PLAN SUPPORT ANDRESTRUCTURING AGREEMENT

EX-10.3 5 v194450_ex10-3.htm Unassociated Document

Schedule 1

PLAN SUPPORT AND RESTRUCTURING AGREEMENT

This PLAN SUPPORT AND RESTRUCTURING AGREEMENT (together with the Term Sheet (as defined below), the “Agreement”), dated as of July 22, 2010, is made by and among those certain holders of the July/August Debentures, the March Debentures, the VPP Debentures, and the November Debentures (as defined in the Term Sheet, and collectively, the “Debentures”) issued by Capital Growth Systems, Inc., (together with its subsidiaries and affiliates, the “Company) that are signatories hereto and (collectively the “Participating Holders”), on the one hand, and the Company, on the other hand.

WHEREAS, the Company and the Participating Holders have engaged in negotiations with the objective of reaching an agreement for a Restructuring (as defined below) of the Company;

WHEREAS, the Company and the Participating Holders now desire to implement a financial restructuring (the “Restructuring”) of the Company that is substantially consistent with the terms and conditions set forth in the term sheet (together with the Exhibits and Schedules attached thereto, the “Term Sheet”) attached hereto as Exhibit A;

WHEREAS, in order to implement the Restructuring, the Company has agreed, on the terms and conditions set forth in this Agreement and the Term Sheet, to use its best efforts to consummate the Restructuring through a pre-negotiated plan of reorganization (the “Reorganization Plan”), the requisite acceptances of which shall be solicited following commencement of voluntary cases (“Chapter 11 Case”) by the Company and its affiliated debtors under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101-1532 (as amended, the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”);

WHEREAS, to expedite and ensure the implementation of the Restructuring, each of the Participating Holders is prepared to commit, on the terms and subject to the conditions of this Agreement and applicable law, to, if and when solicited in accordance with applicable bankruptcy law, to accept the Reorganization Plan and support its confirmation and to, in either case, perform its other obligations hereunder.

NOW THEREFORE, in consideration of the promises and the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and each Participating Holder hereby agree as follows:

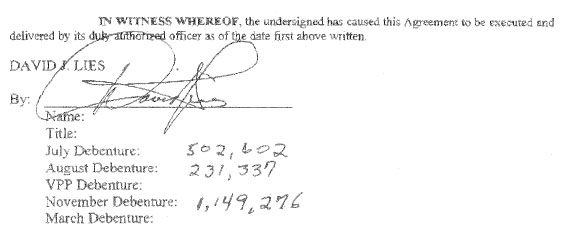

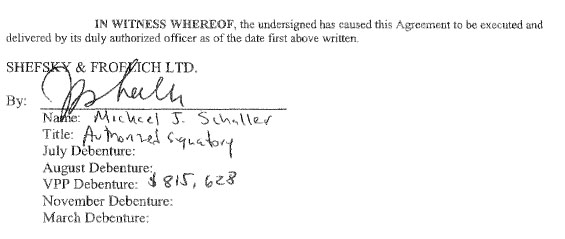

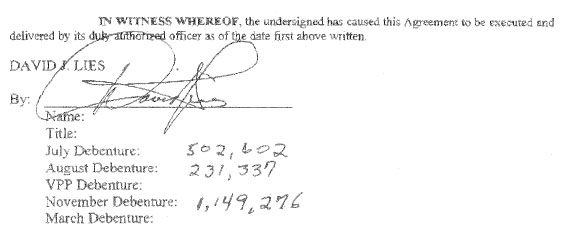

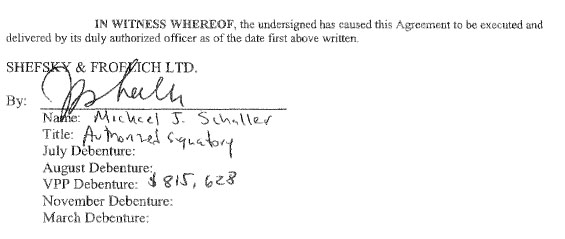

1. Acknowledgment. Each Participating Holder signatory hereto represents that the debenture holdings listed in their respective signature lines are true and accurate as of June 30, 2010.

2. Term Sheet. The Term Sheet is incorporated herein and is made part of this Agreement. The general terms and conditions of the Restructuring are set forth in the Term Sheet. In the event of any inconsistencies between the terms of this Agreement and the Term Sheet, the Term Sheet shall govern. This Agreement is not a solicitation of acceptances or rejections with respect to any restructuring plan or reorganization. Any such solicitation will be conducted in accordance with the Bankruptcy Code and/or applicable securities laws. This Agreement is not a commitment by the Participating Holders to lend to the Company. Any such commitment is subject to negotiation and execution of acceptable documentation and approval by the Bankruptcy Court.

3. Condition Precedent. It is a condition precedent to the effectiveness of this Agreement that (i) the Restructuring as set forth in the Term Sheet be approved by the Company's Board of Directors, which approval shall be obtained prior to filing of the voluntary Chapter 11 Cases; (ii) the Chapter 11 Cases are commenced no later than 5:00 p.m. (NY Time) on July 23, 2010; and (iii) the DIP Facility (as defined below) be approved by the Bankruptcy Court and the senior Pivotal Global Capacity, LLC (“Pivotal”) debt be repaid from the proceeds of the DIP Facility and all commitment of Pivotal to make loans under Pivotal’s senior loan agreement be terminated.

