the Certificate of Substantial Completion attached hereto as Exhibit D, to be delivered by the Corporation upon the completion of the Redevelopment Project and each phase thereof, and upon approval thereof accepted by the City in accordance with Section 2.08 of this Agreement.

“Developer” means Centene Corporation, a Delaware corporation, and its permitted successors and assigns.

-2-

“Effective Date” means the effective date of this Agreement, which shall be the date written above on page 1.

“Phase I” means Phase I of the Developer’s undertakings, as described in the Proposal (but which is not part of the Redevelopment Project and which is not included in the Redevelopment Area).

“Phase II” means Phase II of the Redevelopment Project, as described in the Redevelopment Plan.

“Phase III” means Phase III of the Redevelopment Project, as described in the Redevelopment Plan.

“Phase III (Forsyth Retail Properties)” means the portion of Phase III of the Redevelopment Project which consists of the redevelopment of the “Forsyth Retail Properties,” as described in the Redevelopment Plan.

“Phase III (Tower B)” means the portion of Phase III of the Redevelopment Project which consists of the redevelopment of the “Plaza B Property,” as described in the Redevelopment Plan.

“Proposal” means the proposal submitted by the Developer on May 27, 2005, relating to the development of the Redevelopment Area.

“Redevelopment Area” means all of the real property located within and comprising the Redevelopment Area as shown on the Site Plan and as more particularly described on Exhibit B attached hereto, upon which the Redevelopment Project will be constructed pursuant to this Agreement.

“Redevelopment Plan” means the Development Plan for Hanley/Forsyth Redevelopment Area, approved by the City pursuant to the Authorizing Ordinance, a copy of which Redevelopment Plan is attached hereto as Exhibit C.

“Redevelopment Project” means the project to be constructed by the Corporation in the Redevelopment Area, which collectively encompasses “Phase II” and “Phase III” as described in the Proposal, the Redevelopment Plan and the Site Plan.

“Site Plan” means the preliminary site plan depicting the Redevelopment Project attached hereto as Exhibit A, as the same may be changed or amended in accordance with this Agreement.

“URC Law” means The Urban Redevelopment Corporations Law, Chapter 353 of the Revised Statutes of Missouri, as amended.

1.03 Exhibits. The following exhibits are attached to and incorporated into this Agreement:

| Exhibit A | Site Plan | |

| Exhibit B | Legal Description of the Redevelopment Area | |

| Exhibit C | Redevelopment Plan | |

| Exhibit D | Form of Certificate of Substantial Completion | |

| Exhibit E | Form of Transferee Agreement | |

| Exhibit F | Special Development Conditions | |

-3-

ARTICLE 2

REDEVELOPMENT PROJECT

2.01 Redevelopment Project. The Corporation shall, in order to eliminate the conditions that have caused the Redevelopment Area to become “blighted” within the meaning of the URC Law, but subject to the terms and conditions of this Agreement, (a) acquire all property within the Redevelopment Area in one or more phases and (b) develop and construct the Redevelopment Project in one or more phases in accordance with the Site Plan, the Redevelopment Plan and all applicable federal, state and local laws, rules, regulations and ordinances.

2.02 Acquisition by Negotiation.

(a) Reasonable Efforts to Acquire by Negotiation. The Corporation represents and warrants that, with respect to any property it seeks to acquire within the Redevelopment Area, the Corporation will make reasonable efforts to acquire the same by negotiated purchase within the time specified in Section 2.06. With respect to property in the Redevelopment Area that is acquired by negotiated sale before the commencement of a jurisdictional hearing as contemplated in Section 2.03 of this Agreement, the Corporation agrees to pay all of the seller’s costs and expenses (to the extent deemed reasonable by the City Manager) associated with the sale of such property, but not to exceed 5% of the purchase price of the property being acquired.

(b) Requirements for Purchase Agreement. Without limiting the generality of the foregoing subdivision (a), within 60 days after the execution of this Agreement, the Corporation shall offer to owners of parcels an Purchase Agreement (the “Purchase Agreement”) which shall include the following terms:

(1) A purchase price equal to at least 105% of the appraised value of the parcel (which shall be exclusive of any relocation benefits to which the owner is entitled under state law), as evidenced by an appraisal with respect to such parcel performed subsequent to August 1, 2005, by an independent third-party appraiser licensed in the State of Missouri who is reasonably acceptable to the City. The City pre-approves the use of Mueller & Neff Real Estate Appraisers & Consultants, Inc. as the Corporation’s appraiser. The appraisal shall be obtained at the Corporation’s sole cost and expense. Prior to the delivery of the Purchase Agreement to an owner, the Corporation shall provide a copy to the City Attorney who shall have one week either to approve the form and substance of the appraisal (i.e., in a customary form and of a professional caliber in accordance with other appraisals prepared by certified appraisers) or to provide objections thereto to the Corporation.

(2) Unless waived by the owner, the Corporation must provide at least thirty (30) days’ notice for closing on the property. If the Corporation terminates its obligation to acquire the property once such notice is given (unless in the City’s reasonable opinion there is due cause for such termination), all redevelopment rights granted hereunder, including the rights of eminent domain and tax abatement, shall expire and terminate.

(3) Unless waived by the owner, the owner (and any tenant of the owner) will have 150 days from closing on the parcel to vacate the property.

-4-

(c) Other Information to be Provided. At the time the Purchase Agreement is submitted to a Property owner, the Corporation shall:

(1) Advise the owner in writing of the relocation benefits to which the owner would be entitled under this Agreement, and (if applicable) advise the owner in writing that the proposed purchase price includes an express waiver of such relocation benefits;

(2) Advise the owner in writing of the time period for acceptance of the Purchase Agreement (the “Acceptance Deadline”), which shall not be less than 45 days; and

(3) Provide a copy of the Purchase Agreement to the City.

(d) Mediation Process.

(1) Before the initiation of condemnation proceedings with respect to any parcel of the property, an owner is entitled to participate in a mediation process by which an independent third party can facilitate the resolution of any differences between the owner and the Corporation. To initiate the mediation process, the owner must notify the City and the Corporation, on or before the Acceptance Deadline, that the owner does not intend to accept the offer made by the Corporation under the Purchase Agreement, and that the owner desires to participate in mediation.

(2) Within 7 days after the owner has given notice to the Corporation and to the City of its desire to participate in mediation, the Corporation and the owner (or their attorneys) shall select a mediator. The mediator shall be selected from a list of five mediators provided by United States Arbitration & Mediation Midwest Inc. If the parties cannot agree on a mediator on the list, then each party shall eliminate two mediators and the remaining person shall be the designated mediator. The mediation shall be scheduled within 30 days of the mediator’s selection.

(3) Within one week after the mediator’s selection, the owner must submit to the Corporation a counteroffer to the offer made by the Corporation under the Purchase Agreement. Failure to provide a counteroffer shall be deemed a waiver of the owner’s right to mediation. The mediation shall not exceed one 8-hour session. The Corporation shall pay for the mediator’s costs and expenses for up to 8 hours of mediation.

(4) To ensure each party is negotiating in good faith, immediately following the conclusion of any mediation, the mediator shall submit a report to the City Attorney that shall include the last offer made by each party.

