LEASE by and between BMR-650 E KENDALL B LLC, a Delaware limited liability company and AVEO PHARMACEUTICALS, INC., a Delaware corporation TABLE OF CONTENTS

Exhibit 10.3

LEASE

by and between

BMR-650 E KENDALL B LLC,

a Delaware limited liability company

and

AVEO PHARMACEUTICALS, INC.,

a Delaware corporation

TABLE OF CONTENTS

| Page | ||||||

| 1. | Lease of Premises | 1 | ||||

| 2. | Basic Lease Provisions | 2 | ||||

| 3. | Term | 5 | ||||

| 4. | Possession and Commencement Date | 5 | ||||

| 5. | Condition of Premises | 7 | ||||

| 6. | Rentable Area | 7 | ||||

| 7. | Rent | 7 | ||||

| 8. | Rent Adjustments | 8 | ||||

| 9. | Operating Expenses | 8 | ||||

| 10. | Taxes on Tenant’s Property | 13 | ||||

| 11. | Security Deposit | 14 | ||||

| 12. | Use | 15 | ||||

| 13. | Rules and Regulations, CC&Rs, Parking Facilities and Common Areas | 18 | ||||

| 14. | Property Control by Landlord | 21 | ||||

| 15. | Quiet Enjoyment | 22 | ||||

| 16. | Utilities and Services | 22 | ||||

| 17. | Alterations | 25 | ||||

| 18. | Repairs and Maintenance | 28 | ||||

| 19. | Liens | 30 | ||||

| 20. | Estoppel Certificate | 31 | ||||

| 21. | Hazardous Materials | 32 | ||||

| 22. | Odors and Exhaust | 35 | ||||

| 23. | Insurance; Waiver of Subrogation | 36 | ||||

| 24. | Damage or Destruction | 38 | ||||

| 25. | Eminent Domain | 41 | ||||

| 26. | Surrender | 42 | ||||

| 27. | Holding Over | 42 | ||||

| 28. | Indemnification and Exculpation | 43 | ||||

| 29. | Assignment or Subletting | 44 | ||||

| 30. | Subordination and Attornment | 48 | ||||

| 31. | Defaults and Remedies | 49 | ||||

i

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 32. | Bankruptcy | 53 | ||||

| 33. | Brokers | 54 | ||||

| 34. | Definition of Landlord | 54 | ||||

| 35. | Limitation of Liability | 55 | ||||

| 36. | Joint and Several Obligations | 56 | ||||

| 37. | Representations | 56 | ||||

| 38. | Confidentiality | 57 | ||||

| 39. | Notices | 57 | ||||

| 40. | Rooftop Installation Area | 57 | ||||

| 41. | Miscellaneous | 59 | ||||

| 42. | Options to Extend Term | 61 | ||||

| 43. | Right of First Offer | 62 | ||||

| 44. | Right of First Refusal | 64 | ||||

ii

TABLE OF DEFINITIONS

| Page | ||||

| Accountant | 12 | |||

| ADA | 17 | |||

| Additional Rent | 7 | |||

| Affected Areas | 38 | |||

| Alterations | 25 | |||

| ANSI | 42 | |||

| Applicable Laws | 3, 5, 8, 9, 10 | |||

| Available ROFO Premises | 63 | |||

| Available ROFR Premises | 64 | |||

| Bankruptcy Code | 50 | |||

| Base Rent | 3 | |||

| Baseball Arbitrator | 61 | |||

| BMBL | 33 | |||

| Broker | 54 | |||

| Building | 1 | |||

| CC&R | 18 | |||

| Claims | 17 | |||

| Common Area | 1 | |||

| Cosmetic Alterations | 26 | |||

| Damage Repair Estimate | 39 | |||

| Default | 49 | |||

| Default Rate | 49 | |||

| DHHS | 33 | |||

| Discount Rate | 51 | |||

| Execution Date | 1 | |||

| Exempt Transfers | 44 | |||

| Existing Mortgagee | 48 | |||

| Exit Survey | 42 | |||

| FMV | 61 | |||

| Garage | 20 | |||

| Garage Operator | 20 | |||

| Garage Parking Spaces | 20 | |||

| Generator | 24 | |||

| Governmental Authority | 8 | |||

| Hazardous Material | 32 | |||

| Hazardous Materials Documents | 33 | |||

| HVAC | 5 | |||

| Independent Review | 11 | |||

| L/C Security | 14 | |||

| Land | 1 | |||

| Landlord | 1, 54 | |||

| Landlord Delay | 6 | |||

| Landlord Indemnitees | 17 | |||

| Landlord Parties | 37 | |||

iii

TABLE OF DEFINITIONS

(continued)

| Page | ||||

| Lease | 1 | |||

| Lender | 17 | |||

| Mortgagee | 48 | |||

| MWRA | 18 | |||

| New Tenant | 35 | |||

| Notice of Marketing | 63 | |||

| Notice of Offer | 64 | |||

| OFAC | 56 | |||

| Operating Expenses | 8 | |||

| Option | 61 | |||

| Option Notice | 61 | |||

| Phase 1 Premises | 5 | |||

| Phase 1 Premises Deadline | 5 | |||

| Phase 1 Premises Rent Commencement Date | 5 | |||

| Phase 1 Premises Tenant Improvements | 5 | |||

| Phase 2 Premises | 5 | |||

| Phase 2 Premises Rent Commencement Date | 5 | |||

| Phase 2 Premises Tenant Improvements | 5 | |||

| Premises | 1 | |||

| Property | 1 | |||

| Property Management Fee | 11 | |||

| Property Operations Agreements | 18 | |||

| REBA | 61 | |||

| REFA | 61 | |||

| Revenue Code | 45 | |||

| ROFO | 63 | |||

| ROFR | 64 | |||

| Rooftop Installation Area | 57 | |||

| Rules and Regulations | 18 | |||

| Security Deposit | 14 | |||

| Signage | 16 | |||

| SNDA | 48 | |||

| Specialty Alterations | 27 | |||

| Substantial Completion | 6 | |||

| Substantially Complete | 6 | |||

| Tenant | 1 | |||

| Tenant Improvements | 6 | |||

| Tenant Premises Notice | 2 | |||

| Tenant’s Affiliate | 44 | |||

| Tenant’s Parking Spaces | 19 | |||

| Tenant’s Rooftop Equipment | 58 | |||

| Tenant’s Share | 10 | |||

| Term | 5 | |||

| Term Expiration Date | 5 | |||

| Termination Notice | 39 | |||

iv

TABLE OF DEFINITIONS

(continued)

| Page | ||||

| TI Allowance | 6 | |||

| TI Deadline | 6 | |||

| Transfer | 44 | |||

| Transfer Date | 44 | |||

| Transfer Notice | 44 | |||

| UBC | 34 | |||

| Work Letter | 6 | |||

v

LEASE

THIS LEASE (this “Lease”) is entered into as of this 9th day of May, 2012 (the “Execution Date”), by and between BMR-650 E Kendall B LLC, a Delaware limited liability company (“Landlord”), and AVEO Pharmaceuticals, Inc., a Delaware corporation (“Tenant”).

RECITALS

A. WHEREAS, Landlord owns certain real property commonly known as Parcel B and described further on Exhibit A-1 attached hereto (the “Land”) and the improvements on the Property located at 650 East Kendall Street, Cambridge, Massachusetts, including the building and the Garage (as defined in Section 13.5) (collectively, the “Building”) in which the Premises (as defined below) are located; and

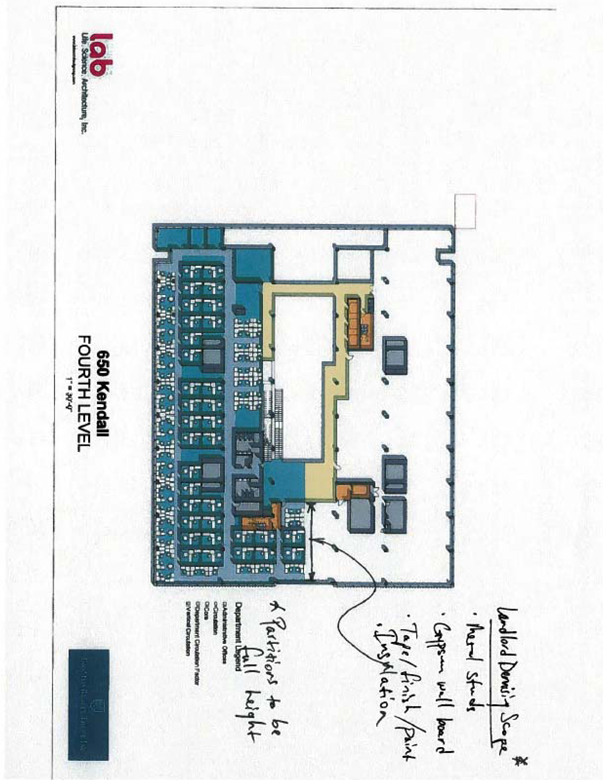

B. WHEREAS, Landlord wishes to lease to Tenant, and Tenant desires to lease from Landlord, certain premises (the “Premises”) located on a portion of the fourth (4th) floor, and the entire fifth (5th) and sixth (6th) floors, together with certain off-floor mechanical areas, of the Building, pursuant to the terms and conditions of this Lease, as detailed below.