4. Means for Effectuating the Restructuring. The Company shall seek to effectuate the Restructuring through the commencement of the voluntary Chapter 11 Case, consummation of the DIP Facility and the confirmation and consummation of the Reorganization Plan.

5. Preparation of Restructuring Documents.

a) No later than the date hereof, the Company shall instruct its counsel in consultation with the Participating Holders to prepare all of the documents necessary to commence the Chapter 11 Cases (collectively, the “Chapter 11 Documents”), which shall include, without limitation, the following:

i Petitions for relief and required schedules under chapter 11 of the Bankruptcy Code for the Company (the “Petition”):

ii A disclosure statement, including customary exhibits, related to the Reorganization Plan (the “Disclosure Statement”) that complies with section 1125 of the Bankruptcy Code;

iii The Reorganization Plan, which shall incorporate the terms and conditions set forth in the Term Sheet and such other terms and conditions agreed upon by the Company and the Participating Holders, including any exhibits and, prior to confirmation, plan supplement documents (which shall include appropriate revised corporate governance documents);

iv A proposed order confirming the Reorganization Plan;

v Proposed forms of the DIP Financing Order (as defined below) and the DIP Financing Agreement, and a motion for approval of the DIP Facility; and

vi Any other typical or necessary motions and applications for relief filed by the Company on the date of the commencement of the Chapter 11 Cases (the “First Day Pleadings”), as set forth in the Term Sheet.

Each Chapter 11 Document shall be in the form and substance reasonably acceptable to the Participating Holders prior to its filing with the Bankruptcy Court and shall be prepared jointly with the Participating Holders.

6. Company Undertakings. The Company hereby agrees to use its best efforts to, as applicable, (i) take all acts reasonably necessary to effectuate and consummate the Restructuring, (ii) obtain approval of the DIP Facility and repayment in full of the prepetition secured debt owing to Pivotal, and (iii) implement all reasonable steps necessary to obtain an order of the Bankruptcy Court confirming the Reorganization Plan, in each case, as expeditiously as possible. The Company hereby agrees that it will not take any action inconsistent with this Agreement or the Reorganization Plan.

7. Conduct of Business. The Company agrees that, prior to the Effective Date (as defined below) of the Reorganization Plan and prior to termination of this Agreement pursuant to Sections 10 and 11 below, unless the Participating Holders consent to such actions in writing:

| | a) | The Company shall not (i) directly or indirectly engage in, agree to or consummate any transaction that is not on an arms' length basis or outside the ordinary course of its business (other than the Restructuring) or incur any liability outside the ordinary course of business (other than pursuant to the DIP Financing Agreement, defined below), or that is not on an arms' length basis, and, if between unaffiliated parties, also on market terms or (ii) enter into any transaction or perform any act which would constitute any breach by it of any of its representations, warranties, covenants or obligations hereunder; |

| | b) | The Company shall maintain its corporate existence and shall maintain its qualification in good standing under the laws of each state or other jurisdiction in which it is organized or required to be qualified to do business and is presently so qualified; |

2

| | c) | The Company shall not pay any dividends to holders of common and/or preferred equity in the Company (the “Old Equity”) or make any distributions to Old Equity; |

| | d) | The Company shall not make any payments on or account of existing indebtedness (other than secured indebtedness owing to Pivotal after Bankruptcy Court approval upon notice (including to the Participating Holders) and, if necessary, a hearing) other than in the ordinary course of business or authorized under a first day motion, provided such amounts are allowed under the Budget; |

| | e) | Except as expressly allowed in this Agreement or the Term Sheet, the Company shall not directly or indirectly, and shall cause each of its direct and indirect subsidiaries not to directly or indirectly do or permit to occur any of the following: (i) issue, sell, pledge, dispose of, or encumber any additional shares of, or any options, warrants, conversion privileges or rights of any kind to acquire any shares of, any of its equity interests; (ii) amend or propose to amend its respective articles of incorporation or comparable organizational documents; (iii) split, combine, or reclassify any outstanding shares of its capital stock or other equity interests, or declare, set aside, or pay any dividend or other distribution payable in cash, stock, property, or otherwise with respect to any of its equity interests; (iv) redeem, purchase, or acquire or offer to acquire any of its equity interests; (v) acquire, transfer, or sell (by merger, exchange, consolidation, acquisition of stock or assets, or otherwise) any corporation, partnership, joint venture, or other business organization or division, or any assets; |

| | f) | The Company shall promptly, and in any event within three (3) business days after receipt or knowledge of the same by any of them, notify (i) the Participating Holders, or (ii) counsel for the Participating Holders of any governmental or third party notices, complaints, investigations, hearings, orders, decrees or judgments (or communications indicating that any of the foregoing may be contemplated or threatened) which could reasonably be anticipated to (i) have a Material Adverse Effect (as defined below) or (ii) prevent or delay the timely consummation of the Restructuring. “Material Adverse Effect” shall mean any change, event, occurrence, effect, or state of facts that, individually, or aggregated with other such matters, is materially adverse to the business, assets (including intangible assets), properties, prospects, condition (financial or otherwise), or results of operations of the Company and its subsidiaries taken as a whole, but excluding changes, events, occurrences, effects or states of fact that customarily occur as a result of the commencement of a case under chapter 11 of the Bankruptcy Code. |