(5) The Corporation agrees to cooperate in all reasonable respects to facilitate the mediation process; provided, if for any reason the parties are unable to hold or complete the mediation within 45 days after the owner has given notice to the Corporation and to the City of its desire to participate in mediation, or if the mediation effort fails to result in an executed Purchase Agreement, the Corporation can proceed with condemnation as provided in this Agreement.

2.03 Acquisition by Condemnation.

(a) Covenant to Comply with Statutory Requirements. As a condition to its authorization hereunder to institute any eminent domain proceedings against an owner of all or part of the Redevelopment Area, the Corporation hereby covenants and agrees that it shall first satisfy all jurisdictional prerequisites necessary for the initiation of such eminent domain proceedings, including the requirement to negotiate in good faith.

-5-

(b) Conditions Precedent. At least fifteen (15) days prior to the initiation of eminent domain proceedings with respect to any property within the Redevelopment Area that the Corporation fails to acquire by negotiated purchase in accordance with Section 2.02, the Corporation shall deliver, at the Corporation’s sole cost and expense, the following documentation to the City Attorney:

(1) The appraisal prepared in connection with the Purchase Agreement provided pursuant to Section 2.02(b)(1).

(2) Evidence that the purchase price offered to the owner of the property was not less than the greater of (A) 105% of the appraised value of the parcel to be acquired (as determined by the appraiser referenced in Section 2.02(b)(1)), or (b) 100% of the County Assessor’s valuation of the parcel to be acquired.

(3) If the parcel to be acquired includes businesses that are tenants, information regarding the terms of each tenant’s lease and the benefits that each tenant would receive under the Corporation’s most recent proposal to acquire the property.

(4) Evidence of the Corporation’s efforts to acquire such parcel(s) (including but not limited to evidence of communications or attempts at communications with the owners of such parcel(s), copies of proposed purchase contracts, offers and counter-offers, if any, tendered to the owners); provided, the City shall retain all such documents submitted to the City in connection with the acquisition of any parcel through eminent domain, as closed records to the extent permitted by law, including but not limited to the provisions of Chapter 610 of the Revised Statutes of Missouri, as amended.

(c) Information to be Provided to City. During the condemnation proceedings, the Corporation agrees to consult with the City regarding the prosecution of the litigation. Advice and consultation with the City shall continue throughout such proceedings. The City shall, upon initiation of the condemnation proceedings, designate in writing to the Corporation an individual who is authorized to represent the City in consultations with the Corporation and its counsel. Upon the request of the City’s designee, the Corporation shall provide copies of all pleadings and other documents filed or prepared in conjunction with the prosecution of the condemnation proceedings for the designee’s inspection. The Corporation shall pay all costs incurred by the City in connection with any condemnation action in which the City is named as a third-party defendant.

2.04 Business Assistance. The Corporation shall relocate those occupants or businesses displaced from any portion of the Redevelopment Area acquired by the Corporation in accordance with and to the extent required by the Business Assistance Policy, except insofar as otherwise agreed in writing by such displaced occupant or business and approved in writing by the Corporation; it being understood and agreed that any displaced occupant or business may waive his/her/their rights to statutory and other relocation benefits under the Business Assistance Policy or otherwise. The Corporation understands that the Business Assistance Policy prohibits the Corporation from displacing businesses from the Redevelopment Area until the Corporation determines in its good faith discretion that such property is required for construction of the Redevelopment Project. The parties hereby acknowledge that the schedule set forth in Section 2.06(b) hereof for the Corporation’s acquisition of the property in the Redevelopment Area is intended in part to demonstrate the Corporation’s good faith intention to pursue the Redevelopment Project, and the Corporation shall use commercially reasonable efforts to allow tenants and owners currently operating businesses in the Redevelopment Area to continue operations until the Corporation determines in its good faith discretion that vacation of such property is required for construction of the Redevelopment Project.

-6-

2.05 Notice of Acquisition.

(a) Within thirty (30) days after acquiring any and each parcel of property within the Redevelopment Area, the Corporation shall provide to the City (1) written notice (the “Notice of Acquisition”) to the City confirming that it has acquired title to such property and (2) a copy of the recorded instrument conveying ownership of such property to the Corporation. The Notice of Acquisition shall specify the phase of the Redevelopment Project to which such property relates.

(b) The City will not issue a Building Permit for the construction of permanent buildings and structures to the Corporation or an authorized transferee of the Corporation for any structure in the Redevelopment Area associated with the applicable phase until the Corporation submits a Notice of Acquisition to the City concerning the Corporation’s acquisition of all property within the applicable phase.

2.06 Deadline for Acquisition of Property and Construction of Redevelopment Project.

(a) As of the date hereof, the parties agree that the Developer owns all of the property (excluding rights-of-way and other publicly-owned property) in the Redevelopment Area except those located at 7716, 7720, 7730, 7732 and 7736 Forsyth Blvd. The Corporation will cause notice to be provided to the City within 10 days after either the Corporation or the Developer enters into an agreement to purchase or obtains a judgment giving such party right to title to each of said parcels.

(b) Subject to Section 3.01 hereof, if the Corporation fails to acquire all property (excluding rights-of-way and other publicly-owned property) in the Redevelopment Area within eleven (11) months after the Effective Date, all redevelopment rights granted hereunder, including the rights of eminent domain and tax abatement, shall expire and terminate. In addition, upon request of the Corporation the Board of Aldermen will give reasonable consideration to eliminating the requirement to acquire all property within the Redevelopment Area, if the goals of the Agreement (including but not limited to eliminating the blighting conditions within the Redevelopment Area) can be accomplished without acquiring one or more specific structures. The date on which the Corporation has acquired all property (except as otherwise required by the preceding sentence) in the Redevelopment Area is hereinafter referred to as the “Final Acquisition Date.” In addition, within 30 days after any commissioners’ award, the Corporation shall either: (1) notify the City that it is terminating this Agreement; or (2) settle the proceeding; or (3) pay the amount of any commissioners’ award issued in conjunction with any such condemnation proceeding to the Clerk of the Circuit Court.

(c) Subject to Section 3.01 hereof, if the Corporation fails to commence construction of Phase II within twenty-seven (27) months after the Effective Date, all redevelopment rights granted hereunder, including the rights of eminent domain and tax abatement, shall expire and terminate. For purposes of this paragraph, “commence construction” means the demolition of all (or substantially all) of the improvements within Phase II as of the Effective Date and the pouring of foundations for at least 75% of the new structures within Phase II, as shown on the Site Plan.

(d) Subject to Section 3.01 hereof, if the Corporation fails to commence construction of Phase III (Forsyth Retail Properties) within thirty-six (36) months after the Final Acquisition Date, all redevelopment rights granted hereunder, including the rights of eminent domain and tax abatement, shall expire and terminate. For purposes of this paragraph, “commence construction” means the demolition of all (or substantially all) of the improvements within Phase III (Forsyth Retail Properties) as of the Effective Date and the pouring of foundations for 100% of the new structures within Phase III (Forsyth Retail Properties), as shown on the Site Plan.

-7-

(e) The parties acknowledge that by operation of Section 4.02(b) of this Agreement, if the Corporation fails to commence construction of Phase III (Tower B) within thirty-six (36) months after the Final Acquisition Date, the total period during which the Corporation is entitled to tax abatement hereunder shall be shortened in accordance with such Section 4.02(b).