AGREEMENT

NOW, THEREFORE, Landlord and Tenant, in consideration of the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, agree as follows:

1. Lease of Premises.

1.1. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises, as shown on Exhibit A attached hereto for use by Tenant in accordance with the Permitted Use (as defined below) and no other uses. The Building, Land and all landscaping, parking facilities, private drives and other improvements and appurtenances located thereon and related thereto, including the Building and other buildings located on the Land, are hereinafter collectively referred to as the “Property.” All portions of the Building and Property that are for the non-exclusive use of the tenants of the Property, such as service corridors, elevators, loading docks, public restrooms, public entranceways, lobbies and stairways, electric and telephone closets (other than those exclusively serving the Premises, if any), janitor closets, and other areas from time to time designated as common areas by Landlord (all to the extent located in the Building or on the Property) are hereinafter referred to as “Common Area.” The Premises exclude Common Areas, fan rooms, mechanical rooms, elevators wells, pipes, ducts, conduits, wires and appurtenant fixtures serving other parts of the Property (exclusively or in common), and any exterior walls (including without limitation the roof and roof system) and structural members of the Building. If the Premises include less than the entire rentable area of any floor, then the Premises also exclude the common corridors, elevator lobby and toilets located on such floor.

Tenant shall have the right, on or before to June 1, 2012, in each case by written notice (a “Tenant Premises Notice”) to Landlord identifying the alternative demising of the Premises proposed by Tenant, to (x) reduce or expand the portion of the Premises located on the fourth floor by adjusting the location of the demising walls between the Premises and contiguous leaseable areas on the fourth floor by an amount not to exceed five thousand (5,000) square feet of Rentable Area, provided that the remainder of the leaseable areas on the fourth floor are readily leaseable for multi-tenant purposes in a first class office and laboratory building, as reasonably determined by Landlord; there is no adverse impact on Building systems or structure as a result of such adjustment; and/or (y) substitute alternative, existing off-floor mechanical locations in the Building for the off-floor mechanical portions of the Premises, provided that such areas are, in Landlord’s reasonable determination, of an equivalent aggregate Rentable Area, do not impose an inequitable allocation or use of similar mechanical spaces for tenant spaces in the Building, do not reduce any leaseable areas of the Building, and do not adversely affect Building operations or access. Within 10 days following the giving of a Tenant Premises Notice, Landlord shall approve the proposed revised Premises or disapprove such proposal with specific reasons therefor. Landlord’s failure to respond within such ten day period shall be deemed approval by Landlord. Following the adjustment of the Premises in accordance with this Section, the parties shall enter into an amendment to this Lease substituting the revised Premises plans for the applicable floors of the Premises for the Premises plans initially attached as Exhibit A hereto, and the annual Base Rent, Tenant’s Parking Spaces, and Tenant’s Pro Rata Share (as each term is defined below) shall be adjusted accordingly based on the change in Rentable Area of the Premises as determined by Landlord in accordance with Article 6, below.

2. Basic Lease Provisions. For convenience of the parties, certain basic provisions of this Lease are set forth herein. The provisions set forth herein are subject to the remaining terms and conditions of this Lease and are to be interpreted in light of such remaining terms and conditions.

2.1. This Lease shall take effect upon the Execution Date and, except as specifically otherwise provided within this Lease, each of the provisions hereof shall be binding upon and inure to the benefit of Landlord and Tenant from the date of execution and delivery hereof by all parties hereto.

2.2. In the definitions below, each current Rentable Area (as defined below) is expressed in rentable square footage. Rentable Areas and “Tenant’s Pro Rata Shares” are all subject to adjustment only as expressly provided in this Lease.

| Definition or Provision | Means the Following (As of the Execution Date) | |

| Rentable Area of Premises | 126,065 square feet | |

| Rentable Area of Building | 291,498 square feet | |

| Rentable Area of Lab Building | 278,736 square feet | |

| Tenant’s Pro Rata Share of Building | 43.25% | |

| Tenant’s Pro Rata Share of Lab Building | 45.23% |

2

2.3. Initial monthly and annual installments of Base Rent for the Premises (“Base Rent”) as of the Phase 1 Premises Rent Commencement Date (as defined in Section 4.1 below), subject to adjustment under this Lease:

| Dates | Square Feet of Rentable Area for the Premises | Base Rent per Square Foot of Rentable Area of the Premises | Monthly Base Rent | Annual Base Rent | ||||||||||||

| Phase 1 Premises Rent Commencement Date – the date immediately preceding the first (1st) anniversary of the Phase 1 Premises Rent Commencement Date | 126,065 | $ | 54.50 annually | $ | 572,545.21 | $ | 6,870,542.50 | |||||||||

As further described in Section 4.1, below, Base Rent shall be prorated for the Premises between the Phase 1 and Phase 2 Premises, and only payable with respect to the Phase 1 Premises, until such time as the Phase 2 Premises Rent Commencement Date occurs.

2.4. Term Commencement Date: The date upon which Landlord delivers the Premises to Tenant in its “as is” condition as of the date hereof with a temporary demising wall constructed on the 4th floor of the Building that is reasonably sufficient for Tenant to secure such portion of the Premises, which date Landlord shall cause to occur no later than May 31, 2012.

2.5. Estimated Term Expiration Date: December 31, 2024.

2.6. Security Deposit: $2,862,726.

2.7. Permitted Use: Office and laboratory use in conformity with all federal, state, municipal and local laws, codes, ordinances, rules and regulations of Governmental Authorities (as defined below), committees, associations, or other regulatory committees, agencies or governing bodies having jurisdiction over the Premises, the Building, the Property, Landlord or Tenant, including both statutory and common law and hazardous waste rules and regulations (“Applicable Laws”). Tenant shall obtain validation by any medical review board or other similar governmental licensing of the Premises required for the Permitted Use.

3

| 2.8. Address for Rent Payment: | BMR-650 E Kendall B LLC | |

| Pursuant to the following wire instructions: | ||

| Name of beneficiary: BMR-650 E Kendall B LLC | ||

| Account number: 153495105154 | ||

| Bank Name: US Bank | ||

| Routing/Transit #: 122235821 | ||

| Branch Name & Address: San Diego Main | ||

| 600 W Broadway #100 | ||

| San Diego, CA 92101 | ||

| 2.9. Address for Notices to Landlord: | BMR-650 E Kendall B LLC | |

| 17190 Bernardo Center Drive | ||

| San Diego, California 92128 | ||

| Attn: Vice President, Real Estate Counsel | ||

| 2.10. Address for Notices to Tenant: | ||

| Prior to the Rent Commencement Date: | AVEO Pharmaceuticals, Inc. | |

| 75 Sidney Street | ||

| Cambridge, MA 02139 | ||

| Attn: Chief Financial Officer | ||

| On or after the Rent Commencement Date: | At the Premises | |

| With a copy to: | Langer & McLaughlin, LLP | |

| 855 Boylston Street | ||

| Boston, MA 02116 | ||

| 2.11. The following Exhibits are attached hereto and incorporated herein by reference: | ||

| Exhibit A | Premises | |||

| Exhibit A-1 | Land | |||

| Exhibit B | Work Letter | |||

| Exhibit B-1 | Scope of Landlord’s Demising Work | |||

| Exhibit C | Acknowledgement of Rent Commencement Date and Term Expiration Date | |||

| Exhibit D | Development Approvals | |||

| Exhibit E | Form of Letter of Credit | |||

| Exhibit F | Rules and Regulations | |||

| Exhibit G | Tenant’s Personal Property | |||

| Exhibit H | Form of Estoppel Certificate | |||

| Exhibit I | SNDA | |||

| Exhibit J | Rooftop Installation Area | |||

| Exhibit K | Kendall Square | |||

| Exhibit L | Tenant’s Signage Location |

4

3. Term. The actual term of this Lease (as the same may be extended pursuant to Article 42 hereof, and as the same may be earlier terminated in accordance with this Lease, the “Term”) shall commence on the Term Commencement Date and end on the date that is twelve (12) years after the actual Phase 1 Premises Rent Commencement Date (such date, the “Term Expiration Date”), subject to earlier termination of this Lease as provided herein, provided that if the Phase 1 Premises Rent Commencement Date is not the first day of a calendar month, then the Term Expiration Date shall be the last day of the calendar month in which the twelfth (12th) anniversary of the Phase 1 Premises Rent Commencement Date occurs.