8. Timetable. The Company shall file petitions for relief for the Chapter 11 Cases no later than 5:00 p.m. (NY Time) on July 23, 2010 (the “Petition Date”). The Reorganization Plan, Disclosure Statement, and motion to approving bidding and sale procedures (including break-up fee, qualified bidder requirements; bid, sale hearing, auction and closing deadlines, and bidding rules) shall be filed as soon as practicable after commencement of the Chapter 11 Cases but in no event later than 15 days after the Petition Date. The Company shall obtain approval of the sale transaction contemplated hereby by no later than 90 days after the Petition Date.. The Bankruptcy Court shall confirm the Plan no later than 105 days after the Petition Date. The Effective Date of the Plan shall occur by the later of 125 days after the Petition Date or the date all conditions precedent to the Effective Date under the Plan are satisfied or waived. The dates provided in this Section 8 may be extended by agreement of the Required Participating Holders in writing.

9. Agreement to Support Company Restructuring. For so long as this Agreement remains in effect, and subject to the parties hereto fulfilling their respective obligations as provided herein, the Participating Holders, severally but not jointly, agree to (i) support approval of the Reorganization Plan; (ii) not, nor encourage any other person or entity to, delay, impede, appeal or take any other negative action, directly or indirectly, to interfere with, the approval of the Reorganization Plan; (iii) cooperate with the Company by providing the Company with information about Participating Holders that, based upon advice of counsel, the Company reasonably believes is required to be included in the Disclosure Statement, and (iv) not commence any proceeding or prosecute, join in or otherwise support any objection to oppose or object to the Reorganization Plan.

3

10. Termination of Agreement. This Agreement shall terminate upon the occurrence of any “Agreement Termination Event (as hereinafter defined), unless the occurrence of such Agreement Termination Event is waived in writing by the Participating Holders. If any Agreement Termination Event occurs (and has not been waived) at the time when permission of the Bankruptcy Court shall be required for any Participating Holder to change or withdraw (or cause to be changed or withdrawn) its votes to accept the Reorganization Plan, the Company shall not oppose any attempt by such Participating Holder to change or withdraw (or cause to be changed or withdrawn) such votes at such time. Upon the occurrence of an Agreement Termination Event, unless such Agreement Termination Event is waived in accordance with the terms hereof, this Agreement shall terminate and no party hereto shall have any continuing liability or obligation to any other party hereunder and (i) each of the Participating Holders shall have all rights and remedies available to it under the applicable law and (ii) the obligations of each of the parties hereunder shall thereupon terminate and be of no further force and effect with respect to each party.

An “Agreement Termination Event” shall mean any of the following events, upon which the Agreement shall automatically terminate following the occurrence of such event, other than with respect to items (i), (ii), (iv) and (vii), upon which the Agreement shall terminate if such event remains uncured for five (5) days after receipt of written notice from the Required Participating Holders following the occurrence of such event:

i The Company shall have breached any provision of this Agreement, including but not limited to, ceasing to take any steps that are reasonably necessary to obtain approval of the Disclosure Statement and/or confirmation of the Reorganization Plan, as applicable, or any provision of any order (each, a “DIP Financing Order”) authorizing the Company to obtain post-petition financing in its Chapter 11 cases in accordance with the Debtor in Possession Loan and Security Agreement executed by the Parties hereto (the agreement governing such post-petition financing is referred to herein as the “DIP Financing Agreement” and the credit facility contemplated by the DIP Financing Agreement, the “DIP Facility”;

ii Any representation or warranty made by the Company to any Participating Holder in this Agreement shall have been untrue in any material respect when made or any breach of any covenant or material provision hereof by the Company shall have occurred;

iii The Company takes formal action (including, without limitation, the filing of a pleading in the Chapter 11 Case), or announces an intention to take or pursue action, inconsistent with (i) the Term Sheet, (ii) any of the Chapter 11 Documents, or (iii) the Financing Order or the DIP Financing Agreement, or selects the treatment of any claim or class from the contemplated alternatives set forth in the Term Sheet without the consent and approval of the Participating Holders;

iv The Chapter 11 Documents, including, without limitation, the Reorganization Plan, contain any term or condition (a) not set forth in the Term Sheet or (b) inconsistent with the Term Sheet or the DIP Financing Agreement, and such term or condition is not reasonably acceptable to the Participating Holders;

v There shall have been issued or remain in force any order, decree, or ruling by any court or governmental body having jurisdiction restraining or enjoining the consummation of or rendering illegal the transactions contemplated by this Agreement or the Reorganization Plan;

vi The Company shall propose, consent to, support, acquiesce or participate in the formulation of any out-of-court restructuring, any chapter 7 or chapter 11 plan of reorganization or liquidation or any other such similar reorganization or liquidation (whether foreign or domestic) other than the Restructuring as set forth on the Term Sheet and other than as agreed to by the Participating Holders;