2.07 Site Plan. The Corporation may make changes to the Site Plan as site conditions or other issues of feasibility may dictate or as may be required to meet the reasonable requests of prospective tenants or as may be necessary or desirable in the sole determination of the Corporation to enhance the economic viability of the Redevelopment Project; provided that (a) the Corporation may not make any material changes to the Site Plan (i.e., changes which either reduce the square footage or intended uses of the Redevelopment Project by more than 10% exclusive of reductions required to comply with the City’s Code of Ordinances), whether individually or in the aggregate, without the advance written consent of the Board of Aldermen and (b) the Corporation shall obtain the City’s consent to any changes to the extent required by the City’s Code of Ordinances. The Corporation shall promptly furnish the City with a current Site Plan in the event of any changes thereto.

2.08 Certificate of Substantial Completion. After substantial completion of construction of any phase of the Redevelopment Project in accordance with the Redevelopment Plan, the Corporation shall deliver to the City a Certificate of Substantial Completion for the applicable phase of the Redevelopment Project in substantially the form attached hereto as Exhibit D. The City shall sign the Certificate of Substantial Completion upon the City’s verification that the representations in such certificate are accurate (which shall not be unreasonably withheld, conditioned or delayed). The City may issue any and all appropriate certificates of occupancy in accordance with the City’s ordinances, even if the City has not yet accepted the Certificate of Substantial Completion. If the Corporation fails to deliver a Certificate of Substantial Completion to the City with respect to any phase of the Redevelopment Project in a timely fashion and the City has issued occupancy certificates with respect to at least seventy-five percent (75%) of the usable space in such phase of the Redevelopment Project, the City may at its sole option deem the delivery of such occupancy certificates to constitute delivery of the Certificate of Substantial Completion for such phase.

2.09 Financial Ability. The Corporation shall submit to the City, prior to the commencement of construction of any phase or all of the Redevelopment Project, as applicable, (a) reasonable proof of the Corporation’s financial ability to complete the Redevelopment Project, and (b) reasonably acceptable performance and payment bonds and maintenance bonds, as required by the City’s Code of Ordinances, issued in connection with the public improvements to be constructed by or at the direction of the Corporation for the Redevelopment Project. The City and the Corporation shall be named as obligees on the bonds. The City will not issue a Building Permit for any structure in the Redevelopment Area until the Corporation submits to the City the items specified in this Section.

2.10 Removal of Blight. The Corporation shall clear blight or rehabilitate to eliminate the physical blight existing in the Redevelopment Area, or to make adequate provisions satisfactory to the City for the clearance of such blight. This obligation shall be a covenant running with the land and shall not be affected by any sale or disposition of the Redevelopment Area. Any purchaser of property in the Redevelopment Area from the Corporation or any of the Corporation’s successors in title, who wishes to receive the development rights and tax abatement granted by this Agreement, shall acquire title subject to this obligation insofar as it pertains to the land so acquired.

2.11 Insurance. Not less than ten (10) days prior to commencement of construction of each and any portion of the Redevelopment Project, the Corporation and/or its general contractor shall provide the City with a certificate of insurance evidencing a commercial general liability insurance policy with

-8-

coverages of not less than $2,234,121 for claims arising out of a single accident or occurrence and $335,118 for any one person in a single accident or occurrence, which reflects the current absolute statutory waivers of sovereign immunity in Sections 537.600 and 537.610 of the Revised Statutes of Missouri, as amended. Further, the policy shall be adjusted upward annually, to remain at all times not less than the inflation-adjusted sovereign immunity limits as published in the Missouri Register on an annual basis by the Department of Insurance pursuant to Section 537.610 of the Revised Statutes of Missouri, as amended. The policy shall provide that it may not be cancelled, terminated, allowed to lapse or be substantially modified without at least thirty (30) days prior written notice to the City. The City shall be listed as an additional insured on such certificate. Such policy shall include a severability of interests clause and the insurance shall be primary with respect to any applicable insurance maintained by the City. The requirements of this Section shall terminate for each Phase upon the City’s acceptance of a Certificate of Substantial Completion for said Phase of the Redevelopment Project.

2.12 Redevelopment Project Maintenance. Upon substantial completion of the Redevelopment Project and so long as this Agreement is in effect, the Corporation or its successor(s) in interest, as owner or owners of the affected portion(s) of the Redevelopment Area, shall maintain or cause to be maintained the buildings and improvements within the Redevelopment Area which it owns in a good state of repair and in conformity with applicable state and local laws, ordinances, and regulations.

2.13 Changes. The Corporation shall promptly notify the City in writing of any changes in the location of the Corporation’s principal place of business and of any other material adverse change in fact or circumstance directly affecting the Redevelopment Project.

2.14 City Access to Redevelopment Project. The City may conduct such periodic inspections of the Redevelopment Area and the Redevelopment Project as may be generally provided in the City’s Code of Ordinances. In addition, the Corporation shall allow any authorized representatives of the City access to the Redevelopment Area and the Redevelopment Project from time to time upon reasonable advance notice prior to the completion of the Redevelopment Project for reasonable inspection thereof. The Corporation shall also allow the City and its employees, agents and representatives to inspect, upon request, all architectural, engineering, demolition, construction and other contracts and documents pertaining to the construction of the Redevelopment Project as the City determines is reasonable and necessary to verify the Corporation’s compliance with the terms of this Agreement.

2.15 Construction/Use Provisions.

(a) The Corporation agrees to construct the Redevelopment Project in accordance with the City’s Code of Ordinances and with the site development/construction specifications that are described on Exhibit F hereto. In addition, the Corporation agrees that the office towers within the Redevelopment Project will be constructed and maintained in a manner such that they will be classified as “Class A” or “first-class” office space by commercial real estate brokers. The Corporation further acknowledges the City’s desire that the Redevelopment Project be constructed in accordance with standards established by the U.S. Green Building Council (USGBC) in order to obtain LEED certification, and the Corporation will, or will cause the Developer to, use commercially reasonable efforts to incorporate USGBC standards into the design, construction and maintenance of the Redevelopment Project.

(b) The Corporation covenants that the uses in the Redevelopment Area shall at all times be in accordance with the zoning and subdivision approvals granted by the City, and all conditions thereof, for the Redevelopment Area.

(c) The City agrees to cooperate with the Corporation and to process and timely consider all applications for governmental approvals as received, all in accordance with the applicable City ordinances and laws of the State of Missouri, for the vacation of one or more alleys in the Redevelopment Area and the granting of other City easements as necessary to implement the Site Plan.

-9-

2.16 Development Expertise. The Corporation shall, before May 15, 2006, provide evidence to the City that the Corporation has entered into a joint venture or co-developer arrangement with an entity with sufficient expertise to carry out the retail portion of the Redevelopment Project.

ARTICLE 3

FORCE MAJEURE

3.01 Force Majeure.

(a) Upon satisfaction of the provisions of paragraph (b) of this Section, the time periods provided for herein shall be extended by the number of days of delay caused by actions or events beyond the control of the Corporation, including acts of God, labor disputes, strikes, lockouts, civil disorder, war, lack of issuance of any permits and/or legal authorization by any governmental entity necessary for Corporation to proceed with the construction of the Redevelopment Project, shortage or delay in the shipment of material or fuel, governmental action, fire, unusually adverse weather conditions, wet soil conditions, unavoidable casualties, litigation that challenges the Corporation’s right to acquire property by eminent domain or that contests the designation of the Redevelopment Area as blighted, or by any other cause which the City Manager determines may justify the delay; provided that any such occurrences or events shall not be deemed to exist as to any matter initiated or unreasonably sustained by Corporation, and further provided that Corporation notifies the City in writing within thirty (30) days of the commencement of any of the foregoing events.