4. Possession and Commencement Date.

4.1. Landlord has delivered to Tenant, broom clean and free of occupants, and Tenant has accepted possession of, the Premises as of the date hereof. Landlord represents and warrants to Tenant that, as of the date hereof, the heating, ventilation and air-conditioning (“HVAC”), electrical, life safety and plumbing systems of the Building are in good working condition and, to the best of Landlord’s knowledge, not in violation of Applicable Laws applicable to office and laboratory use, generally. Tenant shall undertake its Tenant Improvements and occupy the Premises for the conduct of its business in two phases. The “Phase 1 Premises” shall consist of not less than twenty thousand (20,000) square feet of Rentable Area on the sixth (6th) floor of the Building identified by Tenant to Landlord no later than June 1, 2012 (the “Phase 1 Premises Deadline”). If Tenant fails to provide Landlord with such notice by the Phase 1 Premises Deadline, then the Phase 1 Premises shall be as shown on Exhibit B-2 attached hereto. Promptly following the Phase 1 Premises Deadline, the parties shall enter into a written instrument confirming the square footage of Rentable Area of the Phase 1 Premises. The “Phase 2 Premises” shall consist of the balance of the Premises. The Rent Commencement Date shall be determined separately for each Phase and Base Rent shall be prorated based on the ratio of square footage of the Phase 1 Premises to the entire Premises until such time as the “Rent Commencement Date” occurs with respect to the entire Premises (i.e., until such time as the Phase 2 Premises Rent Commencement Date occurs). The “Phase 1 Premises Rent Commencement Date” shall be the earlier of (a) the Date earlier to occur of (i) Substantial Completion of the work described on Exhibit B with respect to the Phase 1 Premises (the “Phase 1 Premises Tenant Improvements”), and (ii) January 1, 2013 and (b) the date on which Tenant has occupied any portion of the Phase 1 Premises for the conduct of its business, as opposed to occupying any portion of the Phase 1 Premises for the installation of the Tenant Improvements (as defined below). The “Phase 2 Premises Rent Commencement Date” shall be the earlier of (y) the Date that is the earlier to occur of (i) Substantial Completion of the work described on Exhibit B with respect to the Phase 2 Premises (the “Phase 2 Premises Tenant Improvements” and, together with the Phase 1 Premises Tenant Improvements, the

5

“Tenant Improvements”), and (ii) November 1, 2013 and (z) the date on which Tenant has occupied any portion of the Phase 2 Premises for the conduct of its business, as opposed to occupying any portion of the Phase 2 Premises for the installation of the Tenant Improvements. Each of the Phase 1 Premises Rent Commencement Date and the Phase 2 Premises Rent Commencement Date shall be subject to extension for Landlord Delay as further described in Section 4 of Exhibit B hereto. Each party shall execute and deliver to the other written acknowledgment of the actual Commencement Date, the actual Phase 1 Premises Rent Commencement Date, the actual Phase 2 Premises Rent Commencement Date and/or the Term Expiration Date within ten (10) business days after request by the other party, substantially in the form attached as Exhibit C hereto. Failure to execute and deliver such acknowledgment, however, shall not affect the Phase 1 Premises Rent Commencement Date, the Phase 2 Premises Rent Commencement Date, the Term Expiration Date or Landlord’s or Tenant’s liability hereunder. The term “Substantially Complete” or “Substantial Completion” means that the applicable Phase of Tenant Improvements is substantially complete in accordance with the Approved Plans (as defined in Exhibit B hereto), except for minor punch list items, and that Tenant is able to lawfully occupy the Premises for the conduct of its business in accordance with the Permitted Use.

4.2. Tenant shall cause the Tenant Improvements to be constructed in the Premises pursuant to the Work Letter attached hereto as Exhibit B (the “Work Letter”) at a cost to Landlord not to exceed Eighteen Million Nine Hundred Nine Thousand Seven Hundred Fifty and 00/100 Dollars ($18,909,750.00) (based upon One Hundred Fifty and 00/100 Dollars ($150.00) per square foot of Rentable Area (as defined below)) (the “TI Allowance”). The TI Allowance may be applied to the costs of (s) construction, (t) building permits and other permits, approvals, taxes, fees, charges and levies by Governmental Authorities (as defined below) for permits or for inspections of the Tenant Improvements, and (u) costs and expenses for labor, material, equipment and fixtures. In no event shall the TI Allowance be used for (v) the cost of work that is not authorized by the Approved Plans (as defined in the Work Letter) or otherwise approved in writing by Landlord, (w) payments to Tenant or any affiliates of Tenant, (x) Tenant’s soft costs or the purchase of any furniture, personal property or other non-building system equipment, (y) costs resulting from any default by Tenant of its obligations under this Lease or (z) costs to extent recoverable by Tenant from a third party (e.g., insurers, warrantors, or tortfeasors). Notwithstanding the foregoing to the contrary, Tenant may apply up to ten percent (10%) of the TI Allowance toward the costs of Tenant’s architectural, engineering, and project management fees, data/telecom cabling, relocation expenses, and an additional amount up to ten percent (10%) of the TI Allowance towards the costs of Tenant’s furniture, fixtures and equipment installation related to the initial occupancy of the Premises. In no event shall any unused TI Allowance entitle Tenant to a credit against Rent payable under this Lease. Tenant shall have until May 31, 2014 (the “TI Deadline”) to requisition the unused portion of the TI Allowance, after which date Landlord’s obligation to fund such costs shall expire.

4.3. The Phase 1 Premises and Phase 2 Premises are sometimes generically referred to herein as a “Phase”.

6

4.4. Prior to entering upon the Premises, Tenant shall furnish to Landlord evidence satisfactory to Landlord that insurance coverages required of Tenant under the provisions of Article 23 are in effect.

5. Condition of Premises. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty with respect to the condition of the Premises, the Building or the Property, or with respect to the suitability of the Premises, the Building or the Property for the conduct of Tenant’s business, except as expressly set forth in this Lease. Without in any way derogating from Landlord’s ongoing maintenance, repair and restoration obligations set forth elsewhere in this Lease, Tenant acknowledges that (a) it is familiar with the condition of the Premises and agrees to take the same in its condition “as is” as of the Execution Date and (b) Landlord shall have no obligation to alter, repair or otherwise prepare the Premises for Tenant’s occupancy or to pay for or construct any improvements to the Premises, except with respect to the TI Allowance; provided, however, that Landlord shall separately demise that portion of the Premises located on the fourth (4th) floor of the Building separately as shown on Exhibit B-1 attached hereto and furnish and provide a reception desk in the main building lobby as further provided in Exhibit B, at Landlord’s sole cost and expense (in addition to the TI Allowance).

6. Rentable Area. The Rentable Areas initially set forth herein are deemed conclusive between the parties and are not subject to remeasurement, except that in the event that the size of the Premises or Building is actually reduced or expanded pursuant to the provisions of Articles 1, 24, 25, 43 or 44 below, the Rentable Areas (and, as applicable, Tenant’s Pro Rata Share) shall be adjusted as reasonably calculated by Landlord’s architect in a manner consistent with Landlord’s initial determination of Rentable Areas for the Premises and the Building.

7. Rent.

7.1. Tenant shall pay to Landlord as Base Rent for the Premises, commencing on the Phase 1 Premises Rent Commencement Date, the sums set forth in Section 2.3, subject to the rental adjustments provided in Section 4.1 and Article 8 hereof. Base Rent shall be paid in equal monthly installments, subject to the rental adjustments provided in Section 4.1 and Article 8 hereof, each in advance on the first day of each and every calendar month during the Term.

7.2. In addition to Base Rent, Tenant shall pay to Landlord as additional rent (“Additional Rent”) at times hereinafter specified in this Lease (a) Tenant’s Share (as defined below) of Operating Expenses (as defined below), (b) the Property Management Fee (as defined below) and (c) any other amounts that Tenant assumes or agrees to pay under the provisions of this Lease that are owed to Landlord, including any and all other sums that may become due by reason of any default of Tenant or failure on Tenant’s part to comply with the agreements, terms, covenants and conditions of this Lease to be performed by Tenant, after notice and the lapse of any applicable cure periods.