4

vii The occurrence of a Material Adverse Effect;

viii If any of the final forms of the documents prepared in connection with or related to the Restructuring (including, without limitation, any stockholders' agreement, any certificate of incorporation, any bylaws, any document concerning the corporate governance of the Company upon the consummation of the Reorganization Plan or any document concerning the rights of Company shareholders or debtholders upon the consummation of the Reorganization Plan) necessary for the implementation of the Restructuring are not reasonably acceptable to the Participating Holders, including being inconsistent with any provisions of the Term Sheet;

ix The exclusive periods (as provided for in section 1121 of the Bankruptcy Code) to (a) file a plan of reorganization or (b) solicit acceptances thereof are terminated or expire as to any party other than the Participating Holders;

x [intentionally deleted].

xi The Reorganization Plan shall not have been confirmed by order (the “Confirmation Order”) entered by the Bankruptcy Court on or before one hundred and five (105) days following the Petition Date, and the Effective Date of such Plan shall not occur by the later of one hundred five (125) days after the Petition Date or the satisfaction of the conditions precedent to the Plan have been satisfied or waived

xii A trustee or examiner with enlarged powers shall have been appointed under section 1104 or 105 of the Bankruptcy Code for service in the Chapter 11 Cases;

xiii Any of the Chapter 11 Cases shall have been converted to a case under chapter 7 of the Bankruptcy Code;

xiv The Confirmation Order is not in form and substance reasonably acceptable to counsel for the Participating Holders; and

xv. Any affiliate or subsidiary of the Company object to the terms of this Agreement, the Term Sheet, or the proposed transactions contemplated thereby.

A Participating Holder may rescind its vote on the Reorganization Plan (which vote shall be null and void and have no further force and effect) by giving written notice thereof to the other Participating Holders and the Company if: (a) the Reorganization Plan is modified to provide any term that is inconsistent with the Term Sheet, (b) after filing the Reorganization Plan, the Company (i) submits a second or amended plan of reorganization that changes, modifies, or deletes any provision of the Term Sheet in any respect, or (ii) moves to withdraw the Reorganization Plan, (c) the Company fails to satisfy any term or condition set forth in this Agreement, or (d) the Company is in breach of any DIP Financing Order or the DIP Financing Agreement. After giving notice pursuant to this Section and no cure having occurred within five (5) days after the Company's receipt of such notice, this Agreement shall be of no force and effect with respect to and as between the terminating Participating Holder and the Company.

11. Fiduciary Obligations .. The Company may terminate this Agreement upon five (5) days’ written notice to the Participating Holders (A) that the Company has been presented with a financing proposal to fund a transaction as an alternative to the transaction contemplated by this Agreement, provided that such proposal is contained in a plan of reorganization that is filed with the Bankruptcy Court that provides for the payment in full, in cash, of all outstanding obligations under the DIP Facility and all obligations under the Company’s prepetition debentures, and the filing of such plan, as well as the timetable for confirmation and effectiveness of such plan complies with the timetable set forth herein in Section 8, and provided further that such proposal is a proposal of committed funds and not conditioned upon financing and has been proposed by a creditworthy source; (B) if the Participating Holders have not funded the DIP Facility, provided the Company is not in default of the DIP Facility; or (C) subject to the terms herein, if after solicitation of votes for the Plan, the Debenture classes of the Participating Debenture Holders vote to reject the Plan and the Company cannot confirm its case.

5

12. Representations and Warranties. The Company represents and warrants that (i) to the extent applicable, it is duly organized, validly existing, and in good standing under the laws of the jurisdiction of its formation, (ii) its execution, delivery, and performance of this Agreement are within the power and authority of such party and have been duly authorized by such party and that no other approval or authorization is required, (iii) this Agreement has been duly executed and delivered by it and constitutes its legal, valid, and binding obligation, enforceable in accordance with the terms hereof, subject to bankruptcy, insolvency, fraudulent conveyance, and similar laws affecting the rights or remedies of creditors generally, and (iv) none of the execution and delivery of this Agreement or compliance with the terms and provisions hereof will violate, conflict with, or result in a breach of, its certificate of incorporation or bylaws or other constitutive document, any applicable law or regulation, any order, writ, injunction, or decree of any court or governmental authority or agency, or any agreement or instrument to which it is a party or by which it is bound or to which it is subject.

Each Participating Holder represents and warrants that it is either the beneficial owner, of the principal amount of the Debentures set forth in the signature pages hereof.

13. Covenants.

| | a) | Each Participating Holder, the Company and its affiliates and subsidiaries agrees to use commercially reasonable efforts to (i) support and complete the Restructuring and (ii) do all things reasonably necessary and appropriate in furtherance thereof. |

| | b) | Each party hereby further covenants and agrees to negotiate the definitive documents relating to the Restructuring in good faith. The Company shall keep the Participating Holders apprised of any discussions, negotiations or meetings with any other creditor constituency. |

14. Impact of Appointment to Creditors' Committee. Notwithstanding anything herein to the contrary, if any Participating Holder is appointed to and serves on an official committee of creditors in the Chapter 11 Cases, the terms of this Agreement shall not be construed so as to limit such Participating Holder's exercise (in its sole discretion) of its fiduciary duties, if any, to any person arising from its service on such committee, and any such exercise of such fiduciary duties shall not be deemed to constitute a breach of the terms of this Agreement.