(b) No event under (a) shall be deemed to exist (1) as to any matter that could have been avoided by the exercise of due care on the part of the Corporation, (2) as to any matter initiated or unreasonably sustained by the Corporation, and (3) unless the Corporation provides the City with a written notice within 30 days of the commencement of such claimed event specifying the event of force majeure.

3.02 Extensions. In addition to any extension permitted pursuant to Section 3.01 of this Agreement, the City may, upon request of the Corporation and approval by the Board of Aldermen in its sole discretion, extend times within which development activities are to commence or be completed.

ARTICLE 4

TAX ABATEMENT AND PAYMENTS IN LIEU OF TAXES

4.01 Tax Abatement. The tax abatement provided in this Section, and the corresponding payments in lieu of taxes as required by Section 4.02, shall apply to each phase of the Redevelopment Project, and references in this Section and in Section 4.02 to the Redevelopment Area shall apply to that portion of the Redevelopment Area associated with the appropriate phase of the Redevelopment Project; provided, in no event shall the tax abatement extend longer than 15 years after the Effective Date.

(a) First Ten (10) Years. Subject to the provisions of this Agreement, the real property within the Redevelopment Area shall not be subject to assessment or payment of general ad valorem taxes imposed by the City, the State of Missouri, or any political subdivision thereof, for a period of ten (10) years after the date upon which the Corporation acquires title to such property (but only for so long as said parcel is used in accordance with the Redevelopment Plan),

-10-

except to such extent and in such amount as may be imposed upon such real property during such period measured solely by the amount of the assessed valuation of land, exclusive of improvements, during the calendar year preceding the calendar year during which the Corporation acquired title to such real property.

(b) Next Five (5) Years. Until the earlier of (1) the completion of five (5) additional years after the first ten (10) years in Section 4.01(a); or (2) twelve (12) complete calendar years after delivery or deemed delivery of the Certificate of Substantial Completion, ad valorem taxes upon the real property within the Redevelopment Area shall be measured by the assessed valuation thereof as determined by the St. Louis County Assessor upon the basis of not to exceed fifty percent (50%) of the true value of such real property, including improvements thereon, nor shall such valuations be increased above fifty percent (50%) of the true value of said real property from year to year during such period so long as the Redevelopment Area is used in accordance with this Agreement and the Redevelopment Plan.

(c) Abatement Contingent upon Compliance with Redevelopment Plan. The tax relief provided in this Section shall be contingent upon the Corporation’s compliance with the Redevelopment Plan and this Agreement, and shall apply to general ad valorem taxes only and shall not be deemed or construed to exempt the Corporation or its successors in interest, in whole or in part, from special assessments, fees, charges or other taxes that may be imposed by the City or another governmental unit.

(d) Expiration. Upon the expiration of such periods, the real property comprising the Redevelopment Area shall be subject to assessment and payment of all ad valorem taxes, based upon the full true value of such real property.

4.02 Payments in Lieu of Taxes.

(a) Agreement to Make PILOTs. Notwithstanding any provisions of Section 4.01 above and Section 353.110 of the URC Law to the contrary, the Corporation agrees that, in addition to the ad valorem taxes computed pursuant to Section 4.01 hereinabove, it will pay to the St. Louis County Collector of Revenue (“Collector”), on or before December 31 of each year during which real property taxes are abated in accordance with Section 4.01 above, payments in lieu of taxes (“PILOTs”) according to the following:

(1) PILOTs during First Ten (10) Years. During the first ten (10) years of each phase or all of the Redevelopment Project, as applicable, the Corporation will make the following PILOTS:

(A) Calendar years before and including Substantial Completion:

(i) The portion of the PILOTs calculated for the land in the Redevelopment Area shall equal one hundred percent (100%) of the total assessed valuation of such land, excluding the value of such land prior to the initiation of the Redevelopment Project, until the City accepts the Certificate of Substantial Completion; and

(ii) The portion of the PILOTs calculated for the improvements on property in the Redevelopment Area shall equal one hundred percent (100%) of the total assessed valuation of the improvements, until the City accepts the Certificate of Substantial Completion.

-11-

(B) Calendar years after Substantial Completion:

(i) The portion of the PILOTs calculated for the land in the Redevelopment Area shall equal fifty percent (50%) of the total assessed valuation of such land, excluding the value of such land prior to the initiation of the Redevelopment Project, for each year after the City accepts the Certificate of Substantial Completion; and

(ii) The portion of the PILOTs calculated for the improvements on property in the Redevelopment Area shall equal fifty percent (50%) of the total assessed valuation of the improvements, for each year after the City accepts the Certificate of Substantial Completion.

(2) PILOTs during Next Five (5) Years. Until the earlier of (A) the completion of five (5) additional years after the first ten (10) years in Section 4.02(a)(1) or (B) twelve (12) complete calendar years after delivery of the Certificate of Substantial Completion for the Redevelopment Project, the Corporation shall make PILOTs which, when added to payments made pursuant to Section 4.01, shall equal fifty percent (50%) of the general ad valorem taxes that would have been due and payable for both land and improvements in the absence of the tax abatement provided in Section 4.01.

(b) Adjustment of PILOTS for Failure to Maintain Jobs. Centene Corporation will maintain the following number of Jobs within the Redevelopment Area during the term of this Agreement:

| Calendar Year | Number of Jobs | |

| 2006 | 336 | |

| 2007 | 436 | |

| 2008 | 567 | |

| 2009 | 738 | |

| 2010 and Thereafter | 959 |

If Centene Corporation fails to maintain the minimum number of Jobs within the Redevelopment Area as herein provided, measured by determining the highest actual number of Jobs during the 90-day period ending on each Test Date, either Centene Corporation or the Corporation shall make a PILOT payment (in addition to any payments required under Section 4.02(a)) to the Collector on or before December 31 of each such calendar year in which Centene Corporation fails to maintain the required number of Jobs, in an amount equal to:

| A.V. 100 | X | T.T.L. | X .50 X | R.J.-A.J. R.J. | = | Additional PILOT Payment |

| A.V. | = | assessed valuation of the Corporation’s property in the Redevelopment Area for Test Date year | ||

| T.T.L. | = | total of all ad valorem tax levies of all taxing jurisdictions in which the Redevelopment Area is located | ||

| A.J. | = | highest number of Jobs during the 90-day period ending on the Test Date | ||

| R.J. | = | required number of Jobs for Test Date year | ||

-12-

The Corporation shall perform the calculation set forth in this Section on each Test Date, and shall promptly provide a copy of such calculation to the City, accompanied by a written certification of the Corporation that none of the Jobs included in such calculation is occupied by a person that has been hired for the primary purpose of satisfying or inflating the calculation of Jobs required by this Agreement. The Corporation shall also provide to the City, promptly upon request, any information reasonably required by the City to verify such calculation. Any resulting increase in Additional PILOT Payments as a result of such calculation shall be paid for the calendar year in which such Test Date occurs. In no event shall the PILOT payments as a result of such calculation exceed the amount of taxes that the Corporation would have been required to pay during the applicable year in the absence of the adoption of the Development Plan.