7.3. Base Rent and Additional Rent shall together be denominated “Rent.” Rent shall be paid to Landlord in lawful money of the United States of America at the office of Landlord as set forth in Section 2.8 or to such other person or at such other place as Landlord may from time designate in writing. In the event the Phase 1 Rent Commencement Date or Phase 2 Rent

7

Commencement Date occurs or the Term ends on a day other than the first day of a calendar month, then the Rent for such fraction of a month shall be prorated for such period on the basis of a thirty (30) day month and shall be paid at the then-current rate for such fractional month. All payments of Rent shall be made without set-off, deduction or offset except as expressly provided in this Lease. Without limiting the foregoing, Tenant’s obligation to pay Rent shall be absolute, unconditional, and independent and shall not be discharged or otherwise affected by any Applicable Laws now or hereafter applicable to the Premises, or any other restriction on Tenant’s use, or, except as provided in Articles 24 and 25, any casualty or taking, or any failure by Landlord to perform or other occurrence; and Tenant assumes the risk of the foregoing and waives all rights now or hereafter existing to quit or surrender the Premises or any part thereof, to terminate or cancel this Lease, or to assert any defense in the nature of constructive eviction in any action seeking to recover rent (other than mandatory counterclaims). Subject to the provisions of this Lease, however, Tenant shall have the right to injunctive relieve or to seek judgments for direct money damages occasioned by Landlord’s breach of its Lease covenants (but may not set-off any such judgment against any rent or other amount owing hereunder). Nothing in this Section 7.3 shall limit the exercise of Tenant’s express remedies on the terms and conditions set forth in Sections 16.2 and 18.3 below).

8. Rent Adjustments. Base Rent shall be subject to an annual upward adjustment of three percent (3%) of the then-current Base Rent during the initial Term. The first such adjustment shall become effective commencing on the first (1st) annual anniversary of the Phase 1 Premises Rent Commencement Date, and subsequent adjustments shall become effective on every successive annual anniversary for the remainder of the initial Term of this Lease.

9. Operating Expenses.

9.1. As used herein, the term “Operating Expenses” shall include:

(a) Government impositions, including property tax costs consisting of real and personal property taxes and assessments (including amounts due under any improvement bond upon the Building or the Property (including the parcel or parcels of real property upon which the Building, the other buildings on the Property and areas serving the Building and the Property are located)) or assessments in lieu thereof imposed by any federal, state, regional, local or municipal governmental authority, agency or subdivision (each, a “Governmental Authority”); taxes on or measured by gross rentals received from the rental of space in the Property; taxes based on the square footage of the Premises, the Building or the Property, as well as any parking charges, utilities surcharges or any other costs levied, assessed or imposed by, or at the direction of, or resulting from Applicable Laws or interpretations thereof, promulgated by any Governmental Authority in connection with the use or occupancy of the Building or Property or the parking facilities serving the Building; any actual and reasonable third party expenses, including the reasonable cost of attorneys or experts, reasonably incurred by Landlord in seeking reduction by the taxing authority of the applicable taxes. If Landlord is successful in obtaining any refund, abatement or other reduction of any taxes payable in respect of the Property for any year for which Tenant has paid Operating Expenses, Landlord shall promptly refund to Tenant Tenant’s Pro Rata Share of the Building of such refund, abatement or other reduction (including any interest paid by the taxing authority),

8

but in any event not to exceed amounts actually paid by Tenant on account of such taxes during such period. To the extent that Landlord is billed for any taxes on the execution of this Lease or any other document to which Tenant is a party creating or transferring an interest in the Premises, Tenant shall pay the same directly to Landlord within thirty (30) days after receipt of an invoice therefor (which invoice shall be accompanied by a copy of the applicable tax bill(s)). Operating Expenses shall not include any state, federal or local net income, franchise, capital stock, estate, transfer or inheritance taxes, or taxes that are the personal obligation of Tenant or of another tenant of the Property; and

(b) All other actual third party costs (or costs for Landlord personnel or services provided by Landlord so long as the same is provided at a cost that does not exceed the cost of such personnel or service rendered by unaffiliated third parties on a competitive basis) of any kind paid or incurred by Landlord in connection with the operation or maintenance of the Building and the Property, including costs of repairs and replacements to improvements within the Property as appropriate to maintain the Property as required hereunder; costs of utilities furnished to the Common Areas; sewer fees; trash collection (including recyclables, but excluding special handling or collection costs associated with collection of any Hazardous Materials not customarily collected in the ordinary maintenance of a first class office and laboratory building); Common Area cleaning, including windows; heating; ventilation; air-conditioning; maintenance of landscaping and grounds; maintenance of drives and parking areas; maintenance of the roof; security services and devices; building supplies; maintenance or replacement of equipment utilized for operation and maintenance of the Property; license, permit and inspection fees; sales, use and excise taxes on goods and services purchased by Landlord in connection with the operation, maintenance or repair of the Building or Property systems and equipment; telephone, postage, stationery supplies and other expenses incurred in connection with the operation, maintenance or repair of the Property; accounting, legal and other professional fees and expenses incurred in connection with the Property; costs of furniture, draperies, carpeting, landscaping, snow removal and other customary and ordinary items of personal property provided by Landlord for use in Common Areas; Property office rent or rental value for a commercially reasonable amount of space, to the extent an office used for Property operations is maintained at the Property, plus customary expenses for such office; capital expenditures amortized over the useful life thereof, as reasonably determined by Landlord, in accordance with generally accepted accounting principles; costs of complying with Applicable Laws (except to the extent such costs are incurred to remedy non-compliance as of the Execution Date with Applicable Laws); costs to keep the Property in compliance with, or fees otherwise required under, any Property Operations Agreements (as defined below); insurance premiums; portions of insured losses paid by Landlord as part of a deductible portion of a loss pursuant to the terms of insurance policies (provided that such deductibles are commercially reasonable); service contracts; costs of services of independent contractors retained to do work of a nature referenced above; and costs of compensation (including employment taxes and fringe benefits) of all persons who perform regular and recurring duties connected with the day-to-day operation and maintenance of the Property, its equipment, the adjacent walks, landscaped areas, drives and parking areas, including janitors, floor waxers, window washers, watchmen, gardeners, sweepers, plow trucks and handymen. Operating Expenses for each year will be calculated in a reasonably consistent manner.

9

(c) Notwithstanding the foregoing, Operating Expenses shall not include any (i) leasing commissions; (ii) expenses that relate to preparation of rental space for a tenant; (iii) expenses of initial development and construction of the Building, or of any expansion or elective upgrade (other than for the primary purpose of reducing Operating Expenses as described in clause (x) below) of the Building or Common Areas, including grading, paving, landscaping and decorating (as distinguished from maintenance, repair and replacement of the foregoing); (iv) legal expenses relating to other tenants; (v) costs of repairs to the extent Landlord is entitled to be reimbursed by payment of insurance, warranties or guaranties or by any other third party or parties; (vi) principal amount of, or interest upon loans to Landlord or secured by a mortgage or deed of trust covering the Property or a portion thereof; (vii) costs to operate, maintain, or repair the Garage; (viii) salaries of executive officers of Landlord; (ix) depreciation claimed by Landlord for tax purposes (other than amortization of capital expenditures as expressly provided herein); (x) capital improvements (as distinguished from repairs and maintenance) unless and except to the extent incurred (i) in replacing obsolete equipment or other capital items, (ii) for the primary purpose of reducing Operating Expenses or (iii) required by any Governmental Authority to comply with changes in Applicable Laws that take effect after the Execution Date or to ensure continued compliance with Applicable Laws in effect as of the Execution Date (but expressly excluding the costs of curing or contesting violations of Applicable Law that existed on or prior to the Execution Date); (xi) the cost of leasehold improvements, including without limitation redecorating or renovation work, for other tenants in the Building; (xii) to the extent of any increase in Landlord’s insurance rates which may result from the grossly negligent failure of Landlord or its agents, employees or contractors to comply with the provisions of this Lease; (xiii) the cost of any work or service performed for any tenant in the Building (other than Tenant) to a materially greater extent or in a materially more favorable manner than that furnished generally to tenants (including Tenant) in the Building; (xiv) the general corporate overhead costs and expenses of the Landlord entity (except to the extent of the Property Management Fee and personnel costs at the level of Senior Property or Facilities Manager and below to the extent related to the Property); (xv) costs and expenses incurred in any dispute with any particular tenant; (xvi) any costs of remediation of hazardous materials or substances in the Building, or on the land parcels on which it is located; (xvii) any costs (other than the Property Management Fee described below) representing an amount paid to an entity related to Landlord which is in excess of the amount which would have been paid absent such relationship; and (xviii) taxes that are excluded from Operating Expenses by the last sentence of Subsection 9.1(a). To the extent that Tenant uses more than Tenant’s Pro Rata Share of the Building of any item of Operating Expenses, Landlord shall provide notice to Tenant of such excess usage, and Tenant shall pay Landlord for such excess in addition to Tenant’s obligation to pay Tenant’s Pro Rata Share of Lab Building of Operating Expenses for the Property (such excess, together with Tenant’s Pro Rata Share of Lab Building, “Tenant’s Share”). Notwithstanding anything in this Article 9 to the contrary, Tenant’s Share with respect to taxes and other impositions as set forth in Subsection 9.1(a) and to expenses payable by the Building under the CC&Rs shall mean such excess together with Tenant’s Pro Rata Share of the Building. Nothing in this paragraph shall be deemed to limit the extent to which CC&Rs are included in Operating Expenses.