15. Approval, Acceptance, Waiver, or Consent by Participating Holders. Where this Agreement provides that the Participating Holders may agree, waive, accept, consent, or approve any action or document, including, but not limited to, the Participating Holder's approval of documents in “form and substance reasonably acceptable” to the Participating Holders, then approval by Participating Holders owning at least 66.67% in principal amount of the Debentures owned by all of the Participating Holders (“Required Participating Holders”) will constitute such agreement, waiver, acceptance, consent, or approval, as applicable. The Participating Holders agree that they will respond to any waiver, approval, request for acceptance, or consent sought by the Company within three (3) business days.

16. Governing Law; Jurisdiction. This Agreement shall be governed by and construed in accordance with the internal laws of the state of New York, without regard to any conflicts of law provisions which would require the application of the law of any other jurisdiction. By its execution and delivery of this agreement, each of the parties hereby irrevocably and unconditionally agrees for itself that any legal action, suit, or proceeding against it with respect to any matter under or arising out of or in connection with this Agreement or for recognition or enforcement of any judgment rendered in any such action, suit, or proceeding, shall be brought in the United States District Court for the Southern District of New York or in any New York state court, and, by execution and delivery of this Agreement, each of the parties hereby irrevocably accepts and submits itself to the exclusive jurisdiction of such court, generally and unconditionally, with respect to any such action, suit, or proceeding and agrees that service of process in connection therewith shall be effective if made by first class mail and shall not contest the form of manner of such service. Notwithstanding the foregoing consent to New York jurisdiction, upon the commencement of the Chapter 11 Cases, the parties agree that the Bankruptcy Court shall have exclusive jurisdiction of all matters arising out of or in connection with the Participating Holders' obligations under this Agreement and that the parties shall not seek to enforce this Agreement in any other court.

6

17. Specific Performance. It is understood and agreed by the parties to this Agreement that money damages would not be a sufficient remedy for any breach of this Agreement by any party, and each non-breaching party shall be entitled to seek specific performance and injunctive or other equitable relief as a remedy of any such breach, including, without limitation, an order of the Bankruptcy Court requiring any party to comply promptly with any of its obligations hereunder.

18. Reservation of Rights. This Agreement and the Reorganization Plan are part of a proposed settlement of disputes among the parties hereto. Except as expressly provided in this Agreement, nothing herein is intended to, or does, in any manner waive, limit, impair or restrict the ability of the Company and each of the Participating Holders to protect and preserve its rights, remedies and interests, including without limitation, with respect to each Participating Holder its claims against the Company or its full participation in any bankruptcy case filed by the Company. If the transactions contemplated herein or in the Reorganization Plan are not consummated, or if this Agreement is terminated, the parties hereto fully reserve any and all of their rights. Pursuant to Rule 408 of the Federal Rules of Evidence and any applicable state rules of evidence, this Agreement shall not be admitted into evidence in any proceeding other than a proceeding to enforce its terms.

19. Headings. The headings of the Sections and Subsections of this Agreement are inserted for convenience only and shall not affect the interpretation hereof.

20. Successors and Assigns. This Agreement is intended to bind and inure to the benefit of the parties and their respective successors, assigns, heirs, executors, administrators and representatives. If any Participating Holder transfers or assigns its debt , it shall provide any such transferee a copy of this Agreement and notify the Company of such transfer. The agreements, representations and obligations of the Participating Holders under this Agreement are, in all respects, several and not joint.

21. Notice. Notices given under this agreement shall be to:

If to the Company:

Global Capacity Group, Inc.

200 S. Wacker Drive, Suite 1600

Chicago, IL 60606

Attn: Patrick C. Shutt

and

Heller, Draper, Hayden, Patrick & Horn, LLC

650 Poydras Street, Suite 2500

New Orleans, La. 70130

Attn: Douglas S. Draper, Esq.

-and-

If to Any Participating Holder or the Participating Holders:

At the address set forth on the signature pages hereto

7

-and-

Olshan Grundman Frome Rosenzweig & Wolosky LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022-1106

Attn: Adam H. Friedman, Esq.

22. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which shall constitute one and the same Agreement. This Agreement may be executed and delivered by hand, facsimile, or by electronic mail in portable document format.

23. Amendments and Waivers. This Agreement may not be modified, amended, or supplemented except in writing signed by the signatories to this Agreement.

24. No Third Party Beneficiaries. Unless expressly stated herein, this Agreement shall be solely for the benefit of the parties hereto and no other person or entity.

25. . No Solicitation. This Agreement is not and shall not be deemed to be a solicitation for votes in favor of the Reorganization Plan in the Chapter 11 Cases. The vote of each of the Participating Holders' with respect to the Reorganization Plan will not be solicited until such Participating Holder has received the Reorganization Plan and Disclosure Statement. Each party hereto acknowledges that it has been represented by counsel in connection with this Agreement and the transactions contemplated hereby. The provisions of this Agreement shall be interpreted in a reasonable manner to effectuate the intent of the parties hereto.

26. . Several, but not Joint Liability. The obligations of each Participating Holder hereunder shall be several and not joint, and for avoidance of doubt, no Participating Holder shall be liable for obligations or liabilities of any other Participating Holder or for any breach by any other Participating Holder under this Agreement, the DIP Financing Agreement or any other Chapter 11 Document.