For purposes of this Section, (a) “Job” means a full-time equivalent job position with Centene Corporation of not less than 35 hours per week within the Redevelopment Area, which shall include normal full-time employee benefits offered by Centene Corporation, and (b) “Test Date” means October 1 of each year, beginning on October 1, 2006.

(c) Payment, Distribution and Enforcement. The obligation to make the foregoing PILOTs shall constitute a lien against the Redevelopment Area, enforceable by the City in the same manner as general real estate taxes. The Board of Aldermen shall furnish the Collector with a copy of this Agreement. The Collector shall allocate the revenues received from such PILOTs (whether received under this Section or any other provision of this Agreement) among applicable taxing authorities in accordance with Section 353.110.4 of the URC Law.

4.03 Earnings Limitation on Redevelopment Project. The net earnings of the Corporation (and/or any successor owner) from the Redevelopment Project shall be limited in accordance with the applicable provisions of the URC Law.

4.04 Financial and Annual Reports.

(a) During the period of tax relief provided in this Agreement for each phase or all of the Redevelopment Project, as applicable, the Corporation shall provide annually to the City’s Finance Director, within one hundred twenty (120) days after the end of the Corporation’s fiscal year, three (3) copies of its detailed financial report for the preceding year for the Redevelopment Project, examined by a certified public accountant and containing a certification concerning such examination. Said financial reports shall disclose:

(1) the Corporation’s earnings derived from the Redevelopment Project;

(2) the disposition of any net earnings in excess of those permitted by Section 4.03 above;

(3) the interest rate on income debentures, bonds, notes or other evidences of debt of Corporation;

(4) the Corporation’s cost of the Redevelopment Project; and

(5) the Corporation’s income and expenses derived from or attributable to the Redevelopment Project.

-13-

(b) If, in the Finance Director’s judgment, the financial reports fail to provide the information required by this Section in accordance with generally accepted accounting principles or if a material dispute arises regarding the information provided in a financial report, and if requested by the City in writing, the Corporation shall, at its own expense and in an amount agreed by the Corporation and the City, have an audit made of its books by an auditing firm to be named by the City and approved by the Corporation, and the findings of such audit shall be made available to the Finance Director.

4.05 Accounting Practices. The Corporation shall establish and maintain depreciation, obsolescence, and other reserves, and surplus and other accounts, including a reserve for the payment of taxes and PILOTs, according to recognized standard accounting practices.

ARTICLE 5

TRANSFER OF THE REDEVELOPMENT AREA

5.01 Corporation’s Right to Transfer the Redevelopment Area.

(a) Sale to Developer. The Corporation may voluntarily sell, lease, assign, transfer, convey and/or otherwise dispose (hereinafter collectively referred to as a “Sale”) the Redevelopment Area or any portion thereof to the Developer or an Affiliate without the City’s prior written consent, but the Corporation shall provide written notice to the City within ten (10) days following such Sale to any such entity. Upon a Sale, all of the Corporation’s rights and obligations hereunder with respect to the subject property, including those concerning tax abatement and eminent domain, shall transfer to such entity.

(b) Sale to Third Party. If the proposed Sale is to a party other than the Developer or an Affiliate, then the Corporation shall first obtain the City’s written consent (which consent shall not be unreasonably withheld or delayed). The City may require that any proposed transferee, other than the Developer or an Affiliate, demonstrate to the City’s reasonable satisfaction that the transferee is sufficiently experienced and financially capable in that it has reasonable financial worth and experience in light of the responsibilities undertaken. In the event of such a Sale, all rights and obligations of the Corporation hereunder with respect to the subject property, including those concerning tax abatement and eminent domain, shall transfer to the transferee.

(c) Transferee Agreement. In the event of each transfer of property in the Redevelopment Area pursuant to Section 5.01(b), the Corporation or its authorized successors and assigns shall require the proposed transferee to execute a transferee agreement with the City in substantial compliance with the form attached as Exhibit E. No Sale shall occur without the prior execution of a transferee agreement with the City. The parties agree that the intention of each transferee agreement is to protect the Corporation and the City by ensuring that all transferees of property within the Redevelopment Area receive actual notice of the rights, duties and obligations contained in this Agreement prior to taking ownership, and nothing contained in a transferee agreement that is an accordance with Exhibit E shall be deemed to impose any rights, duties or obligations that are not imposed pursuant to this Agreement.

ARTICLE 6

DEFAULT AND REMEDIES

6.01 Default and Remedies.

(a) Event of Default. The occurrence and continuance of any of the following shall constitute a “Corporation Event of Default”:

(1) Centene Corporation fails to maintain its headquarters within the Redevelopment Area (for purposes of this section the term “headquarters” means the location at which Centene Corporation maintains its centralized administrative, management, finance and support functions); or

-14-

(2) the Corporation fails to make the punctual payment of the PILOTs on the due date; or

(3) the Corporation fails to timely perform, in all material respects, any obligation or covenant of the Corporation under this Agreement, and such failure is not cured to the City’s reasonable satisfaction within thirty (30) days after the City gives written notice thereof to the Corporation, or if it cannot reasonably be cured within thirty (30) days, the Corporation is not diligently proceeding to cure same.

(b) Remedies. The City shall have the following remedies upon the occurrence of a Corporation Event of Default:

(1) if the default is under (a)(1) or (a)(3) above, the City’s sole remedy shall be to terminate this Agreement; and

(2) if the default is under (a)(2) above, the City may bring an action for specific performance to enforce such payments and/or may terminate this Agreement. In the event of litigation pertaining to the enforcement of such payments, the losing party shall pay all costs of litigation, including reasonable attorneys’ fees. In addition, any amounts due hereunder that are not paid when due shall bear interest at the then applicable statutory interest rate per annum from the date such payment was first due.

(c) Results of Termination. Upon termination of this Agreement pursuant to this Section, a declaration of abandonment shall be filed with the Recorder of Deeds of St. Louis County, and the real property included in the Redevelopment Area shall from that date be subject to assessment and payment of all ad valorem taxes based on the true full value of such real property.

ARTICLE 7

GENERAL PROVISIONS

7.01 Modifications; Successors and Assigns. The terms, conditions and provisions of this Agreement and of the Redevelopment Plan shall not be modified or amended except by mutual agreement in writing between the City and the Corporation. This Agreement shall be binding upon and inure to the benefit of the City and the Corporation and their respective successors and assigns; provided, however, the Corporation may not assign its rights under this Agreement except in conjunction with a Sale in accordance with the provisions of Section 5.01 hereof.

7.02 Payment of City’s Costs. The Developer has heretofore advanced, pursuant to a Preliminary Funding Agreement dated as of June 15, 2005, between the City and the Developer, the sum of $75,000 to assist in the payment of the City’s costs, fees and expenses (including attorneys’ fees and expenses) incurred with respect to the approval of the Redevelopment Plan and this Agreement. Within sixty (60) days after the execution of this Agreement, the City shall provide Developer with a detailed accounting of the use of funds paid pursuant to the Preliminary Funding Agreement. To the extent any portion of the funds advanced by Developer pursuant to the Preliminary Funding Agreement exceeds the

-15-

professional service costs, planning costs, legal costs, financial advisor costs, other consultant costs and administrative costs incurred or charged by the City associated with the Redevelopment Plan (“City Costs”) as of the Effective Date, the City shall retain such excess (the “Excess Funds”) in a separate account and apply such Excess Funds as needed to pay additional City Costs paid or incurred after the Effective Date and not previously reimbursed. Upon full disbursement of the Excess Funds to pay City Costs, City shall notify Developer, and Developer shall reimburse the City for all additional City Costs paid or incurred by the City and not previously reimbursed, within thirty (30) days after the City makes written request therefor. This Section shall survive the expiration or earlier termination of this Agreement. The obligations of the parties under the Preliminary Funding Agreement are deemed fully performed and shall be merged into and superseded by this Agreement.