9.2. Tenant shall pay to Landlord on the first day of each calendar month of the Term, following the Phase 1 Premises Rent Commencement Date, as Additional Rent, (a) the Property Management Fee (as defined below) and (b) Landlord’s estimate of Tenant’s Share of Operating Expenses for such month.

10

(x) The “Property Management Fee” shall equal three percent (3%) of Base Rent due from Tenant. Tenant shall pay the Property Management Fee in accordance with Section 9.2 with respect to the entire Term, commencing on the applicable Rent Commencement Date, including any extensions thereof or any holdover periods, regardless of whether Tenant is obligated to pay Base Rent, Operating Expenses or any other Rent with respect to any such period or portion thereof, except as expressly provided in this Lease.

(y) Within ninety (90) days after the conclusion of each calendar year (or such longer period as may be reasonably required by Landlord but in any event not to exceed one year), Landlord shall furnish to Tenant a statement showing in reasonable detail the actual Operating Expenses and Tenant’s Share of Operating Expenses for the previous calendar year. Any additional sum due from Tenant to Landlord shall be due and payable within thirty (30) days. If the amounts paid by Tenant pursuant to this Section exceed Tenant’s Share of Operating Expenses for the previous calendar year, then Landlord shall credit the difference against Tenant’s Share of Operating Expenses next due and owing from Tenant; provided that, if the Term has expired, Landlord shall accompany such statement with payment for the amount of such difference.

(z) Any amount due under this Section for any period that is less than a full month shall be prorated (based on a thirty (30)-day month) for such fractional month.

9.3. Landlord’s annual statement shall be final and binding upon Tenant unless Tenant, within 180 days after Tenant’s receipt thereof, shall contest any item therein by giving written notice to Landlord, specifying in reasonable detail the reasons therefor; provided that Tenant shall in all events pay the amount specified in Landlord’s annual statement, pending the results of the Independent Review and determination of the Accountant(s), as applicable and as each such term is defined below. At the request of Tenant at any time within such 180-day period, Landlord shall provide Tenant with reasonable access to Landlord’s books and records to the extent relevant to determination of Operating Expenses, and such information as Landlord reasonably determines to be responsive to Tenant’s written inquiries. In the event that, after Tenant’s review of such information, Landlord and Tenant cannot agree upon the amount of Tenant’s Share of Operating Expenses, then Tenant shall have the right to have a qualified and reputable third party consultant or accounting firm hired by Tenant (but not on a contingent-fee basis) at Tenant’s sole cost and expense audit and review such of Landlord’s books and records for the year in question as directly relate to the determination of Operating Expenses for such year (the “Independent Review”). Landlord shall make such books and records available at the location where Landlord maintains them in the ordinary course of its business, but need not provide Tenant with copies of any books or records. Tenant shall commence the Independent Review within thirty (30) days after the date Landlord has given Tenant access to Landlord’s books and records for the Independent Review and following at least 10 days’ prior notice to Landlord of the identity of the consultant or accounting firm conducting such review so that Landlord can confirm that such reviewer meets the foregoing qualifications. Tenant shall complete the Independent Review and notify Landlord in writing of

11

Tenant’s specific objections to Landlord’s calculation of Operating Expenses (including Tenant’s accounting firm’s written statement of the basis, nature and amount of each proposed adjustment) no later than sixty (60) days after Landlord has first given Tenant access to Landlord’s books and records for the Independent Review. Landlord shall review the results of any such Independent Review. The parties shall endeavor to agree promptly and reasonably upon Operating Expenses taking into account the results of such Independent Review. If, as of sixty (60) days after Tenant has submitted the Independent Review to Landlord, the parties have not agreed on the appropriate adjustments to Operating Expenses, then the parties shall engage a mutually agreeable independent third party accountant with at least ten (10) years’ experience in commercial real estate accounting in the Kendall Square, Cambridge, Massachusetts area (the “Accountant”). If the parties cannot agree on the Accountant, each shall within ten (10) days after such impasse appoint an Accountant (different from the accountant and accounting firm that conducted the Independent Review) and, within ten (10) days after the appointment of both such Accountants, those two Accountants shall select a third (which cannot be the accountant and accounting firm that conducted the Independent Review). If either party fails to timely appoint an Accountant, then the Accountant the other party appoints shall be the sole Accountant. Within ten (10) days after appointment of the Accountant(s), Landlord and Tenant shall each simultaneously give the Accountants (with a copy to the other party) its determination of Operating Expenses, with such supporting data or information as each submitting party determines appropriate. Within ten (10) days after such submissions, the Accountants shall by majority vote select either Landlord’s or Tenant’s determination of Operating Expenses. The Accountants may not select or designate any other determination of Operating Expenses. The determination of the Accountant(s) shall bind the parties. If the parties agree or the Accountant(s) determine that the Operating Expenses actually paid by Tenant for the calendar year in question exceeded Tenant’s obligations for such calendar year, then Landlord shall, at Tenant’s option, either (a) credit the excess to the next succeeding installments of estimated Additional Rent or (b) pay the excess to Tenant within thirty (30) days after delivery of such results. If the parties agree or the Accountant(s) determine that Tenant’s payments of Operating Expenses for such calendar year were less than Tenant’s obligation for the calendar year, then Tenant shall pay the deficiency to Landlord within thirty (30) days after delivery of such results. If the Independent Review reveals or the Accountant(s) determine that the Operating Expenses billed to Tenant by Landlord and paid by Tenant to Landlord for the applicable calendar year in question exceeded by more than four percent (4%) what Tenant should have been billed during such calendar year, then Landlord shall pay the reasonable cost of the Independent Review and the Accountants. In all other cases, Tenant shall pay the cost of the Independent Review, and one-half of the cost of the Accountants. Any Operating Expense not billed to Tenant on or before the second (2nd) anniversary of the last day of the calendar year in which such Operating Expense was billed to or incurred by Landlord shall be deemed waived by Landlord, and Tenant shall have no liability or obligation with respect thereto.

9.4. Tenant shall not be responsible for Operating Expenses attributable to the time period prior to the Phase 1 Premises Rent Commencement Date, with respect to the Phase 1 Premises; or the Phase 2 Premises Rent Commencement Date, with respect to the Phase 2 Premises.

9.5. Operating Expenses for the calendar year in which Tenant’s obligation to share therein commences and for the calendar year in which such obligation ceases shall be prorated

12

on a commercially reasonable basis determined by Landlord and consistent with generally accepted commercial property accounting principles. Expenses such as taxes, assessments and insurance premiums that are incurred for an extended time period shall be prorated based upon the time periods to which they apply so that the amounts attributed to the Premises relate in a reasonable manner to the time period wherein Tenant has an obligation to share in Operating Expenses.

9.6. In the event that the Building is less than fully occupied, Tenant acknowledges that Landlord may extrapolate those particular items of Operating Expenses that vary depending on the occupancy of the Building to reflect the amount that would have been incurred for those particular expenses had the entire Building been occupied during such period; provided, however, that Landlord shall not recover more than one hundred percent (100%) of Operating Expenses.

10. Taxes on Tenant’s Property.

10.1. Tenant shall be responsible for any and all taxes levied against any personal property or trade fixtures placed by Tenant in or about the Premises. Tenant shall not be deemed to be in default of its obligations under the preceding sentence in the event that Tenant shall contest the validity of any such taxes by appellate or other proceedings permitted under Applicable Laws, provided that: (a) any such contest is made reasonably and in good faith, (b) Tenant makes commercially reasonable provisions reasonably acceptable to Landlord (which shall include posting bond(s) or giving other security satisfactory to Landlord if the Building or the Property are subjected to any liens arising out of such failure to pay or contest, with Tenant in each case agreeing to discharge or bond over any such liens within 15 days after such liens arise) to protect Landlord, the Building and the Property from any liabilities, costs, damages and expenses arising in connection with Tenant’s inability to pay, or the contest of, such taxes, (c) Tenant agrees to indemnify, defend (with counsel reasonably acceptable to Landlord) and hold Landlord harmless from and against any and all liabilities, costs, damages and expenses arising in connection with Tenant’s failure to pay, or contest of, such taxes as required by Applicable Law, and (d) Tenant promptly pays any and all such taxes in the event that it exhausts all available appeals without success or if such payment is required as a precondition to such contest.