27. Consideration. It is hereby acknowledged by the parties hereto that no consideration shall be due or paid to the Participating Holders for their agreement to vote to accept the Reorganization Plan in accordance with the terms and conditions of this Agreement other than the Company's agreement to commence the Chapter 11 Cases and, if applicable, to use its best efforts to take all steps necessary to obtain approval of the Disclosure Statement and to seek to confirm, consummate and implement the Reorganization Plan in accordance with the terms and conditions of the transaction contemplated by the Restructuring and this Agreement.

24. Severability. Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement shall be prohibited by or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Agreement.

(signature pages follow)

8

Exhibit A to Plan Support and Restructuring Agreement

GLOBAL CAPACITY GROUP, INC, et al.

TERM SHEET FOR SALE UNDER A PROPOSED SALE/PLAN OF REORGANIZATION

The following is an outline of the principal terms and conditions of a proposed Plan of Reorganization (the “Proposed POR”) including a sale of the Assets to a Newco formed by the holders (collectively the “Debenture Holders”) of the July/ August Debentures, VPP Debentures, the March Debentures, and the November Debentures (as defined below, and collectively, the “Debentures”) issued by Capital Growth Systems, Inc. (together with its subsidiaries and affiliates, the “Company”) that participate in the DIP Facility described below (the “Participating Debenture Holders”). This term sheet (this “Term Sheet”) and the proposals contained herein are subject to, among other conditions, the completion of legal, financial and other due diligence by the Parties and their advisors and does not, and shall not be construed to, indicate the agreement by any parties to support the Proposed POR contemplated hereby until mutually agreeable, definitive documentation is executed and delivered. This Term Sheet does not contain all of the terms of any Proposed POR and, except for the provisions set forth below under the heading “Exclusivity”, shall not be construed as (i) an offer capable of acceptance, (ii) a binding agreement of any kind, (iii) a commitment to enter into, or offer to enter into, any agreement, or (iv) an agreement to file any plan of reorganization or disclosure statement or consummate any transaction or to vote for or otherwise support any plan of reorganization or any restructuring. Nothing in this Term Sheet shall affect in any way, nor be deemed a waiver of, any of the rights of the Company or the Debenture Holders.

This Term Sheet is not a solicitation of acceptances or rejections with respect to any restructuring plan or reorganization. Any such solicitation will be conducted in accordance with the Bankruptcy Code and/or applicable securities laws. Any POR based hereon is subject to approval by the Bankruptcy Court. This Term Sheet and all related communications are for discussion and settlement purposes only and shall be deemed to be settlement negotiations and subject to Rule 408 of the Federal Rules of Evidence and any other applicable state or federal law or rule.

| I. | TREATMENT OF CLAIMS AND INTERESTS UNDER THE PLAN |

This Term Sheet is conditioned on the consummation of a confirmed chapter 11 plan of reorganization of the Company satisfactory to the Company and the Participating Debenture Holders (the “POR”) or other sale transaction. Except as specified below, claims and interests shall be satisfied in full by the delivery of the applicable consideration with respect to any class as soon as practicable after the effective date of the POR (the “Effective Date”).

| Newco | The Participating Debenture Holders will form a Newco, in a form acceptable to them, with which to purchase the Assets of the Company as part of the POR.1 |

1 The Company, in consultation with the Participating Debenture Holders, Newco, and the Reorganized Debtor, as the case may be, shall seek to preserve any and all net operating losses of the Company, including, but not limited to, through the POR and any transaction contemplated hereby. At the option of the Participating Debenture Holders, the Reorganized Debtor may remain a public company.

| DIP Facility | There shall be a $10.25 million DIP Facility providing for the terms set forth in the Debtor in Possession Loan and Security Agreement to be executed by the parties thereto, including but not limited to the payoff of the senior secured claim of Pivotal Global Capacity, LLC in the approximate amount of $5.1 million and $3.2 million of Vendor Utility Deposits. The DIP Facility and any advances thereunder are subject to execution of definitive Loan Documents. The DIP Financing Order shall require that (a) the Plan and Disclosure Statement and Motion to Approve Bid Procedures be filed no later than 15 days after the Petition Date, (b) a hearing to confirm a winning bidder and to approve the sale of the Assets thereto be held no later than 90 days after the Petition Date, (c) Confirmation of the POR occur no later than 105 days after the Petition Date (the “Confirmation Deadline”), and (d) the Effective Date be no later than the later of (i) 125 days after the Petition Date or (ii) the date on which all conditions precedent to the Effective Date have been met or waived. | ||

| Purchase of Assets and Assumption of Liabilities under POR or 363 Sale Transaction | Newco shall be the Stalking Horse bidder on, and if it is the winning bidder purchase the assets of the Company in, a sale pursuant to Section 363 of the Bankruptcy Code (a “363 Sale”), which sale shall be a component of a POR subject to clause 6 below, as follows: | ||