7.03 Creation of Community Improvement District.

(a) The Corporation and/or the Developer may petition the Board of Aldermen for the creation of a Community Improvement District (the “District”) pursuant to Section 67.1401 through 67.1571 of the Revised Statutes of Missouri, as amended (the “CID Act”), which will encompass all or a portion of the property in the Redevelopment Area. The parties agree that the District shall be operated in accordance with the following conditions and limitations:

(1) The District will be authorized to impose a special assessment up to the value of the tax abatement on all redeveloped parcels, to ensure that all benefited property contributes to offset the extraordinary costs of the Redevelopment Project.

(2) The Corporation shall cause the District, at the request of the City, to impose a sales tax of up to one percent (1.0%) of gross retail sales in accordance with the CID Act to pay for public improvements and/or services mutually agreed upon by the District and the City and benefiting the Redevelopment Area.

(3) The District shall impose no other tax, assessment, toll or charge whatsoever without the written consent of the City.

(4) The District shall maintain its existence until all costs of such District for which it was created and all outstanding District Obligations, if any, have been paid in full, at which time such District shall dissolve and the District Tax shall no longer be levied.

(5) The District shall keep accurate records of all revenues received and costs incurred, and such records shall be open to inspection by the City at all reasonable times.

(b) The City will cooperate with and assist the Corporation and/or the Developer in all proceedings relating to the creation and certification, as necessary, of the District. The City shall timely consider and act upon the petition for the formation of the District and shall appoint directors, if applicable, as such time as requested by the Corporation and/or the Developer. The Corporation shall pay or cause to be paid all reasonable costs incurred by the City in connection with the creation of the District.

7.04 Term of Agreement. Unless otherwise terminated pursuant to Section 6.01, this Agreement shall terminate when no portion of the real property located within the Redevelopment Area is subject to abatement of general ad valorem taxes pursuant to Section 4.01 hereof. The rights and privileges given to the Corporation by this Agreement and the duties and obligations imposed on the Corporation shall apply only to the Redevelopment Project described in the Redevelopment Plan. Notwithstanding anything herein to the contrary, any liability of the Corporation to the City accruing prior to the termination of this Agreement and remaining unsatisfied at the time of such termination shall continue and remain actionable beyond such date of termination.

-16-

7.05 Representatives Not Personally Liable. No elected or appointed official, agent, employee or representative of the City shall be personally liable to the Corporation in the event of any default or breach by any party under this Agreement, or for any amount which may become due to any party or on any obligations under the terms of this Agreement.

7.06 Indemnification and Hold Harmless. The indemnification and covenants contained in this Section 7.06 shall survive expiration or earlier termination of this Agreement. As used in this Section, the term “Corporation” shall include the authorized successors and assigns of the Corporation.

(a) Notwithstanding anything herein to the contrary, the City shall not be liable to the Corporation for damages or otherwise in the event that all or any part of the URC Law, the Authorizing Ordinance and/or any other ordinance of the City adopted in connection with this Agreement or the Redevelopment Plan or affecting the proposed Redevelopment Project is declared invalid or unconstitutional in whole or in part by the final (as to which all rights of appeal have expired or have been exhausted) judgment of any court of competent jurisdiction.

(b) The Corporation hereby agrees that, anything to the contrary herein notwithstanding, it will defend, indemnify and hold harmless the City, its governing body members, officers, agents, servants and employees against any and all claims, demands, actions, causes of action, loss, damage, injury, liability and/or expense (including attorneys’ fees and court costs) resulting from, arising out of, or in any way connected with (1) a Corporation Event of Default, (2) the negligence or intentional misconduct of the Corporation, its employees, agents, contractors, or subcontractors, or (3) the presence of hazardous wastes, hazardous materials or other environmental contaminants on any property within the Redevelopment Area. If the validity or construction of the URC Law, the Authorizing Ordinance and/or any other ordinance of the City adopted in connection with this Agreement or the Redevelopment Plan or affecting the proposed Redevelopment Project is contested in court, the Corporation shall defend, hold harmless and indemnify the City from and against all claims, demands and/or liabilities of any kind whatsoever including, without limitation, any claim for attorneys’ fees and expenses and court costs, and the Corporation shall pay any monetary judgment and all court costs rendered against the City, if any. Notwithstanding the foregoing terms of this Section 7.06(b), the Corporation is not obligated to defend, hold harmless or indemnify the City with respect to any matter or expense resulting from or arising out of the negligence or willful misconduct of the City and/or its elected and/or appointed officers, governing body, members, servants, employees, agents, contractors or subcontractors.

(c) The City and its governing body members, officers, agents, servants and employees shall not be liable for any damage or injury to the persons or property of the Corporation or its officers, agents, servants or employees or any other person who may be about the Redevelopment Area, or to the construction of the Redevelopment Project, except for matters arising out of the willful misconduct or negligence of the City or its governing body members, officers, agents, servants, employees, contractors or subcontractors.

7.07 Contest of Assessed Valuation. In consideration for the incentives and benefits provided by this Agreement, the Corporation agrees that neither it nor any successor in title or interest to any of the real property within the Redevelopment Area will challenge, appeal or otherwise make an effort to reduce the assessed valuation of such real property during any time that the Redevelopment Project is receiving tax abatement under this Agreement; provided, the foregoing shall not bind the

-17-

Corporation or any successor if the assessed valuation is more than 10% greater than the projected assessed valuation of such property, as shown in the Tax Impact Statement for the Redevelopment Area, attached hereto as part of Exhibit C. If (a) the Corporation or any successor challenges the assessed valuation pursuant to the provisions in the preceding sentence, and (b) as a result of such challenge, the assessed valuation is reduced to an amount below the amount shown in the Tax Impact Statement, the Corporation shall make PILOTs to the Collector in an amount sufficient to produce the same amount of revenues (i.e., taxes and PILOTs) under this Agreement as would otherwise be payable if the assessed valuation equaled the amount shown in the Tax Impact Statement.

7.08 Notices. Whenever notice or other communication is called for herein to be given or is otherwise given pursuant hereto, it shall be in writing and shall be personally delivered or sent by registered or certified mail, return receipt requested, addressed as follows:

| (a) | If to the City: | |

| City of Clayton | ||

| 10 N. Bemiston Avenue | ||

| Clayton, Missouri 63105 | ||

| Attention: Michael A. Schoedel | ||

| with a copy to: | ||

| Curtis, Heinz, Garrett & O’Keefe, P.C. | ||

| 130 South Bemiston, Suite 200 | ||

| St. Louis, Missouri 63105 | ||

| Attention: Kevin M. O’Keefe | ||

| (b) | If to the Corporation: | |

| Centene Plaza Redevelopment Corporation | ||

| c/o Centene Corporation | ||

| Centene Place | ||

| 7711 Carondelet Avenue, Suite 800 | ||

| Clayton, Missouri 63105 | ||

| Attention: James Reh | ||

| with a copy to: | ||

| Armstrong Teasdale LLP | ||

| One Metropolitan Square, Suite 2600 | ||

| St. Louis, Missouri 63102 | ||

| Attention: James E. Mello | ||

All said notices by mail shall be deemed given on the day of deposit in the mail. A change of designated officer or address may be made by a party by providing written notice of such request to the other party.