10.2. If (a) (i) any such taxes on Tenant’s personal property or trade fixtures are levied against Landlord or Landlord’s property, or (ii) the assessed valuation of the Building or the Property is increased by inclusion therein of a value specifically attributed to Tenant’s personal property or trade fixtures, as evidenced by information provided in writing by the tax assessor, and (b) Landlord, after written notice to Tenant, pays the taxes on Tenant’s personal property or trade fixtures, then Tenant shall, upon demand, repay to Landlord the taxes so paid by Landlord.

13

11. Security Deposit.

11.1. Tenant shall deposit with Landlord on or before the Execution Date a letter of credit (the “L/C Security”) as the entire security deposit (the “Security Deposit”), as follows:

(a) Tenant shall provide Landlord, and maintain in full force and effect throughout the Term and until the date that is ninety (90) days after the then-current Term Expiration Date, a letter of credit substantially in the form of Exhibit E issued by an issuer reasonably satisfactory to Landlord, in the amount of the Security Deposit, with an initial term of at least one year. Landlord may require the L/C Security to be replaced by an L/C Security issued by a different issuer at any time during the Term if Landlord reasonably believes that the issuing bank of the L/C Security is or may soon become insolvent, in which event Landlord shall cooperate with Tenant to arrange for the replacement of the L/C Security in a manner that does not require the simultaneous issuance of two (2) letters of credit. If Tenant has actual notice, or Landlord notifies Tenant at any time, that any issuer of the L/C Security has become insolvent or placed into FDIC receivership, then Tenant shall promptly deliver to Landlord (without the requirement of further notice from Landlord) substitute L/C Security issued by an issuer reasonably satisfactory to Landlord, and otherwise conforming to the requirements set forth in this Article. As used herein with respect to the issuer of the L/C Security, “insolvent” shall mean the determination of insolvency as made by such issuer’s primary bank regulator (i.e., the state bank supervisor for state chartered banks; the OCC or OTS, respectively, for federally chartered banks or thrifts; or the Federal Reserve for its member banks).

(b) Landlord may draw upon the L/C Security, and hold and apply the proceeds for the payment of any Rent or any other sum in default, or to compensate Landlord for any other loss or damage that Landlord may suffer by reason of Tenant’s default, if: (i) a Default (as defined below) exists (or would have existed with the giving of notice and passage of applicable cure periods, but only if transmittal of a default notice is stayed or barred by applicable bankruptcy or other similar law), provided that such draw pursuant to his clause (i) shall be limited to the amount that Landlord reasonably determines is required to cure such Default; (ii) as of the date forty-five (45) days before any L/C Security expires Tenant has not delivered to Landlord an amendment or replacement for such L/C Security, reasonably satisfactory to Landlord, extending the expiry date to the earlier of (1) ninety (90) days after the then-current Term Expiration Date or (2) the date one year after the then-current expiry date of the L/C Security; (iii) Tenant fails to pay (when and as Landlord reasonably requires) any bank charges for Landlord’s transfer of the L/C Security; or (iv) the issuer of the L/C Security ceases, or announces that it will cease, to maintain an office in the city where Landlord may present drafts under the L/C Security (and fails to permit drawing upon the L/C Security by overnight courier or facsimile). This Section does not limit any other provisions of this Lease allowing Landlord to draw the L/C Security under specified circumstances. In the event of any such draw upon the L/C Security, Tenant shall within 10 days thereafter provide Landlord with a replacement letter of credit, or amendment to the existing letter of credit increasing the amount of such letter of credit, in the amount of L/C Security required hereunder, and Tenant’s failure to do so shall be a material breach of this Lease. Landlord shall hold the proceeds of any draw not applied as set forth above as a cash Security Deposit as further described below.

(c) If Landlord transfers its interest in the Premises, then Landlord shall transfer the L/C Security to the transferee of its interest, and Tenant shall at Tenant’s expense, within fifteen (15) business days after receiving a request from Landlord, deliver (and, if the issuer requires, Landlord shall consent to) an amendment to the L/C Security naming Landlord’s grantee as substitute beneficiary. If the required Security Deposit changes while L/C Security is in force, then Tenant shall deliver (and, if the issuer requires, Landlord shall consent to) a corresponding amendment to the L/C Security.

14

(d) If and to the extent Landlord is holding the proceeds of the L/C Security in cash from time to time, such cash shall be held by Landlord as security for the faithful performance by Tenant of all of the terms, covenants and conditions of this Lease to be kept and performed by Tenant during the period commencing on the Execution Date and ending upon the expiration or termination of Tenant’s obligations under this Lease. If Tenant Defaults with respect to any provision of this Lease, including any provision relating to the payment of Rent, then Landlord may (but shall not be required to) use, apply or retain all or any part of the Security Deposit for the payment of any Rent or any other sum in Default, or to compensate Landlord for any other loss or damage that Landlord may suffer by reason of Tenant’s Default as provided in this Lease. The provisions of this Article shall survive the expiration or earlier termination of this Lease. In the event of bankruptcy or other debtor-creditor proceedings against Tenant, any cash Security Deposit then being held by Landlord shall be deemed to be applied first to the payment of Rent and other charges due Landlord for all periods prior to the filing of such proceedings. Landlord shall deliver or credit to any purchaser of Landlord’s interest in the Premises the funds then held hereunder by Landlord, and thereupon (and upon confirmation by the transferee of such funds, whether expressly or by written assumption of this Lease, generally) Landlord shall be discharged from any further liability with respect to such funds. This provision shall also apply to any subsequent transfers. If Tenant shall fully and faithfully perform every provision of this Lease to be performed by it, then the Security Deposit, if any, or any balance thereof, shall be returned to Tenant (or, at Landlord’s option, to the last assignee of Tenant’s interest hereunder) within 90 days after the expiration or earlier termination of this Lease. If and to the extent the Security Deposit shall be in cash, Landlord shall hold the Security Deposit in an account at a banking organization selected by Landlord; provided, however, that Landlord shall not be required to maintain a separate account for the Security Deposit, but may intermingle it with other funds of Landlord. Landlord shall be entitled to all interest and/or dividends, if any, accruing on the Security Deposit. Landlord shall not be required to credit Tenant with any interest for any period during which Landlord does not receive interest on the Security Deposit.

12. Use.

12.1. Tenant shall use the Premises for the purpose set forth in Section 2.7, and shall not use the Premises, or permit or suffer the Premises to be used, for any other purpose without Landlord’s prior written consent, which consent Landlord may withhold in its sole and absolute discretion.

12.2. Tenant shall not use or occupy the Premises in violation of Applicable Laws; zoning ordinances; or the certificate of occupancy issued for the Building or the Property, and shall, upon five (5) days’ written notice from Landlord, discontinue any use of the Premises that is declared or claimed by any Governmental Authority having jurisdiction to be a violation of any of the above, or that in Landlord’s reasonable opinion violates any of the above. Tenant shall comply with any direction of any Governmental Authority having jurisdiction that shall, solely by reason of the nature of Tenant’s use or occupancy of the Premises (other than for general office or laboratory use), impose any duty upon Tenant or Landlord with respect to the Premises or with respect to the use or occupation thereof.

15

12.3. Tenant shall not do or permit to be done anything that will invalidate or increase the cost of any fire, environmental, extended coverage or any other insurance policy covering the Building or the Property, and shall comply with all commercially reasonable and customary rules, orders, regulations and requirements of the insurers of the Building and the Property, and Tenant shall promptly, upon demand, reimburse Landlord for any additional premium charged for such policy solely by reason of Tenant’s failure to comply with the provisions of this Article, or cease the applicable activity, to the extent that ceasing such activity does in fact prevent such cost increase from occurring. The use of the Premises for office or laboratory uses, generally, will not result in a breach of the provisions of this paragraph.