| 1. 2. 3. 4. 5. 6. | Credit bid of all or some, in Newco’s discretion, of (i) the liens and pre-petition amounts due under the Debentures , including accrued OID and (ii) Tranche B amounts due under the DIP Facility plus accrued interest; Issuance to the Company of common stock of Newco representing 10% of the outstanding shares of New Common Stock (as defined below) on a Fully-Diluted Basis (the “New Common Stock Pool”); As more fully set forth below, assumption of all mission critical vendor payments; As more fully set forth below, assumption or payment of (i) the Tranche A Loan in full and (ii) all administrative and priority payments set forth in the Budget (subject to any variances from the Budget permitted by or pursuant to the Credit Agreement) and the Exit Capital Requirements, annexed hereto as Schedule 1 and Schedule 2, respectively, as allowed by the Bankruptcy Court; Establishment and payment of a wind-down fund for the Estate, consistent with the Budget, mutually acceptable to the Company and the Participating Debenture Holders. If, pursuant to an order issued by the Bankruptcy Court, Newco is the winning bidder, either the assets of the Company shall be sold to Newco pursuant a 363 Sale, which sale shall be a component of a POR, for the consideration set forth in the winning bid or a transaction having substantially the same effect shall be consummated as a restructuring of the Company pursuant to a POR (the Company, as restructured pursuant to such a POR, the “Reorganized Debtor”); provided, however, that if the POR is not confirmed by the Confirmation Deadline or an Event of Default occurs under the DIP Facility, then, if the Participating Debenture Holders so elect, the assets of the Company shall be sold to Newco pursuant to a sale order as a 363 Sale outside of a plan for the consideration set forth in the winning bid. | ||

Page | 2

| Conditional Exclusivity for Stalking Horse Status | For a period from the Petition Date through the date that is forty-five (45) days after the date of the filing of an agreed upon Plan and Disclosure Statement and Motion to Approve Bid Procedures (the “Exclusivity Period”), Newco shall have the exclusive right to provide a commitment of funds and/or agreements to meet in order to satisfy the Stalking Horse bid requirements. In the event Newco is unable to commit to the necessary funds or have the necessary agreements in place by the end of the Exclusivity Period, (a) the Company shall have the option to extend Newco’s exclusivity or immediately select a different Stalking Horse bidder and/or proceed to conduct an orderly and open sales process with or without a Stalking Horse Bidder and (b) Newco shall have no obligation to participate in the bidding. If this occurs, it will not be an event of default under the DIP or a Termination Event under the Plan Support Agreement. Notwithstanding anything to the contrary set forth herein, any bid or sale procedures shall include a provision that (a) the Participating Debenture Holders are qualified bidders, (b) the Participating Debenture Holders may credit bid the full amount of their pre-petition and post-petition debt and (c) any bid of the Participating Debenture Holders is subject only to the Participating Debenture Holders providing adequate assurances per the approval of the Bankruptcy Court. |

| Administrative Expense Claims | Newco shall assume and pay each holder of an allowed Administrative Expense set forth in the Budget and Exit Capital Requirements in full and final satisfaction of such allowed Administrative Expense Claim, as follows: either (i) in cash, in full on the later of (x) the Effective Date and (y) the date such claim becomes allowed, or due and payable in the ordinary course of business or (ii) on such other terms and conditions as may be agreed between the holder of such claim, on the one hand, and the Company and the Debenture Holders, on the other hand. |

| Priority Non-Tax Claims | Newco shall assume and pay each holder of an allowed Priority Non-Tax Claim set forth in the Budget and Exit Capital Requirements, in full and final satisfaction of such Priority Non-Tax Claim, be paid in full in cash on the Effective Date, unless the holder of such claim agrees to deferred cash payments of a value, as of the Effective Date of the POR, equal to the amount of such claim. |

| Priority Tax Claims | Newco shall assume and pay each allowed Priority Tax Claim set forth in the Exit Capital Requirements, in full and final satisfaction of such allowed Priority Tax Claim, in accordance with the Bankruptcy Code. |

| Tranche A DIP Facility Claim | Newco shall assume and pay each holder of an allowed Tranche A DIP Facility Claim in full on the Effective Date of the POR, unless otherwise agreed to in writing by the holders of the Tranche A DIP Facility Claims. |