7.09 Severability. The provisions of this Agreement shall be deemed severable. If any provision of this Agreement is found by a court of competent jurisdiction to be invalid, the remaining provisions of this Agreement shall remain valid unless the court finds that the valid provisions are so essentially and inseparably connected with and so dependent upon the invalid provision that it cannot be presumed that the parties hereto would have agreed to the valid provisions of this Agreement, or unless the Court finds the valid provisions, standing alone, are incomplete and incapable of being executed in accordance with the contracting parries’ intent.

-18-

7.10 Headings. The headings and captions of this Agreement are for convenience and reference only, and in no way define, limit, or describe the scope or intent of this Agreement or any provision hereof.

7.11 Recording of Agreement. The Corporation shall, at its sole expense, record this Agreement in the real property records of St. Louis County, Missouri. The rights and obligations set forth herein shall be a covenant running with the Redevelopment Area throughout the term of this Agreement. No Building Permit shall be issued for any structure in the Redevelopment Area until proof of such recording has been provided to the City.

7.12 Governing Law; Other Applicable Provisions. This Agreement shall be governed by and construed in accordance with the domestic laws of the State of Missouri without giving effect to any choice or conflict of law provision or rule (whether of the State of Missouri or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Missouri. The terms of this Agreement do not usurp or limit the City’s or any other governmental entity’s exercise of administrative and/or legislative discretion as to review and approval of land uses, infrastructure improvements, site plan, architectural elements and related matters.

7.13 Corporation’s Right of Termination. At any time prior to commencement of construction of the Redevelopment Project, the Corporation may, by giving written notice to the City, abandon the Redevelopment Project and terminate this Agreement if the Corporation determines in its sole discretion that the Redevelopment Project is no longer economically feasible. Upon termination of this Agreement, the parties shall have no further rights or obligations hereunder except as may expressly survive termination.

7.14 Counterparts. This Agreement may be executed in several counterparts, each of which shall be an original and all of which together shall constitute one and the same instrument.

[Remainder of page intentionally left blank.]

-19-

IN WITNESS WHEREOF, the parties have set their hands and seals the day and year first above written.

| CITY: | ||||||||

| ATTEST: | CITY OF CLAYTON | |||||||

|

|

| |||||||

| Name: |

| Michael A. Schoedel | ||||||

| City Clerk | City Manager | |||||||

| CORPORATION: | ||||||||

| CENTENE PLAZA REDEVELOPMENT | ||||||||

| CORPORATION | ||||||||

| By: | /s/ James E. Reh | |||||||

| Name: | James E. Reh | |||||||

| Title: | V.P. Facilities Mgmt. | |||||||

Red Agr 12/23/05

-20-

ACKNOWLEDGMENTS

| STATE OF MISSOURI | ) | |||

| ) | SS. | |||

| COUNTY OF ST. LOUIS | ) |

On this day of December, 2005, before me appeared MICHAEL A. SCHOEDEL, to me personally known, who, being by me duly sworn, did say that he is the City Manager of the CITY OF CLAYTON, MISSOURI, an incorporated political subdivision of the State of Missouri, and that the seal affixed to the foregoing instrument is the seal of said city, and said instrument was signed and sealed in behalf of said City by authority of its Board of Aldermen, and said MICHAEL A. SCHOEDEL acknowledged said instrument to be the free act and deed of said city.

Subscribed and sworn to before me this day of December, 2005.

|

| ||

| Name: |

| |

| Notary Public | ||

My Commission Expires:

| STATE OF MISSOURI | ) | |||

| ) | SS. | |||

| COUNTY OF ST. LOUIS | ) |

On this 28th day of December, 2005, before me appeared James Reh, to me personally known, who, being by me duly sworn, did say that he is the V.P. Facilities Mgmt. of CENTENE PLAZA REDEVELOPMENT CORPORATION, an urban redevelopment corporation organized under the laws of the State of Missouri, and said instrument was signed in behalf of said corporation by authority of its Board of Directors, and said James Reh acknowledged said instrument to be the free act and deed of said corporation.

Subscribed and sworn to before me this 28th day of December, 2005.

|

| ||

| Name: | Kimerly A. Beard | |

| Notary Public | ||

My Commission Expires:

-21-

EXHIBIT A

SITE PLAN

[On file in the Office of the City Manager]

A-1

EXHIBIT B

LEGAL DESCRIPTION OF THE REDEVELOPMENT AREA

Phase II

Lots 1, 2, 3, 4 and 5 of Langtry’s Subdivision in Clayton, a Subdivision of Lots 4, 5 and 6 of the Resubdivision of the Eastern portion of Block 13 of the Town (now City) of Clayton, according to plat thereof recorded in Plat Book 25 page 75 of the St. Louis County Recorder’s Office.

Phase III

Parcel 1:

Lots 1, 2 and 3 of the Resubdivision of the Eastern portion of Block 13 of the Town (now City) of Clayton, in St. Louis County, Missouri, according to the plat thereof recorded in Plat Book 1 page 125 of the St. Louis County Recorder’s Office.

Parcel 2:

The East 1/2 of Lot 19 in Block 13 of the Town of Clayton, according to the plat thereof recorded in Plat Book 1, Page 7 of the St. Louis County Recorder’s Office.

Parcel 3:

The West 1/2 of Lot 19 in Block 13 of the Town of Clayton, according to the plat thereof recorded in Plat Book 1, Page 7 of the St. Louis County Recorder’s Office.

Parcel 4:

Lot 20 in Block 13 of Town (now City) of Clayton, according to the plat thereof recorded in Plat Book 1 Page 7 of the St. Louis County Records.

Parcel 5A:

Lot 21 in Block 13 of Town of Clayton, according to the plat thereof recorded in Plat Book 1 Page 7 of the St. Louis County Records.

Parcel 5B:

Lot 22 in Block 13 of the Town (now City) of Clayton, according to the plat thereof recorded in Plat Book 1 Page 11, now 7, of the St. Louis County Records, fronting 50 feet on the south line of Forsyth Boulevard, by a depth Southwardly of 190 feet to an alley.

Parcel 6:

Lot 23 in block 13 of the Town (now City) of Clayton, a subdivision in St. Louis County, Missouri, according to the plat thereof recorded in plat book 1 page 11 now 7 of the St. Louis County Records.

B-1

Parcel 7:

Lot 24 in Block 13 of Town (now City) of Clayton, as per plat thereof recorded in Plat Book 1 Page 7 of the St. Louis County Recorder’s Office.