12.4. Tenant shall keep all doors opening onto public corridors closed, except when in use for ingress and egress.

12.5. No additional locks or bolts of any kind shall be placed upon any of the doors or windows by Tenant, nor shall any changes be made to existing locks or the mechanisms thereof without Landlord’s prior written consent. Tenant shall, upon termination of this Lease, return to Landlord all keys to offices and restrooms either furnished to or otherwise procured by Tenant. In the event any key so furnished to Tenant is lost, Tenant shall pay to Landlord the cost of replacing the same or of changing the lock or locks opened by such lost key if Landlord shall deem it necessary to make such change.

12.6. No awnings or other projections shall be attached to any outside wall of the Building. No curtains, blinds, shades or screens shall be attached to or hung in, or used in connection with, any exterior or atrium window or door of the Premises other than Landlord’s standard window coverings as described in the Tenant Manual. Neither the interior nor exterior of any windows shall be coated or otherwise sunscreened without Landlord’s prior written consent, nor shall any bottles, parcels or other articles be placed on the windowsills. No equipment, furniture or other items of personal property shall be placed on any exterior balcony without Landlord’s prior written consent.

12.7. No sign, advertisement or notice (“Signage”) shall be exhibited, painted or affixed by Tenant on any part of the Premises or the Building without Landlord’s prior written consent, which may be withheld in Landlord’s sole discretion, except as expressly set forth in this Section 12.7. Tenant shall be entitled to install and maintain, at its sole cost and expense, (1) one exterior sign identifying Tenant on the facade of the Building to be located within the area designated on Exhibit L attached hereto, and (2) interior entry signage on doors to the Premises in Landlord’s reasonable discretion (to the extent visible from Common Areas) and in a manner consistent with Landlord’s reasonable Building Standards, subject in each case to all Applicable Laws, codes and ordinances and Landlord’s reasonable approval with regards to installation, size, design, location and other reasonable criteria (provided, however, the standard corporate lettering and logo of Tenant are hereby approved). For any Signage, Tenant shall, at Tenant’s own cost and expense, (a) acquire all permits for such Signage in compliance with Applicable Laws and (b) design, fabricate, install and maintain such Signage in a first-class condition. Tenant shall be responsible for removing any of Tenant’s Signage upon the expiration

16

or earlier termination of this Lease. The directory tablet shall be inscribed, painted or affixed for Tenant by Landlord at Landlord’s sole cost and expense, and shall be of a size, color and type and be located in a place acceptable to Landlord. The directory tablet shall be provided exclusively for the display of the name and location of tenants only. Tenant shall not place anything on the exterior of the corridor walls or corridor doors other than Landlord’s standard lettering.

12.8. Tenant shall only place equipment within the Premises with floor loading consistent with the Building’s structural design (which is 100 psf) without Landlord’s prior written approval, and such equipment shall be placed in a location designed to carry the weight of such equipment.

12.9. Tenant shall cause any equipment or machinery to be installed in the Premises so as to reasonably prevent sounds or vibrations therefrom from extending into the Common Areas or other offices in the Property.

12.10. Tenant shall not (a) do or permit anything to be done in or about the Premises that shall in any way unreasonably obstruct or interfere with the rights of other tenants or occupants of the Property, or injure them, (b) use or allow the Premises to be used for unlawful purposes, (c) cause, maintain or permit any nuisance or waste in, on or about the Property or (d) take any other action that would in Landlord’s reasonable determination in any manner unreasonably and adversely affect other tenants’ quiet use and enjoyment of their space or adversely impact their ability to conduct business in a professional and suitable work environment for office and laboratory uses.

12.11. Landlord shall be responsible for ensuring the Common Areas comply with the Americans with Disabilities Act, 42 U.S.C. § 12101, et seq., and any state and local accessibility laws, codes, ordinances and rules (collectively, and together with regulations promulgated pursuant thereto, the “ADA”) to (which cost may be included in Operating Expenses) and that the Landlord Demising Work is performed in compliance with the ADA. Subject to the foregoing, Tenant shall be responsible for all liabilities, costs and expenses arising out of or in connection with the compliance of the Premises with the ADA, and Tenant shall indemnify, save, defend (at Landlord’s option and with counsel reasonably acceptable to Landlord) and hold Landlord and its affiliates, employees, agents and contractors; and any lender, mortgagee or beneficiary (each, a “Lender” and, collectively with Landlord and its affiliates, employees, agents and contractors, the “Landlord Indemnitees”) harmless from and against any demands, claims, liabilities, losses, costs, expenses, actions, causes of action, damages or judgments, and all reasonable expenses (including reasonable attorneys’ fees, charges and disbursements) incurred in investigating or resisting the same (collectively, “Claims”) arising out of any such failure of the Premises to comply with the ADA. This Section (as well as any other provisions of this Lease dealing with indemnification of the Landlord Indemnitees by Tenant shall be deemed to be modified in each case by the insertion in the appropriate place of the following: “except as otherwise provided in Mass. G.L. Ter. Ed., C. 186, Section 15.” The provisions of this Section shall survive the expiration or earlier termination of this Lease.

17

12.12. Tenant shall establish and maintain a chemical safety program administered by a licensed, qualified individual in accordance with the requirements of the Massachusetts Water Resources Authority (“MWRA”) and any other applicable Governmental Authority. Tenant shall be solely responsible for all costs incurred in connection with such chemical safety program, and Tenant shall provide Landlord with such documentation as Landlord may reasonably require evidencing Tenant’s compliance with the requirements of (a) the MWRA and any other applicable Governmental Authority with respect to such chemical safety program and (b) this Section. Tenant shall not introduce anything into the sewer system serving the Building (x) in violation Applicable Laws. Landlord agrees to reasonably cooperate with Tenant, at no unreimbursed cost to Landlord, in order for Tenant to obtain any MWRA permit and wastewater treatment operator license required for Tenant’s operations. Tenant shall reimburse Landlord within ten (10) business days after demand for any third party costs reasonably incurred by Landlord in cooperating with Tenant pursuant to this Section.

13. Rules and Regulations, CC&Rs, Parking Facilities and Common Areas.

13.1. Tenant shall have the non-exclusive right, in common with others, to use the Common Areas in conjunction with Tenant’s use of the Premises for the Permitted Use (including without limitation such Common Areas as are reasonably designated by Landlord for the connection of any equipment located in off-floor mechanical areas that are contained within the Premises to the applicable occupied floor of the Premises), and such use of the Common Areas and Tenant’s use of the Premises shall be subject to the rules and regulations and tenant manual governing Alterations, each as adopted by Landlord and initially attached hereto as Exhibit F, together with such other reasonable and nondiscriminatory rules and regulations as are hereafter promulgated by Landlord of which Tenant is given prior written notice (collectively, the “Rules and Regulations”), provided, however, that in the case of any conflict between the provisions of this Lease and any such Rules and Regulations, the provisions of this Lease shall control. Tenant shall faithfully observe and comply with the Rules and Regulations. Landlord shall use reasonable efforts to enforce the Rules and Regulations against Tenant or any other tenant of the Building or Property, but shall have no responsibility for any violations thereof. Landlord shall not enforce the Rules and Regulations in a discriminatory manner against Tenant.

13.2. This Lease is subject to any recorded covenants, conditions or restrictions on the Property (the “CC&R”), to the Development Approvals (as defined on Exhibit D), and to any other matters of record, in each case as the same may be amended, amended and restated, supplemented or otherwise modified from time to time (collectively, the “Property Operations Agreements”; provided that any such amendments, restatements, supplements or modifications do not materially modify Tenant’s rights or obligations or Landlord’s obligations hereunder. Each of Landlord and Tenant, in the exercise of their respective rights and the performance of their respective obligations pursuant to this Lease, shall observe and comply with all requirements of the CC&R and Development Approvals. The CC&R covers certain areas shown on the site plan attached as Exhibit K, including landscaping, private drives, streets, parks, open space, walkways, sidewalks, the ice skating rink, the water fountain, the sky bowl and other improvements and appurtenances located thereon and related thereto, including the Building and other buildings located on the Property thereon, all commonly referred to as “Kendall Square”, and expenses payable by the Building under the CC&R (which are based on the Lot’s proportionate share of Kendall Square) are included in Operating Expenses.

18

13.3. Tenant shall be permitted access to the Building and Premises on a 24 hour per day, 7 day per week basis, subject to matters described in Section 41.6 of this Lease and Landlord’s reasonable security measures, and subject to Landlord’s rights pursuant to this Lease to temporarily prohibit, restrict or limit access to the Building or the Premises in emergency situations if Landlord determines, in its reasonable discretion, that it is necessary or advisable to do so in order to prevent or protect against death or injury to persons or damage to property.