Page | 3

| Debenture Holders and other Tranche B Lenders | As determined by Newco, the Debenture Holders and other Tranche B Lenders shall be entitled to preferred stock in Newco in accordance with the following2: Each holder of an allowed Tranche B DIP Facility Claim shall receive, in full and final satisfaction of such allowed Tranche B DIP Facility Claim, its pro-rata share (based on its interest in the Tranche B Loan) of Series C Preferred Stock. “Series C Preferred Stock” means participating convertible preferred stock of Newco (or a Reorganized Debtor, as applicable) that (i) will have a liquidation preference, senior to all other capital stock of the issuer, equal in the aggregate to the total amount of the Tranche B DIP Facility Claim (including all outstanding principal of and accrued and unpaid interest on the Tranche B Loan), (ii) will be convertible, at the option of the respective holders thereof as to the shares thereof held by each of them, into shares of New Common Stock representing in the aggregate up to 63% of the issued and outstanding New Common Stock on a Fully-Diluted Basis, subject to dilution by the Exit Financing,3 and (iii) will entitle the holders thereof to voting rights on the basis of one vote for each share of New Common Stock into which the Series C Preferred Stock is convertible. “New Common Stock” means the common stock of Newco (or the Reorganized Debtor, as applicable). “Fully-Diluted Basis” means as if all shares of the Series C Preferred Stock, the Series B Preferred Stock and the Series A Preferred Stock were converted to New Common Stock in accordance with the respective terms of such preferred stock. Each holder of an allowed July or August Debenture Claim shall receive, in full and final satisfaction of such allowed July or August Debenture Claim, a number of shares of Series B Preferred Stock based upon a formula taking into account the outstanding amount of the July or August Debenture Claim held by it and the level of its participation in the Tranche B DIP Facility. “Series B Preferred Stock” means participating convertible preferred stock of Newco (or a Reorganized Debtor, as applicable) that (i) will have an aggregate liquidation preference of $6,000,000, senior to all other capital stock of the issuer other than Series C Preferred Stock, (ii) will be convertible, at the option of the respective holders thereof as to the shares thereof held by each of them, into shares of New Common Stock representing in the aggregate up to 13.5% of the issued and outstanding New Common Stock on a Fully-Diluted Basis, subject to dilution by the Exit Financing, and (iii) will entitle the holders thereof to voting rights on the basis of one vote for each share of New Common Stock into which the Series B Preferred Stock is convertible. Each holder of an allowed VPP, March or November Debenture Claim shall receive, in full and final satisfaction of such allowed VPP, March or November Debenture Claim, a number of shares of Series A Preferred Stock based upon a formula taking into account the outstanding amount of the VPP, March or November Debenture Claim held by it and the level of its participation in the Tranche B DIP Facility. “Series A Preferred Stock” means participating convertible preferred stock of Newco (or a Reorganized Debtor, as applicable) that (i) will have an aggregate liquidation preference of $6,000,000, senior to all other capital stock of the issuer other than Series C Preferred Stock and Series B Preferred Stock, (ii) will be convertible, at the option of the respective holders thereof as to the shares thereof held by each of them, into shares of New Common Stock representing in the aggregate up to 13.5% of the issued and outstanding New Common Stock on a Fully-Diluted Basis, subject to dilution by the Exit Financing, and (iii) will entitle the holders thereof to voting rights on the basis of one vote for each share of New Common Stock into which the Series A Preferred Stock is convertible. |

2 Each class of Debentures will constitute a separate class in the Bankruptcy.

3 The Exit Financing may be in the form of a capital raise, rights offering or similar transaction(s).

Page | 4

| Bidding and Sales Procedures | The Participating Debenture Holders and the Company shall agree to mutually acceptable bidding and sales procedures for the 363 Sale. |

| General Unsecured Claims & Equity Interests | To the extent permitted by the Bankruptcy Court, each holder of an allowed General Unsecured Claim (including any deficiency claim) and common equity interests of any kind in the Company, shall participate in the New Common Stock Pool in such manner as the Board of the Company may determine, and, if so requested by the Company, the Participating Debenture Holders will waive any right to participate in the New Common Stock Pool or other distribution in respect of their deficiency claims (if any). |

| Documentation | Any plan of reorganization and related disclosure statement and related documentation shall be in form and substance reasonably satisfactory to the Company and the Participating Debenture Holders. |

| Additional Capital Requirements | It is anticipated that Newco will require additional capital to fund the acquisition or reorganization. Newco will work with CapStone Investments during the Exclusivity Period to immediately establish market terms acceptable to Newco. In the event CapStone brings in additional capital on substantially the agreed upon terms, Newco will accept the capital. In the event the terms are substantially different, Newco can reject or accept such different terms at its own option. |

Page | 5

| CRO Function | During the Exclusivity Period (to be extended until the closing date of the Sale in the event Newco provides a satisfactory commitment to provide sufficient funds to be the Stalking Horse bidder on or before the end of the Exclusivity Period), George King and Mark Rubin will report directly to the Board of the Company and will jointly carry out the functions of a CRO, including but not limited to the following: 1. Implementing and leading the Company’s restructuring efforts in Bankruptcy Court; 2. Supervision of accounting functions and financial reporting; 3. Ensuring compliance with agreements, Budget, DIP Financing reporting requirements and Court orders; 4. Assisting the Company to comply with all US Trustee Guidelines, Bankruptcy Code & Rules and Local Bankruptcy Rule reporting requirements to ensure compliance with such rules and regulations; 5. Preparing the Company for sale; 6. Attendance at Court hearings and creditors meetings, including section 341 meetings; and 7. Claims reconciliation and similar bankruptcy functions Newco may retain an advisor to advise Newco on the Company operations and financing to insure the orderly operation of the Company until the POR is confirmed and the sale is closed. The Company will provide (a) up to $25,000 per month for the payment of such advisor and (b) complete transparency on all financial and operational issues. |

| Exclusivity | The Company shall not, directly or indirectly, through any director, officer, employee, accountant or other agent or representative (collectively, “Representatives”) of the Company or otherwise, solicit or entertain offers from, negotiate with or in any manner encourage, discuss, accept or consider any proposal of any person other than the Debenture Holders (and any other parties the Debenture Holders elect to include in the DIP Facility or any purchase or financing of the purchase of the Company’s assets) and their affiliates and Representatives relating to the provision of DIP financing to or the acquisition of all or any portion of the assets of the Company, except in accordance with the bid procedures approved by the Court. Notwithstanding any other provision of this Term Sheet, the Company agrees that the provisions of this and the immediately preceding sentence constitute the binding obligations of the Company. |

Page | 6

Schedule 1

Budget

[See attached.]

Page | 7

Page | 8

Schedule 2

Exit Capital Requirements

[See attached.]

Page | 9

Page | 10