B-1-2

EXHIBIT C

REDEVELOPMENT PLAN

[On File in the Office of the City Clerk]

C-1

CENTENE PLAZA REDEVELOPMENT CORPORATION

PROPOSED DEVELOPMENT PLAN

FOR

FORSYTH/HANLEY REDEVELOPMENT AREA

Submitted to

City of Clayton, Missouri

Clayton City Council

October 28, 2005

FORSYTH/HANLEY REDEVELOPMENT AREA

PROPOSED DEVELOPMENT PLAN

| I. | INTRODUCTION | 3 | ||||

| Background information on Chapter 353 | 3 | |||||

| The proposed redevelopment area and redevelopment project | 4 | |||||

| II. | FINDING THAT THE REDEVELOPMENT AREA IS BLIGHTED | 5 | ||||

| III. | DEVELOPMENT PLAN OBJECTIVES | 5 | ||||

| IV. | DEVELOPMENT PLAN | 6 | ||||

| (a) | Legal Description of the Redevelopment Area | 6 | ||||

| (b) | Description of the Project | 6 | ||||

| (c) | No Property to Public Agencies | 8 | ||||

| (d) | Zoning Changes | 8 | ||||

| (e) | Street Changes | 9 | ||||

| (f) | Business Relocations | 9 | ||||

| (g) | Projects or Relocations Outside the Redevelopment Area | 9 | ||||

| (h) | Financing; Marketability | 9 | ||||

| (i) | Management | 11 | ||||

| (j) | Eminent Domain | 11 | ||||

| (k) | Limitations on Assignment of Project | 11 | ||||

| (l) | Reimbursement and Indemnification Agreements | 12 | ||||

| (m) | Current Assessed Values of Parcels | 12 | ||||

| (n) | Tax Abatement Requested; Economic Impact on Tax Base | 12 | ||||

| (o) | Objectives of Development Plan | 13 | ||||

| (p) | Other Information | 13 | ||||

| APPENDICES | ||||||

| 1. | LEGAL DESCRIPTIONS OF THE REDEVELOPMENT AREA | |||||

| 2. | REDEVELOPMENT AREA MAP AND SITE PLAN | |||||

| 3. | BLIGHTING STUDY | |||||

| 4. | TAX IMPACT STATEMENTS | |||||

-2-

| I. | INTRODUCTION |

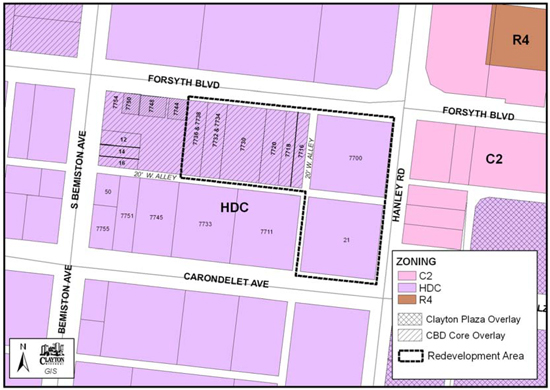

This proposed Development Plan is submitted to the City of Clayton (the “City”) by the Centene Plaza Redevelopment Corporation (the “Corporation”), an urban redevelopment corporation organized under and pursuant to the provisions of “The Urban Redevelopment Corporations Law,” Chapter 353 of the Revised Statutes of Missouri 2000, as amended (“Chapter 353” or the “Law”) and covers a redevelopment area of seven (7) parcels containing approximately three and four-tenths (3.4) acres within a portion of the city block bounded by Forsyth Road and Carondolet Avenue (North/South) and Bemiston and Hanley Boulevard (East/West). The boundaries of the Redevelopment Area are displayed on Plate 1 in Appendix 2.

Background information on Chapter 353

In pursuing the redevelopment of a declining area or to induce the development of an area that has been deficient in growth and development, the State of Missouri has provided various statutory tools a municipality may use in order to initiate private and public development. One such tool is Chapter 353. This legislation provides for the establishment of a “redevelopment area”. In order to establish a redevelopment area, the area proposed for designation must be “blighted” according to the criteria set forth in Chapter 353.

Chapter 353 allows cities and counties to (1) identify and designate redevelopment areas that qualify as “blighted areas”; (2) adopt a Development Plan that designates the redevelopment area and states the objectives to be attained and the program to be undertaken; (3) approve a redevelopment project(s) for implementation of the Development Plan; and (4) utilize the tools set forth in the Law to assist in reducing or eliminating those conditions that cause the area to qualify as a redevelopment area. The purpose of establishing a redevelopment area is to reduce or eliminate blighting conditions, foster economic and physical improvement, and enhance the tax base of the taxing jurisdictions that levy taxes within the redevelopment area.

Generally, the Law allows municipalities to foster economic and physical improvements in a redevelopment or project area by granting a developer the power of eminent domain to provide necessary property acquisition for the implementation of a Development Plan and redevelopment project. Chapter 353 also allows municipalities to grant the developer an abatement of the increased portion of the ad valorem taxes (real estate taxes) that would otherwise result from the developer’s redevelopment project.

The premise underlying the tax abatement portion of Chapter 353 is relatively straight-forward. Ad valorem taxes in a redevelopment area are expected to increase over prior levels when there is an increase in development activity. New development is induced through the ability to abate a percentage of the incremental ad valorem tax revenue created by the new development to lower future operating costs of the developer and/or end user.

-3-

Chapter 353 allows up to 100% incremental tax abatement for a period of 10 years and up to 50% incremental tax abatement for the following 15 years. When incremental tax abatement is approved, local jurisdictions that levy real property taxes continue to collect the taxes based on the assessed value of the property prior to the implementation of Chapter 353. If the incremental tax abatement granted is less than 100%, local jurisdictions also collect taxes on a portion of the increased assessed value of the property. Following the abatement period, the assessor reassesses the property and taxes are thereafter based on the full assessed value of the developed property. Throughout the entire abatement period, the taxing jurisdictions receive 100% of any new revenues from economic activity taxes (generally sales and utility taxes) and 100% of any personal property taxes.

Depending on the needs of any particular project, the municipality may require that the developer make payments in lieu of taxes (PILOTS) which payments are distributed on a pro rata basis to all local jurisdictions which levy ad valorem taxes on real property. In addition, the developer and the municipality can agree to an incremental abatement that is less than the maximum percentages described above.

The proposed redevelopment area and redevelopment project.

On April 22, 2005, the City of Clayton requested proposals for redevelopment of the 7700 block of Forsyth Blvd. and Carondelet Ave., in the heart of the City’s downtown business district. On May 27, 2005, Centene Corporation (the “Developer”) submitted a proposal (the “Proposal”) in response thereto. The Corporation proposes to redevelop the designated Redevelopment Area, to create a signature project suitable as a location for Centene Corporation’s expanding headquarters and provide new retail shopping experiences for downtown Clayton.

The project will include two, new first-class office buildings total approximately 560,000 square feet, and additional retail and office space along Forsyth Blvd. Construction of the facilities will be focused around a pedestrian-friendly design in order to attract visitors and customers. The redevelopment project will take full advantage of the Redevelopment Area’s highly visible and strategic location and significantly strengthen Clayton’s economy, as well as have a positive impact on the region.

The Redevelopment Area includes two parcels currently controlled by the Developer: a parking garage located at 21 S. Hanley Road (the “Plaza C Property”) and a building located at 7700 Hanley Road, the former site of a Library Limited bookstore (the “Plaza B Property”). The Redevelopment Area also includes five parcels located on Forsyth Blvd., at 7716 and 7718, 7720, 7730, 7732 and 7734, and 7736 Forsyth Blvd., each of which is currently under separate ownership (collectively, the “Forsyth Retail Properties”). The Plaza B Property, the Plaza C Property, and the Forsyth Retail Properties are collectively referred to herein as the “Redevelopment Area.”

-4-