13.4. It is intended that all Rent payable by Tenant to Landlord, which includes all sums, charges, or amounts of whatever nature to be paid by Tenant to Landlord in accordance with the provisions of this Lease, shall qualify as “rents from real property” within the meaning of both Sections 512(b)(3) and 856(d) of the Code and the U.S. Department of Treasury Regulations promulgated thereunder (the “Regulations”). If Landlord, in its sole discretion, determines that there is any risk that all or part of any Rent shall not qualify as “rents from real property” for the purposes of Section 512(b)(3) or 856(d) of the Code and the Regulations, Tenant agrees (i) to cooperate with Landlord by entering into such amendment or amendments to this Lease as Landlord reasonably deems necessary to qualify all Rent as “rents from real property,” and (ii) to permit an assignment of this Lease; provided, however, that any adjustments required under this Section shall be made so as to produce the substantially equivalent (in economic terms) Rent as payable before the adjustment.

13.5. (a) Tenant shall have a non-exclusive, irrevocable license to use up to a total of 189 unreserved parking spaces (i.e., determined by multiplying the Rentable Area of the Premises by 0.0015) from and after the Phase 1 Rent Commencement Date (“Tenant’s Parking Spaces”) in the underground parking garage on the Property in common with other tenants of the Property at the market rate for such comparable parking lots in commercial garages in the East Cambridge market, as reasonably determined by Landlord (as of the date hereof, such rate being Two Hundred Sixty and 00/100 Dollars ($260.00) per parking space per month), which Tenant shall pay simultaneously with payments of Base Rent as Additional Rent commencing on the Phase 1 Rent Commencement Date unless and except to the extent that Landlord directs Tenant to pay the same to a Garage Operator as defined below. Upon 30 days’ notice given prior to the Phase 1 Rent Commencement Date, Tenant will have the option of designating any number of Tenant’s Parking Spaces between the maximum number set forth above and the portion of Tenant’s Parking Spaces allocable to the Phase 1 Premises (based on Rentable Area) as being licenses as of the Phase 1 Rent Commencement Date (with the remainder of Tenant’s Parking Spaces being treated as allocable to the Phase 2 Premises). Tenant’s failure to make any such election prior to the Phase 1 Premises Rent Commencement Date shall be deemed to be an election to allocate such spaces on a prorated basis between the Phase 1 Premises and Phase 2 Premises. Tenant shall pay for the license to use Tenant’s Parking Spaces regardless of whether such spaces are in fact used by Tenant; provided, however, that Tenant shall have the right to terminate its license with respect to any such spaces on 30 days’ prior written notice to Landlord. Any such termination of Tenant’s license hereunder in whole or in part shall be irrevocable and Landlord shall have no further right to provide Tenant with spaces for which such rights have terminated, provided that Landlord shall use reasonable efforts to make additional spaces available to Tenant, subject to availability, on a revocable, month-to-month

19

basis as reasonably requested by Tenant on at least 30 days’ prior notice (and otherwise on the terms and conditions contained in this Section 13.5, including the limitation on total spaces licensed by Tenant set forth above). All of Tenant’s Parking Spaces shall be located in the underground parking structure in the Building (the “Garage”), which Garage may be owned or leased by or to a third-party Garage operator from time to time. The owner or operator of the Garage from time to time is herein referred to as the “Garage Operator,” and the Tenant’s Parking Spaces are sometimes herein referred to as the “Garage Parking Spaces.” Landlord covenants and agrees that if the Garage is conveyed or leased by Landlord to any Garage Operator, such conveyance shall be subject to a lease, permanent easement or similar instrument by and between Landlord and the Garage Operator so that the Tenant shall have, from and after the Phase 1 Rent Commencement Date, throughout the Term, the right to use the Garage Parking Spaces, subject to the terms of this Lease.

(b) Landlord or the Garage Operator, as applicable, shall have the right, from time to time but not more often than every two (2) years, to relocate, on a temporary basis (not to exceed thirty (30) days) as may be necessary to effect repairs and improvements to the Garage or for other business reasons, parking spaces located in the Garage to another location within 1,000 feet of the Property. Except to the extent resulting from their negligence or willful misconduct and subject to Section 23.7, neither Landlord nor the Garage Operator shall be responsible for money, jewelry, automobiles or other personal property lost in or stolen from the Garage, regardless of whether such loss or theft occurs when the Garage or other areas therein are locked or otherwise secured against entry, or liable for any loss, injury or damage to persons using the Garage or automobiles or other property therein, it being agreed that the use of the Garage and the Tenant’s Parking Spaces shall otherwise be at the sole risk of Tenant and its employees, visitors and guests. Landlord and the Garage Operator shall have the right from time to time to promulgate Rules and Regulations regarding the Garage, the Tenant’s Parking Spaces and the use thereof, including, but not limited to, Rules and Regulations controlling the flow of traffic to and from various parking areas, the angle and direction of parking and the like, and to implement valet parking. Tenant shall comply with and cause its employees, visitors and guests to comply with all such Rules and Regulations as well as reasonable additions and amendments thereto.

(c) Landlord or the Garage Operator, as applicable, may elect to provide parking cards or keys to control access to the Garage. In such event, Landlord or the Garage Operator shall provide Tenant with one card or key for each Tenant’s Parking Space that Tenant is leasing hereunder, provided that Landlord or the Garage Operator shall have the right to require Tenant or its employees to place a reasonable deposit (not to exceed Twenty-Five Dollars ($25.00)) on such access cards or keys and to pay a reasonable fee for any lost or damaged cards or keys. Tenant, at its sole cost and expense, may obtain extra cards and keys from Landlord or the Garage Operator, as applicable, if any cards are lost, stolen or destroyed.

13.6. Landlord reserves the right to modify the Common Areas, including the right to add or remove exterior and interior landscaping. Tenant acknowledges that Landlord specifically reserves the right to allow the exclusive use of corridors and restroom facilities located on specific floors to one or more tenants occupying such floors; provided, however, that Tenant shall not be deprived of the access to or use of the corridors reasonably required to serve the Premises or of restroom facilities serving each floor upon which any portion of the Premises is located.

20

13.7. Subject to the terms of this Lease including the Rules and Regulations and the rights of other tenants of the Building, Tenant shall have the non-exclusive right to access the freight loading dock, at no additional cost.

14. Property Control by Landlord.

14.1. Landlord reserves full control over the Building and Property to the extent not inconsistent with Tenant’s use and enjoyment of the Premises as provided by this Lease. Subject to the foregoing, this reservation includes Landlord’s right to convert the Building to a condominium form of ownership; add or eliminate a portion of the Property; grant easements and licenses to third parties; maintain or establish ownership of the Building separate from fee title to the Property; make additions to or reconstruct portions of the Building; install, use, maintain, repair, replace and relocate for service to the Premises and other parts of the Building or the Property pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the Premises, the Building or elsewhere at the Property; and alter or relocate any other Common Area or facility, including private drives, lobbies and entrances. Landlord will use reasonable efforts to ensure that any work undertaken in the Premises by Landlord shall (except in an emergency) be undertaken in a manner that will not unreasonably interfere with Tenant’s operations.

14.2. Possession of those existing areas of the Premises necessary for utilities, services, safety and operation of the Building is reserved to Landlord.

14.3. Tenant shall, at Landlord’s request, promptly execute such further documents, in form and substance reasonably acceptable to the parties, as may be reasonably appropriate to assist Landlord in the performance of its obligations hereunder; provided that Tenant need not execute any document that creates additional liability for Tenant or that deprives Tenant of the quiet enjoyment and use of the Premises as provided for in this Lease.

14.4. Landlord may, at any and all reasonable times during non-business hours (or during business hours, if (a) with respect to Subsections 14(u) through 14.4(y), Tenant so requests, and (b) with respect to Subsection 14.4(z), if Landlord so requests), and upon twenty-four (24) hours’ prior notice (provided that no time restrictions shall apply or advance notice be required if an emergency necessitates immediate entry), enter the Premises to (u) inspect the same and to determine whether Tenant is in compliance with its obligations hereunder, (v) supply any service Landlord is required to provide hereunder, (w) alter, improve or repair any portion of the Building other than the Premises for which access to the Premises is reasonably necessary,(x) post notices of nonresponsibility, (y) access the telephone equipment, electrical substation and fire risers and (z) show the Premises to prospective and actual lenders, purchasers or, during the final year of the Term, tenants. In connection with any such alteration, improvement or repair as described in Subsection 14.4(w), Landlord may erect in the Premises or elsewhere in the Property scaffolding and other structures reasonably required for the alteration, improvement or repair work to be performed. Notwithstanding anything to the contrary set forth herein, neither Landlord, nor Landlord’s agents, representatives, contractors or employees may enter any portion of the Premises reasonably designated from time to time by Tenant as a

21